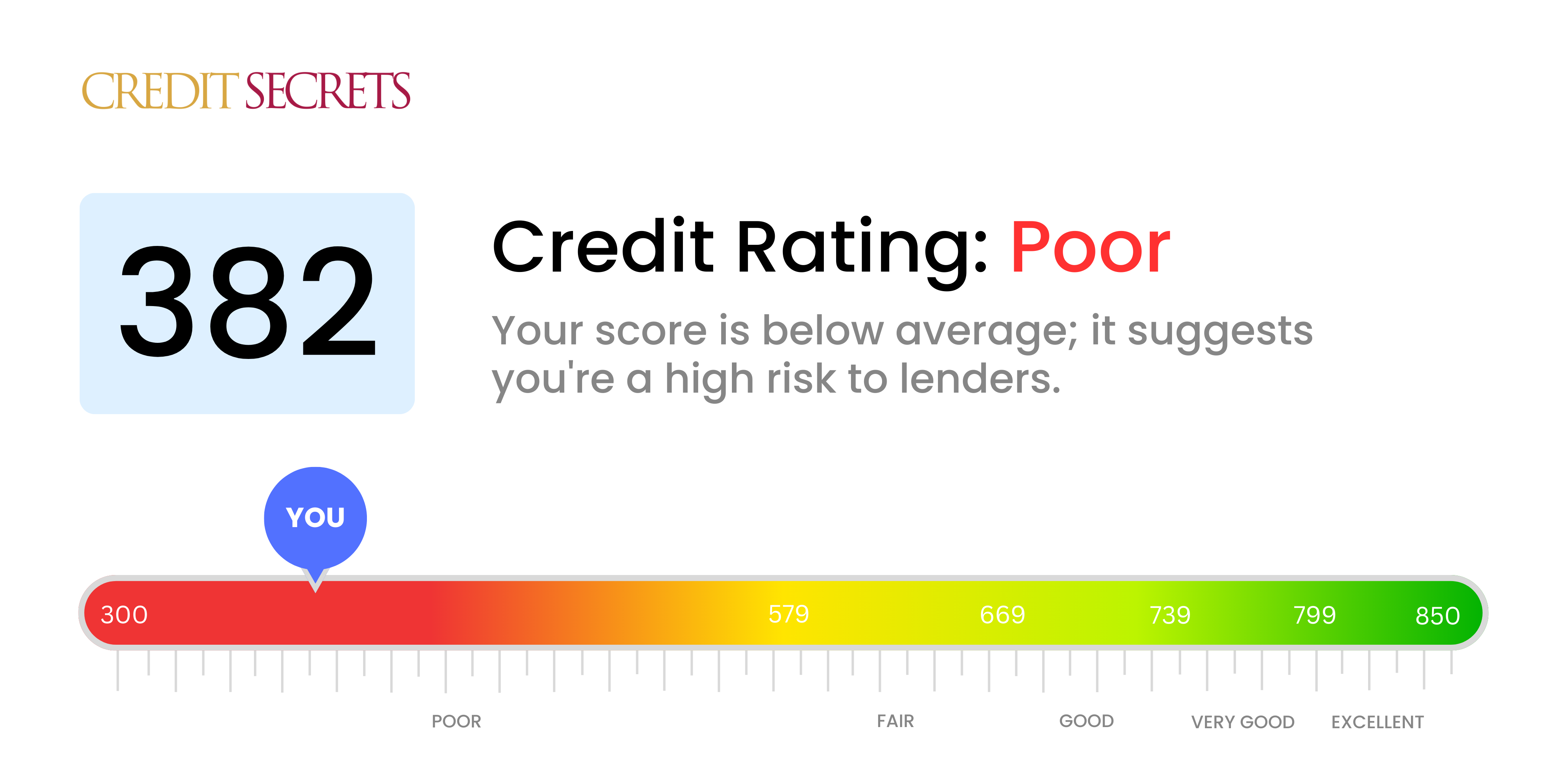

Is 382 a good credit score?

The credit score of 382 falls under the poor range. This unfortunately means you may have a more challenging time securing loans, credit cards, and attractive interest rates. However, don't lose heart; even with a score like this, it's still possible for you to improve your financial standing and creditworthiness over time.

Making timely payments, reducing existing debt, and making responsible new credit decisions can all support your journey toward improving your credit score. With persistence and a conscious effort, you have the ability to change your financial destiny. Remember, everyone's credit journey is unique and it's never too late to start improving your credit score.

Can I Get a Mortgage with a 382 Credit Score?

Carrying a credit score of 382, your prospects of obtaining a mortgage approval are slim. The vast majority of lenders look for a higher score, signifying a more reliable repayment history. A credit score in your current range suggests significant financial disruptions, such as missed payments or defaults.

Though it may feel disheartening, it's pivotal to begin the journey of credit score rehabilitation. Start off by tackling any debts or overdue payments that are presently lowering your score. As you settle these, aim to establish a consistent trend of on-time payments. While this may be challenging, it's a journey well worth undertaking. Keep in mind, restoring your credit score is a progressive process, but with continuous dedication, you can strengthen your financial standing for future endeavors.

