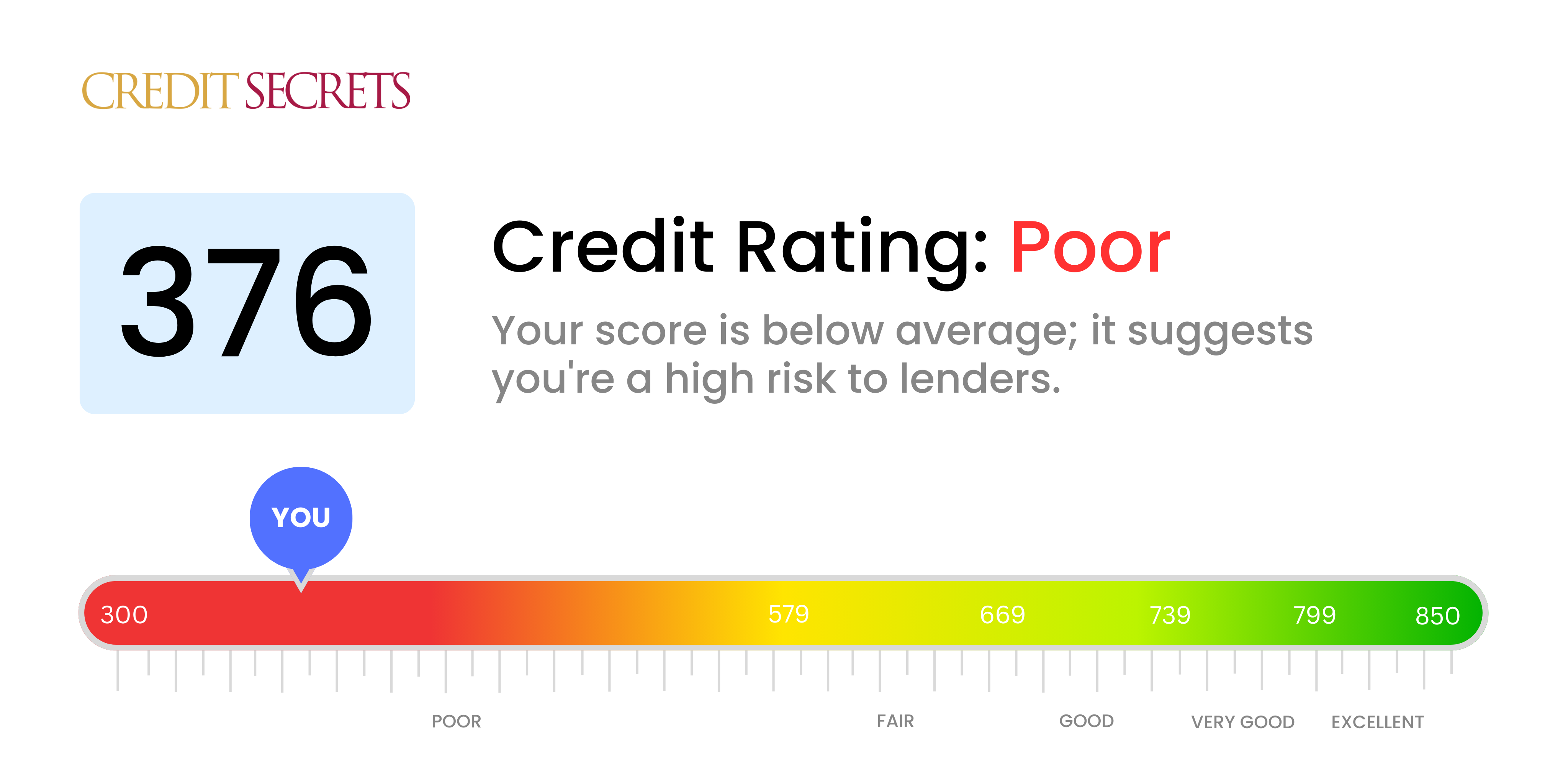

Is 376 a good credit score?

Your score of 376 falls into the 'Poor' credit category. This suggests that lenders may see you as a high-risk borrower and you might find it challenging to get credit approval. But remember, this isn't the end of your financial journey. There are steps you can take to enhance it.

While a 376 credit score can make borrowing more tricky, it doesn't mean you can't take actions to improve it. Stay optimistic, steer clear of more debt and focus on timely payments. It requires patience and consistency, but with careful planning, you can boost your credit health and gain stronger financial footing.

Can I Get a Mortgage with a 376 Credit Score?

If you have a credit score of 376, it's extremely unlikely that your application for a mortgage will be successful. This score is significantly below the typical minimum lenders require for approval. A credit score of this level usually implies a history of financial struggles, including missed payments and defaults.

Knowing your current credit score might feel like a setback; however, it's important to tackle this issue from a realistic viewpoint. Begin by addressing and clearing any pending debts that are adversely affecting your credit score. Then, strive to establish consistent, timely payments and proper use of credit. Eligibility for a mortgage usually comes with improved credit scores, which unfortunately don't increase overnight but require persistence and effort. Remember, the road to financial health is a journey filled with incremental steps, and each one gets you closer to your goal.

