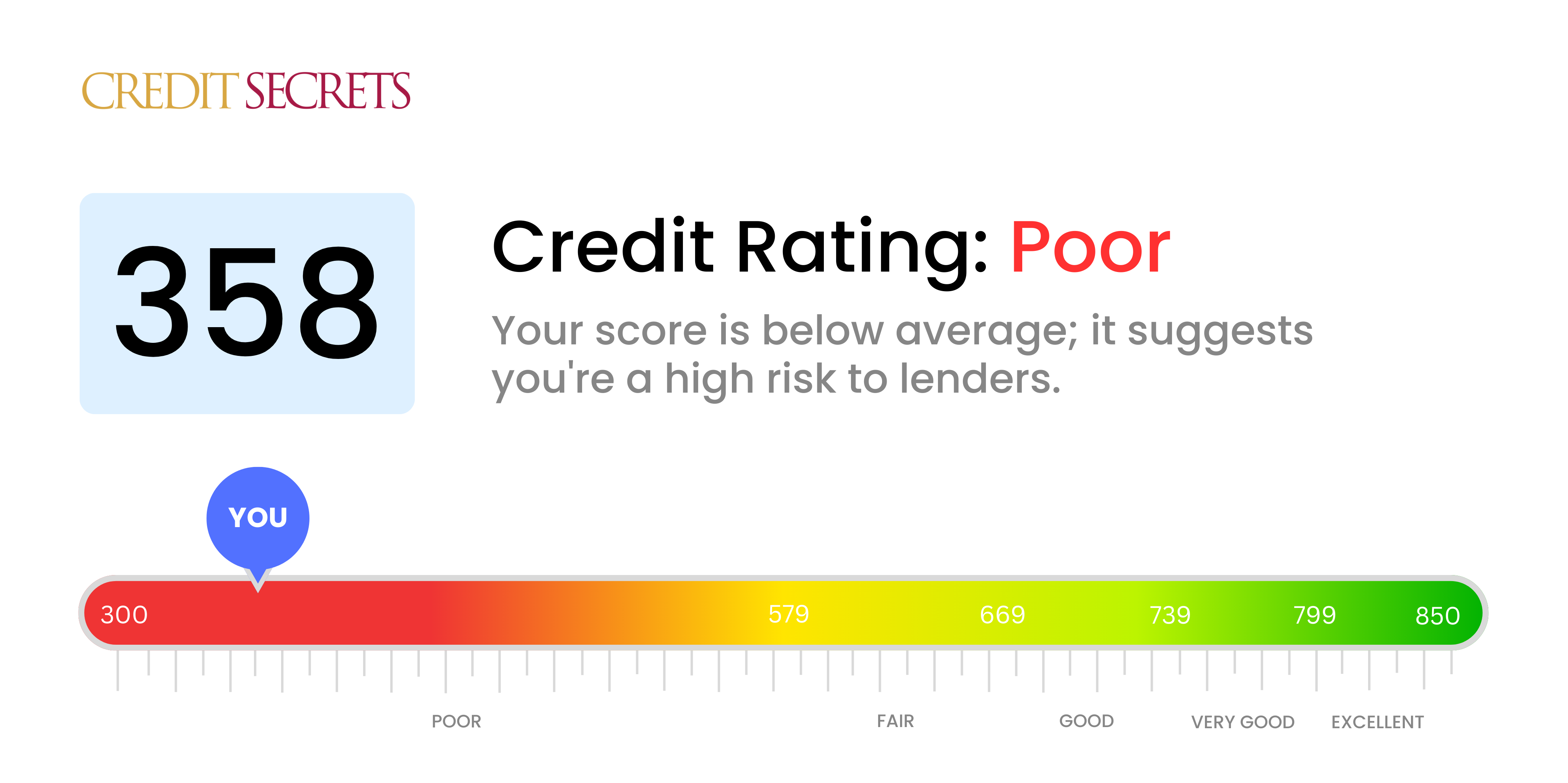

Is 358 a good credit score?

A credit score of 358 falls into the 'Poor' category. This is not an idea score, but don't lose hope; it's still possible to improve your financial standing from here. While this score may limit your ability to get credit and loans, or may result in higher interest rates, remember that it's never too late to take small steps towards bigger improvements in your credit score.

Although this moment might seem tough, remember credit scores are not permanent. It’s important to know your credit score to have an idea of what credit products or loan offers are open to you. But even more crucial is taking steps to improve your score, if needed. With a persistent approach towards better financial habits and consistent credit observation, anyone can enhance their credit score.

Can I Get a Mortgage with a 358 Credit Score?

With a credit score of 358, it's quite improbable to be approved for a mortgage. This score is substantially below what most lenders typically require, signifying previous severe financial issues like delinquencies or defaulted payments.

Your score can make the path towards homeownership seem difficult, but remember that it's only a snapshot of your credit history at this moment. In terms of alternatives, utilizing programs for first-time homebuyers or looking into federally-backed FHA loans could be a possibility as they often provide options for those with lower credit. However, a lower score may also result in higher interest rates. Though it might feel overwhelming, remember it's not a permanent state. A credit score can be enhanced over time with consistent, disciplined financial behaviour.

