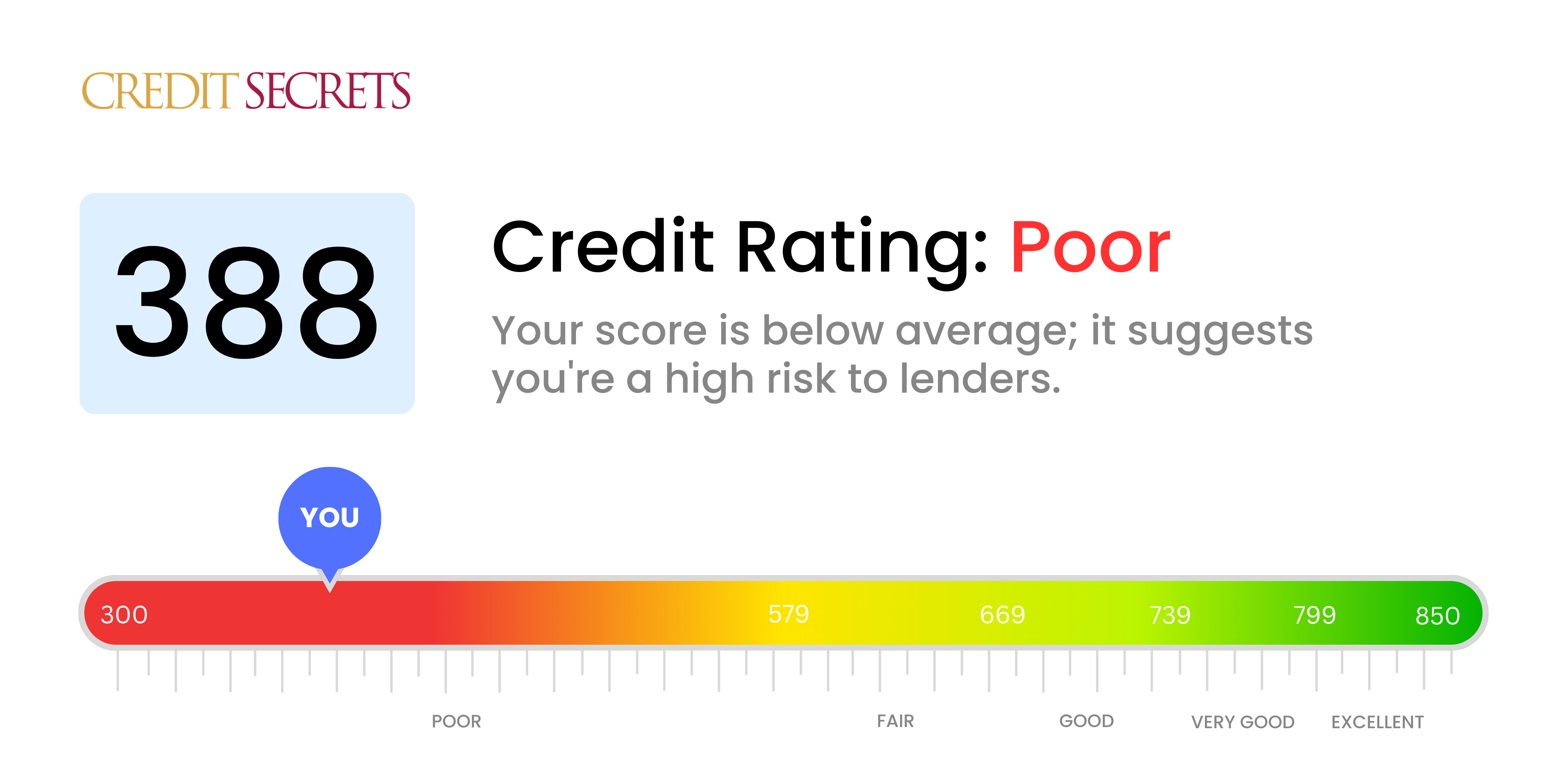

Is 388 a good credit score?

With a credit score of 388, you find yourself in the 'poor' category. This might make it challenging to secure loans, credit cards, or have access to other forms of credit on favorable terms. However, remember that it's not a stagnant position, and there are proactive steps you can take to inevitably improve this score.

Though your current standing might seem unfavorable, it's essential to remember that this isn't an indicator of personal failure, nor is it irrevocable. The upside of this situation is the room to grow and enhance your creditworthiness. Getting to know where you stand is the first step to charting a path of steady credit improvement, paving the way towards better financial opportunities in the future.

Can I Get a Mortgage with a 388 Credit Score?

Regrettably, with a credit score of 388, it's very unlikely you'll qualify for a mortgage. Typically, lenders need to see higher scores to approve a mortgage application. Your current score suggests there may be a history of severe financial issues, like late payments or repossessions, which predict high risk to lenders.

But, don't be discouraged. Even though it might feel overwhelming right now, know that it is possible to improve your position. Begin by settling any existing debts that could be dragging your score down. Further, try to establish a consistent pattern of timely bill payments, as this can reflect positively on your credit history. Obtaining a secured credit card or using a co-signer for a loan could be possible alternatives. Being conscious about controlling your spending and handling your credit responsibly will be pivotal. Just remember, enhancing your credit standing may take some time, but it's entirely viable with dedication and careful planning.

