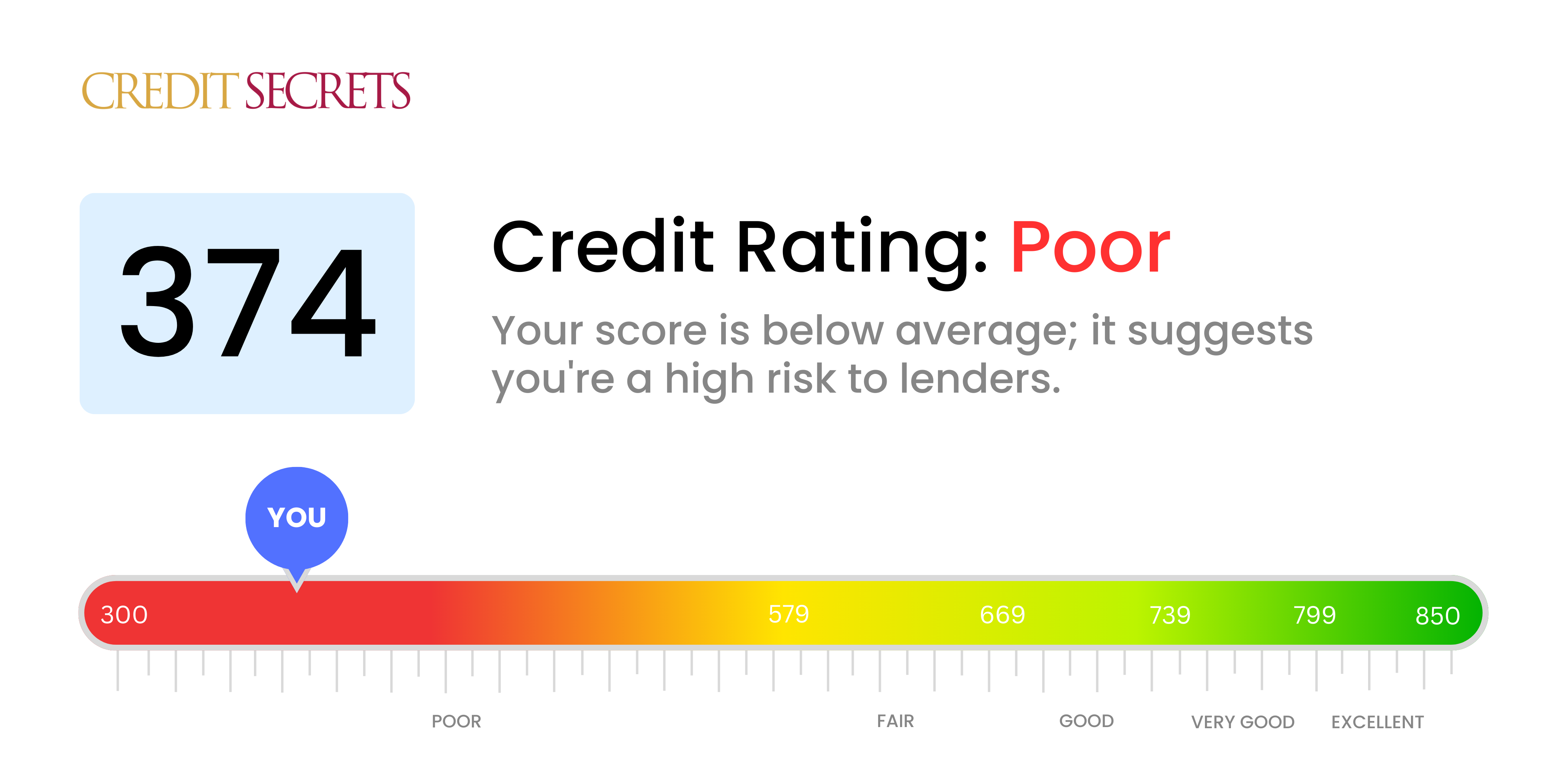

Is 374 a good credit score?

With a credit score of 374, it's clear that you've encountered some financial bumps in the road. This falls into the 'poor' category. You might have a hard time securing credit from lenders, and when you do, you're likely to face high interest rates and potentially additional criteria or conditions.

Don't let this dishearten you - everyone starts somewhere and your journey towards better credit can begin right now. By taking the right actions and making sound financial decisions, you can start to improve your credit score. Just remember, improving your credit score is a journey, not a race.

Can I Get a Mortgage with a 374 Credit Score?

With a credit score of 374, the prospect of being approved for a mortgage appears bleak. This score is considerably lower than what many lenders typically demand. Having such a credit score often signals severe financial issues in the past, like missed payments or defaults.

While this situation might be daunting, it's essential to begin improving your credit score immediately. Prioritize addressing any unresolved debts or delinquencies currently affecting your score. Start creating a record of punctual payments, and exercise responsible credit habits. Do bear in mind that this is a gradual process, but with a consistent effort and commitment, you can change your financial circumstance slowly but surely. This will not only increase your chances of obtaining a mortgage but also ensures that lenders offer you reasonable interest rates. High credit scores often secure lower interest rates, reducing the cost of borrowing and making your mortgage more affordable.

