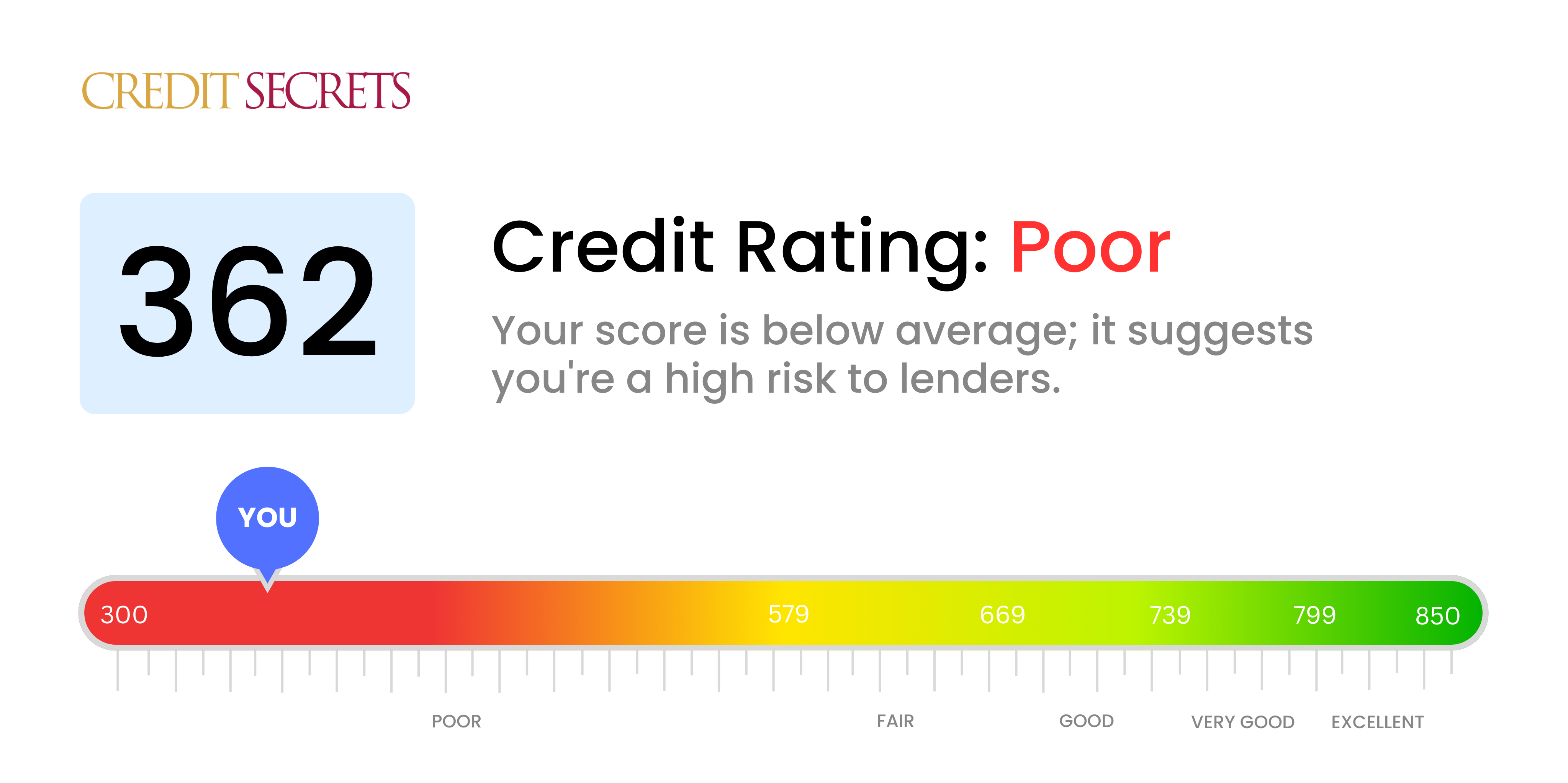

Is 362 a good credit score?

Your credit score of 362 falls into the category of 'Poor'. With this score, you may find it challenging to obtain credit or loans; if approved, you're likely to face higher interest rates.

However, remember that your current score is not a life sentence. There are actions you can take to improve it over time, like consistently paying your bills on time, monitoring your credit report for errors, and maintaining a low balance on credit cards. Always keep your financial goals in sight and you will make progress.

Can I Get a Mortgage with a 362 Credit Score?

If your credit score is 362, securing a mortgage approval may prove to be a difficult task. Generally, lenders require a higher credit score to ensure that borrowers are reliable and capable of making regular payments. A credit score of 362 typically signifies that you've experienced serious financial obstacles, which may include payment defaults or significant indebtedness.

Although the situation might seem dire, don't lose hope. There are routes you can adopt to eventually work towards homeownership. Start by addressing and settling any outstanding debts that are causing your credit score to dip. Going forward, establish a pattern of making your payments on time and refrain from amplifying your existing debt. This slow and steady approach will, over time, boost your credit score gradually. The process is not going to be easy, but your consistency and determination will move you towards your goal of enhanced financial stability.

Alternatives like seeking a cosigner with great credit or considering a FHA loan could improve your chances of securing a home loan. However, be prepared for potentially higher interest rates due to your lower credit score. Homeownership is a substantial financial commitment, so take your time to consider all your options and make an informed decision.

