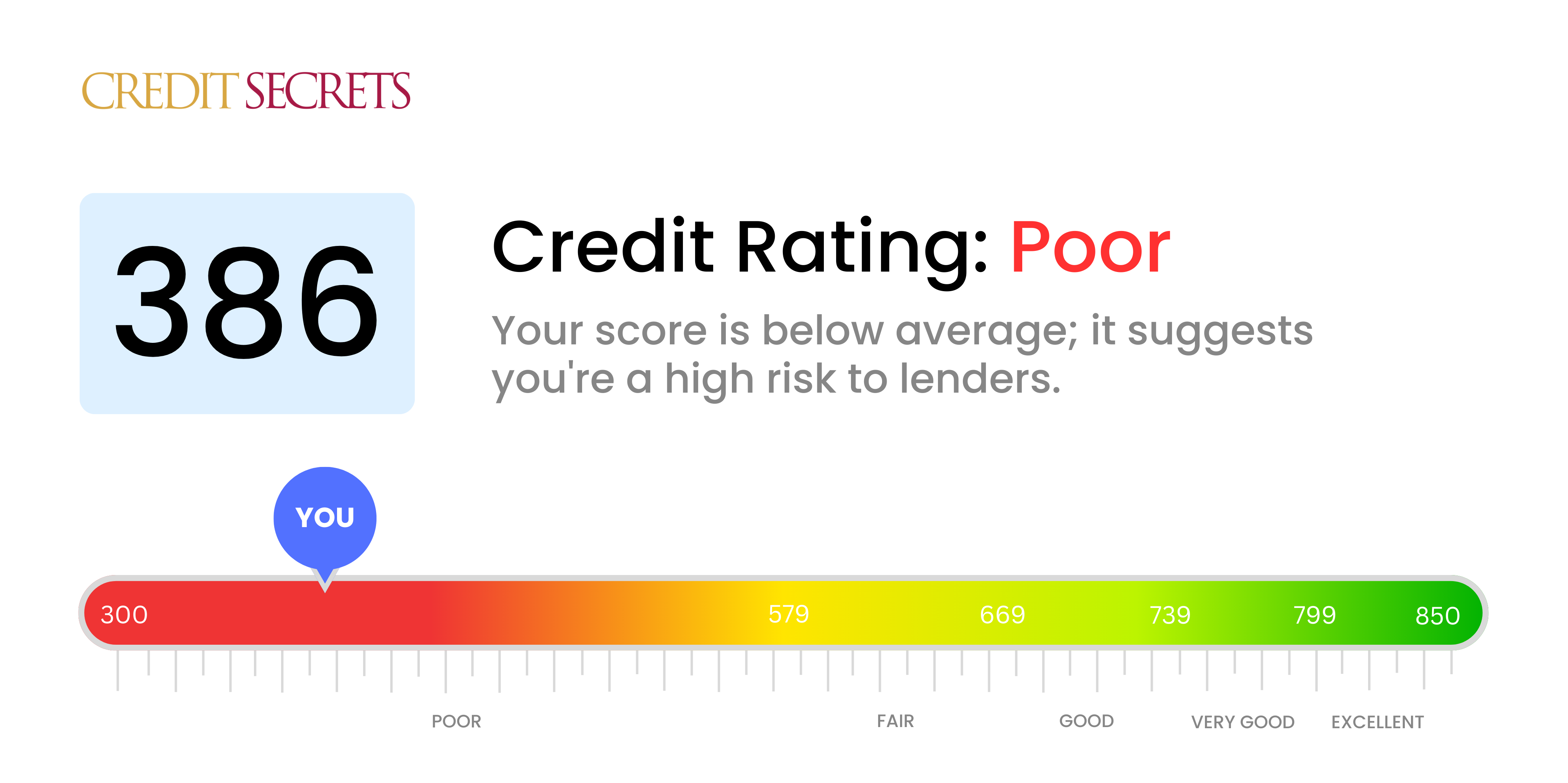

Is 386 a good credit score?

With a credit score of 386, you are currently in the 'Poor' credit category. It's not the ideal situation, but remember this isn't final. Credit scores change over time and there are steps you can take to improve your financial health.

Having a 386 credit score may make it more challenging to get approved for credit cards and loans with favorable interest rates. You may find that you're often subject to higher interest rates and more restrictive terms. However, you can positively influence your score by making timely payments, reducing your debt, and carefully managing your credit. You have the power to change your financial future!

Can I Get a Mortgage with a 386 Credit Score?

Having a credit score of 386 signifies a poor credit history, which unfortunately lowers the likelihood of you being approved for a mortgage. Most loan providers typically seek a higher score, demonstrating a consistent record of financial responsibility and prompt payment history.

Due to your current score, mortgage lenders may perceive you as being a high-risk borrower, which indicates a higher probability of you defaulting on your mortgage payments. Interest rates, if a loan is approved, are usually significantly higher for people with low credit scores.

However, don't lose heart. There are alternatives available for you. One option could be seeking a co-signer with a high credit score to help secure the mortgage. Also, there are several reputable non-profits and government agencies providing free resources and programs designed to assist individuals in improving their credit health. Remember, improving a credit score needs persistence and discipline, but with time and diligent effort, it is achievable.

