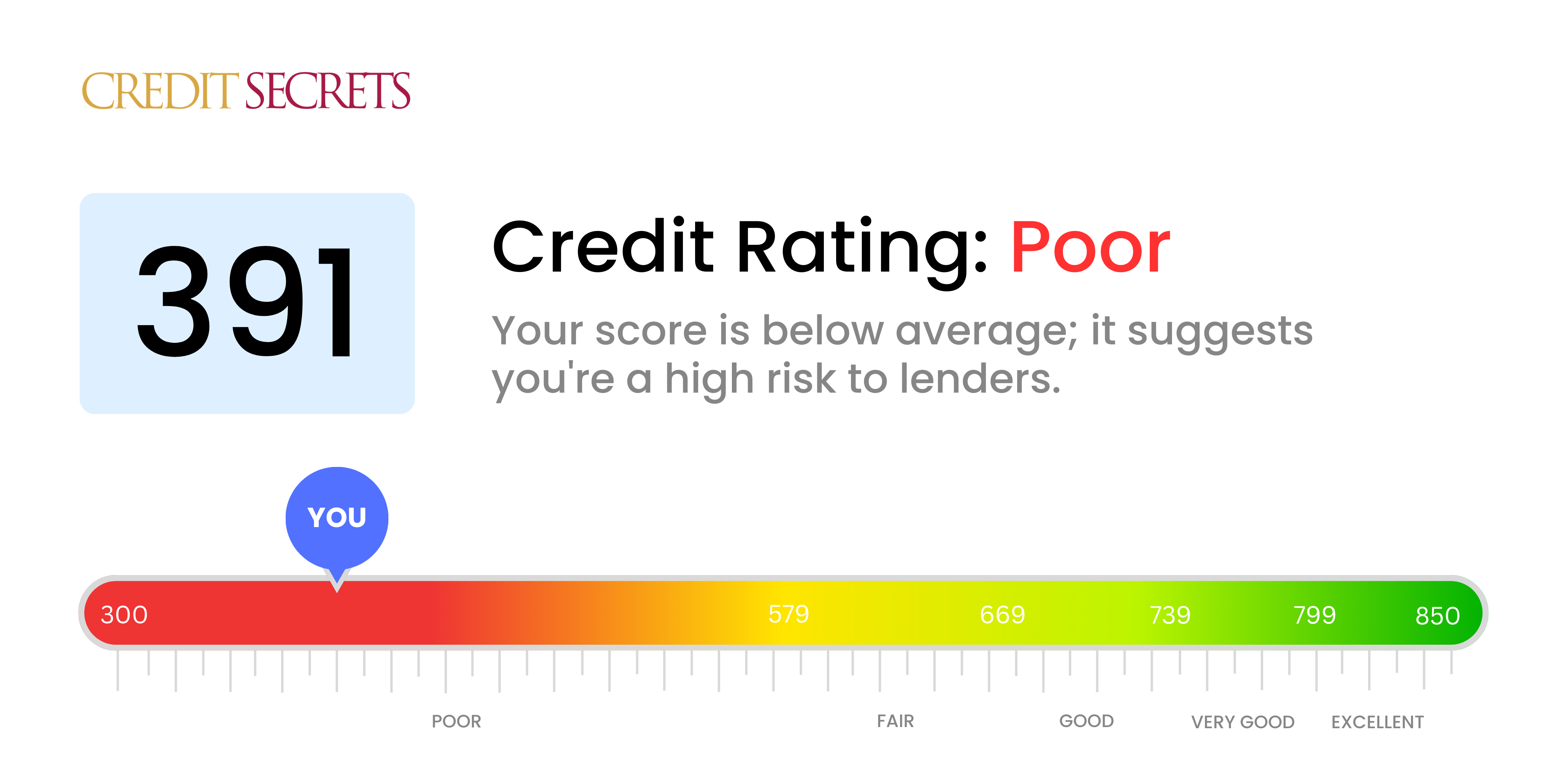

Is 391 a good credit score?

A credit score of 391 is considered within the 'Poor' range. With such a score, you might face difficulties in getting approved for new credit, and if approved, you're likely to be offered higher interest rates and less favorable terms. However, remember that everyone has the possibility to improve their credit score. Working on a strategic plan to build credit health can initiate changes sooner than you might think.

Can I Get a Mortgage with a 391 Credit Score?

With a credit score of 391, it might be difficult for you to get approval for a mortgage. Most lenders often necessitate a minimum credit score threshold which is typically higher. As awareness and understanding are important, a credit score at this level can reflect a past filled with critical monetary mishaps such as nonpayment or loan defaults.

Though this may seem like an unfortunate circumstance, rest assured that steps can be taken to enhance your credit score. Initially, seek to manage any outstanding financial obligations or negative items on your credit report. Subsequently, strive to maintain a pattern of timely payments and thoughtful use of credit, which can positively impact your credit score over time. Patience is key, as rebuilding your credit does not happen immediately. But with continuous effort, you can steadily boost your credit status and boost your potential of securing a mortgage in the future.

Remember, a lower credit score might not only affect your chances of approval, but could also lead to higher interest rates on the mortgage, if approved. This is because lenders consider lower-score borrowers to be at higher risk of defaulting. So, while working to improve your score, also prepare to navigate potentially elevated borrowing costs.

