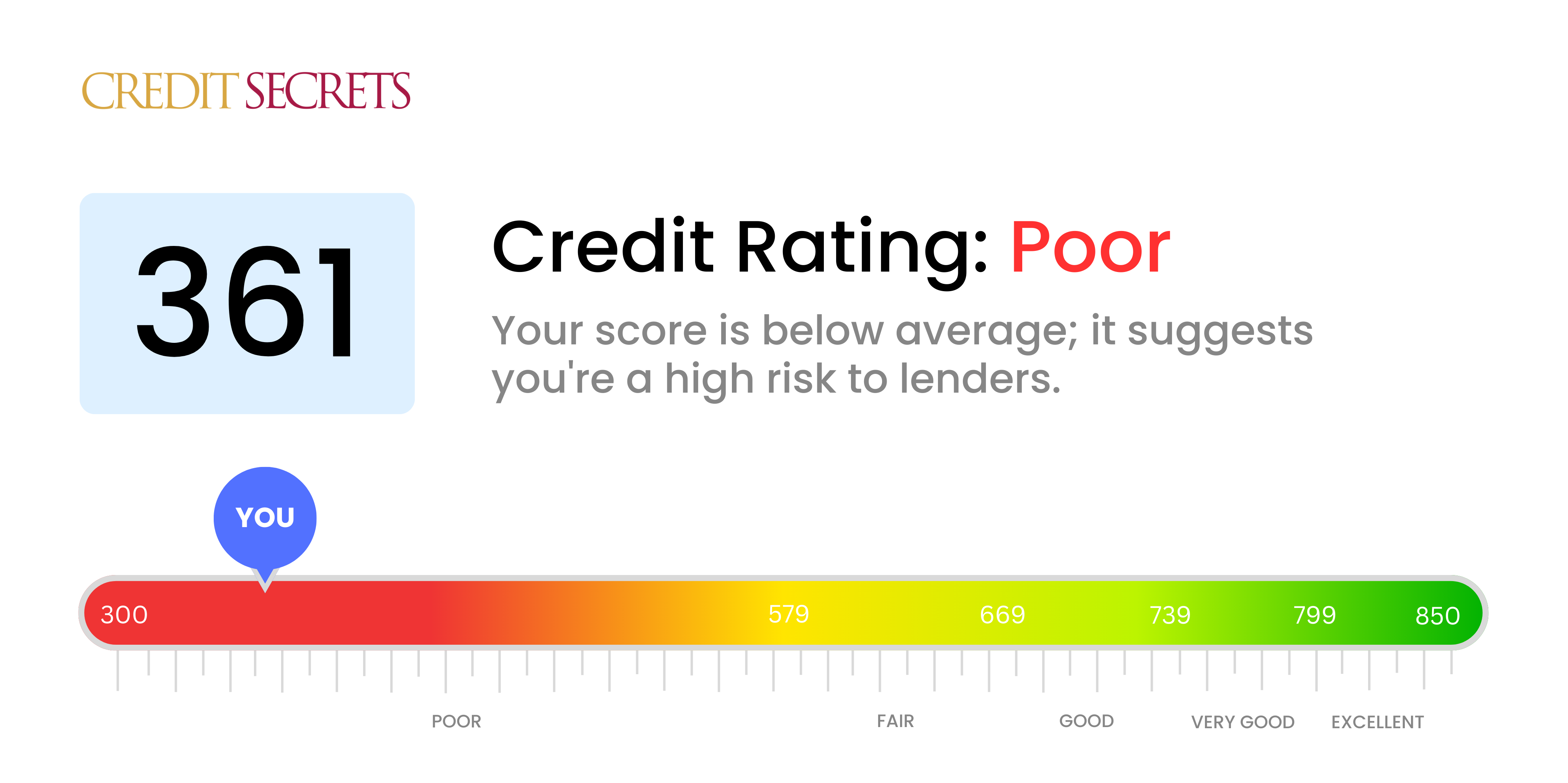

Is 361 a good credit score?

Regrettably, a credit score of 361 is considered poor. A credit score in this range often makes it harder to get approved for credit, likely leading to higher interest rates or even potential loan rejections. But don't lose hope, your score is not permanent and there are steps you can take to improve it.

While it might seem discouraging, improving your credit is a journey, not a race. Taking steps such as making payments on time, reducing the amount of debt you owe, and regularly checking your credit reports for inaccuracies, can make a significant difference. Remember, no matter where you're starting from, there's always room for improvement.

Can I Get a Mortgage with a 361 Credit Score?

If you have a credit score of 361, chances are that getting a mortgage approval may prove to be extremely difficult. This score falls significantly below what most lenders consider as a minimum threshold. Your credit score gives lenders a snapshot of your creditworthiness, but a score in this range often signifies severe financial issues including late payments or defaults.

Though this moment can feel disheartening, it's essential to remember that it's not a permanent state. A viable alternative could be looking at non-traditional lending platforms that evaluate more than just your credit score for mortgage approval. Alternatively, you could focus your effort on improving your credit score before reapplying. A better score not only increases your chances of approval but also attracts more favorable interest rates. Do your utmost to resolve outstanding debts that are adversely affecting your score and work towards cultivating a consistent record of making payments on time. Your credit score will not improve overnight, but with determination and perseverance, it is achievable.

