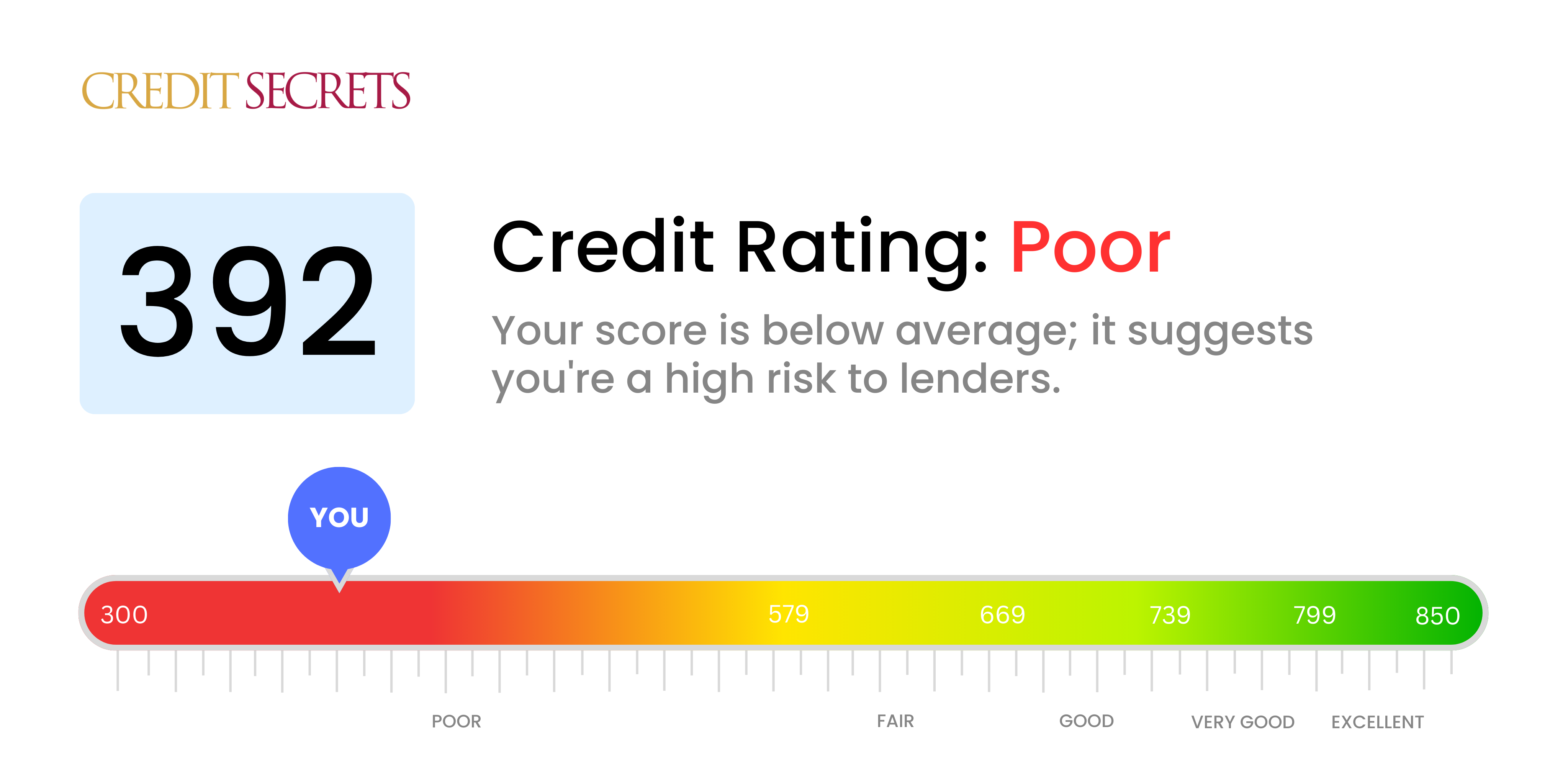

Is 392 a good credit score?

A credit score of 392 falls within the 'Poor' category. This score isn't considered good credit and you may face hardships when attempting to secure loans or credit with favorable terms. Yet, it's important to remember that improving your credit score is an achievable goal.

With a score of 392, you could likely expect higher interest rates, potential difficulty in securing a mortgage or a car loan, and probable rejection for credit cards. Regardless, this situation is not permanent and there are various strategies that can help raise your credit score. Keep in mind, the road to better credit might be challenging, but diligence and consistency can lead to financial improvement.

Can I Get a Mortgage with a 392 Credit Score?

With a credit score of 392, securing a mortgage may be challenging as this score falls significantly below the minimum most lenders need to offer approval. This score indicates a pattern of financial difficulties such as missed payments, defaults, or excessive debt. Such factors might discourage lenders from considering you able to handle the financial responsibility of a mortgage.

While this can seem an uphill battle, there are alternatives that might be explored. You might consider a rent-to-own arrangement or attempt to secure a mortgage with a co-signer, although it's necessary to proceed with caution in such cases. Also, it's always beneficial to work towards gradually increasing your score - consistent, on-time payments and responsible credit usage can slowly but surely boost your credit standing. With dedication and patience, you can work your way towards better credit and closer to homeownership. It's a journey, and every step counts.