Can I Get a Credit Card with a 358 Credit Score?

With a credit score of 358, unfortunately, attaining a traditional credit card is rather unlikely. Lenders see such a score as high-risk, indicating past financial struggles or mishandling of money. It's an unwelcome reality, but understanding your credit status is a critical first step towards regaining financial stability, even if it requires confronting some tough truths.

This score may make options like established credit cards more difficult to get, but other alternatives exist. For example, secured credit cards might be a viable choice. These require a deposit which then serves as your credit limit and can be significantly easier to acquire. They also provide a pathway to rebuild your credit over time. Another route could be obtaining a co-signer or exploring pre-paid debit cards. Although these may not be ideal, they can play a significant role in your journey towards better financial health. Finally, keep in mind, any available lending options to those with a low score like 358 tend to come with noticeably higher interest rates, indicating lenders' perceived risk.

Can I Get a Personal Loan with a 358 Credit Score?

With a credit score of 358, the possibility of being approved for a personal loan by traditional lenders is pretty low. This score is significantly below the acceptable range, and it presents a considerably high risk to a lender, making them less likely to approve your loan application. We understand the frustration this may bring, but it's important to accept the reality and understand what this score says about your financial options.

While mainstream personal loans might not be feasible for now, there are alternatives available, such as secured loans where you use an asset as a guarantee, or co-signed loans where another person with a higher credit score assures the lender on your behalf. Another option could be peer-to-peer lending platforms which may have more relaxed credit score requirements. Yet, bear in mind these alternatives may come with higher interest rates and less optimum terms because lenders often account for the increased risk associated with a lower credit score.

Can I Get a Car Loan with a 358 Credit Score?

Having a credit score of 358 puts you in a challenging position when applying for a car loan. Lenders typically consider scores above 660 as favorable, and anything below 600 can be labeled as high-risk. Your score of 358 is part of this high-risk category, which means you might face higher interest rates or could potentially be denied for a loan. This is because your lower score signifies a higher risk for lenders, indicating you may struggle to repay funds.

But don't lose hope, a lower score is not an outright denial. There are lenders out there who can work with people with such scores, but remember to tread lightly, as these types of loans often carry higher interest rates. These high rates are the lenders' safety net for the risk involved. But, with careful consideration and a keen understanding of your loan terms, it's still possible to see your dream car in your driveway.

What Factors Most Impact a 358 Credit Score?

Understanding your credit score of 358 is the first step toward improving your financial situation. It presents an opportunity for reassessment and growth. The factors contributing to this number might include your payment history, credit utilization, length of credit history, credit mix, and public records.

Payment History

Consistent late payments or defaults can significantly lower your credit score. If this is a pattern, it's crucial to address it promptly.

How to Check: Look at your credit report carefully for recorded late payments or defaults. Were there periods when you struggled to pay on time? These could have damaged your score.

Credit Utilization

Your credit score may be weighted down by high credit utilization. It implies you're using too much of your available credit which can be a red flag.

How to Check: Peruse your credit card statements and compare your balances to your limits. If balances are consistently high, it could be affecting your score negatively.

Length of Credit History

If your credit history is relatively short, it could hinder your score. Lenders feel more confident when they see a longer, stable credit history.

How to Check: Verify the age of your oldest and newest accounts on your credit report and the average age overall. If your credit history is rather short, this could be influencing your score.

Credit Mix and New Credit

Your credit score could suffer if you don’t have a diverse mix of credit or if you've recently taken on new credit. Managing different types of credits responsibly helps boost your score.

How to Check: Assess your different credit accounts and recent credit applications. If you only have one type of credit or been applying for many new credits, it could be damaging your score.

Public Records

Events like bankruptcies or tax liens on public record can drastically impact your credit score.

How to Check: Scrutinize your credit report for any public records. These could be harming your score.

How Do I Improve my 358 Credit Score?

With a credit score as low as 358, it’s evident that there’s considerable room for improvement. However, adopting these practical strategies can certainly help you gradually strengthen your credit health.

1. Debt Settlement

One common cause of extremely low credit scores is having outstanding debts that have gone to collections. Address these immediately. Reach out directly to your creditors to negotiate a settlement for less than what’s owed. This will stop the harmful updates that collection accounts can send to credit bureaus.

2. Set Up Payment Reminders

Punctual payment is crucial to credit recovery. Make sure that all of your future bills are paid on time by setting up automatic payments or reminders. This is an easy step that can hugely affect your score over time.

3. Apply for a Secured Credit Card

At this level of scoring, most traditional credit cards might be out of reach. However, a secured credit card requires a cash deposit equal to your credit limit. On-time payments with this card can start to rebuild your credit history and score.

4. Take Out a Credit-Builder Loan

A credit-builder loan can help increase your score by establishing a reliable payment history. These loans hold the funds in an account while you make payments, releasing the money to you once it’s fully paid.

5. Be an Authorized User

If possible, ask someone you trust to add you as an authorized user on their credit card. This can help improve your credit score as long as they maintain good credit habits.