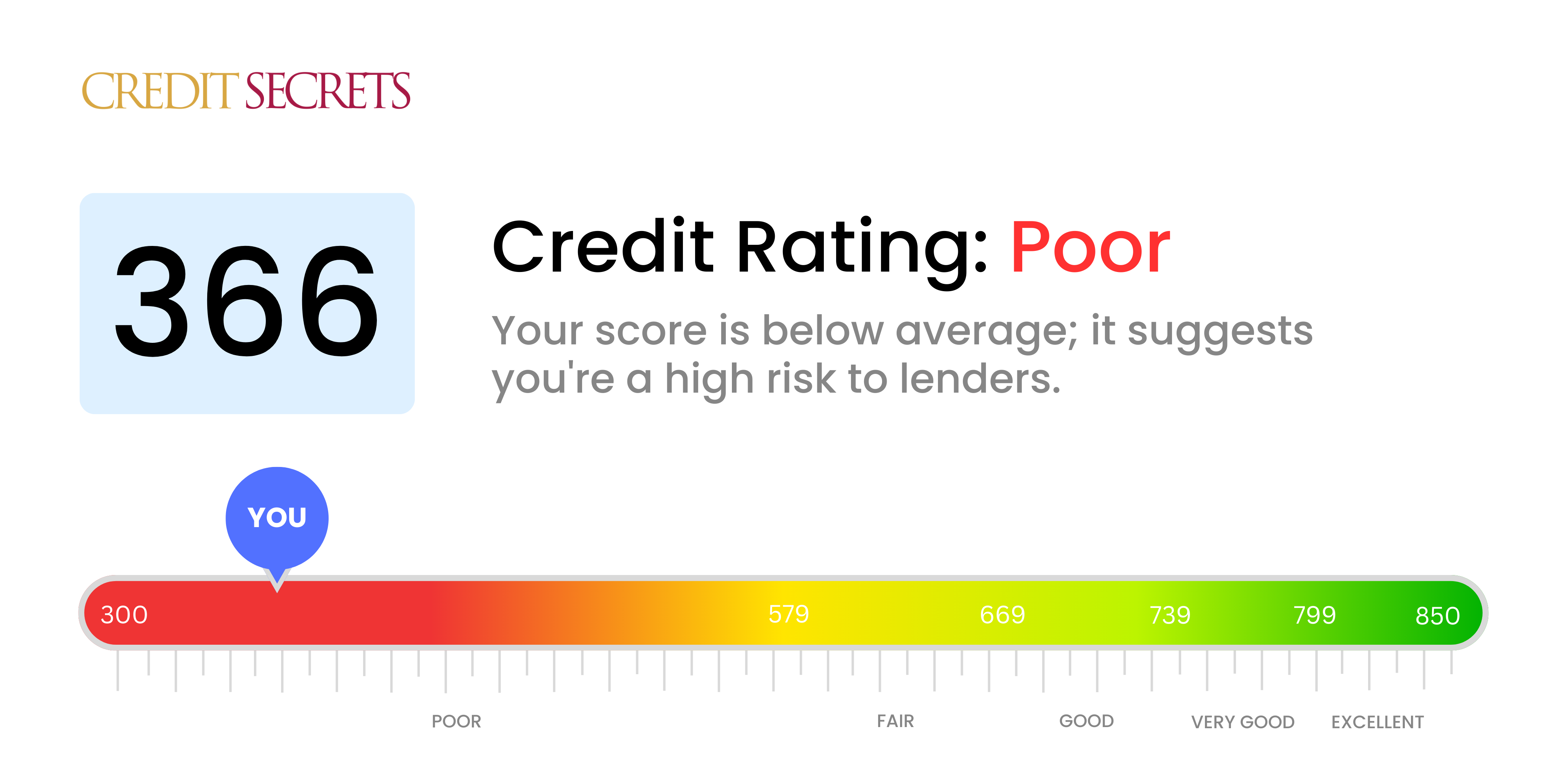

Is 366 a good credit score?

Having a credit score of 366 falls within the 'poor' category, according to widely accepted credit scoring ranges. It's far from ideal, but it doesn't mean you're stuck with this score forever. You might encounter difficulties in obtaining credit lines or getting approved for loans, and if you do, they could come with higher interest rates. However, rest assured that there's always room for improvement, and every step you take towards boosting your credit score will bring you closer to better financial health.

Remember, your credit score isn’t written in stone, it's a dynamic part of your financial profile that changes as you make different decisions. Start with timely bill payments and being mindful of maintaining a good balance between your credit limits and balances. Staying focused on your financial goals will help you steadily raise your credit score over time. It's a journey, but with time and effort, you can get to where you want to be.

Can I Get a Mortgage with a 366 Credit Score?

Unfortunately, with a credit score of 366, the likelihood of securing a mortgage approval is quite slim. Many mortgage lenders require a minimum score that far surpasses this. Possessing a credit score at this level may suggest a history of financial hardships, including late payments, defaults or perhaps bankruptcy.

Don't be dismayed, there are ways around this predicament. One alternative approach is to consider saving for a larger down payment. This could lessen the risk for lenders and possibly increase your chances of securing a mortgage. Additionally, consider government-insured loans which could be more lenient with credit score requirements. It's important to remember, however, that while these options may make getting a loan possible, they may come with higher interest rates due to the perceived risk associated with a low credit score.

It's never too late to start working towards a healthier credit score. Timely payments, settling any outstanding debts and mindful financial habits can positively influence your score over time. Persistence and patience are key to improving your financial situation.

