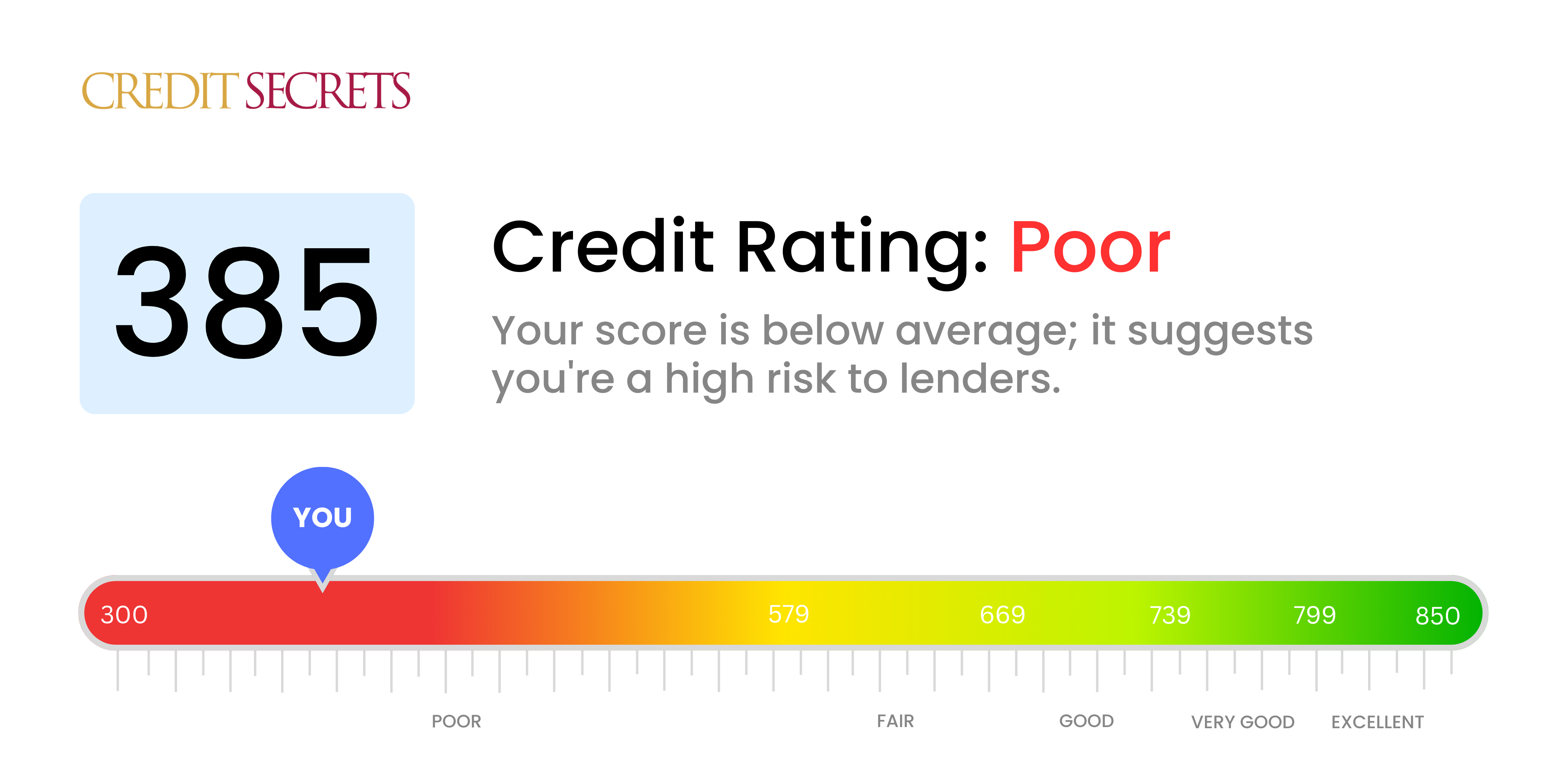

Is 385 a good credit score?

Having a credit score of 385 is categorized as poor under traditional credit ratings. With this score, you may face challenges when applying for loans or credit, given that lenders often consider it a risky proposition to lend to those with poor credit ratings. However, don't be discouraged, there's always room to improve and elevate your credit score.

The path to a better credit score begins with understanding the factors that influence it, such as payment history, amounts owed, and the length of credit history, among others. From there, you can set about creating a robust plan to manage and improve these factors, from making timely payments to decreasing your overall debt load, all while keeping a closer eye on your credit usage.

Can I Get a Mortgage with a 385 Credit Score?

A credit score of 385 is significantly lower than what most lenders typically consider satisfactory. Having a score in this range suggests a history of financial obstacles, possibly including late or missed payments. In most cases, it'sunlikely that a mortgage would be approved with a credit score in this range.

This news may seem difficult to bear, but there's no reason to lose hope. There are a number of ways to start the process of improving your credit score. Address any overdue debts and make consistent, on-time payments moving forward. Be diligent about your credit use in order to develop a healthier financial track record. This process may take time, so patience is key. Remember, it's entirely possible to improve your credit situation and work toward a future where obtaining a mortgage is within reach.