Can I Get a Credit Card with a 392 Credit Score?

With a credit score of 392, it may be challenging to be approved for a standard credit card. This score may suggest to lenders that there's a high level of risk involved, likely due to past financial struggles or mismanagement. While this can be a hard fact to face, acknowledging your credit standing is a critical step in your path to financial improvement. It can be a difficult reality to accept, but tackling it head-on is the key to making progress towards a better financial future.

There are certain alternatives to consider when navigating with a low credit score. One such option is a secured credit card that requires a deposit which becomes your credit limit. This type of card can be more accessible to you and can also help you rebuild your credit gradually. Alternatively, you might think about asking someone to co-sign a card with you or possibly use a pre-paid debit card. Though these options won't provide an immediate remedy, they can be helpful tools in your journey toward financial stability. Be aware that interest rates on credit cards for individuals with scores like yours may be substantially higher, due to the heightened risk presented to lenders.

Can I Get a Personal Loan with a 392 Credit Score?

A credit score of 392 isn't within the range most lenders typically consider when approving personal loans. For them, this score could indicate a high degree of risk. It might seem like a tough situation, but it's crucial to understand what this credit score means for your borrowing potential.

While a conventional loan might not be a viable option at this point, consider looking into alternatives such as secured or co-signed loans. In a secured loan, you provide some form of collateral, while in a co-signed loan, another individual with a better credit score co-signs the loan with you. You might even consider peer-to-peer lending platforms, which sometimes have more relaxed credit requirements. However, always remember that these alternative paths may come with higher interest rates and less favorable terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 392 Credit Score?

Regrettably, with a credit score of 392, securing a car loan might be tricky. Most lenders prefer scores well over 600, while anything beneath this range tends to be considered high risk. This score of 392 falls into this high-risk category, which could result in either inflated interest rates or loan rejection. This is due to the fact that lower credit scores convey a greater risk to moneylenders, as past performance suggests potential difficulties with debt repayment.

Nevertheless, do not lose hope. Even with a low credit score, acquiring a car loan isn't an impossible feat. Certain lenders specialize in assisting individuals with lower credit scores. However, be aware that these loans often come with high interest rates. This is to compensate for the perceived risks associated with lending to individuals with a lower credit score. Even though it might be a bit challenging, securing a car loan can be achieved with careful planning and a clear understanding of the loan terms.

What Factors Most Impact a 392 Credit Score?

A credit score of 392 is considered poor, but understanding the factors impacting this score can greatly assist you on your path to credit improvement. This is all about learning from past financial challenges and using that knowledge to work toward a healthier financial future.

Record of Payment Defaults

Payment defaults have a significant effect on your credit score. If these are present on your credit report, they could be a leading factor behind the 392 score.

How to Check: Scrutinize your credit report for any defaulted payments. Consider if there have been circumstances that caused you to default on payments.

High Outstanding Debts

A high amount of outstanding debt is likely affecting your credit score negatively. Large outstanding balances could be a critical reason your credit score is currently 392.

How to Check: Evaluate your loan statements. If the unpaid balances are high, it's important to address this.

Credit History Duration

A shorter credit history may negatively influence your score. Having recently opened new credit lines could be adversely affecting your score.

How to Check: Look over your credit report to determine the age of your oldest and newest accounts, and the average age of all your accounts.

Inadequate Portfolio Diversity

A lack of diverse credit types can harm your credit score. Solely having one type of credit account, like only credit cards, may be a contributing factor to your score.

How to Check: Check your credit report for your mix of credit accounts, such as credit cards, retail accounts, installment loans, or mortgage loans.

Public Records

Public records such as bankruptcies or tax liens can greatly impact your score. These sorts of items in your public records may be influencing your score.

How to Check: Study your credit report for any public records. Tackle any items listed that require attention.

How Do I Improve my 392 Credit Score?

With a credit score of 392, improvement may seem daunting but it is possible. Here are several steps tailored particularly for you:

1. Initiate Payment Plan Negotiations

Focus on any delinquent accounts, which greatly affect your credit score. If paying in full is not feasible, speak with your creditors about constructing a payment plan that can help you become current with your debts.

2. Settle Any Collections

Accounts that have gone to collections tremendously harm your credit. Consider reaching out to collectors to negotiate a repayment plan or a settlement in order to ward off further damage to your score.

3. Apply for a Secured Credit Card

Credit cards for bad credit, or secured credit cards, can be a good starting point. These require a deposit but allow you to build up positive credit history by making regular, manageable payments.

4. Leverage an Authorized User Option

You may increase your credit score by linking your credit history with a person having good credit. Seek permission to be added as an authorized user to their card, but be certain their card provider reports user activity to the credit bureaus.

5. Branch Out Your Credit

Once you’ve established a solid repayment pattern with a secured credit card, explore other credit types like retail credit cards or credit builder loans. A diversified credit portfolio can contribute positively to your credit score.