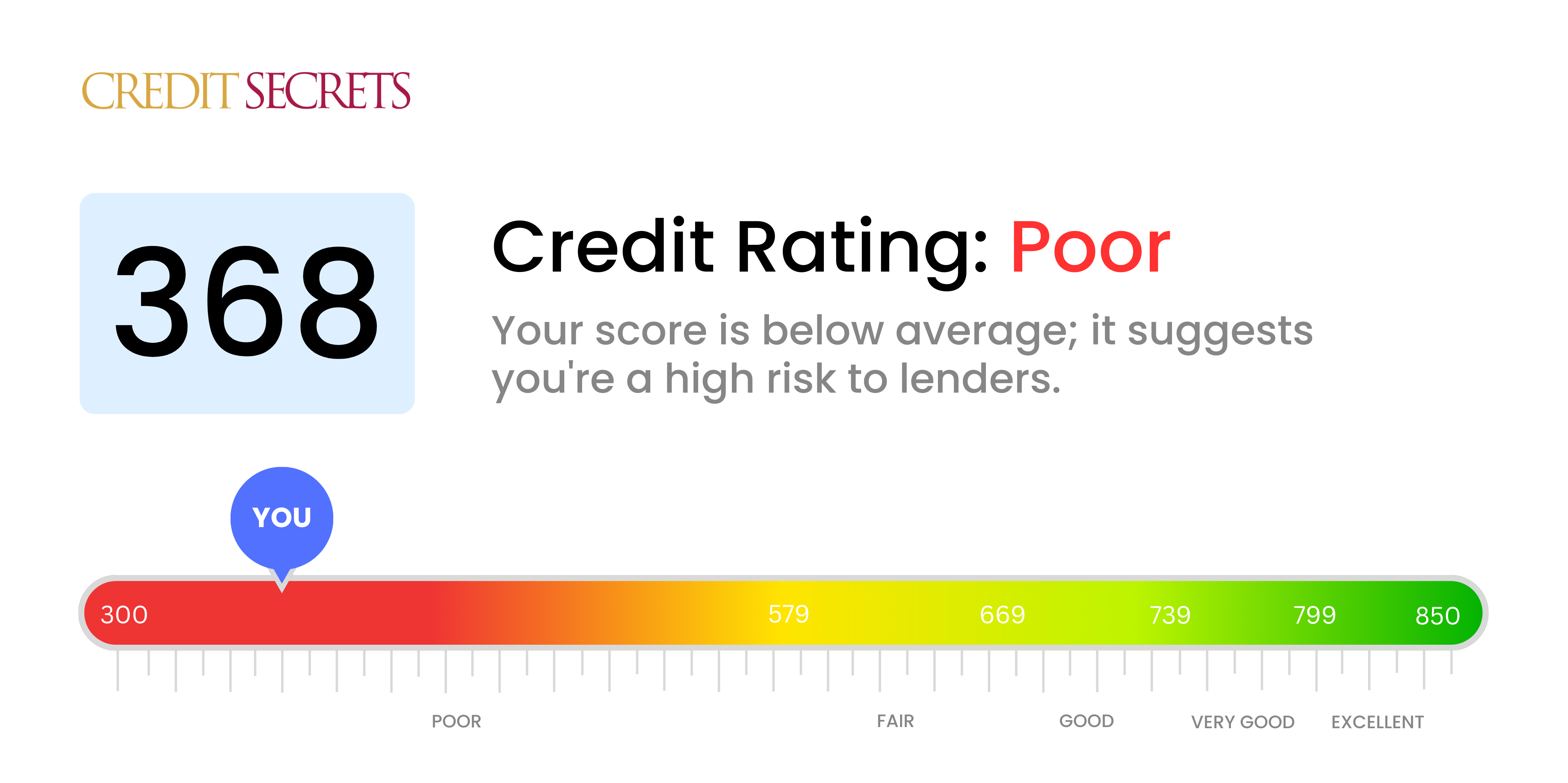

Is 368 a good credit score?

Having a credit score of 368 unfortunately falls within the 'Poor' credit score range. This isn't ideal, but it's a situation which many find themselves in and it can be improved over time. Typically, a score like this may cause problems when attempting to secure loans or credit with decent interest rates. However, remember it's not a life sentence but a starting point for improvement. With concerted effort, financial discipline and smart credit management, you can definitely elevate your credit score.

Practical steps can include paying bills on time, maintaining a low balance on credit cards and regularly checking your credit report for errors. Even with a lower score such as 368, it's certainly possible to reach a healthier financial state. Remember that improving your credit score is a journey and with the right strategies and habits, you can work your way towards financial security and better opportunities.

Can I Get a Mortgage with a 368 Credit Score?

A credit score of 368, unfortunately, is significantly lower than what most lenders require for mortgage approval. This score signifies a track record of financial distress which could include late payments, defaults, or other credit issues. Being in this situation is undeniably tough, but it's crucial to remain hopeful and proactive. The journey to improve your credit rating may be a long one, but it's achievable.

Addressing the problems that have negatively affected your score, such as unresolved debts, is a recommended first step. Establishing a history of timely payments and responsible credit usage can also make a significant difference. To improve your financial situation, you might consider alternatives like rent-to-own agreements or seeking out a co-signer for a loan while you work on your credit score. It's essential to remember that even though the improvement process can seem slow and tedious, your dedication will pay off with better financial prospects in the future.