As your credit score significantly impacts the interest rates offered to you, a higher credit score will generally mean lower interest rates. This highlights the importance of improving your current credit score before applying for a mortgage. A lower credit score could result in higher interest rates, ultimately costing you more in the long term. So, it's best to focus on improving your credit score first.

Can I Get a Credit Card with a 385 Credit Score?

With a credit score of 385, you're likely to face substantial hurdles when applying for a traditional credit card. This score is seen as high-risk by lenders, indicating a past marked by financial setbacks or struggles. It's hard to accept, there's no doubt about that, but facing your financial situation head-on is crucial to finding a path towards improvement.

Since acquiring a standard credit card might prove extremely difficult with a low credit score, you might want to look at other options, such as secured credit cards. These cards require a deposit, which sets your credit limit and can be simpler to attain, thereby assisting in the gradual improvement of your credit. Alternatively, exploring options like getting a co-signer or using prepaid debit cards may also be plausible solutions. While these alternatives may not rectify the situation instantly, over time they can work towards improving your financial standing. It’s worth noting that interest rates associated with any credit cards or loans you might be approved for, are likely to be significantly higher due to the perceived risk from lenders.

Can I Get a Personal Loan with a 385 Credit Score?

A credit score of 385 is rather low and generally considered risky by traditional lenders. This score might make the prospect of securing a personal loan challenging. However, it's important to understand this isn't a reflection of your worth, but merely an indication of risk from a lender's perspective.

Unfortunately, this credit score may restrict your options with traditional personal loans, but that doesn't mean all doors are closed to you. Options like secured loans, where you offer an asset as security, or co-signed loans, where someone with better credit stands as your guarantor, remain accessible. Peer-to-peer lending platforms might also be a route to explore, given their potentially more flexible credit requirements. Do keep in mind, these options often bear higher interest rates and less favorable conditions due to the increased risk for the lender.

Can I Get a Car Loan with a 385 Credit Score?

A credit score of 385 falls below what most lenders consider acceptable for a car loan. They usually prefer scores above 660, categorizing any score under 600 as subprime. With a score of 385, you might face higher interest rates or even denial of your loan application, as it suggests a higher risk to the lenders. Lenders interpret this score as a possible indicator of difficulty in repaying loans in the past.

However, it's important to know that a low credit score doesn't completely prevent the possibility of a car purchase. Some lenders work specifically with individuals with lower credit scores, but beware—these loans typically come with substantially higher interest rates. The high rates are attributed to the increased risk lenders perceive, making it a method to maintain their investment. Ensuring that a car loan is still possible involves diligent consideration and comprehensive exploration of the terms. Down this potentially rough road, securing a car loan is still achievable, even with a lower credit score.

What Factors Most Impact a 385 Credit Score?

Understanding your credit score of 385 is a vital step to turning your financial situation around. Uncovering the potential reasons behind this score is the key to initiate positive changes.

Poor Payment History

With a score of 385, it's likely that a history of missed or late payments have had a significant impact on your credit. This is the main factor to review and improve on.

How to Check: Examine your credit report for any instances of payments made past their due date, or not made at all.

High Debt-to-Credit Ratio

Higher utilization of available credit can often drag your score down. If you're using most of your available credit, this could be a contributing issue.

How to Check: Review your credit balances. If they’re at or near their limits, lower those balances to improve your score.

Limited Credit History

Limited credit history can affect your score. With fewer accounts or a shorter history, lenders have less to assess your creditworthiness on.

How to Check: Look at the length and number of your credit accounts on your report. The longer the history and more diverse the account types, the better for your score.

Negative Records

Public records such as defaults, bankruptcies, or tax liens could drastically lower your credit score.

How to Check: Review your credit report for any negative records – resolving these should help in boosting your score.

Too Many Inquiries

Applying for multiple new credit can harm your score as it gives the impression of financial desperation.

How to Check: Check how many new applications or 'hard inquiries' you have made on your credit report. Aim to minimize these for a healthier credit score.

How Do I Improve my 385 Credit Score?

Having a credit score of 385 might be discouraging, but it’s a starting point for progress. Here are targeted steps that you can take to begin improving your credit.

1. Settle Outstanding Debts

Focus on paying any outstanding debt. This takes priority since it severely impacts your credit score. Contact your creditors; they may be willing to agree on a payment plan.

2. Lower Credit Card Utilization

High balances on your credit cards can harm your score. Try to keep your balance under 30% of your credit limit. If possible, aim to bring it down to less than 10%. Begin by tackling cards with the highest utilization.

3. Consider a Secured Credit Card

Securing a regular credit card may be tough with your current score. A secured credit card could be a feasible option- it uses a cash collateral deposit as a credit line. Use it judiciously to build a healthy payment history.

4. Enlist as an Authorized User

If you have a trusted individual with good credit, you could ask them to add you as an authorized user on their credit card. This allows their good payment behavior to boost your credit score. Make certain the card provider reports authorized user activities to credit bureaus.

5. Diversify Credit Portfolio

Diversifying your credit accounts can positively affect your score. Start with responsible usage of a secured card, then consider applying for a credit builder loan or retail credit card. Proper management of different credit types can lead to improvement in your score.