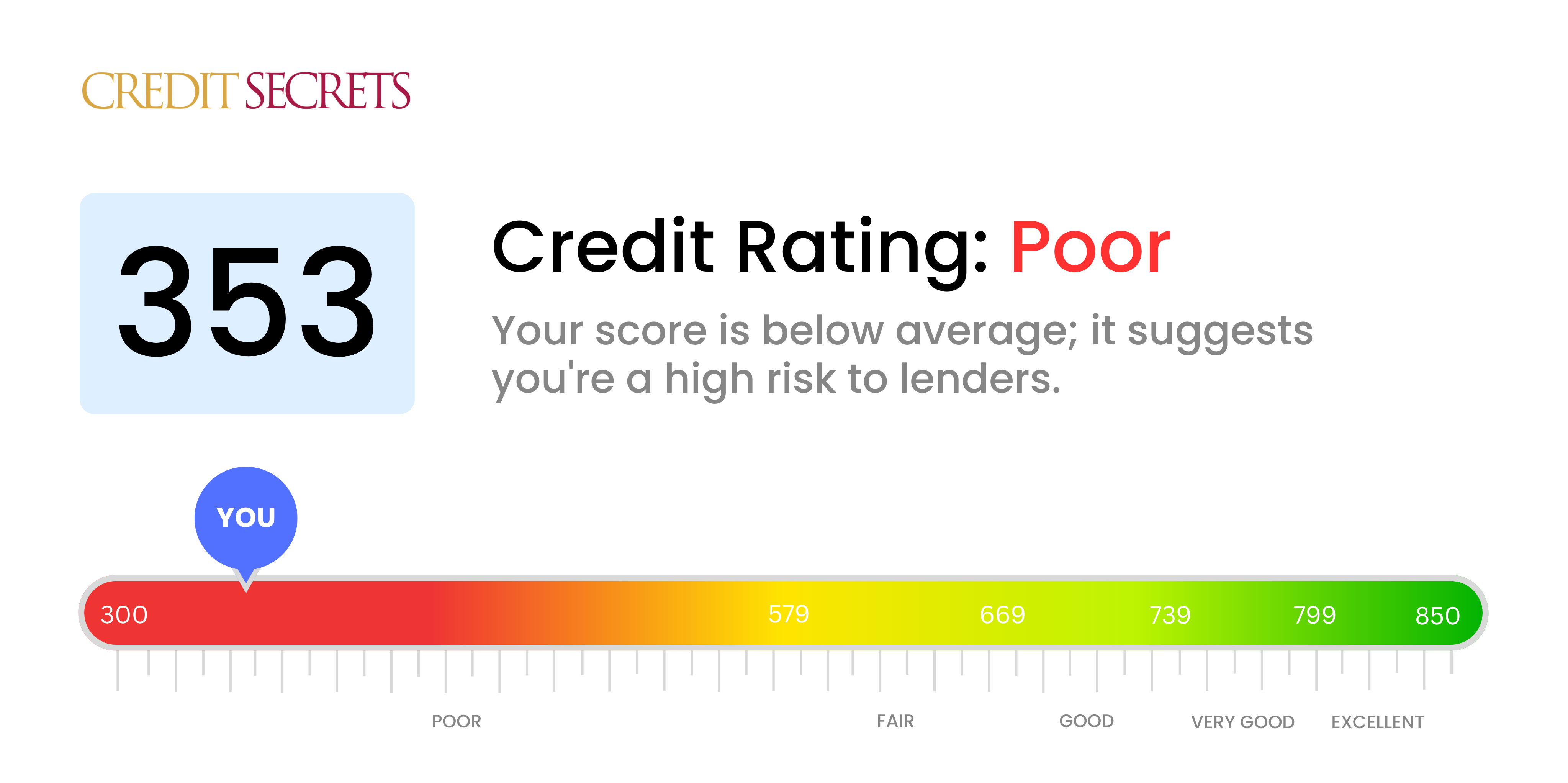

Is 353 a good credit score?

With a credit score of 353, it's important to understand that this score falls under the 'Poor' category. It can be daunting and may present some challenges when attempting to secure loans or credit, but it doesn't mean your situation can't be improved.

Reflecting such a score, you might face higher interest rates or difficulty in securing credit approval from lenders. However, the great news is that you may start taking steps today to begin increasing your credit score. While raising your credit score will take some time and discipline, it's definitely attainable with thoughtful decisions and consistent effort.

Can I Get a Mortgage with a 353 Credit Score?

If your credit score sits at 353, unfortunately, it's quite unlikely that you'll qualify for a mortgage. This is a lower score than many lenders require and it typically signifies past financial struggles like skipped payments or defaulted loans. Don't be disheartened: a low credit score doesn't mean you're locked out of homeownership forever.

Higher credit scores often lead to more favorable mortgage rates, but a low score doesn't erase all your options. You might consider starting with a government-backed loan, like an FHA loan, which is designed to help those with lower credit scores. Regardless, it's crucial to keep paying all your bills on time and strive to reduce any debts that might be lowering your score. Improvement may take time, but don't lose hope. Even though the journey to a better credit score might be long, every step brings you closer to the dream of owning your own home.

