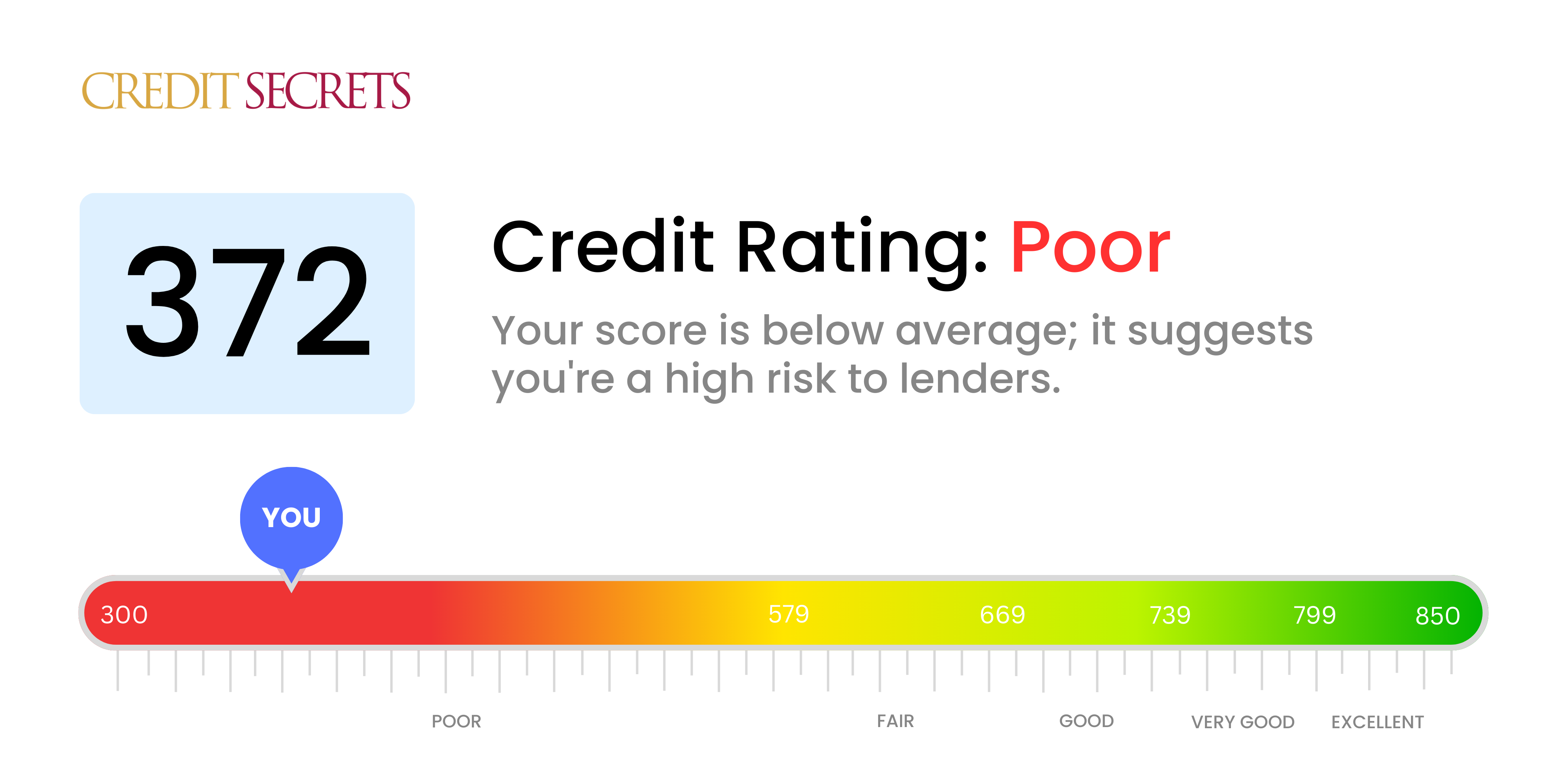

Is 372 a good credit score?

A credit score of 372 falls into the poor range, which unfortunately indicates that your credit outlook is not ideal. Nevertheless, it's important to remember that regardless of your current state of affairs, there are always opportunities to improve and make better financial decisions for the future.

With a score of 372, you might face multiple obstacles when seeking credit or trying to secure attractive terms for loans or credit cards. Financial institutions may perceive you as a high risk based on this rating leading to higher interest rates or stricter repayment plans. However, don't lose hope or feel disheartened. By adopting more responsible financial habits and strategies, you can journey towards improving your credit score and regaining financial security.

Can I Get a Mortgage with a 372 Credit Score?

With a credit score of 372, chances are unfortunately slim for being approved for a mortgage. Most lenders require a significantly higher score which indicates financial stability and a history of reliable repayment. A credit score in this range may be indicative of past financial hardships, such as defaults or missed payments.

This doesn't mean all hope is lost. It is crucial to view this situation as a stepping stone towards improving your financial health. Start by addressing the factors that have led to your current credit score, particularly any existing debts or late payments. Although it takes time, consistently making payments on time and using credit responsibly can gradually improve your score. In lieu of a traditional mortgage, considering alternatives like a Federal Housing Administration (FHA) loan or a private lender who caters to individuals with lower credit scores may be beneficial. Remember, this season of financial difficulty does not define your future. With dedication and consistency, you can establish stronger credit health.