Can I Get a Credit Card with a 368 Credit Score?

With a credit score of 368, getting approved for a regular credit card may unfortunately be a tough hurdle. This score tends to signal to lenders a history of financial struggles and they often see it as risky. It's definitely a tough pill to swallow, but it's better to acknowledge the situation as it is, keeping in mind that this is the keystone to restoring your credit health.

Considering the challenge tied to a score as low as this, alternatives like going for secured credit cards could be a feasible option. These cards do ask for a deposit serving as your credit limit, yet can be much easier to receive and can aid in strengthening your credit score gradually. Another alternative might involve getting a co-signer or trying prepaid debit cards. While none of these options are magic fixes, they function as valuable stepping stones towards a financially stable future. It is also important to be aware that the interest rates associated with credit offered to people with lower scores are usually quite high, mirroring the increased risk sensed by lenders.

Can I Get a Personal Loan with a 368 Credit Score?

Having a credit score of 368 isn't quite promising when it comes to securing a traditional personal loan. Lenders typically view this score as representing a high risk, which might make it difficult for you to get approved. This situation might seem tough, but acknowledging the impact of this credit score on your borrowing opportunities is crucial.

Standard personal loans might not be possible at this point, but that doesn't mean you're out of options altogether. Alternatives like secured loans, where you put up an asset as collateral, or a co-signed loan backed by a person with a better credit score, may be pathways you could explore. Peer-to-peer lending platforms could also be of help as they tend to have less strict credit requirements. Be mindful, however, these substitutes often bear higher interest rates and less welcoming terms as a reflection of the greater risk perceived by the lender.

Can I Get a Car Loan with a 368 Credit Score?

With a credit score of 368, getting a car loan could be a pretty big hurdle. In the world of lending, a score of 660 or above is typically what lenders hope to see. Anything under 600 is doing a bit of a tightrope walk and your score of 368 is unfortunately in that precarious zone. This score could signal to lenders that there's a higher risk involved, alluding to potential issues with timely repayment of the loan.

While this may feel like discouraging news, all is not lost. There are lenders who focus on working with people who have lower credit scores. Prospects of a car loan are not entirely dimmed. Although, it must be mentioned that there will likely be spikes on the interest rates. The higher interest is a way for lenders to protect their investment given the potential risk. It's vital to be mindful about the rates and terms before finalizing a deal. Though the path may be steeper, owning a new car is still definitely achievable.

What Factors Most Impact a 368 Credit Score?

Navigating financial health is a significant journey, and your credit score of 368 indicates some areas to focus on for improvement. Here are some factors likely influencing your score:

On-time Payments

Your payment history is critical for your credit score. Late or missed payments are likely impacting your score negatively.

How to Check: Scan your credit report for any late payments or missed dues. Delays or missed payments could have reduced your score.

Credit Utilization Ratio

A high credit utilization ratio can contribute to a lower score. This means you are using a large percentage of your available credit.

How to Check: Check your credit card statements. Are the balances near the maximum limit? Keeping balances low can provide a beneficial influence on your score.

Credit History Duration

The length of your credit history can also affect your score. A brief credit history may be contributing to your current status.

How to Check: Analyze your credit report's account ages. Consider if you have recently opened numerous new accounts, as this could have a negative effect.

Diversity of Credit and New Credit

Maintaining a variety of credit types, like credit cards and loans, and managing new credit responsibly can improve your score.

How to Check: Scrutinize your credit mix such as credit cards, retail accounts, and loans. Consider how frequently you have been applying for new credit. It's important to be mindful of new credit applications.

Public and Legal Records

Public records such as bankruptcies, tax liens, or judgments could heavily impact your score.

How to Check: Review your credit report for public or legal records. It's vital to resolve any such items to improve your score.

How Do I Improve my 368 Credit Score?

With a credit score of 368, you currently find yourself in a challenging credit situation. But don’t despair – there are specific and effective steps you can take to improve your score. Here are the most practical ways to elevate your current credit score:

1. Find and Dispute Errors on Your Credit Report

Incorrect information on your credit report can significantly lower your score. Order your credit report, examine it thoroughly, and dispute any inaccuracies with the credit bureaus. You have the right to an accurate credit report.

2. Prioritize Past-Due Accounts

Ignoring past-due accounts can be severely damaging to your credit score. Focus on settling these debts as best you can. Initiate a conversation with your creditors and establish a feasible payment plan for yourself. This strategic step will propagate a positive impact on your credit score.

3. Utilize a Secured Credit Card

At this score, a secured credit card could be a viable option for you. With a deposit serving as your credit limit, it’s a safer way to prove your creditworthiness. Use this card wisely, keeping your balance low and making punctual payments.

4. Tread Carefully with New Credit

Avoid applying for new credit cards or loans at this time as each application dings your credit score slightly. Until improvement is seen in your score, it’s better to work with the credit you currently have.

5. Create a Budget and Stick to it

Incorporate healthy financial habits like creating a budget and adhering to it. This will help you keep your spending in check, save money and prevent any future debt, thereby favorably influencing your credit score.