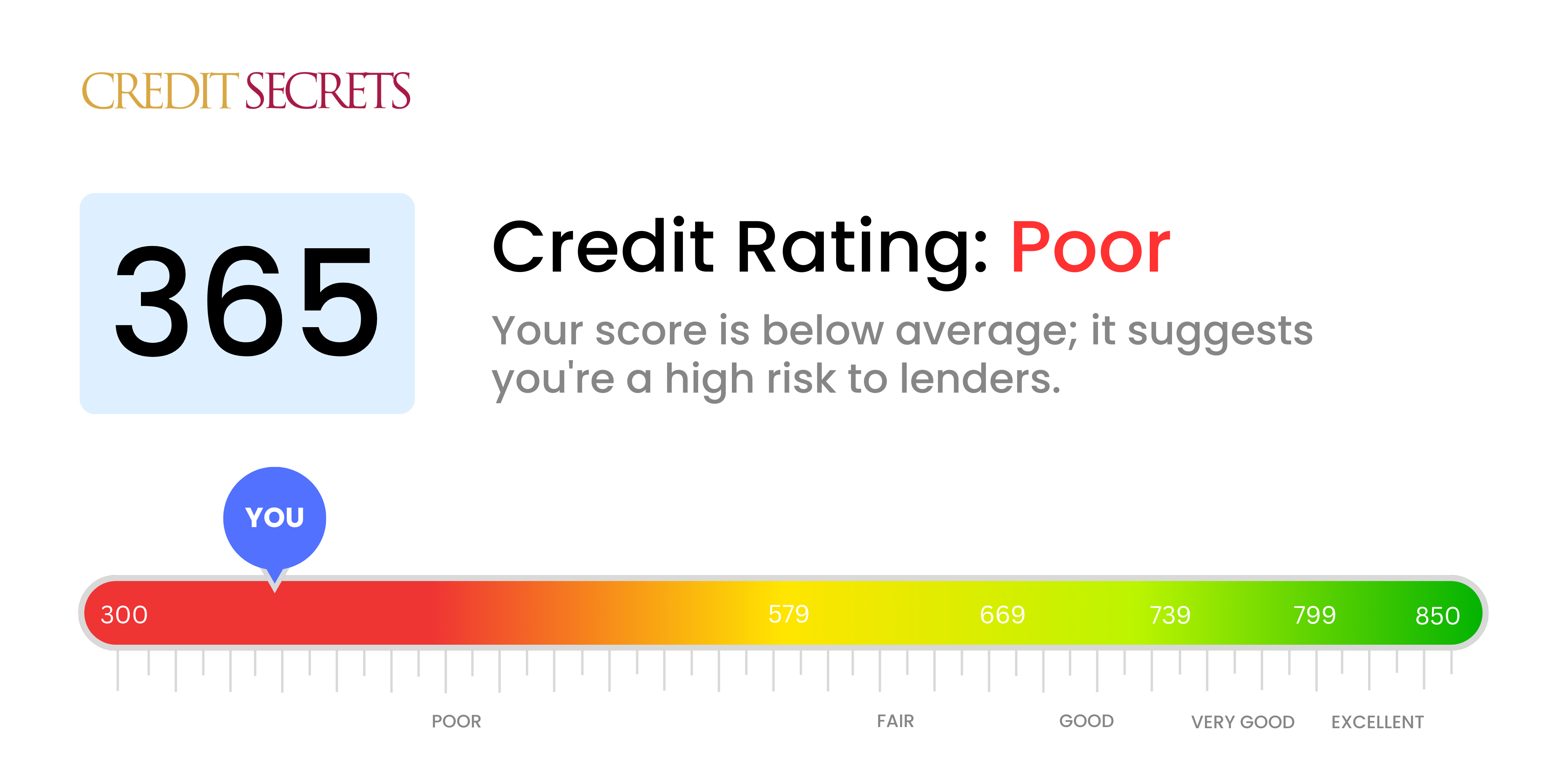

Is 365 a good credit score?

With a score of 365, it's clear that your credit health is currently in the 'Poor' category. This can undoubtedly make things troublesome when attempting to secure loans or credit cards, as lenders may perceive you as a high risk. However, don't lose hope, as your current situation is not permanent and there are certainly measures that you can take to improve your score.

It's important to understand that your credit score is a reflection of your financial history, and a low score might be the result of past credit mistakes. But keep in mind, each day is a new opportunity to make better financial decisions and improve your credit health. Furthermore, the Credit Secrets program is here to guide you on the path to a healthier credit score. So while the road may be long and winding, with determination and commitment, you can work towards a better score.

Can I Get a Mortgage with a 365 Credit Score?

Having a credit score of 365 implies a challenging financial scenario and it is unlikely you will get approval for a mortgage. This score is significantly below the minimum required by most lenders, demonstrating previous financial obstacles such as late payments or defaults. It's disheartening, but it's not the end of the road. This score will make it more complex for you to get loans, and if approved, the interest rates will be substantially higher.

