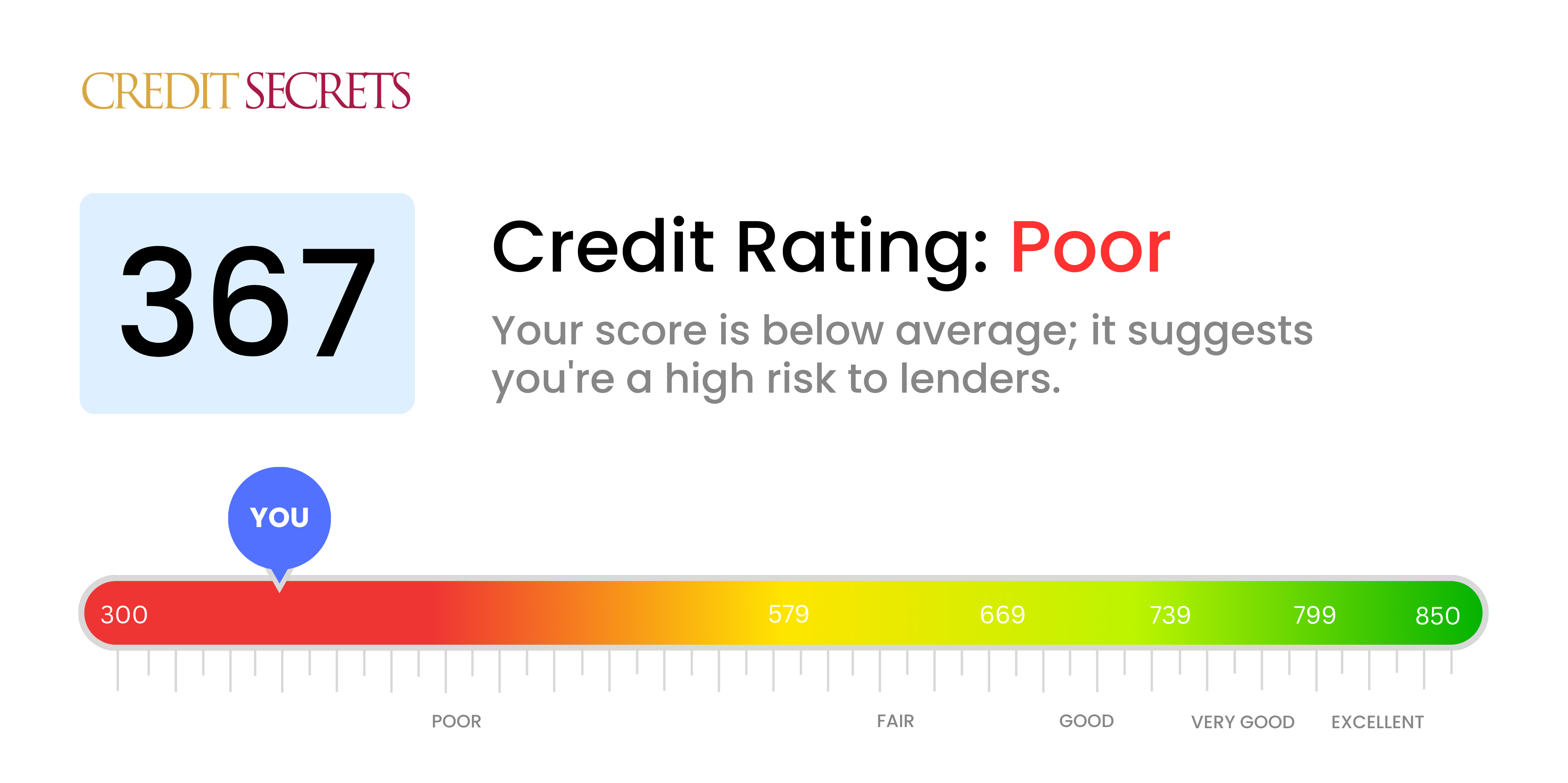

Is 367 a good credit score?

With a score of 367, your credit is unfortunately in the poor range. This simply means that lenders or credit card companies might find it more risky to loan you money. Nevertheless, it's essential to remember that you've begun the journey towards understanding and improving your financial health, which opens doors for better opportunities down the line.

A person carrying a credit score of 367 might face greater challenges in getting approved for loans or credit cards, and when they do, it could come with higher interest rates. However, it's entirely possible to raise your score. Every small step towards responsible money management, like paying bills on time and reducing debt, can contribute to a better score. Your past does not need to define your future; you have the power to improve your credit status.

Can I Get a Mortgage with a 367 Credit Score?

Your credit score of 367 signifies a significant credit challenge, making it extremely difficult for you to secure a mortgage. Generally, mortgage lenders are looking for credit scores at least in the mid-600s, and a score below this range can be a clear indication of severe financial instability, such as numerous late payments, defaults, or bankruptcy.

Given your current situation, it's essential to explore other possible alternatives. These may include saving to make a substantial down payment, or considering government-backed programs that are more lenient with credit scores. Whether you're seeking traditional or alternative routes, the key focus should be to steadily and responsibly manage your finance. For instance, ensuring your bills are paid on time, reducing your debt, and not applying for new credit needlessly can support your credit score growth. Furthermore, high interest rates may also be a concern in your case. However, remember that while this may present difficulties now, the continual effort in financial self-improvement can enhance your credit health over time.