Having a lower credit score may lead to higher interest rates on loans you qualify for as lenders might perceive you as a high-risk borrower. Hence, enhancing your credit score before mortgage application might assist in getting you better interest rates.

Can I Get a Credit Card with a 376 Credit Score?

Facing a credit score of 376 can feel overwhelming. It's important to understand that this score generally represents a high-risk to lenders, making it quite difficult to qualify for a credit card. Unfortunately, this lower score can be seen as an indication of past financial hardships or mishandling. The good news is that acknowledging your credit status is the first step towards achieving better financial health. Sometimes, this journey involves acknowledging harsh realities.

You might want to consider other financial tools, such as secured credit cards. These cards require a deposit which becomes your credit limit, making them a more manageable option. Co-signing with someone who has a stronger credit score or using pre-paid debit cards might also be good possibilities. Remember, these tools aren't an immediate fix, but they can be instrumental in creating positive change. Also, be aware that any credit options you qualify for may come with higher interest rates due to your current score. This is a reflection of the elevated risk seen by lenders.

Can I Get a Personal Loan with a 376 Credit Score?

With a credit score of 376, it's unlikely that traditional lenders will approve you for a personal loan. This score might be disheartening, but it's crucial to understand that lenders see it as a significant financial risk. The straightforward truth is you will find it challenging to secure a loan with this credit score. But remember, every cloud has a silver lining.

Even though conventional loans might be difficult to attain, alternative options exist. Secured loans, co-signed loans, and peer-to-peer lending platforms might be possibilities for you. With secured loans, you'll need to provide collateral, or with co-signed loans, someone with a stronger credit status backs your loan. Peer-to-peer lending sometimes offers loans for those with lower credit scores. Nevertheless, it's key to bear in mind that these alternative routes may come with higher interest rates and slightly tougher terms due to increased lender risk.

Can I Get a Car Loan with a 376 Credit Score?

With a credit score of 376, you might find it difficult to secure a car loan. It's common for lenders to seek credit scores in the higher spectrum, typically above 660, for favorable loan conditions. Scores below 600 are often viewed as subprime, indicating a higher risk for lenders. Your score of 376 falls into this high-risk category, potentially leading to higher interest rates or the denial of your loan application. This is due to lenders seeing a lower credit score as a possible sign of challenges in repaying borrowed funds.

Despite these challenges, it's not completely impossible to purchase a car. Certain lenders may specialize in catering to individuals with lower credit scores like yours. But be mindful, loans from these sources often come with substantially higher interest rates. These rates are the lender's protective measure against the perceived risk they are taking on. The journey might feel tough, but with careful thought and a solid understanding of the loan terms, getting a car loan isn't totally out of the question.

What Factors Most Impact a 376 Credit Score?

Knowing the particulars behind a credit score of 376 is a pivotal step on the path to improving your financial health. When you understand and target the core factors responsible for this score, you're taking a stride toward a robust financial future. Each financial journey is unique, offering opportunities to grow and learn.

Payment History

With a considerable influence on your credit score, a history of late or missed payments is a probable factor in a score of 376. Assess your payment habits and ensure future payments are made promptly.

How to Check: Investigate your credit report for signs of delinquency or defaults. Any late or missed payments will have had a negative effect on your score.

Credit Utilization

When your credit utilization rate is high, it puts a downward pressure on your credit score. Maxed out credit cards or loan limits could be a contributing issue.

How to Check: Scrutinize your credit card and loan statements. Are your balances scraping the ceilings? Strive to maintain balances that are low relative to your limits.

Length of Credit history

A brief credit history could negatively skew your credit score. The longevity of your credit accounts is important.

How to Check: Check your credit report to see the length of your oldest account, newest account, and the overall average age of your accounts. If your credit history is relatively young, this could have impacted your score.

Public Records

Public filings such as bankruptcies or tax liens can impose a hefty toll on your credit score.

How to Check: Search your credit report for any public records. Address any mentioned issues and take steps to resolve them promptly.

How Do I Improve my 376 Credit Score?

A credit score of 376 is low, but it’s never too late to redefine your financial future. Here are some practical and actionable steps tailored to your present score:

1: Pull and Examine Your Credit Report

Get a copy of your credit report and meticulously examine every detail. If you spot any inaccuracies or errors, promptly dispute them as they can significantly reduce your credit score.

2: Pay Down Existing Debt

Paying off your accumulated debt is essential. Start by paying down overdue accounts, as the age of the debt matters. Aim to keep your credit card balances under 30% of your total credit limit as high utilization rates can negatively affect your score.

3: Apply for a Secured Credit Card

Secured credit cards can bolster your credit score. They require a cash collateral deposit, which then becomes your credit limit. Ensure you use the card for small purchases and pay off your balance each month to maintain a positive payment history.

4: Seek to Become an Authorized User

Explore the possibility of becoming an authorized user on a credit card belonging to someone else with an established, strong credit history. Positive payment history from their account will reflect on your credit report, effectively improving your score.

5: Explore Credit Builder Loans

Credit builder loans could also be a suitable option. They are designed to help individuals build or improve their credit scores. Make sure all your payments are timely and reported to the credit bureaus.

Implementing these steps will help you regain control over your financial health and bring you closer to your finance goals.