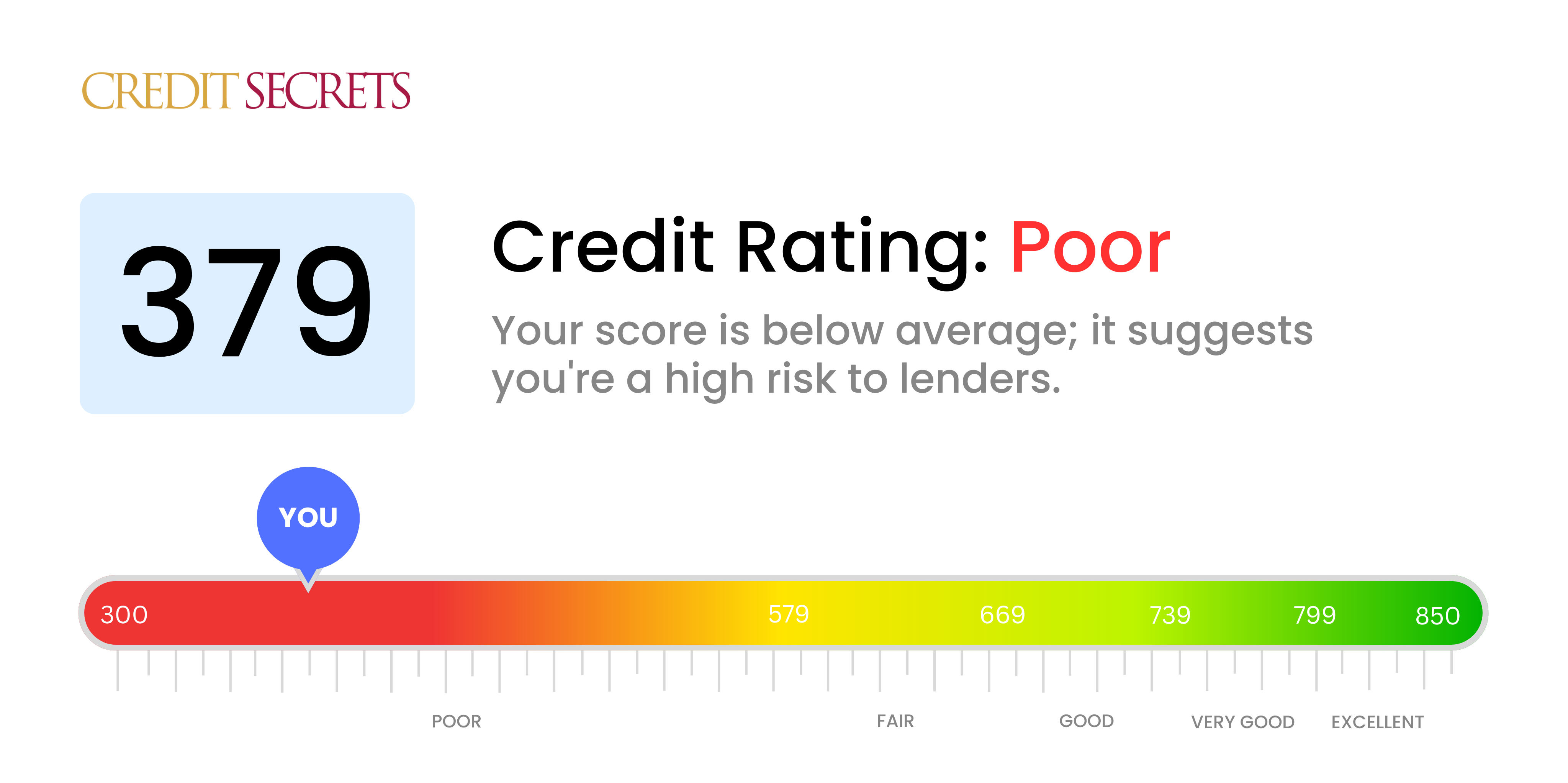

Is 379 a good credit score?

With a credit score of 379, it's clear that your financial status falls into the 'poor' category according to standard industry ratings. This can present a significant amount of challenges for securing loans or favorable interest rates, but understanding this is the initial step towards enhancing your credit health.

It is crucial to remember that while a score like yours does indicate a troubled financial past, it certainly isn't a life sentence. There are several measures you can take to start improving your credit score, from paying your bills on time to responsibly using and maintaining credit balances. The journey towards a stronger credit stance might feel strenuous at times, but your effort and persistence can pay off. A better score can open doors to opportunities that help foster a stable financial future.

Can I Get a Mortgage with a 379 Credit Score?

With a credit score of 379, the prospects of being approved for a mortgage are unfortunately quite slim. This score is significantly lower than what lenders typically require. Poor credit scores like these often reflect a record of financial complications, such as delayed payments or financial defaults.

Being in such a situation may feel disheartening, but it's important to remember that steps can be taken to improve. Firstly, aim to resolve any existing debts or past-due accounts that could be causing your score to decrease. Following this, foster a consistent pattern of making payments on time and utilizing credit wisely. The journey to a healthier credit score is a long one, but with persistence and dedication, it's entirely achievable. Remember that with each incremental improvement in your score, you increase your possibilities for the future.

