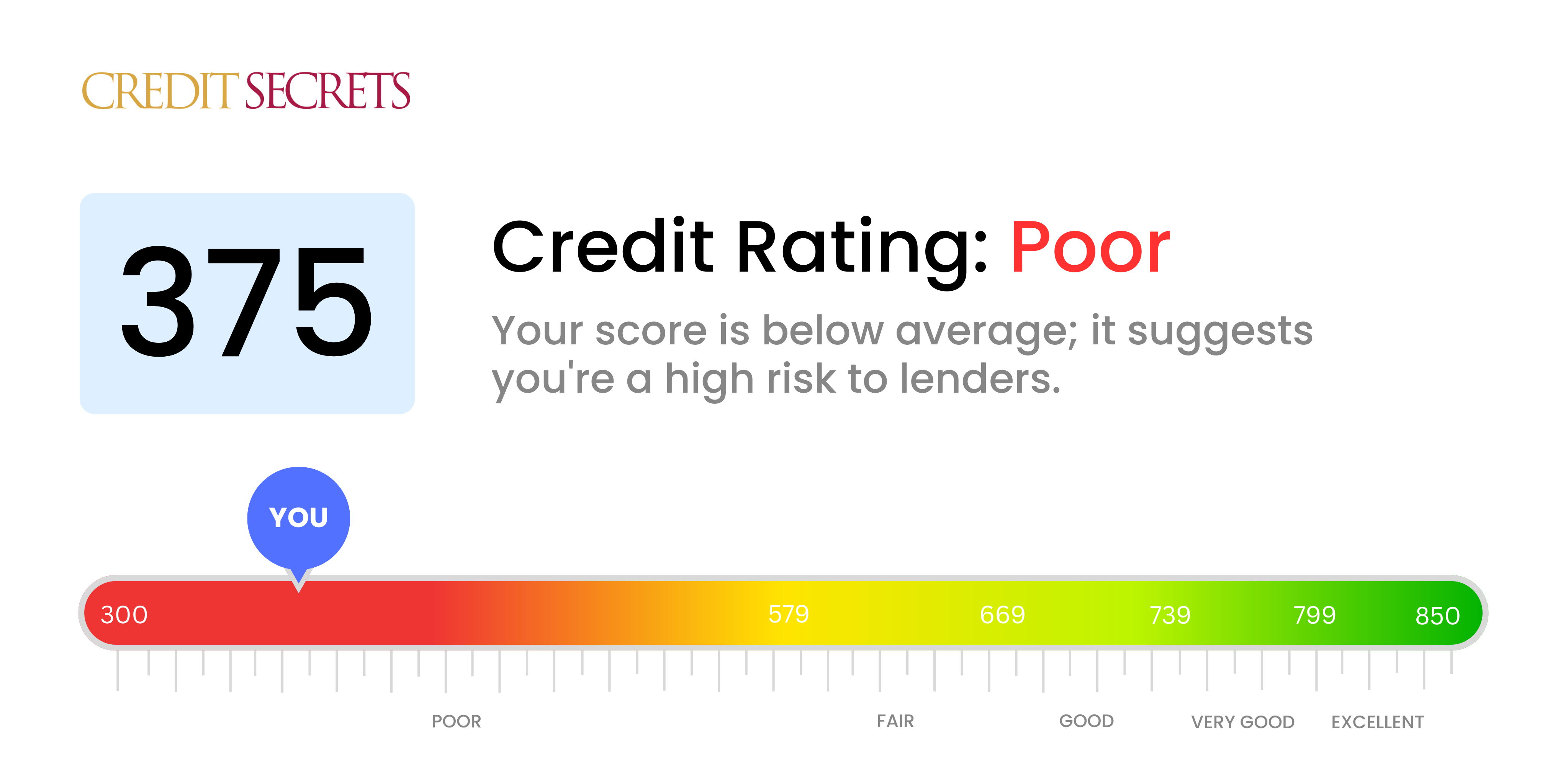

Is 375 a good credit score?

A credit score of 375 falls into the 'poor' category according to established credit score ranges. This typically means that securing credit may be challenging as lenders could see you as a risk, often leading to higher interest rates or stricter lending terms if you're approved.

However, it's important to remember that everyone's financial journey is unique, and a low score is not the end of the road. Your current situation can change, and there are plenty of viable options and strategies to improve your score, move forward, and accomplish your financial objectives.

Can I Get a Mortgage with a 375 Credit Score?

If you have a credit score of 375, it's unlikely that you will be approved for a mortgage, as this score is considerably lower than what most lenders require. A score in this range suggests a history of financial struggles, such as missed payments or outstanding debt.

This is a difficult situation, but not an impossible one. It's possible to work on increasing this score. Aim to address the existing financial issues that have led to this score, like unpaid debts. Establishing a track record of timely payments can also help boost this score. Though the process of improving your credit score is gradual and will require continuous effort, it will ultimately help you achieve your goal of potential homeownership. Regarding mortgage interest rates, those are usually higher for individuals with lower credit scores, which makes repayment even more costly.

Fortunately, there are alternatives to getting a traditional mortgage. An option like a rent to own agreement may be feasible in certain situations. With this kind of plan, a portion of your monthly rent payment is put towards the purchase of the home, which can eventually lead to ownership. Or, you might explore a co-signer on a loan or seek less conventional loans. The key here is to stay committed and persistent to improving your financial situation. Remember, change is indeed possible.

