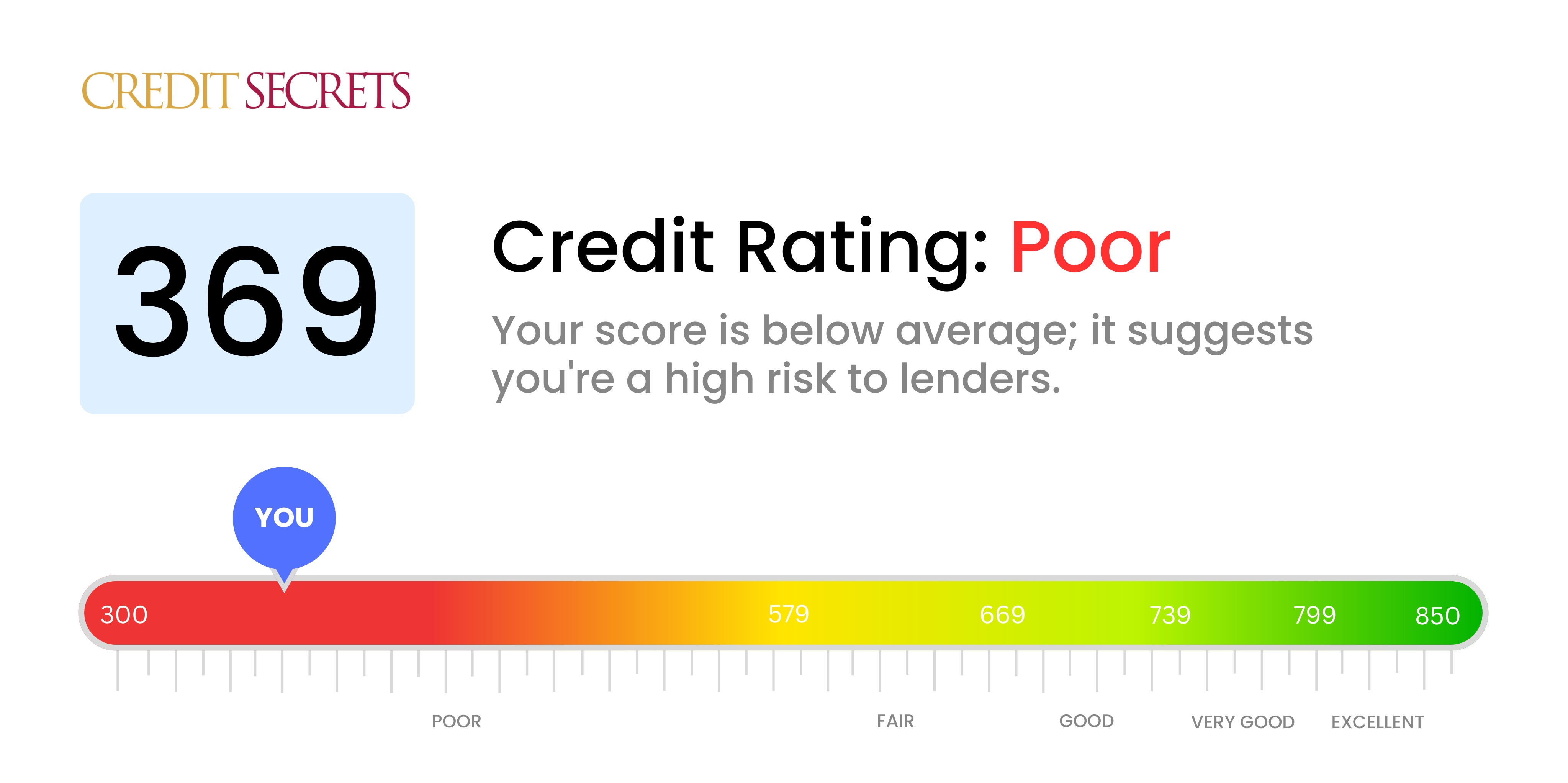

Is 369 a good credit score?

A credit score of 369 is firmly in the 'Poor' category according to standard credit score ranges. This unfortunately means that obtaining credit could potentially be difficult for you, with lenders likely viewing you as a risk due to past financial behavior.

Having said that, it's important to remember there is room for improvement. Even though you're starting from a disadvantaged point, there are actionable steps that can help increase your score. Gradually improving your financial habits and consistently paying bills on time can help you work towards a better credit standing. Don't lose hope: with commitment and responsible financial practices, a higher credit score is certainly achievable.

Can I Get a Mortgage with a 369 Credit Score?

If your credit score is 369, mortgage approval may be difficult. This score is substantially below the threshold that many lenders consider acceptable for approval, indicating a past filled with significant financial hurdles such as late payments or loan default.

Having a low score can feel daunting, but it's never impossible to alter your credit fortune. A starting point could be tackling the existing debt and past-due balances adding negative marks to your score. Work your way up by practicing timely payments and prudent credit usage. Although you may be faced with high interest rates due to your score, alternative lending systems like credit unions might offer loans with more relaxed requirements. However, keep in mind these alternatives may come with higher costs. The road to credit score improvement may be slow, but every single step counts towards achieving financial stability in the long run.