Can I Get a Credit Card with a 361 Credit Score?

Realistically, a credit score of 361 is unlikely to result in approval for a traditional credit card. Financial institutions frequently regard these low scores as a considerable risk, implying past financial challenges or mismanagement. But don't lose heart, acknowledging credit status is really the initial step toward financial recovery, even though it might hurt a bit.

For scores as low as 361, consider alternatives such as secured credit cards, which need a deposit matching your credit limit. They're typically easier to get and can help bring that score up over time. Contemplating a co-signer or investigating pre-paid debit cards might also be potential options. Understandably, these options don't instantly improve things, but with patience, they often help on the path to financial security. It's also crucial to note that lower scores often mean higher interest rates on any available credit, due to lenders' perceived risks.

Can I Get a Personal Loan with a 361 Credit Score?

A credit score of 361 places you in a challenging position when it comes to seeking a personal loan. Scores in this range are generally viewed by lenders as high risk, which decreases the likelihood of being approved for traditional loan options. This may seem disheartening, but understanding the gravity of your credit score's implications is the first step towards finding a solution.

As access to traditional loans becomes less likely, alternatives such as secured loans and co-signed loans might come into play. Secured loans involve providing collateral, while a co-signed loan requires someone with better credit to vouch for you. Another option is peer-to-peer lending platforms, which can sometimes have more flexible credit requirements. However, it's important to bear in mind that these options often bring about higher interest rates and not-so-favorable terms given the increased risk for the lender. It's essential to weigh these options carefully and consider your ability to meet repayment terms to avoid further credit damage.

Can I Get a Car Loan with a 361 Credit Score?

With a credit score of 361, unfortunately, securing approval for a car loan could be extremely difficult. This score is considered poor, falling significantly below the standard score of 660 that most lenders favor. The primary reason for this is lenders perceive a lower credit score as an increased risk. They view a low credit score as an indication that repayment of the borrowed money might not occur in a timely manner.

However, don't lose hope. While the possibility of securing a car loan may seem bleak, it's not entirely impossible. There are lenders who cater to people with low credit scores. But always remember, loans from these sources often come with decidedly higher interest rates. Increased rates act as a safety net for the lender to counterbalance the risk of non-payment. It's vital to carefully review the loan terms before agreeing to accept such a loan. Use this information wisely to navigate the path to fulfilling your dream of purchasing a car.

What Factors Most Impact a 361 Credit Score?

If you have a credit score of 361, improvement may seem challenging, but it’s achievable with focus and effort. The elements affecting your score are likely the following:

Payment History

Your payment history has the most influence on your score. Late payments or defaults would lower your score, particularly if they are frequent.

How to Check: Review your financial statements for any late. Any late payments or defaults will be listed there.

Credit Utilization Rate

Your credit utilization rate, or the portion of your available credit that you use, contributes significantly to your score. High credit utilization is a common reason for a low score.

How to Check: Look at your credit card statements to see if you’re close to your credit limits, which would increase your credit utilization rate.

Account Age

Your credit score benefits from having older, active accounts. A short credit history may have unfavorably impacted your score.

How to Check: Check your credit report to see the age of your oldest and newest accounts and the average age of all accounts.

Credit Variety

Having a mix of credit types can help boost your score. Too many of one type of credit, such as credit cards, may be affecting your score negatively.

How to Check: Examine your credit report for the types of credit you have.

Public Record Items

Public records such as bankruptcies or tax liens can hurt your score, depending on the severity and how recent they are.

How to Check: Review your credit report for any public record items that may be reported.

How Do I Improve my 361 Credit Score?

Having a credit score of 361 may be disheartening, but improving it is absolutely possible by following a few crucial steps:

1. Focus on Outstanding Debts

Your priority should be to bring any overdue accounts up to date. These have the most detrimental effect on your credit score. Contact your lenders, negotiate a manageable payment scheme if you need to. Every step towards a clean debt sheet helps.

2. Check Your Credit Report

Errors on your credit report could be pulling your score down. Get a copy of your report and go through it meticulously. If you spot mistakes, dispute them with the credit bureau involved. Getting these rectified may raise your credit score.

3. Apply for a Secured Credit Card

It may be tough to get a traditional credit card with your present score. Secured credit cards, backed by a cash deposit, could be a feasible alternative. Use this sensibly and always pay off the entire balance each billing cycle to create an improved payment history.

4. Use Credit as an Authorized User

Find someone with a healthy credit history who is willing to add you as an authorized user on their credit card. This allows their positive payment habits to reflect on your account, which could improve your credit score. Make sure to confirm the creditor communicates all user activity to credit bureaus.

5. Explore a Credit-Builder Loan

A diversified credit portfolio can benefit your credit score. Once you’ve handled a secured card responsibly, consider a credit-builder loan. These loans can help build your credit history, so long as you manage them appropriately.