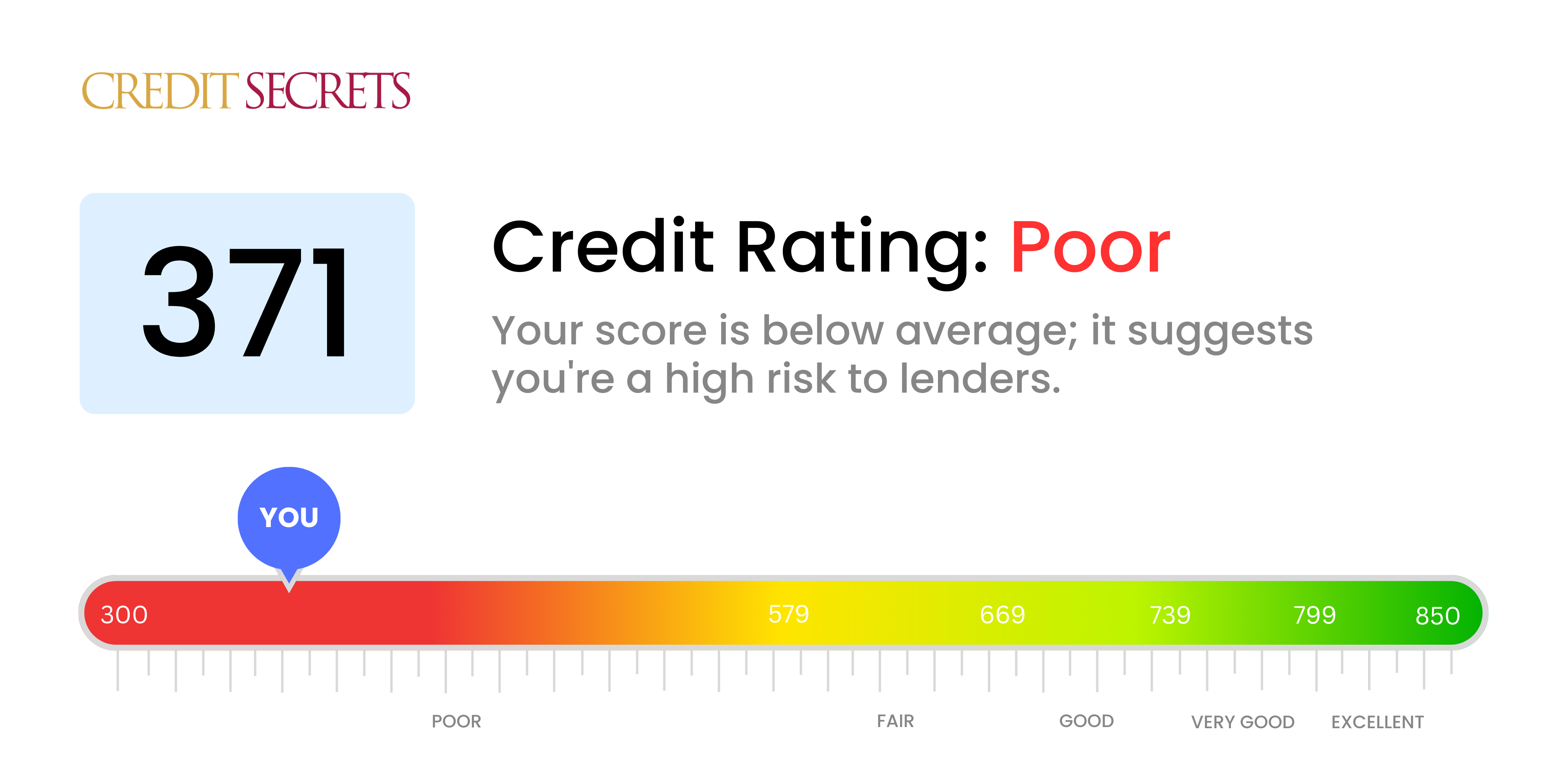

Is 371 a good credit score?

With a credit score of 371, your credit health falls in the "Poor" category. Understandably, this is not an ideal place to be, but it's key to remember that there is always room for improvement.

At this level, you might find it challenging to get approved for conventionally low-interest credit cards, loans, or favourable mortgage rates. However, with consistent effort, developing good financial habits, paying off existing debts timely, and monitoring credit reports regularly, one can certainly work on enhancing their credit score gradually.

Can I Get a Mortgage with a 371 Credit Score?

Having a credit score of 371 suggests a high financial risk to lenders. Thus, it is quite improbable that you will be approved for a mortgage. This score often implies a history of financial instability, such as late payments, defaults, or bankruptcy, which mortgage lenders typically see as a red flag.

While it's a difficult situation, it's not the end of the road. Begin by concentrating on strengthening your credit score. This can be achieved over time by first focusing on any existing debts and ensuring payments are made punctually. Also, maintain a low credit card balance and be cautious about opening new credit accounts. Consider alternatives such as looking into Federal Housing Administration (FHA) loans, which have more lenient requirements. Keep in mind that even though it's a painstaking process, there's always room for credit improvement with continual effort.

