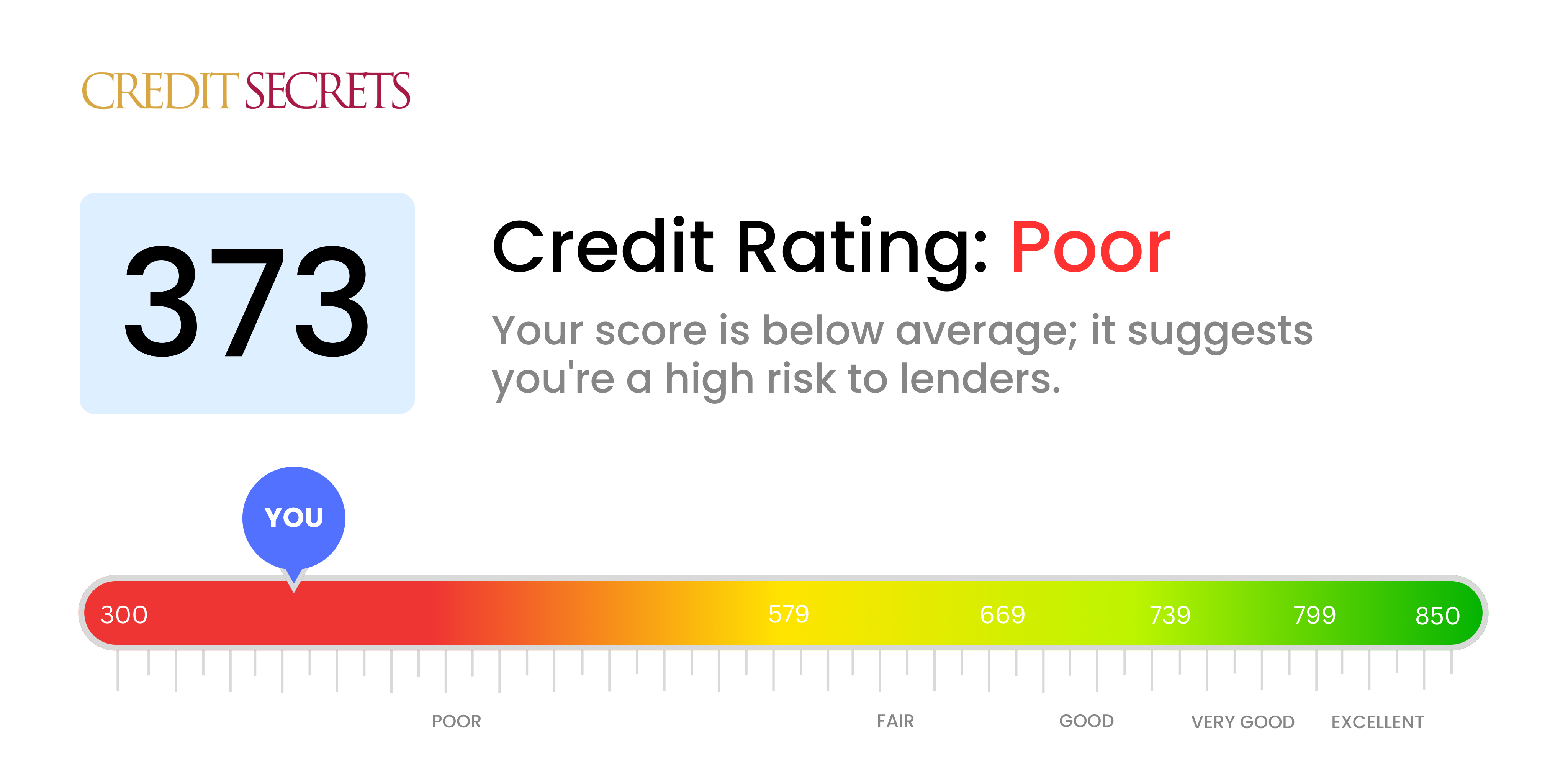

Is 373 a good credit score?

A credit score of 373 is indeed categorized as poor. However, don't be discouraged, you certainly have room to improve and you're not alone. Many people start on the journey to better financial health from a similar position.

With this type of score, obtaining new credit can be a challenge, and if approved, interest rates may be on the higher side. However, don't lose hope. Taking the right steps such as making bill payments on time, clearing existing debt, and keeping credit utilization low can help increase your score over time. Keep positive and remember that improving credit is a journey that requires patience and discipline.

Can I Get a Mortgage with a 373 Credit Score?

A credit score of 373 can create some challenges when applying for a mortgage. It falls well below the credit score that lenders typically look for. This could be seen as indicative of past financial difficulties such as missed payments, defaults, or other serious credit issues.

Facing this reality can be daunting, but it's essential to know there are steps that can be taken. Rectifying outstanding debts and making committed efforts to make payments on time can be the start point. While the journey to improving the score will require patience and diligence, these small steps can gradually enhance your credit score over time. Alternatives, if you need immediate housing, include exploring rentals or considering rent-to-own arrangements. Assuredly, you can work towards a better credit future, thereby increasing the likelihood of being approved for a mortgage in the future.