Can I Get a Credit Card with a 375 Credit Score?

With a credit score of 375, getting approved for a conventional credit card presents a significant hurdle. This score is considered low risk, indicating past financial mishaps or missteps. It's discouraging, but acknowledging the current credit landscape is a vital part of the journey to financial recovery. It's important to face these facts with courage and honesty.

Given the challenges associated with such a low score, it might be worth exploring other routes such as secured credit cards. These demand a deposit, which represents your credit limit, and are generally simpler to attain. They can also be a tool for gradually rebuilding your credit score. Other options to consider could be finding a co-signer or opting for a prepaid debit card instead. Though they won't bring an immediate solution, these options are part of a progressive journey towards greater financial stability. Do bear in mind, however, that the interest rates associated with any credit accessible to someone with such a credit score would likely be higher, reflecting the increased risk for lenders.

Can I Get a Personal Loan with a 375 Credit Score?

Having a credit score of 375 is indeed a difficult situation and it certainly places you at a disadvantage when applying for a personal loan. Lenders typically perceive such a low score as a significant risk, and it's highly probable that you would face challenges securing approval for a conventional loan. It's a tough spot to be in, but recognizing what this particular credit score means for your loan prospects is crucial.

Though traditional personal loans could be a challenge, you might still have other borrowing options. Options such as secured loans, where you offer some form of collateral, or co-signed loans, where another individual with strong credit stands as a guarantor for you, could be viable alternatives. You might also consider exploring peer-to-peer lending platforms, which could have more lenient credit requirements. Keep in mind, however, these alternatives often result in higher interest rates and less appealing terms, a reflection of the increased risk involved for the lender.

Can I Get a Car Loan with a 375 Credit Score?

With a credit score of 375, getting a nod for a car loan might be an uphill battle. Lenders usually seek credit scores above 660 to offer agreeable terms. Anything under 600 is often seen as risky, and unfortunately, 375 fits into this risk-prone category. Lenders view lower credit scores as a sign of potential difficulty making repayments. This could result in less favorable loan terms or even denial.

Yet, a low credit score doesn't mean it's impossible to secure a car loan. There are lenders who work with individuals with lower credits scores. However, it's important to tread carefully. These loans often carry much higher interest rates. After all, lenders use these higher rates to protect their investment against the perceived risk. It might not be the smoothest journey, but with a careful understanding of the terms, you can still make your dream of owning a car a reality.

What Factors Most Impact a 375 Credit Score?

If you are sensing the need to enhance a credit score of 375, you are on the right path. Recognizing predominant factors and accounting for them can set the stage for a brighter financial outlook. Each financial journey is distinct with moments of understanding and growth.

History of Payments

Punctual payment is a significant contributing factor to your credit score. Failure to make payments precise and timely could be a significant reason behind your score.

Way to Check: Scrutinize your credit report for any late payments. Consider instances where delay in payments has transpired, as this could have potentially influenced your score.

Consumption of Credit

Elevated credit consumption can adversely impact your score. If your credit card balances are reaching high proportions, this could be causing depressed scores.

Way to Check: Investigate your credit card summaries. Are your balances tiptoeing around the limit? Lowering the balances when compared to the total limit can aid in improving your score.

Time of Credit History

Having a limited credit history can be a detriment to your score.

Way to Check: Examine your credit report for the longevity of your oldest and recent accounts, along with the mean age of all accounts. You might need to ponder if new accounts have been opened recently.

Assortment of Credit Types and Fresh Credit

Maintaining a variety of credit types and capably managing new credit are integral components for achieving a good credit score.

Way to Check: Examine your array of credit accounts such as credit cards, retail accounts, personal loans, and home loans. Avoid an impulsive spree of opening new credit accounts.

Public Records

Unsettled public records like bankruptcies or tax liens can deeply dent your credit score.

Way to Check: Review your credit report for any public records that are affecting your score negatively. Addressing them in a timely fashion can improve your score.

How Do I Improve my 375 Credit Score?

If you have a credit score of 375, rest assured that it’s possible to turn it around. Here are manageable and effective steps that you might consider at this score level:

1. Handle Existing Debt

Paying off any existing debts should be your top priority. Overdue accounts significantly hurt your credit score, so try to settle them first. If required, don’t hesitate to reach out to your creditors to arrange a payment plan.

2. Secured Credit Card or Secured Loan

With a 375 score, getting a traditional credit card might seem improbable. A secured credit card, however, could be obtained. This card requires a refundable deposit that becomes your credit limit. Likewise, you could consider a secured loan. Both options can help rebuild your credit score when used responsibly.

3. Become an Authorized User

Being added as an authorized user on someone else’s credit card can be beneficial. This will enable you to benefit from their established credit history. Ensure that the cardholder’s positive payment record is reported to the credit bureaus.

4. Limit New Credit Applications

Frequent credit applications can have a negative impact on your credit score. So, limit your credit applications and only apply when necessary.

5. Check credit report for inaccuracies

Sometimes, errors on your credit report can drag down your score. Be sure to review your credit report for any inaccuracies and dispute them with the credit bureau.