In terms of alternatives, some borrowers might look into federally insured loans like FHA loans, which at times accept lower credit scores. But understand that even these options come with their own criteria and may bring higher interest rates due to the risk associated with lower credit scores.

Can I Get a Credit Card with a 379 Credit Score?

If your credit score is 379, it may be tough to get approved for a conventional credit card. This low score can indicate to lenders that you may be a high-risk client, possibly due to past financial struggles or challenges in managing credit. It's certainly not easy to face the truth about such a low score, but acknowledging your current situation is the initial step towards improving your financial health.

As it's hard to secure traditional credit cards with a score of 379, you might have to consider some alternatives. Secured credit cards for instance, are an option worth exploring. These cards require a deposit which serves as your credit limit. They can be easier to acquire and may help rebuild your credit score gradually. Another alternative could be acquiring a co-signer or using prepaid debit cards. While they don't offer an instant solution, they can play a vital role on your path to financial betterment. Just remember, any credit option accessible with such a low score is likely to come with higher interest rates, due to the lenders perceiving you as a higher risk.

Can I Get a Personal Loan with a 379 Credit Score?

With a credit score of 379, obtaining approval for a personal loan from traditional lenders can be exceptionally challenging. This score is considerably lower than the range typically considered acceptable by most lenders, placing you, unfortunately, at a high-risk category. This stark reality implies limited borrowing alternatives given your current score.

But do not lose hope. Other viable options could include secured loans, where an asset such as a home or car serves as collateral, or co-signed loans involving a co-signer with a better credit score. You could also explore peer-to-peer lending platforms that might offer more lenient credit requirements. It's important to note, though, that these alternatives may present higher interest rates and less favorable terms given the riskier nature of the loan from the lender's perspective.

Can I Get a Car Loan with a 379 Credit Score?

Holding a credit score of 379, the pathway towards approval for a car loan might seem rocky. Society has deemed a score above 660 as healthy, and anything below 600 has been labelled as subprime. Unfortunately, your score of 379 falls into this subprime scope. This can commonly lead to higher interest rates or the wrenching experience of loan denial. This reaction stems from lenders' fear of risk — to them, a lower score may hint at potential struggles with repayments.

Nonetheless, the idea of owning a car doesn't have to remain a dream. Some lenders have designed their services to cater to those with lower scores. But tread lightly, as these loans often bear much higher interest rates. The steep rates are a protective layer for lenders against the risk they perceive. Despite the nevertheless challenging road ahead, securing a car loan is not an impossible feat. With careful thought and a deep understanding of the terms, you can very much grasp the keys to your dream car.

What Factors Most Impact a 379 Credit Score?

Knowing the possible factors contributing to a score of 379 is the first step toward boosting your credit. Here are the key areas that are likely impacting your score the most:

Payment History

Payment history plays a significant role. Late or missed payments can significantly lower your score.

How to Check: Check your credit report for any history of late or missed payments. Reflect on any situations where your payments weren't submitted on time.

High Credit Utilization Ratio

Your credit utilization ratio—the amount of credit you’ve used compared to your credit limits—may be high. A lower ratio is better for your credit score.

How to Check: Look over your credit report and review your credit card balances in relation to their limits. If they're continually high, aim for lower balances.

Short Credit History

Only having credit history of a short duration can adversely affect your score.

How to Check: Scrutinize your credit report and compute the average age of your credit accounts. Think about the time elapsed since you opened your newest credit account.

Diversity of Credit

Lacking a mix of credit types—such as installment loans, mortgage loans, and credit cards—may contribute to your current score.

How to Check: Study your credit report to gauge your diversification. It's beneficial to handle different types of credit responsibly.

Negative Public Records

Negative public records like bankruptcies or tax liens can severely impact your score.

How to Check: Scan your credit report for any such records. If found, take steps to address and resolve these issues diligently.

How Do I Improve my 379 Credit Score?

With a credit score of 379, you’re facing certain challenges, but with careful strategies tailored to your situation, you can boost your score. To assist you in this task, here are your accessible and impactful action steps:

1. Handle Outstanding Debts

Start off by managing your unpaid debts. Remember, accounts that are long overdue have the greatest impact on your score. Contact your creditors and explain your situation to potentially agree on a feasible repayment plan.

2. Aim for Lower Credit Card Utilization

Highly utilized credit cards can drag your score down. Where possible, aim to reduce your credit card balances to less than 30% of your available limit. Another healthy practice is striving to keep your ratios under 10% over time. Start by focusing on the cards with the highest usage.

3. Consider a Secured Credit Card

Secured credit cards can be a viable solution if establishing standard credit is proving difficult. To get one, you’ll need to provide a refundable deposit which then becomes your credit line. Use this card wisely, making sure to pay off the balance in full monthly to start building a good payment record.

4. Request to Be an Authorized User

Ask a reliable friend or relative with sound credit if you can be included as an authorized user on their account. Their good payment track record could reflect positively on your credit history; just ensure that the card provider reports authorized user activity to the bureaus.

5. Introduce Variety into Your Credit

Once your record improves with consistent secured card payments, consider applying for diversified credit options like credit builder loans or retail cards. Ensure that you perform your commitments responsibly to set a positive track for your credit improvement.