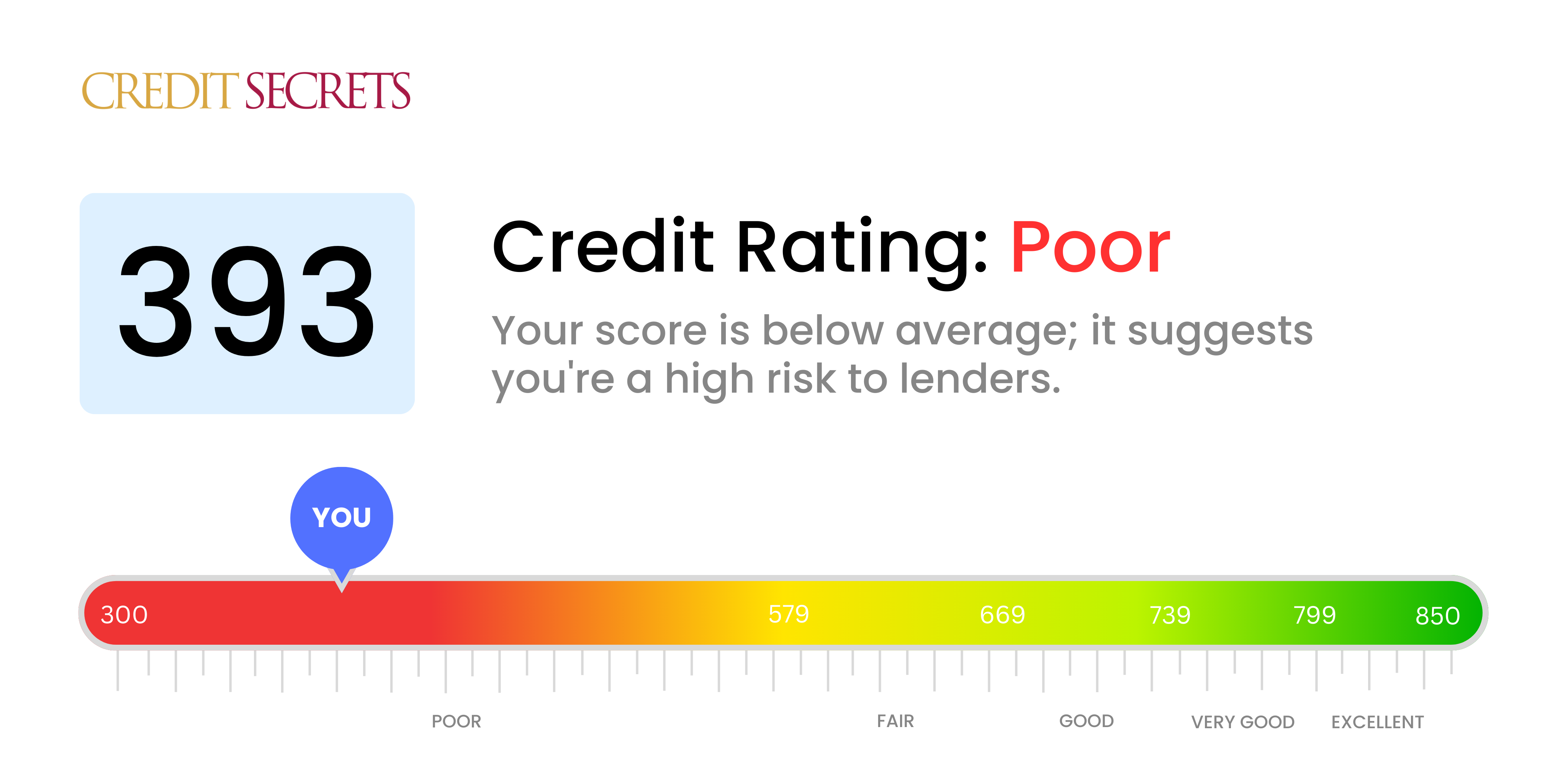

Is 393 a good credit score?

With a score of 393, you're currently in the 'Poor' credit score range. This could make it difficult to obtain lines of credit or may lead to higher interest rates if you're approved. However, it's important to remember that this isn't a life sentence and there are steps you can take to positively impact your score and move towards healthier financial possibilities.

Your journey towards financial growth may be challenging, but understanding your credit score is the first powerful step. By implementing good habits and consistently monitoring your credit, you can rise beyond this difficult moment. With commitment and patience, a more secure financial future is not just a dream but a very achievable reality.

Can I Get a Mortgage with a 393 Credit Score?

If you have a credit score of 393, unfortunately, getting a mortgage approval will be significantly challenging. This score falls in the range of “poor" on the credit scale. It typically signals a history of financial struggles, such as delinquencies or failed repayments. This tends to discourage lenders who are looking for indicators of good, reliable borrowers.

Having such a low score feels defeating, but it's important to understand the situation is not irreversible. Hardships can serve as stepping stones towards improving financial health, and bad credit does not define your ability to handle finances forever. A good start would be paying off any existing debts, which can help to reflect responsible credit behavior. Following this, regular payments and careful credit usage can slowly bolster your score. Keep in mind you could consider alternatives like seeking a co-signer for a loan, or look into Federal Housing Administration loans which cater to those with lower credit scores. Remain patient, as steadily improving one’s credit score is a meticulous journey, yet every step forward brings you closer to your financial objectives.

Can I Get a Credit Card with a 393 Credit Score?