Can I Get a Credit Card with a 369 Credit Score?

Unfortunately, with a credit score of 369, the likelihood of getting approved for a traditional credit card is significantly low. This score clearly indicates some past financial strain or hardships, and creditors and lenders will see it as quite risky. Although these truths may be difficult to digest, knowledge is power and understanding your financial picture is the first step to recovery.

Despite the challenges of a low credit score, there are other options you could consider to navigate this situation. For instance, secured credit cards can be a feasible alternative. With these cards, you make a deposit that essentially becomes your credit limit, making them easier to obtain. You might also think about using a trusted cosigner or exploring pre-paid debit cards. While these choices do not immediately mend your credit situation, they can be instrumental in your journey back to financial health. Remember that interest rates on any credit granted to those with such low scores are likely to be considerably high due to the high perceived risk to lenders.

Can I Get a Personal Loan with a 369 Credit Score?

If your credit score is 453, it might be challenging to be approved for a typical personal loan. Lenders typically view this score as a high risk indicating that lending to you may not be a secure choice. It might be disheartening, but it's crucial to understand what a credit score like this means for your borrowing opportunities.

While standard personal loans might not be a feasible option with a score like this, there are other alternatives you can explore such as secured loans where collateral is provided or co-signed loans where another individual with a stronger credit score supports your application. Peer-to-peer lenders can sometimes be more forgiving regarding credit scores but remember that these alternatives could have higher interest rates and less favorable conditions due to the risk associated with lending to individuals with low credit scores.

Can I Get a Car Loan with a 369 Credit Score?

With a credit score of 369, it is unfortunately likely that you could face difficulties when applying for a car loan. Lenders typically seek credit scores above 660 to approve loans with comparatively lower interest rates. Lower scores such as 369 are considered high risk as they indicate a track record of potential repayment difficulties. This could result in inability to secure loan approvals or exceedingly high interest rates.

Don't be disheartened though; there are alternative routes to fulfill your car ownership dreams. Some lenders focus on providing loans to individuals with lower credit scores. Be mindful, these loans usually carry higher interest rates due to the perceived risk. While it might be a bumpy ride, with alertness and diligence in understanding the loan terms, owning a car is still a possibility. Keep your spirits high and your efforts consistent, and the journey can eventually lead to success.

What Factors Most Impact a 369 Credit Score?

Analyzing a credit score of 369 is fundamental in creating a blueprint for solid financial growth. Knowing the factors weighing down your score can pave the path to a financially secure future. It's important to remember that each credit journey is unique and filled with opportunities to learn and improve.

Payment History

Your credit score is significantly influenced by your payment history. Late payments or multiple defaults could be key factors dragging your score down.

What to Do: Scrutinize your credit report for any instances of late or missed payments. Reflect on past payment difficulties, these lapses may have impacted your score.

Credit Utilization

An over-extended credit utilization can impact your score negatively. If you've been maximising your credit limits, this might be influencing your score.

What to Do: Review your credit card balances. Have they been riding too close to the limits? It's always beneficial to maintain a lower balance as compared to your total limit.

Duration of Credit History

A brief credit history can be a liability when it comes to your score.

What to Do: Go through your credit report, evaluate the age of your oldest and newest accounts, and the average lifespan of all your accounts. Consider whether you've opened new accounts in recent times.

Credit Mix and Fresh Credit

A diversified portfolio of credit types and careful management of new credit is important for maintaining a healthy score.

What to Do: Assess your range of credit accounts: credit cards, retail accounts, installment loans, mortgages, etc. Ensure you're not frequently applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can severely drag down your score.

What to Do: Check your credit report for any public records. Take necessary actions to resolve any listed issues.

How Do I Improve my 369 Credit Score?

With a credit score of 369, you’re certainly facing challenges, yet these can be overcome by implementing specific strategies tailored to your financial situation. Here are your next crucial steps:

1. Examine Your Credit Reports

Closely scrutinizing your credit reports could identify potential errors or discrepancies. If you spot any, dispute them immediately with the credit bureaus. This can significantly influence your score.

2. Pay Current Bills On Time

Maintain a solid payment record on any currently active accounts. Consistency in making payments on time is fundamental when raising your credit score.

3. Opt for a Secured Loan or Credit Card

Given your score, a secured loan or a secured credit card could be ideal. Both demand collateral but allow you to build credit history in a controlled manner.

4. Authorized User Status

Getting enlisted as an authorized user on a credit card belonging to someone with a good credit history can be beneficial. Request someone trustworthy to add you to their account, ensuring their bank reports authorized users to credit bureaus.

5. Tackle Your Collections

If you’ve been sent to collections, do your best to clear these debts or negotiate a payment plan with the collectors. Such actions can offset some damage already done to your score.

Remember, your credit score didn’t drop overnight, so it will take time to rebuild. Stay patient and committed to implementing these steps.