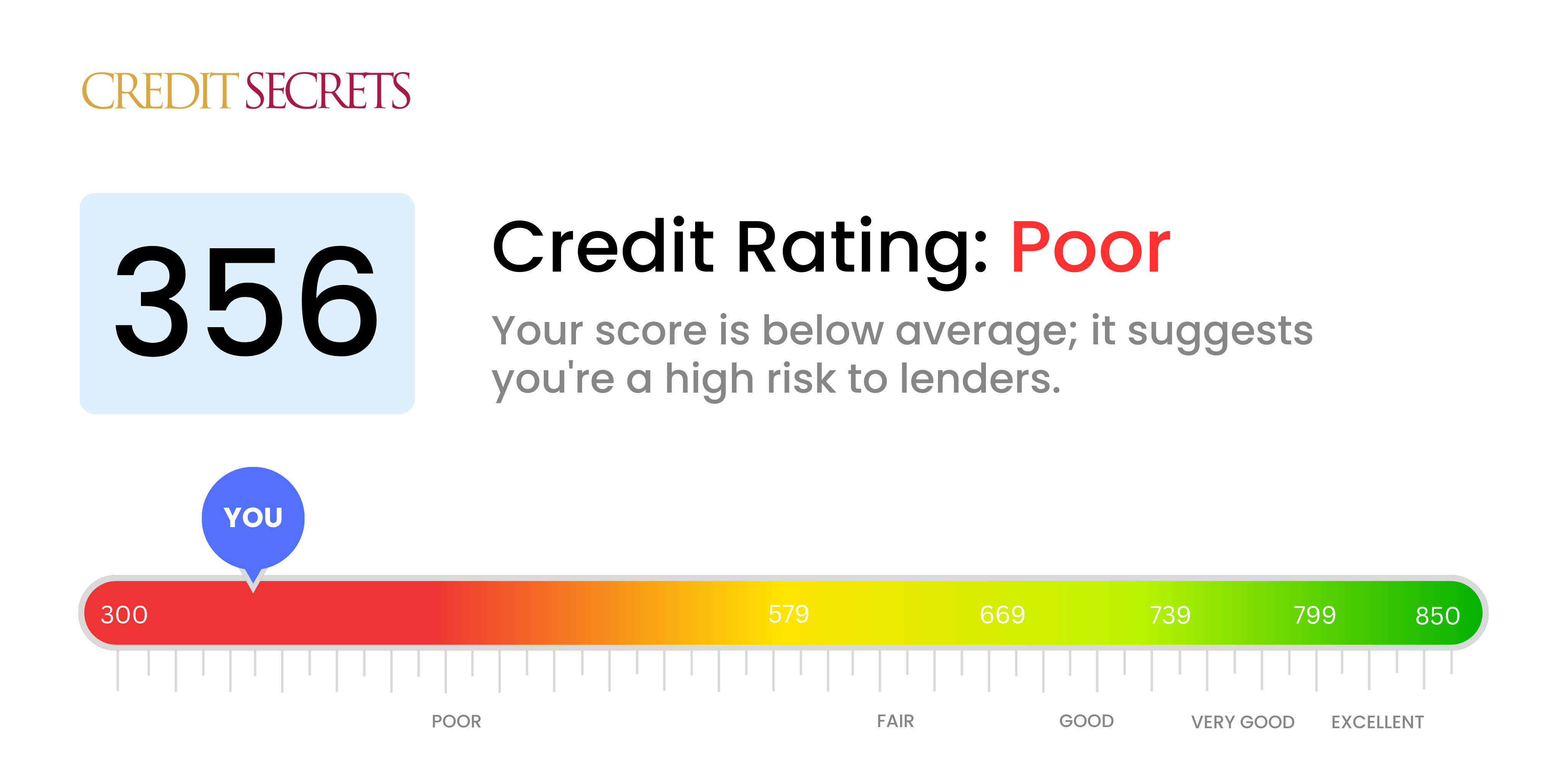

Is 356 a good credit score?

A credit score of 356 is categorized as poor. It's not an ideal score and does signify that you've faced some financial hardships, but remember, it's not a reflection of your worth and it's not permanent.

With a score of 356, you may find it challenging to qualify for loans or credit cards, and if approved, you may face higher interest rates. It might also be more difficult to secure housing or utilities without a cosigner. However, with disciplined financial habits, purposeful actions, and the right assistance from programs like ours, you can work towards actively improving your credit score.

Can I Get a Mortgage with a 356 Credit Score?

Being candid, a credit score of 356 paints a challenging picture if you're planning to apply for a mortgage. This score considerably falls below the minimum threshold that most mortgage lenders look for, implying there have been significant issues in your financial history, such as defaulting on loans or consistent late payments.

Still, everyone starts somewhere. Despite the low score, it's important to remember it's not permanent. The first step towards improving it would be settling existing debts. If you're behind on payments, forging a path towards becoming current with them would slowly diminish the negative effect on your score. This is not a quick process, so patience will be key. In the meantime, focusing on stable rental history and saving for a larger down payment can be alternatives for traditional mortgage procedures. Your journey to financial recovery begins with the right steps, however small.