Can I Get a Credit Card with a 362 Credit Score?

With a credit score of 362, pursuing a traditional credit card might face substantial difficulties. This score is typically perceived by lenders as high-risk, suggesting a past of financial bumps and hurdles. This can be disheartening, but confronting the situation with a clear understanding is important. Recognizing the reality of your credit history is the beginning of your journey towards financial progress, even if it means acknowledging the less than ideal circumstances.

Considering the challenges tied to a score of this magnitude, you might want to look into alternatives such as secured credit cards. These cards require a deposit which sets your credit limit and can be a more accessible option in your situation. Secured cards can also help to gradually rebuild your credit. Other options could include finding a co-signer or using pre-paid debit cards. While these options don't magically resolve the situation, they serve as valuable tools on the path to financial improvement. Remember, interest rates accompanying any credit granted to individuals with such scores are generally quite high, highlighting the lender’s perceived risk in extending credit.

Can I Get a Personal Loan with a 362 Credit Score?

With a credit score of 362, it's unfortunately quite unlikely you'll be approved for a personal loan by most traditional lenders. This score is considerably lower than what is typically considered acceptable for personal lending. A score such as this communicates a level of financial risk that many lenders are hesitant to take on. While this may not be the news you were hoping for, addressing the realities of your current situation is crucial when planning your financial future.

That being said, there exist some alternative lending options that may be open to you. These include secured loans, where you can use an asset like your car or home as collateral, or a co-signed loan, where someone with a higher credit score legally agrees to take on the repayment if necessary. Additionally, certain peer-to-peer lending platforms sometimes have more flexible credit requirements. However, you should be aware that these alternatives usually involve higher interest rates and potentially stringent terms, due to the increased risk posed to the lender by a lower credit score.

Can I Get a Car Loan with a 362 Credit Score?

With a credit score of 362, it can be tough to get a car loan approval. Most lenders are likely to approve loan applications with scores over 660. A score lower than 600, such as 362, is categorized as subprime. This subprime status could lead to increased interest rates or possibly a denial of your loan application. This happens because to lenders, a lower credit score represents a higher risk, suggesting potential issues with returning the borrowed money.

That being said, a lower credit score doesn't completely rule out the chance of you obtaining a car loan. There are lenders who specifically work with those whose credit scores are lower. However, be ready for higher interest rates as lenders view this as a method to mitigate their risk. So, while the journey can be a bit tricky, keeping a close eye on the terms could still make securing a car loan a realistic ambition for you.

What Factors Most Impact a 362 Credit Score?

Understanding your credit score of 362 is a crucial first step on your path towards financial recovery. By identifying the most likely factors contributing to your current score, you can take action to improve your credit health. Let's highlight some important areas for you to pay attention to.

Negative Items on Credit Report

Negative items such as charge-offs, collections, or bankruptcies can severely bring down your credit score. These could be a major reason for your current score.

How to Check: Look at your credit report. You should pay close attention to any negative items listed and address them as promptly as possible.

High Credit Utilization

Credit utilization refers to the percentage of your credit limit that you're using. A high credit utilization can negatively impact your credit score. If you’re often hitting or exceeding your credit limit, it might be a contributing factor to your score.

How to Check: Check your credit card statements. If your balances are consistently close to the limits, aim to reduce them.

Frequent Late Payments

Late payments hold a significant weight in calculating your credit score. If your payment history includes several late payments, this could be a primary reason for your low score.

How to Check: Your credit report will show instances of payment delays. Try to make future payments on time and consider setting up automatic payments to avoid late payments.

Limited Credit History

A short credit history might be lowering your score as lenders have less information to evaluate your creditworthiness.

How to Check: Consider the age of your credit lines. Building up a longer credit history may positively impact your score over time.

Lack of Credit Diversity

Diversity in the type of credit you hold, such as credit cards, personal loans or a mortgage, can impact your score. Lack of diversity could be impacting your score.

How to Check: Analyze the different types of credit accounts you currently hold. Mortgage, personal loans, auto loans, and credit cards all count toward credit diversity.

How Do I Improve my 362 Credit Score?

A credit score of 362 is low, however, it’s never too late to start rebuilding your credit. Here are the most practical and effective steps you should consider:

1. Get a Copy of Your Credit Report

Obtain a free copy of your credit report and scrutinize it for errors. Even a small error could significantly impact your score. If errors are identified, promptly dispute them with the credit bureaus.

2. Deal with Outstanding Debts

It’s essential to address your unpaid debts. Make a plan for paying them off, starting with the highest-interest ones. Speak to your lenders about possible debt-payment arrangement options.

3. Apply for a Secured Credit Card

Your current credit score might make it challenging to get a typical credit card. A secured credit card could be an alternative. Controlled use of this card, followed by timely payments, can go a long way towards rebuilding your credit history.

4. Consider a Credit-Builder Loan

Credit-builder loans are designed to help individuals build their credit. The money you borrow is held by the lender in a secured account until the loan is fully repaid. This process is reported to the credit bureaus, helping to improve your score.

5. Request a Credit Limit Increase

If you have an existing credit card in good standing, consider requesting a limit increase. If approved, your credit utilization ratio can decrease, which could positively impact your score. However, remember to only use a portion of your new limit.