Can I Get a Credit Card with a 386 Credit Score?

With a credit score of 386, the chances of being approved for a traditional credit card are unfortunately very slim. This score likely reflects some previous financial challenges and lenders frequently perceive it to be high-risk. It's tough to hear, but it's crucial to face the fact about the current credit situation. Acknowledging this is a solid step towards a healthier financial future.

There's no need to lose hope, though. Certain alternatives can still help navigate through this stage. Secured credit cards, for instance, can be a good option. These cards require a deposit which will serve as your credit limit, making them somewhat easier to acquire and can assist in credit restoration over time. Pre-paid debit cards or getting a co-signer are also worthwhile considerations. Do keep in mind, any form of credit accessible for such scores will likely carry a high interest rate, given the increased risk perceived by lenders. Nevertheless, these options can be beneficial stepping stones on the path to financial stability.

Can I Get a Personal Loan with a 386 Credit Score?

With a credit score of 386, obtaining a personal loan through traditional lenders might pose a significant challenge. This score, unfortunately, falls considerably below the typical range of credit scores that lenders look for when deciding loan approvals. It denotes high risk in the lender's perspective, making it less probable for a personal loan to be granted. This situation may seem daunting, but it's essential to acknowledge what this score indicates about your borrowing capabilities.

While mainstream personal loans may be a long shot, other options might still be within reach. Considering a secured loan, which uses an asset as collateral, is one option. Co-signed loans are another potential avenue; here, someone with a high credit rating signs on your behalf. Another alternative can be peer-to-peer lending platforms which at times, may have more flexible credit requirements. Be mindful, however, that these options typically come with higher interest rates and less favorable terms due to the perceived risk involved for the lender.

Can I Get a Car Loan with a 386 Credit Score?

When dealing with a credit score of 386, you'll likely find that receiving approval for a vehicle loan can be quite difficult. Most loan providers seek scores that hit over 660 for favorable loan conditions. Unfortunately, anything below 600 is usually seen as subprime, and your score of 386 falls well into this range. This could lead to potentially higher borrowing costs or even loan rejections because lenders associate lower credit scores with increased lending risk.

Nonetheless, a lower credit score doesn’t necessarily stop you from realizing your aspirations of owning a car. There are lenders that work specifically with individuals dealing with lower credit scores. Keep in mind though, the loans they offer tend to carry substantial interest rates. This occurs because lenders view these loans as risky and higher interest rates serve as a means of protecting their investment. Despite the potential setbacks, by exploring carefully and understanding all the terms, securing a car loan is not entirely impossible.

What Factors Most Impact a 386 Credit Score?

Building a brighter financial future starts with understanding where you're starting from. Knowing why your credit score is 386 is the first crucial step.

Poor Payment History

Payment history has a significant influence on your credit score. A history of late or missed payments could potentially be the reason for your score being low.

How to Check:A closer inspection of your credit report will reveal any late or defaulted payments. Reflect on whether any of these instances could relate to your questionable score.

High Credit Utilization

An excessively utilized credit limit can bring down your score drastically. If your credit card balances are consistently near or at their limit, this might be dragging your score down.

How to Check:Update yourself with the latest on your credit card statements. Check if the balances are frequently hitting their limit. It's advisable to maintain a lower balance compared to the credit limit.

Short Credit History

A short length of credit history can also contribute to a lower credit score.

How to Check:Scrutinize your credit report to find the oldest and most recent credit account ages, and note down the average age of all your accounts.

Derogatory Marks

Public records like bankruptcies or collections can have a significant impact on your score.

How to Check:Analyze your credit report and check for any derogatory marks. Work on resolving any issues that appear on your report.

How Do I Improve my 386 Credit Score?

A credit score of 386 is much lower than most creditors would prefer. However, regardless of your current financial situation, it is more than feasible to reverse the trend. Here are concrete, and achievable steps suited specifically for your current credit score situation.

1. Rectify Outstanding Debts

Begin by identifying and settling all existing arrears on your credit report. Overdue accounts are a key factor that can dangerously dip your score. Gradually clear these debts, focussing on the most delinquent accounts first, as their impact is the strongest on your overall score. Don’t shy away from liaising directly with your creditors to discuss feasible repayment structures.

2. Opt for Lower Credit Card Utilization

Keep your credit card balance low compared to your credit limit to avoid a negative score impact. Strive to decrease your balances to below 30% of your credit limit, and in the long run, aim to keep them under 10%. Begin by focusing on the cards with the highest usage rates.

3. Consider a Secured Credit Card

Given your current low score, gaining approval for an unsecured credit card may prove difficult. A secured credit card, which is backed by a cash deposit that then becomes your credit limit, may be easier to acquire. Through responsible use, you can build a favorable payment record.

4. Seek to Become an Authorized User

If you have someone close to you with a robust credit score, kindly request them to add you as an authorized user on one of their credit cards. By doing this, you can benefit from their positive credit activity. Verify with the credit card company that they report the activities of authorized users to credit agencies.

5. Aim for a Diversified Credit Portfolio

Having a variety of credit types can help boost your credit score. Once a positive credit history is established using a secured card, consider other forms of credit like retail cards or credit builder loans, but be sure to manage these accounts responsibly.