Yet, this situation is not irreversible. Start by clearing any past dues or delinquencies that are dragging down your score. Here's where the Credit Secrets program comes into play. It can guide you in making timely payments and prudent use of credit henceforth. This process requires dedication and time, though it's certainly achievable. You must remember that improving your credit score is not an overnight task, but with devoted effort and discipline, future financial prosperity is absolutely within reach.

Can I Get a Credit Card with a 365 Credit Score?

With a credit score of 365, getting approval for a standard credit card can be extremely difficult. This score is usually seen as high-risk by lenders, reflecting past financial missteps or hardships. This may seem discouraging, but understanding your credit status is a critical first step in getting your financial health back on track. Sometimes, facing the hard facts is a necessary stepping stone towards improving your situation.

Considering the challenges that come with a low score like 365, you might want to look into alternative solutions such as secured credit cards. These cards require a deposit that serves as your credit limit, making them typically easier to acquire. However, the interest rates for such cards can be notably higher, due to the increased risk perceived by lenders. Other alternatives may include seeking a reliable co-signer or using pre-paid debit cards. Remember, while these options won't instantly transform your credit situation, they can play an essential role in fostering steady financial growth over time.

Can I Get a Personal Loan with a 365 Credit Score?

Having a credit score of 365 signifies a substantial risk to potential lenders. This means that traditional lenders may hesitate to approve your application for a personal loan. It's a tough situation, but it's essential to recognize what a credit score of this level indicates for your lending alternatives.

Though traditional loans may not be readily available, consider other options such as secured loans that involve offering collateral, or co-signed loans which involve having someone with a better credit score guarantee your loan. You might also contemplate peer-to-peer lending platforms, which sometimes offer more flexible credit requirements. Remember though, such alternatives often involve higher interest rates and less favorable conditions due to the increased risk to the lender. Stay steadfast in your journey to improve your financial health; there are options for you.

Can I Get a Car Loan with a 365 Credit Score?

A credit score of 365 is honestly quite low and obtaining a car loan could prove to be quite a complex task. For better terms and higher chances, lenders usually favor scores over 660. With a score less than 600, you're considered a subprime borrower which means you're seen as a higher financial risk. Due to this, you might face higher interest rates or even experience outright rejection.

However, don't lose heart. There are financial institutions that specialize in helping individuals with lower credit scores. But a word of caution - loans from these lenders often bear much higher interest rates to compensate for the perceived risk. It's advisable that you explore the loan terms in detail before going ahead. The road might be tough and full of challenges, but getting a car loan isn't entirely impossible for you.

What Factors Most Impact a 365 Credit Score?

Understanding a credit score of 365 is a pivotal step toward financial improvement. By pinpointing the significant factors contributing to your score, you can begin to shape a healthier financial future. Remember, your financial journey is unique and there's always room for improvement.

Delinquent Payments

Payment history greatly affects your credit score. Missed or late payments could be pulling your score down.

How to Check: Evaluate your credit report for any instances of missed or late payments. Each of these can negatively impact your score.

High Credit Utilization

Your credit utilization ratio, if high, can hamper your score. If most of your credit limits are maxed out, it's a possible contributing factor to your current score.

How to Check: Review your statements. If you're near or at your credit limit regularly, this is a concern and warrants attention.

Short Credit History

Having a short credit history or lack of diverse credit can pull down your score.

How to Check: Inspect your credit report for the age of your oldest account and the average age of all your accounts. Also, note the diversity of your credit accounts.

Recent Credit Applications

Applying for multiple lines of credit in a short span can negatively impact your score.

How to Check: Check your credit report for hard inquiries. Recognize whether you had multiple credit applications in a short period.

Negative Public Records

Public records like bankruptcies and tax liens can severely lower your score.

How to Check: Scan your credit report for any public records. It's crucial to settle these as they heavily weigh on your score.

How Do I Improve my 365 Credit Score?

With a credit score of 365, various actions can help you start increasing your score. The following steps are specifically designed for individuals in your situation:

1. Settle Delinquent Accounts

Your primary task should be to settle any delinquent accounts on your record. Delinquent accounts heavily sway your credit score and resolving them can drastically bolster your rating. Establish communication with your creditors to discuss viable payment terms.

2. Limit Credit Utilization

High balances on your credit cards in comparison to your credit limit can affect your score negatively. Strive to trim down your balances below 30% of your limit, and eventually aim to keep them under 10%. Concentrate on the cards with the highest utilization rates first.

3. Engage with a Secured Credit Card

In your current scenario, getting a standard credit card may be demanding. A secured credit card might be your optimum option. It requires you to make a cash deposit, which then serves as your credit limit. Use it carefully, pay off the balance every month, and slowly build up your creditworthiness.

4. Request For Authorized User Status

Approach a relative or an intimate with strong credit and enquire if they can add you as an authorized user. This maneuver can enhance your score by associating their solid payment history with your credit file. Verify that the card issuer reports activity of authorized users to the credit bureaus.

5. Expand Your Credit Range

Diverse credit types contribute favorably to your score. Once you establish a good payment history with your secured card, think about adding other credits. Venturing into other credit like credit builder loans or retail credit cards, responsibly managed, can aid to uplift your score.