Can I Get a Credit Card with a 373 Credit Score?

It's tough to hear, but a credit score of 373 is low, meaning traditional credit cards are likely out of reach right now. This kind of score is seen by lenders as very risky, an indication of past financial struggles or mishandling of credit. However, facing this reality is in itself a positive step on the path to better financial health.

Credit is still accessible for persons with low scores, albeit in different forms. Secured credit cards are an excellent consideration. They function by utilizing a deposit as your credit limit, making it easier to obtain than standard cards and helps rebuild your credit gradually. Another alternative is thinking about a co-signer or examining pre-paid debit cards. Always bear in mind that these choices aren't quick fixes but can help in achieving financial stability overtime. Do note, however, that any credit offered to those with such scores comes with considerably higher interest rates due to the increased risk lenders perceive.

Can I Get a Personal Loan with a 373 Credit Score?

With a credit score of 373, it's generally quite challenging to secure a personal loan through conventional lenders. This score is considerably below what many lenders deem as acceptable, and you are seen as a high-risk candidate. Accepting this present reality about your credit situation may be tough, but it's a crucial step towards exploring other borrowing options.

When regular loans seem unattainable, other alternatives could be worth evaluating. Secured loans require collateral as a sort of insurance, while co-signed loans involve someone with a better credit pedigree vouching for you. Another route could be peer-to-peer lending platforms, which occasionally allow for more forgiving credit requirements. But it's essential to remember that these substitute options often carry higher interest rates and come with less favorable terms, owing to the increased risk the lender is taking on.

Can I Get a Car Loan with a 373 Credit Score?

A credit score of 373 is quite low and may pose significant difficulties in securing a car loan. Many lending institutions require a score of at least 660 to consider a loan application favorably. Lower scores, especially those under 600, often fall into what is known as a 'subprime' category. This category simply implies that there's a higher risk for the lender due to the likelihood of repayment issues, as indicated by the low credit score.

Even with a score of 373, securing a car loan isn't entirely out of reach. Some lenders specialize in dealing with credit scores on the lower end. However, caution must be applied as the interest rates may be significantly higher. This is a result of the lender's attempt to balance out the perceived risk. With this in mind, it's important to thoroughly understand the terms before proceeding. It might be a bit of an uphill climb, but owning that dream car isn't entirely off the table.

What Factors Most Impact a 373 Credit Score?

Gaining insight into a credit score of 373 is pivotal for outlining a financial boost. Recognizing and dealing with the circumstances responsible for this score will steer you towards a more secure financial stance. Every financial path is personal and riddled with opportunities for personal growth and understanding.

Record of Payments

Your payment record can have a powerful influence on your credit score. Defaulted or delinquent payments could be playing a major part in shaping your current score.

How to Check: Examine your credit report in detail, looking for any default or delayed payments. Any previous late payments could have brought down your score.

Credit Use

High usage of your available credit can bring down your score. If your credit card balances are maxed out or near their limit, then it is likely contributing to your score.

How to Check: Inspect your credit card statements. Strive to maintain low balances relative to your credit limit for a better score.

Credit History Duration

A relatively short credit history can be a negative factor in your credit score.

How to Check: Review your credit report to weigh in on the longevity of your oldest and newest accounts as well as the average lifespan of all your accounts. Also contemplate if you have opened new accounts recently.

Variety in Credit and Recent Credit

Maintaining an array of different types of credit and handling new credit judiciously is fundamental for a decent score.

How to Check: Review your array of credit accounts. This can include credit cards, retail accounts, installment loans, and house loans. Also consider if you have been applying cautiously for new credit.

Public Records

Public records like bankruptcies or tax liens can deteriorate your score dramatically.

How to Check: Scrutinize your credit report for any public records. If there are any, take steps to resolve these records.

How Do I Improve my 373 Credit Score?

Your credit score of 373 sits in the poor range; however, there are explicit measures you can take to improve your financial situation. Here’s a list of impactful and accessible action items for your specific credit score:

1. Target Delinquent Accounts

Your priority should be to address any delinquent accounts. These overdue accounts largely contribute to a low credit score. Strive to bring these accounts current by working out a payment plan with your creditors, if needed.

2. Pay Off Debt Balances

Large debt balances can hurt your credit score. Make it a priority to reduce these as much as you can, focusing initially on accounts with high interest rates. Aim to have your credit balances less than 30% of your total credit limit.

3. Apply for a Secured Credit Card

Given the low score, consider starting with a secured credit card. This card requires a deposit as collateral and provides you the opportunity to establish a sound payment history. Ensure to make small, manageable purchases and pay your balance in full each month.

4. Seek Credit as an Authorized User

Another potential strategy is becoming an authorized user on a good credit holder’s account. This arrangement allows you to benefit from their favorable credit record. Please get this person’s consent, and ensure the card issuer reports authorized users to the bureaus.

5. Expand Your Credit Types

Having a variety of credit accounts can aid in boosting your score. Begin with a secured card, progressively establishing a reliable payment history, then venture into other credit types like retail credit cards or credit builder loans.