Can I Get a Credit Card with a 374 Credit Score?

Unfortunately, a credit score of 374 is considered poor and it can make it significantly harder to get approval for a regular credit card. It's never easy to face these kinds of challenges, but understanding your current situation is the first step toward making positive changes. Lenders look at scores like this and see a higher risk, often due to past financial difficulties or mishaps. It's a tough position to be in, but remember it's not the end of the road.

Although a regular credit card may be out of reach right now, there are other options that can help you on your journey to a better credit score. Secured credit cards, for instance, require a deposit that doubles as your credit limit. These are generally easier to obtain and can help rebuild your credit over time. Another option could be finding a co-signer or thinking about prepaid debit cards. Understandably, these aren't immediate fixes, but they can be effective tools when working towards financial improvement. It's important to note, though, that interest rates for these types of credit can be high as they reflect the perceived risk to lenders.

Can I Get a Personal Loan with a 374 Credit Score?

A credit score of 374 is well below the range typically considered to meet the threshold for a personal loan. Lenders view this score as indicative of high risk and they are therefore unlikely to approve a loan application under regular circumstances. It's a tough spot to be in, but understanding the realities of what this score means for your borrowing capabilities is a key part of moving forward.

Even with this score, other options may still exist. You might want to look into secured loans where some form of collateral is required, or co-signer loans that rely on a trusted individual with a stronger credit history to vouch for you. Peer-to-peer lending platforms might also be an alternative, as their criterion for lending can sometimes be more lenient. But be aware, these paths often lead to loans with higher interest rates and less desirable terms due to lenders mitigating their risk.

Can I Get a Car Loan with a 374 Credit Score?

Having a credit score of 374 can pose significant obstacles when seeking approval for a car loan. Generally, lenders are on the lookout for credit scores above 660 and anything below 600 is usually seen as less desirable. Your credit score, unfortunately, falls into this less-than-ideal bracket. This might result in steep interest rates or even outright denial. This is mainly because a lower credit score poses more risk to lenders, signaling potential repayment challenges based on past behaviors.

That said, hope is not lost. Certain lenders provide options for people with lower credit scores. Keep in mind though, these options often come with higher interest rates due to the additional risk taken by these lenders. The journey may appear tough, but with prudent choice-making and careful scrutiny of loan terms, securing a car loan with your credit score can still be a reality. Remember, it's critical to understand and evaluate all options before deciding on any financial agreement.

What Factors Most Impact a 374 Credit Score?

When it comes to a credit score of 374, understanding the causes is the first step towards improving your financial life. Key factors possibly contributing to this score require your attention. This is not a one-size-fits-all solution, as everyone has their unique financial journey, but with determination, a brighter financial future is achievable.

Payment Consistency

Your record of payment consistently affects your credit score significantly. Late payments or any form of default would be a primary cause of your current score.

How to Check: Visit your credit report to check for late payments or defaults. Pay attention to those payment instances that might have lowered your score.

Debt-to-Credit Ratio

Higher debt-to-credit ratios, also known as credit utilization, may harm your score. If your credit card balances are habitually close to their upper limits, they may be hurting your score.

How to Check: Evaluate your credit card statements. Is your card maxed out? Strive to keep your balances low relative to your credit limit.

Length & Size of Credit History

A limited or shorter credit history might be lowering your score.

How to Check: Analysis of your credit report should reveal the age of your accounts. Consider if you have recently opened several new accounts.

Credit Diversity and New Credit Management

Introducing variety in your credit types and responsibly acquiring new credit can boost your score.

How to Check: Evaluate your blend of accounts, like credit cards, retail accounts, and loans. Ask yourself if you've been judicious while applying for new credit.

Public Records

Public records such as bankruptcy or tax liens can deeply impact your score.

How to Check: Examine your credit report for any listed public records. Address any of those items that need rectification.

How Do I Improve my 374 Credit Score?

Operating with a credit score of 374 presents challenges, but progress is entirely possible with focused steps. Here are the most practical and powerful tactics suitable for your current credit condition:

1. Prioritize Past Due Accounts

Addressing accounts that are past due is crucial. Your primary objective should be to bring them up-to-date, prioritizing the most delinquent ones as they cause the most damage to your credit score. Connect with your creditors and discuss possible payment plans if required.

2. Lower Outstanding Balances

High balances, especially on credit cards, could be detrimental to your credit score. Work towards reducing these balances to less than 30% of your credit limit, aiming eventually for below 10%. Focus first on the cards with the highest level of utilization.

3. Contemplate Secured Credit Cards

Given your present score, approval for conventional credit cards could be a challenge. A good alternative could be a secured credit card, which comes with a cash deposit that will serve as the credit line. Use it responsibly by making minimal purchases and paying off the full balance each month to establish a positive payment history.

4. Leverage Authorized User Status

Consider asking a close friend or relative with a solid credit record to add you as an authorized user on their card. This strategy can boost your credit score as their good payment history reflects on your credit report. However, make sure their card issuer reports such activity to the credit bureaus.

5. Inject Variety into Your Credit Portfolio

Ranging your credit accounts can influence your credit score positively. Once you’ve shown a good payment history with a secured card, you might explore other credit types like retail credit cards or credit builder loans, managing them responsibly.