However, in the meantime, there may be other housing options to consider such as renting, finding a cosigner for a mortgage or exploring government housing programs. Your present credit score may limit opportunities in the short term, but remember, with diligent and careful credit management, there's always room for improvement.

Can I Get a Credit Card with a 382 Credit Score?

Having a credit score of 382 can make it significantly hard to get approved for a regular credit card. This score can be taken as a signal of financial distress or past issues with managing credit, which makes lenders cautious. It's discouraging, but facing these hurdles with understanding and patience is a constructive step to improving your situation.

With your current credit score, secured credit cards may be a more accessible option. These cards use a deposit that's also the available credit limit. They could help with the process of rebuilding your credit slowly. You could also think about getting a co-signer or using pre-paid debit cards. Even though these options don't provide an immediate resolution, they do offer a pathway to better financial stability. Remember, any credit product accessible to you with this credit score is likely to have considerably higher interest rates because of the elevated risk lenders perceive.

Can I Get a Personal Loan with a 382 Credit Score?

A credit score of 382 falls far below the range typically seen as satisfactory by traditional lenders. This score identifies a significant risk which makes it highly unlikely for you to receive approval for a personal loan. It's challenging when your credit score impedes your borrowing options, but it's vital to understand its severity.

Though traditional personal loans might not be an accessible solution, there are still some alternatives. Secured loans, which require collateral, or co-signed loans, backed by an individual with a higher credit score, might be viable options. Peer-to-peer lending is another alternative, as these platforms can sometimes have more relaxed credit requirements. Be aware that these options often carry higher interest rates and terms that might not be as favorable due to the inherent risk posed to the lender.

Can I Get a Car Loan with a 382 Credit Score?

Having a credit score of 382 is definitely tough when it comes to securing a car loan. Most lenders look for applicants who have a credit score of 660 or above to offer loans with a reasonable interest rate. Your score falls far below this range. This raises red flags for potential lenders as a low score like yours signals a higher risk of lending.

Regrettably, it's highly unlikely for you to get approved for a car loan with a credit score of 382. It implies that there have been serious issues with managing credit in the past which can lead to loan denial or exorbitant interest rates.

However, all hope is not lost. There are auto loan providers that cater to those with lower credit scores. But a word of caution, these loans usually have much steeper interest rates to compensate for the high risk to the lender. It's critical to carefully read and understand the terms before choosing this route. Remember, while challenging, purchasing a car isn't impossible even with a low credit score.

What Factors Most Impact a 382 Credit Score?

With a credit score of 382, it's critical to understand the contributing factors to establish a plan towards improvement. Let's delve into the elements that can greatly influence such a score.

Payment History

One significant factor is your payment history. Late or defaulted payments can markedly impact your score.

How to Check: Peruse your credit report for any missed or late payments - these may have reduced your score.

Credit Utilization

A high credit utilization ratio can also pull down your score. If you're utilizing most of your available credit, it's a potential red flag.

How to Check: Check your credit card statements. Keep an eye on any high balances relative to your limit.

Credit History

A brief credit history could negatively impact your score, making it crucial to establish a record of responsible credit usage over time.

How to Check: Scan your credit report for the age of your oldest and most recent accounts and the average age of all your accounts.

Credit Diversity

The diversity of your credit types contributes to your score. A healthy mix of credit types can demonstrate your ability to manage various forms of credit responsibly.

How to Check: Look at your portfolio of credit accounts. A mix of revolving and installments loans is ideal.

Public Records

Public records, like bankruptcies or tax liens, can significantly pull your score down.

How to Check: Review your credit report for any public records. Act promptly to resolve any outstanding issues.

How Do I Improve my 382 Credit Score?

With a credit score of 382, it’s clear that there is room for improvement, but don’t be disheartened. Here are a series of strategic actions designed specifically for your current credit situation:

1. Deal With Delinquent Accounts

Accounts with payments overdue by 30 days or more can severely affect your credit score. If you have any such accounts, prioritise settling them. Begin with the accounts that are most overdue. If you can’t pay the entire sum, contact your creditors to negotiate a flexible payment plan.

2. Aim for Lower Utilization Rates

High percentage utilization rates of your credit limit can negatively impact your score. Strive to maintain your credit utilization ratio under 30% by reducing your credit card balances. Pays off the balances on cards with highest rates of utilization first.

3. Apply for a Secured Credit Card

Given your current score, procuring a standard credit card might be difficult. A secured credit card, which requires a deposit equal to your credit limit, could be a solution. Use this card responsibly to create a good payment history.

4. Be an Authorized User

If you know someone with a good credit score, ask if you can be an authorized user on their card. This could help by merging their good credit history with yours, provided the card company reports this to credit bureaus.

5. Broaden Your Credit Variety

With responsible management, a mix of credit types can help boost your score. Once a good payment history is established via a secured card, you might consider adding other credit types like retail cards or credit builder loans.