Can I Get a Credit Card with a 356 Credit Score?

Having a credit score of 356 certainly presents certain challenges when applying for a traditional credit card. This score generally indicates financial hardship or past mismanagement of credit, which is seen as a substantial risk by lenders. Though this may be disheartening, it's crucial to face these financial realities straightforwardly and with hope. Knowing the current status of your credit is the first significant stride towards your financial recovery.

Considering such a score, opportunities like secured credit cards can be explored. These types of cards need a deposit which acts as your credit limit. These cards tend to be more accessible for those with lower scores and can gradually help rebuild credit. Other alternatives could be finding a co-signer or looking into pre-paid debit cards. Keep in mind that these routes don't offer immediate repair but instead are stepping stones in the journey to financial stability. It's important to remember that interest rates on credit available to individuals with lower scores are usually higher, reflecting increased risks to lenders.

Can I Get a Personal Loan with a 356 Credit Score?

A credit score of 356 indicates a considerable risk for lenders. Usually, traditional lenders hesitate to approve personal loans for those with such low scores. Despite the tough situation, it's crucial to face the facts surrounding your credit score and what it means for your borrowing possibilities.

Now, let's talk about alternatives. The doors to conventional loans might be currently closed, but other options like secured loans or co-signed loans could be available. Secured loans require some form of collateral, while co-signed loans need someone with a better credit score to vouch for you. Another pathway could be peer-to-peer lending platforms, often willing to entertain applications with lower credit requirement thresholds. But bear in mind, these alternatives can come with strings attached like an elevated interest rate or less flexible terms, owing to the lender's elevated risk. Explore these options carefully before making a decision, keeping your financial well-being in mind.

Can I Get a Car Loan with a 356 Credit Score?

Having a credit score of 356 may present certain challenges when trying to secure a car loan. Most lenders prefer to work with borrowers who have scores in the 660 range or higher. A score like 356 is viewed as a high risk by lenders, as it implies a past struggle in managing credit or paying back loans.

But don't be disheartened! It's important to understand that having a lower credit score doesn't necessarily exclude you from obtaining a car loan. Some lenders do specialize in assisting those with lower scores, although the trade-off may be a higher interest rate. This is due to the lenders protecting themselves against the potential of default. So while the journey to securing a car loan might appear tough, with careful examination of loan terms and persistent effort, it's certainly achievable.

What Factors Most Impact a 356 Credit Score?

Gaining a comprehensive understanding of your 356 credit score is a vital first step in improving your financial health. It is crucial to understand the factors contributing to your credit score and how to address them effectively.

Payment Record

Your payment history holds significant weight in credit score calculation. Late payments, missed payments or defaults could explain your current score.

What You Can Do: Check your credit report for any history of late or missed payments. Evaluating your past payment habits can reveal how they have impacted your score.

Credit Utilization

High credit utilisations could negatively impact your score. If your credit usage is near or exceeds your limit, this could be a significant factor.

What You Can Do: Regularly monitor your credit card statements to figure out if your balances are too close to the limits. Keep balance significantly lower than your credit limit to maintain a healthy score.

Credit History Tenure

A shorter credit history can potentially lower your credit score.

What You Can Do: Assess your credit report to determine the ages of your most recent and oldest accounts, and calculate the average age of all your accounts to perceive if new accounts are affecting your score.

Credit Type Diversity

Having a diverse credit portfolio and managing them responsibly contributes to a good credit score.

What You Can Do: Evaluate your report for varied credit types such as credit cards, retail accounts, installment loans, and mortgage loans. Consider if you have been applying for new credit excessively.

Public Records

Public records such as bankruptcy filings, court judgments or tax liens can have a severe impact on your credit score.

What You Can Do: Check your credit report for any public records. Focus on resolving any items that may negatively affect your score.

How Do I Improve my 356 Credit Score?

At 356, your credit score is quite low, but we believe in your financial recovery. Here are the most critical actions you can take that are both manageable and effective:

1. Clear Delinquent Accounts

Begin by explicitly focusing on delinquent accounts you might have. Neglected debt affects your credit score. Start by paying off these debts or discuss with your creditors adjourning payment schemes if needed.

2. Alleviate Credit Card Debt

Large credit card balances can drag down your score. Aim to limit your credit card debt to under 30% of your total limit, aiming to ultimately keep it below 10%. Start by paying off the cards with the highest ratios of debt to limit.

3. Consider a Secured Credit Card

With your current score, a regular credit card may not be possible. A secured credit card, backed by a cash deposit acting as your line of credit, may be a viable option. Use it wisely by making minor purchases and paying off in full monthly, establishing a solid payment record.

4. Seek Aid from Trusted Contacts

Ask a loved one with a good credit score if you could be an authorized user on their credit card. By doing this, their positive credit behavior can reflect on your credit report. Ensure the card issuer is sharing this information with credit bureaus.

5. Diversify Your Credit History

Broadening your types of credit can enhance your credit score. Once you have a strong payment history with your secured card, investigate alternative credit types, like credit builder loans or retail credit cards. Manage these responsibly to improve your overall credit.