Can I Get a Credit Card with a 366 Credit Score?

With a credit score of 366, the prospects of obtaining a traditional credit card approval might be challenging. This score is often perceived by lenders as high risk, suggesting a history of financial troubles or perhaps previous credit mishandling. It can be a tough pill to swallow, but accepting this reality is a crucial part of regaining financial health. Recognizing your credit score situation is the first stride towards the path of financial healing.

Since a low score like this presents challenges, alternate credit options could be considered. Secured credit cards could be a practical choice, they require a deposit that serves as your credit limit, and they can be less difficult to qualify for and can facilitate the rebuilding of credit over time. Contemplating a co-signer, or investigating prepaid debit cards may also be beneficial. It's important to remember, these options won't magically fix the situation, they're merely helpful resources on the road to financial recovery. It's worth noting, interest rates are likely to be considerably higher with these kinds of credit, in line with the higher perceived risk to lenders.

Can I Get a Personal Loan with a 366 Credit Score?

With a credit score of 366, unfortunately, the likelihood of receiving approval for a typical personal loan is low. Lenders, when considering loan applications, look for a much higher score. This is because a low score like 366 signals a higher risk. It suggests you may have had difficulties with previous repayments, making lenders cautious. While this news might come as a disappointment, it's essential to be frank about the situation.

Luckily, it's not the end of the road. There are alternatives to consider. Options like secured loans might be a pathway for you. This would mean providing some form of collateral, such as property or a car. Co-signed loans are another possibility. Here, you'd ask a trusted person with a higher credit score to back your loan, ensuring the lender gets repaid even if you falter. Some peer-to-peer lending platforms might also work as they can be more accepting of lower credit scores. Keep in mind that these options usually come with higher interest rates and may not offer the best terms. This is due to the increased lending risk from the lower credit score. No matter your choice, it's critical to look thoroughly into the terms and conditions. You want to be sure it's a path you can confidently navigate.

Can I Get a Car Loan with a 366 Credit Score?

With a credit score of 366, the chances of you getting approved for a car loan might be quite slim. Lenders usually look for scores above 660 and anything below 600 is considered a risk. Your score of 366 falls into what lenders label as a high-risk category. This could lead to unfavorable terms, such as higher interest rates, or even not getting the loan approved at all. This is because a lower credit score shows a greater risk to lenders due to past payment difficulties.

But a low credit score is not the end of the road. Some lenders work specifically with individuals who have lower credit scores. Please note that these loans often come with much higher interest rates because there is a perceived risk for the lenders. As they are taking on more risk, they want a higher return on their investment. It might not be an easy journey, but with careful evaluation and understanding of the terms, getting approved for a car loan can still be an achievable goal.

What Factors Most Impact a 366 Credit Score?

A credit score of 366 represents a need for focused action to boost your financial circumstances. Delving into factors that might have contributed to this score is the first crucial step towards enhancement.

Payment History

Significant influencing factor on your credit score is your payment history. Not making timely payments or having defaulted in the past could have led to this score.

How to Check: Initiate by reviewing your credit report for any untimely payments or defaults. Take time to recall any incidents of delayed payments that could have diminished your score.

Credit Utilization

High credit utilization, when your credit cards are consistently near or at their limit, might have negatively impacted your score.

How to Check: Inspect your credit card statements carefully. Are your balances consistently near their limits? Remember, it's beneficial to maintain low balances relative to your limits.

Length of Credit History

A relatively short credit history is another possible factor that might have adversely influenced your score.

How to Check: Go through your credit report to determine the length of your oldest and newest accounts, as well as the average length of all your accounts. Think about whether you have recently opened many new accounts.

Credit Mix and New Credit

The variety of credit types you manage and responsible management of new credit are crucial components of your credit score. The lack of variety or applying for new credit excessively could be part of the cause.

How to Check: Review your credit report to understand your mix of credit types, such as credit cards and different loan types. Assess if you've been applying sparingly for new credits recently.

Public Records

Public records such as bankruptcies or tax liens could have a profound negative impact on your credit score.

How to Check: Scrutinize your credit report for any public records. Address and resolve any listed items promptly.

How Do I Improve my 366 Credit Score?

With a credit score of 366, you’re right to seek ways to improve. The journey might be challenging, but it’s certainly not impossible. Let’s look at practical and specific actions for your current situation.

1. Re-Establishing Credit

At this score level, traditional credit cards may be out of reach. Securing a credit builder loan could be a strategic move. These loans actually help you build up your savings while also improving your payment history as regular payments are reported to the credit bureaus.

2. Work on Your Payment History

Payment history is one of the biggest influences on your credit score. Aim to make all future payments on time. Missing payments or defaulting on loans significantly lowers your score, so it’s imperative to stay on top of your bills.

3. Settle Delinquent Accounts

Dealing with accounts that have gone into collections should be your next priority. Reach out to collections agencies to work out a possible plan for repayment. Clearing these accounts can prevent further credit damage.

4. Scrutinize Your Credit Report

It’s crucial to have an accurate credit report. You can obtain a free annual report from each of the three main credit reporting bureaus. Carefully review it and dispute any errors with the bureaus, as errors can bring down your score.

5. Opt for a Secured Credit Card

This requires a refundable cash deposit which becomes your credit limit. By using and paying off this card responsibly, you can rebuild your credit history.

Remember, enhancing your 366 credit score is less about quick fixes and more about adopting sustainable financial behavior patterns. Start with these steps and stay diligent – improvement is in reach.