If you're having a credit score of 393, getting approval for a standard credit card could be a tough ordeal. This score is seen by lenders as risky, suggesting there might have been financial missteps or hurdles in the past. While this can be a hard pill to swallow, it's crucial to confront the situation with honesty and pragmatism. Recognizing your current credit situation is the first step on the path to financial recovery.

Contemplating alternatives like secured credit cards, which involve a deposit equal to your credit limit, can be an easier way to access credit. These cards are specifically designed to assist in repairing credit over time. It's also worth researching pre-paid debit cards or the opportunity of adding a co-signer to an account. Although this isn't a quick fix, such options serve as practical instruments towards attaining a stable financial position. Be aware that any credit options available for someone with a low score usually attract higher interest rates owing to the increased risk perceived by the lenders.

Can I Get a Personal Loan with a 393 Credit Score?

Having a credit score of 393 is no doubt a tough situation. This score is considerably lower than what most traditional lenders view as acceptable for a personal loan approval. From a lender's perspective, it signals a high potential for risk. Consequently, this makes it unlikely for you to get approved for a personal loan under usual circumstances. Confronting the reality of this credit score is not easy, but it is vital to understand the impact it has on your loan options.

Even with this score, there are still options available, though they may not be as favourable. You might want to explore secured loans, where you offer something as collateral, or co-signed loans, where someone with better credit stands as your guarantor. There's also the option of peer-to-peer lending platforms, which can sometimes have more lenient credit requirements. However, be aware these alternatives tend to carry higher interest rates and less favourable conditions, given the heightened risk for the lender.

Can I Get a Car Loan with a 393 Credit Score?

With a credit score of 393, securing a car loan could be quite a hurdle. This score is significantly below the 660 that lenders usually look for when deciding on loan approvals. In fact, any score below 600 is often categorized as subprime, and that could result in loan rejection or monumental interest rates. The reasoning behind this is that a lower score signifies a higher chance of repayment issues, translating to a bigger risk for lenders.

Yet, don't lose hope entirely. Despite a low score, you still have options. Some loan providers specialize in catering to those with lower credit scores. Please do exercise caution, as these sort of loans often carry steeper interest rates. It's their method of safeguarding their investment because of the risk they are taking on. It's still very possible to obtain a car loan with a credit score of 393. Though it may prove challenging, with prudence and an informed understanding of the terms, driving home your dream car is certainly achievable.

What Factors Most Impact a 393 Credit Score?

Analyzing a credit score of 393 is essential for understanding the steps you need to take towards enhancing your financial situation. Pinpointing the factors affecting your score can enlighten you on your way to a better financial future. Remember, every financial history is exclusive and presents numerous opportunities for positive change.

Payment History

One of the fundamental influences on your credit score is payment history. Regular late payments or defaults could be a primary reason behind your low score.

Action Required: Scrutinize your credit report for any defaults or payments made past the due date. These historical records can explain why your score is currently low.

Credit Utilization Ratio

If you're maxing out your credit cards or exceeding the credit limit, your score may reflect that negatively through a high credit utilization ratio.

Action Required: Go through your credit card statements closely. Are you spending close to your limit? Keep your credit card expenditure low to enhance the score.

Length of Credit History

If you're relatively new to credit usage, a short credit history might negatively influence your score.

Action Required: Review your credit report's details about the duration of your oldest and newest accounts. Reflect on whether you've opened new credit lines recently.

Type of Credit and Recent Inquiries

The diversity of your credit accounts and your approach in managing new credit inquiries play vital roles in forming your credit score.

Action Required: Determine the variety of your credit accounts. Limit the frequency of new credit inquiries to improve your credit score.

Public Records

Public records with data including bankruptcies or tax liens can significantly lower your score.

Action Required: Assess your credit report for any public records. Try resolving these issues to initiate an upward trend in your score.

How Do I Improve my 393 Credit Score?

With a credit score of 393, you’re dealing with a challenging financial hurdle. Nonetheless, with commitment and targeted efforts, you have the aptitude to elevate your credit score significantly. Let’s take a look at the most practical and influential actions for your current score.

1. Manage Your Delinquent Accounts

At this score, it is likely that you have some delinquent accounts. Prioritize reconciling these debts, especially those that have fallen significantly behind. A communication with your creditors to agree on a feasible payment plan is useful in this regard. When these past-due accounts are paid off, you will likely see a positive shift in your credit score.

2. Limit Credit Utilization

If you have high credit card balances, this could severely impact your credit score. A good rule is to keep your balances at 30% or below your credit limit, steadily working towards maintaining them below 10%. Pay attention to the credit cards with the highest utilization first.

3. Consider a Secured Credit Card

Given your present score, getting a conventional credit card could be troublesome. An alternative could be a secured credit card, which can be obtained by depositing a certain amount as collateral. Use this secured card responsibly, ensuring you make payments on time and in full whenever possible.

4. Seek to Become an Authorized User

Find out if a relative or a dependable friend with a positive credit history could add you as an authorized user on their credit card. This action can help boost your score when their good credit habits are reflected in your credit report. Make sure the card issuer reports activity of authorized users to the credit bureaus.

5. Broaden Your Credit Portfolio

Having a diverse array of credit accounts can also uplift your credit score. Once you’ve demonstrated responsible usage of a secured card, consider acquiring other forms of credit such as retail credit cards or credit builder loans, whilst ensuring you manage these new accounts judiciously.