Can I Get a Credit Card with a 367 Credit Score?

A credit score of 367 presents some significant obstacles when it comes to getting approved for a traditional credit card. This score would be viewed as rather risky by most lenders, as it likely indicates past financial challenges or considerable difficulty in managing debt. While this reality might seem daunting, it's an important first step in owning your financial future to recognize and face these hurdles head-on.

The barriers associated with such a low score might lead you to consider other options including secured credit cards. These cards require a deposit, which serves as your credit limit and can be a stepping stone in reestablishing your credit profile. Exploring the possibility of a co-signer or evaluating pre-paid debit cards could be other alternatives to consider. Remember that any credit products that might be available to you with this score are likely to come with higher than usual interest rates due to the lenders' perceived risk. Nevertheless, these options represent a beginning, often necessary, to improving your financial standing bit by bit.

Can I Get a Personal Loan with a 367 Credit Score?

Having a credit score of 367 is regarded as significantly less than ideal when it comes to obtaining a personal loan. This number symbolizes a substantial amount of risk to traditional lenders, reducing the likelihood that they'd be ready to approve your loan. It's a harsh truth to swallow, but understanding what your credit score means for your borrowing ability is vital.

If conventional loans seem unattainable, it may be worthwhile to explore other loan options. Secured loans or a co-signed loans might be a viable avenue for you. These types of loans require collateral or a co-signer with a higher credit score. Alternatively, peer-to-peer lending platforms might offer more lenient standards. But, remember that these options usually come with higher interest rates and less favorable terms, reflecting the increased risk to the lender. Facing your credit score head-on and exhausting all possible alternatives can be a step in the right direction towards achieving your financial goals.

Can I Get a Car Loan with a 367 Credit Score?

It is important to be honest about a credit score of 367: it could indeed pose a serious hurdle in getting approved for a car loan. Lenders typically require a credit score of at least 660 for decent terms. A score below 600 is often seen as subprime, and 367 falls clearly within this category. This lower score could mean higher interest rates or outright disapproval when attempting to secure a loan. This reality is based on how lenders perceive risk: a lower credit score suggests there may have been struggles in making payments on time in the past.

However, having a low credit score does not totally disqualify the possibility of owning a car. There are some lenders who cater to individuals with low credit scores. But a word of caution: these loans may attract considerably higher interest rates, since the lenders view these loans as riskier. Examine any offers and their terms closely before making a decision. Even though it might require more effort, securing a car loan is still possible with a 367 credit score. Just remember, the path to securing such a loan may have a few more bumps along the way.

What Factors Most Impact a 367 Credit Score?

Understanding a credit score of 367 is vital to charting your path towards financial health. Knowing and addressing the main factors contributing to this score can help achieve a more stable financial future. Every financial journey is individual and filled with opportunities for growth and understanding.

Payment History

Your payment history greatly impacts your credit score. If late payments or defaults are apparent, they could be a key driver of your current score.

How to Check: Analyze your credit report for any late payments or defaults. Consider periods of delayed payments as these could be affecting your score.

Credit Utilization

High credit utilization can be damaging to your score. If your credit card balances are near the maximum limits, this could be a crucial player.

How to Check: Scrutinize your credit card statements. If your balances are near the limits, aim to maintain lower balances, compared to the limits, moving forward.

Credit Tenure

A brief credit history can detrimentally affect your score.

How to Check: Check your credit report to gauge the age of your oldest and newest accounts as well as the average age of all accounts. Reflect on whether you've recently opened new accounts.

Diversity and Recency of Credit

Maintaining diverse types of credit and responsibly handling new credit are key to a healthy score.

How to Check: Assess your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider if you have been judiciously applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can have a sizable effect on your score.

How to Check: Scrutinize your credit report for any public records. Tend to any listed items that require resolution.

How Do I Improve my 367 Credit Score?

If your current credit score is 367, you’re in a “very poor” credit category. But don’t dismay. With focused action, you can significantly enhance your credit health. Below are the key steps appropriate for this score’s situation:

1. Clear Delinquent Accounts

Clearing delinquent accounts should be a topline priority because they heavily pull down your credit score. If you find it tough to settle overdue accounts all at once, connect with your creditors directly to arrange for payment plans, ensuring the most delinquent accounts are serviced first.

2. High-Interest Credit Cards

High-interest credit card debts can be a serious strain on your finances and credit score. Focus on paying off as much outstanding credit card balances as you can, to lower your credit utilization ratio. Preferably, keep the balances under 30% of total credit limit, and feel the positive changes in your score.

3. Apply for a Secured Credit Card

Qualifying for a regular credit card might be uphill at your current score. A secured credit card – where the path is paved by a cash collateral deposit – is a great alternative. Make small purchases and clear off the balance monthly to establish a healthy payment history.

4. Leverage an Authorized User Status

If possible, request a close friend or family member to include you as an authorized user on their credit card. Your credit score will benefit from their regular payments and positive credit behavior. Importantly, confirm the card issuer reports such activity to credit bureaus.

5. Broaden Your Credit Variety

In line with enhancing your payment history, explore different types of credit like retail credit cards or credit builder loans. A diverse assortment of credit accounts demonstrates to lenders your capability of managing varied credit responsibly, subsequently boosting your credit score.