Can I Get a Credit Card with a 372 Credit Score?

Having a credit score of 372 can make obtaining a regular credit card a tough hurdle. Many lenders interpret such scores as a signal of high financial risk, stemming from either past financial challenges or mismanagement. It's crucial to face these financial realities head-on, even though it can be disappointing.

However, don't lose hope, there are alternatives to consider. A practical solution could be secured credit cards. These cards usually require a deposit, which sets your credit limit and in turn, these are often simpler to qualify for, helping you progressively rebuild credit. Another alternative might be to find a trustworthy co-signer or consider using prepaid debit cards. While these options won't instantly fix your credit score, they're valuable tools in your journey towards financial recovery. Keep in mind, any credit made available to you may carry higher interest rates due to your lower credit score, reflecting the lender's perceived risk. The road to financial stability may have some bumps, but each step forward makes a difference.

Can I Get a Personal Loan with a 372 Credit Score?

Having a credit score of 372 can be a weighty burden. It's a figure that may appear daunting when considering applying for a personal loan. Traditional institutions might hesitate in granting you a loan due to your low score which, for them, signifies a risk to return on the investment. This doesn't mean it's impossible, just more challenging.

Typical personal loans might be challenging to attain, but there are alternates. You could explore the possibility of secured loans, meaning you back the loan with assets like a car or home. Another option could involve co-signed loans with the help of an acquaintance with a stronger credit reputation. Lastly, peer-to-peer lending platforms might present more lenient credit considerations. Remember, these options come with a catch - generally higher interest rates and stricter terms due to the increased risk for lending parties. It's essential to weigh all your choices, understand the terms, and make a decision guiding you towards a better financial future.

Can I Get a Car Loan with a 372 Credit Score?

If you have a credit score of 372, getting a car loan will likely be a tough hill to climb. The reason is that credit scores over 660 are usually preferred by lenders, because it indicates a history of good credit management. With a score of 372, you're considered a high-risk borrower, making lenders very cautious about approving a car loan.

Nevertheless, your current credit score isn't the end of the world, nor does it mean you have to give up on owning a car. There are lenders who are willing to provide loans to people with low credit scores, but typically at a higher cost. The interest rates for these loans are usually higher due to the perceived risk. Keep in mind that you are deserving of an agreeable loan, but it will take some work to find the right fit and to understand the terms completely. Even amidst challenges, achieving your goal of owning a car remains a possibility.

What Factors Most Impact a 372 Credit Score?

Grasping the causes of a 372 credit score is a vital step on your path to a better financial future. By identifying the key factors that led to this score, you can start cultivating healthier financial habits.

Neglected Payments

The fundamental element influencing your credit score could be a history of neglected or late payments.

How to Check: Scan your credit report for any past due payments or defaults. Consider if there have been occasions where you missed or delayed payments as these could weigh on your score.

Excessive Credit Utilization

Overusing your available credit can detrimentally impact your credit score. If your credit usage is high, it could heavily contribute to your current score.

How to Check: Look over your credit card statements. Are your balances inching close to their limits? Strive to keep balances reasonably low compared to the overall limit.

Short Credit History

A shorter credit history can potentially hamper your credit score.

How to Check: Evaluate your credit report to gauge the age of your earliest and most recent accounts, as well as the average age of all your credit accounts. Think over whether you've opened new accounts recently.

Diversified Credit and Fresh Credit Management

Maintaining various types of credit and responsibly handling new credit are vital elements for a healthier score.

How to Check: Investigate your assortment of credit accounts, which could include credit cards, retail accounts, installment loans, and mortgages. Reflect on whether you've been cautious in pursuing new credit.

Public Records

Public records such as bankruptcies or tax liens can have a substantial negative effect on your score.

How to Check: Inspect your credit report for any listed public records. Pay attention to any entries needing resolution.

How Do I Improve my 372 Credit Score?

With a credit score of 372, you’re currently considered as having severely damaged credit. However, don’t lose hope! With intentional steps, you can start to rebuild this score. Here’s what you can do for your specific situation:

1. Prioritize Unpaid Debt

Your first action should be tackling any unpaid debts. Overdue payments greatly impact your credit score. Contact your creditor to discuss potential payment plans allowing you to manage these overdue amounts. Reaching a point where all accounts are current should be your immediate goal.

2. Simplify and Lower High Balances

Carrying steep balances, particularly on credit cards, can negatively affect your credit score. A simple rule of thumb is keeping your credit balances under 30% of your total limit. Work towards this goal, especially focusing on the accounts where you’re using the most of your available credit.

3. Utilize a Secured Credit Card

Due to your current credit score, a regular credit card might be out of reach. Applying for a secured credit card could be an accessible alternative. This type of card requires a cash collateral deposit which also becomes your credit limit. Use it wisely to start developing a solid payment history.

4. Leverage Close Relationships

Find a responsible friend or family member with good credit who’s willing to add you as an authorized user on their credit card. This could enhance your score by integrating their good credit habits into your credit report. Ensure their card issuer reports such activity to the credit bureaus.

5. Explore Different Types of Credit

Having a variety of credit types can help improve your score. Once you’ve shown consistent payment habits with a secured card, consider applying for other forms of credit like a store card or credit builder loan, always using these responsibly.