Can I Get a Credit Card with a 371 Credit Score?

A credit score of 371 suggests significant financial challenges in the past. Many traditional credit card companies may consider this figure a sign of high risk, making it quite unlikely to secure their line of credit. This information might be difficult to face, but realizing your current financial standing is a critical step towards a healthier credit future.

The constraints associated with a low credit score such as 371 require creative problem-solving. Options like secured credit cards, where the credit limit equals a deposited amount, could be a viable path forward. Such cards are generally more accessible and can aid in rebuilding your credit over time. Potential strategies may also include having a trustworthy co-signer or using prepaid debit cards. Keep in mind, the credit opportunities available to individuals with lower ratings usually come with much steeper interest rates due to lenders' perception of risk. Progress might feel gradual, but continually taking these small steps can set you up for achieving a financially stable future.

Can I Get a Personal Loan with a 371 Credit Score?

With a credit score of 371, it is unlikely that most traditional lenders would approve you for a personal loan. This score, which is considered quite low, signifies to lenders that lending to you possesses a considerable risk. This reality might be tough to digest, but there is value in understanding what this score means for you and looking for other feasible options.

Although mainstream personal loans might not be within your reach, there are other alternatives you could consider. These include secured loans, which require you to provide an asset as collateral, and co-signer loans, where a person with a higher credit score backs your loan. Peer-to-peer lending is another solution that might offer a bit more flexibility in terms of credit requirements. However, it's important to note that these alternatives generally carry higher interest rates. This is because the lender is taking a greater risk. Although the circumstances are difficult, knowing your options gives you the best chance to make an informed, strategic decision.

Can I Get a Car Loan with a 371 Credit Score?

When dealing with a credit score of 371, the pathway towards getting approved for a car loan might be rough. Car loan lenders generally favor applicants with credit scores above 660. Your score of 371 falls significantly below this desired range, implying you may encounter challenges. This might impact loan approvals or result in elevated interest rates. The reason is that scores are tied to perceived risk; a lower credit score suggests a higher risk to lenders.

Despite this, achieving your goal of purchasing a car isn't completely out of reach. There are lenders that work specifically with lower credit scores, but it's necessary to note that their loans usually come with noticeably higher interest rates. This compensates for the increased perceived risk. While acquiring a car loan with a credit score of 371 might seem daunting, understanding and inspecting the terms and conditions can open new avenues towards your car-ownership dream.

What Factors Most Impact a 371 Credit Score?

Recognizing the factors influencing your credit score of 371 is crucial for taking steps towards financial improvement. To better understand why your score is low, you need to evaluate some key elements.

Payment History

One of the biggest influencers on your credit score is your payment history. Unpaid bills or late payments can have a significant effect on your score.

How to Check: Look over your credit report for late or missed payments. Think back to any bills you forgot or were unable to pay on time.

Credit Utilization

High credit utilization, or using a large portion of your available credit, can lower your score. If your credit card balances are nearing their limits, this could be a factor.

How to Check: Check your credit card statements. Is your debt close to your credit limit? Strive to keep your debt lower than your credit limit.

Account History

Short account histories can negatively impact your score, especially if you’ve recently opened several new accounts.

How to Check: Look at your credit report's history section. New accounts or a short overall credit history could be influencing your score.

Type of Credit

Only having one type of credit (like only credit cards) can lower your score. Lenders like to see a mix of credit types.

How to Check: Review your types of credit accounts in your credit report. If they’re all the same, this might be affecting your score.

Public Records

If you have public records such as bankruptcy filings or tax liens, these can greatly impact your credit score.

How to Check: Review your credit report for any public records. It's important to resolve these matters to help improve your score.

How Do I Improve my 371 Credit Score?

A credit score of 371 falls into the poor range, and could be limiting your financial opportunities. With focused efforts, though, it’s entirely possible to improve this score. Here are the most effective steps to consider:

1. Settle Unpaid Debts

If you have outstanding debts, prioritizing their payment can strongly impact your credit score. Getting cleared of any delinquencies by negotiating with the creditors, perhaps with payment plans, is a recommended starting point.

2. Keep Credit Balances Low

If you own credit cards, maintaining balances below 30% of your limit can significantly improve your credit score. Aim to ultimately reduce them to below 10%, prioritizing those with the highest balances.

3. Consider a Secured Card

At this score category, getting approved for traditional credit cards could be a challenge. A secured credit card, backed by a cash collateral deposit acting as your credit limit, could be a viable alternative. Use it modestly and pay off the balance regularly to establish a favorable payment track.

4. Become an Authorized User

Find a trustworthy relative or friend with suitable credit and see if they’re willing to list you as an authorized user. This arrangement can enhance your credit score by integrating their positive payment habits into your financial profile, provided the card issuer shares this data with the credit bureaus.

5. Explore Different Credit Types

Once you’ve maintained good habits with a secured card, consider diversifying types of credit, like retail credit cards or credit builder loans. Managing these responsibly can further boost your credit score.