Can I Get a Credit Card with a 388 Credit Score?

If your credit score stands at 388, chances of getting approved for a conventional credit card might be rather slim. This score is typically seen as risky by lenders, indicating a past marred with financial disruptions or mishandlings. Certainly, this situation can be disheartening, but it's vital to observe it with a clear and realistic view. Recognizing your credit standing is the initial stride towards financial recovery, even if it involves accepting some uncomfortable realities.

Given the obstacles posed by such a low score, you might consider alternative options like secured credit cards. These types of cards need a deposit that sets your credit limit. They tend to be more accessible and can contribute to rebuilding your credit status over time. Other alternative options could include finding a co-signer or exploring pre-paid debit cards, which could be a possible fit. While these options won't promptly rectify the issue, they could be valuable instruments in your voyage to financial resilience. It's important to note, however, any form of credit offered to individuals with low scores are likely to come with considerably high interest rates, due to the higher risk perceived by lenders.

Can I Get a Personal Loan with a 388 Credit Score?

With a credit score of 388, it's unfortunately quite unlikely that you would be approved for a personal loan from traditional lenders. This score is considerably lower than what most lenders typically consider a manageable level of risk. This can make accessing traditional lending options difficult, but that doesn't mean there aren't alternatives for you to consider.

If you're unable to secure a traditional loan, other options may include secured loans, where you pledge an asset as collateral, or a co-signed loan where a trusted individual with a higher credit score vouches for you. Another viable option could be peer-to-peer lending platforms, known for more flexible credit requirements. However, keep in mind that these alternatives often mean higher interest rates and less favorable terms due to the increased risk taken by the lender. While these aren't ideal circumstances, they do offer potential solutions to help you navigate your financial needs.

Can I Get a Car Loan with a 388 Credit Score?

With a credit score of 388, it's important to understand that it will be a significant hurdle to secure a car loan approval. The credit score scale ranges from 300 to 850, and lenders tend to favor scores above 660. Unfortunately, a score of 388 falls into the category often labeled as 'bad credit'. This is viewed by lenders as a red flag because it indicates a higher risk of potential repayment issues.

Nevertheless, hope is not lost. There are lenders out there who specifically cater to those with low credit scores. However, it's critical to approach with caution, as the interest rates these lenders offer are notably higher. This increase in rate is due to the increased risk these lenders are choosing to take. The key is to closely review the terms offered and to perhaps consider other alternatives like saving up to buy a car in full or exploring public transportation and carpooling options in the meantime. Despite the obstacles, remember that it's still possible to navigate this situation.

What Factors Most Impact a 388 Credit Score?

Understanding a credit score of 388 is critical in setting a course toward financial recovery. Comprehending the reasons causing this low score can help you work toward boosting it.

Missed Payments

Missed or late payments make a significant dent in your credit score. They could be a primary reason for your current score.

How to Check: Check your credit report for any missed or delayed payments. Anything past due could have hurt your score.

Overuse of Credit

High credit utilization, using a large part of your available credit, can pull down your score. If your cards are overused, that may be affecting your score negatively.

How to Check: Go through your credit card statements. If you're close to or exceeding your credit limit, that's a red flag.

Credit History Length

Shorter credit history can hurt your score. Having few or new credit accounts could be contributing to your score of 388.

How to Check: Assess your credit report to understand your oldest, newest, and average age of all your credit accounts. Recent account openings may be impacting your score.

Public Records

Public records such as bankruptcies, foreclosures or tax liens can also contribute toward a low score.

How to Check: Review your credit report to find any public records. Any listed items that need resolution can damage your score.

Credit Variety

Lack of variety in the type of credit you've used can be a factor too. It's crucial to manage different types of credit responsibly for a good score.

How to Check: Evaluate your mix of credit accounts - credit cards, retail accounts, installment loans, mortgage loans. It's important to diversify your credit accounts and minimize new credit applications.

How Do I Improve my 388 Credit Score?

With a credit score of 388, you’re facing a lower-than-average rating. Nonetheless, there’s hope in enhancing your score through the right steps customized for your scenario. Here are some accessible strategies for bettering your credit situation:

1. Settle Outstanding Debts

Consult your credit report, identify any outstanding debts, and develop a strategy to tackle them. It’s recommended that you focus on overdue or high-interest loans first. If needed, get in touch with your creditor to discuss the possibility of a better repayment plan.

2. Reduce High-Interest Debts

High-interest debt, typically associated with credit cards, can drastically impact your credit score. Ensure you aim to lower these debts to less than 30 percent of your credit limit to establish a positive credit behavior.

3. Rebuild Credit with a Secured Loan

Due to your current low score, normal loans may be out of grasp. Consider a secured loan, which involves collateral as a security measure. If managed responsibly, this can be a stepping stone towards rebuilding your credit.

4. Seek a Credit-Boosting Program

Explore the possibility of a credit-boosting program that reports bill payments like utilities and telecom to credit bureaus, thereby showcasing your ability toward consistent payments.

5. Maintain Account Age

Older credit accounts contribute positively to your credit history length. As you work on your outstanding debts, try to keep your oldest accounts open and in good standing.

These targeted steps can help improve your credit score from 388, offering a clear path towards better financial health. Remember, patience and consistent responsible behavior are key in this journey.