Can I Get a Credit Card with a 391 Credit Score?

Having a credit score as low as 391 can make getting approval for a credit card quite difficult. Most lenders view this low score as a signal of significant financial risk, meaning a record of past struggles with managing finances well. It's never pleasant news to face, but acknowledging the reality of your credit score is the starting point towards a brighter financial future.

Instead, alternatives to traditional credit cards could present a viable path forward. For example, a secured credit card, which is backed by a cash deposit you make, might be a more attainable option. The deposit amount usually matches your credit limit and can help to steadily rebuild credit over time. Moreover, exploring additional options such as having a co-signer for a card or using pre-paid debit cards could also prove helpful. Keep in mind, while these aren't immediate fixes, they do provide a starting point for regaining financial stability. Also be aware that with scores as low as yours, interest rates on any obtainable credit forms will likely be much higher due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 391 Credit Score?

Understandably, a credit score of 391 might be concerning. This score is considered low by traditional lending standards, which often results in a hesitant response from institutions when it comes to approving personal loans. Unfortunately, securing a personal loan with a score of this level might be challenging due to the risk it represents to lenders. It's not the news anyone wants to hear, but it's fundamental to face the situation realistically.

However, this doesn't mean there are no options available. Secured loans, which require collateral, or peer-to-peer loans, which often have less strict credit requirements, might be viable alternatives. In addition, a co-signed loan can be an option if a trustworthy person with a better credit history agrees to back you. Keep in mind that these alternative lending paths may come with higher interest rates and less beneficial terms due to the higher risk involved for those providing the loan. It's not an ideal situation but remember, this is just a current position, not a final destination.

Can I Get a Car Loan with a 391 Credit Score?

With a credit score of 391, getting approved for a car loan may prove to be a tough task. Financial institutions often prefer applicants with credit scores above 660. Your score, unfortunately, is significantly below this range, placing you into a category often labelled as "subprime". This classification can lead to higher interest rates or even denial of the loan as it signifies a high-risk borrower to the lenders.

Even with a lower credit score, there is still hope for getting a car loan. Some lenders cater specifically to people with lower credit scores. Be aware though, these loans typically have much higher interest rates to offset the higher risk the lender is accepting. Though the path to securing a car loan might seem daunting, by taking the time to understand the terms and considering all options cautiously, the possibility of obtaining a car loan still exists. It's a journey jam-packed with lessons and resilience can go a long way.

What Factors Most Impact a 391 Credit Score?

Effectively deepen your understanding of a 391 credit score as the first step in your financial betterment journey. Uncover the factors influencing your score and address them to build a robust financial future. Each person's financial path is different, filled with scope for improvement and lessons to learn over time.

Prompt Payments

Payment history majorly impacts your credit score. Delayed or missed payments might be the reason behind your current score.

How to Check: Access your credit report to check for delayed or defaulted payments. Think back to instances when you may have been late in making payments, leading to your current credit score.

Credit Utilization Levels

High levels of credit utilization can lower your score. If your credit cards are near their limits, it may have influenced your score detrimentally.

How to Check: Go through your credit card statements. Have you been frequently reaching or exceeding your credit limits? Try to maintain a lower balance-to-limit ratio.

Credit Age

A short credit history might negatively impact your score.

How to Check: Examine your credit report for details on the age of your oldest and newest credit accounts, as well as the average age of all your accounts. Reflect if you have opened new accounts recently.

Types of Credit & New Credit Inquiries

It's vital to have a good mix of credit and manage new credit lines sensibly.

How to Check: Look at the variety of credit you have. Do you have a healthy mix of credit cards, retail accounts, and installment loans? Also consider how frequently you've been applying for new credit.

Public Record Entries

Public record entries like bankruptcies or tax liens can greatly impact your score.

How to Check: Scrutinize your credit report for any public records. Address any issues that could be damaging your score.

How Do I Improve my 391 Credit Score?

Having a credit score of 391 is a challenging position, though there are powerful steps that can be taken forward. Here are some specific recommendations for your current credit circumstance:

1. Correct Mistakes on Your Credit Report

Accurate reporting is crucial to your credit score. Fact check everything on your credit report, from personal information to account details. If any errors are found, dispute them immediately to get them rectified. This could yield an instant lift to your score.

2. Clear Outstanding Debts

Delinquent debts and collections have severe impact on your credit score. Outline a budget to pay off your outstanding debts, focusing first on the ones in collections. Contact your lenders to negotiate a payment plan if possible.

3. Apply for a Secured Credit Card

At this score level, a secured credit card could be a feasible option to rebuild your credit history. You will need to provide a cash security deposit, but regular and responsible use of the card can help repair your credit score over time.

4. Become an Authorized User

If a family member or close friend with strong credit is willing, ask them to add you as an authorized user on one of their credit cards. This won’t require qualifying for a card, but their positive payment history can help rebuild your score.

5. Open a Credit Builder Loan

A credit builder loan helps to enhance your credit file and score step by step. The loan amount is held in a secured savings account while you make payments, demonstrating your reliability to future lenders.