Can I Get a Credit Card with a 353 Credit Score?

Having a credit score of 353 it's likely that securing approval for a traditional credit card could be a real challenge. This score is seen as high risk by lenders, often indicating a past of financial hardship or mismanagement. It's tough, no doubt, but facing this reality with a clear understanding is critical to starting on the path towards financial recovery. Acknowledging your credit status is the first step towards resolving it, even if it means dealing with some uncomfortable truths.

Given the complications that come along with such a low score, considering alternatives such as secured credit cards might be a good place to start. These cards need a deposit which becomes your credit limit, and they're often easier to obtain, helping to rebuild your credit over time. Other options could include finding a co-signer or using pre-paid debit cards. These solutions won’t transform the situation overnight, but they can prove to be crucial tools on the journey to financial health. Remember, interest rates on any type of credit accessible to those with scores like yours tend to be much higher, echoing the increased risk seen by lenders.

Can I Get a Personal Loan with a 353 Credit Score?

If you possess a credit score of 353, it is important to be cognizant of the fact that obtaining approval for a personal loan may be extremely difficult. Traditional lending institutions typically perceive such low credit scores as an indication of higher financial risk. This means that you may find most doors to traditional loans closed to you due to this credit score. It may seem like a daunting situation, but being aware of your present position is a crucial step in navigating your financial path.

Despite these setbacks, alternative borrowing options might be worth considering. For instance, secured loans, which require you to offer collateral, or co-signed loans, where an individual with a superior credit score provides a guarantee on your behalf. Another option may be to allocate funds for loans on peer-to-peer lending platforms. These might offer more lenient credit score requirements. But bear in mind that these alternatives generally charge a higher interest rate and may carry less favorable terms, a reflection of the heightened risk the lender bears due to your low credit score.

Can I Get a Car Loan with a 353 Credit Score?

At a credit score of 353, it's not easy, unfortunately, to qualify for a car loan. With lenders often seeking scores above 660 for terms that are more favorable, a score below 600 is typically seen as subprime. Your score of 353 falls well into this subprime category. This is because, to lenders, this score means you're a higher risk and may encounter difficulties repaying the money they lend.

Despite this setback, don't despair. While your path may be slightly more challenging, the possibility of securing a car loan hasn't completely disappeared. There are lenders familiar with situations like yours and who specifically cater to those with lower credit scores. However, do tread carefully, as these loans frequently carry significantly higher interest rates. These increased rates are due to the perceived risk lenders take on when dealing with lower credit scores. But with due diligence and thorough examination of the loan terms, getting that car is still within your grasp.

What Factors Most Impact a 353 Credit Score?

Navigating a credit score of 353 might seem daunting, but rest assured that understanding the influential factors can help you build towards a healthier credit future. Each financial story is different, leading to its unique growth opportunities and learning experiences.

Poor Payment History

Past payment habits often greatly influence your current score. If there have been instances of late payments or debts unfulfilled, this could be a major factor to your 353-score situation.

How to Check: Thoroughly examine your credit report, looking for instances of late payments and defaulted loans. Reflect on these and think of ways to prevent future late payments.

High Credit Utilization

Using up a large portion of your available credit can damage your score. If you consistently max out your credit cards, this could be contributing to your low score.

How to Check: Review your current credit card balances. Are they nearing their limit? Implementing a strategy to keep balances low can be beneficial.

New Credit

A constant flow of new credit accounts can negatively affect your score. This shows possible lack of financial stability or over-reliance on credit.

How to Check: Go over your credit report and see if there is a common trend of opening new accounts. Minimize applying for new credit unless completely necessary.

Negative Public Records

Public records such as bankruptcies, court judgments, or tax liens can drastically pull your score down.

How to Check: Check your credit report for any public records. Deal with any listed items that might need immediate attention.

How Do I Improve my 353 Credit Score?

A credit score of 353 falls into the range of ‘very poor’, but fear not – every journey to better credit begins somewhere, and yours can start today. Below are the most impactful, immediate measures tailored specifically to your current situation:

1. Clear Your Outstanding Debts

If you possess any unpaid debts, clearing them should be at the forefront of your steps. Having outstanding debts could significantly affect your credit score. Communicate with creditors to arrange a flexible payment plan if a lump-sum payment seems unattainable.

2. Keep Credit Utilization Low

Keep in mind that maintaining high credit balances can damage your credit score. Strive to maintain your credit balance not more than 30% of your credit limit. In the longer run, make it a habit to keep it under 10% for an even healthier credit score.

3. Apply for a Secured Credit Card

In your current situation, obtaining a traditional credit card might be a challenge. In this case, a secured credit card could be a feasible option. A modest refundable deposit is required as collateral. Make small, manageable purchases each month and clear the balance promptly to establish a good repayment history.

4. Become an Authorized User

If a close friend or relative maintains good credit, kindly ask if they can make you an authorized user on their existing credit card. Recognize that it’s essential the card issuer reports authorized users’ activity to credit bureaus.

5. Look beyond Traditional Credit Types

Once you have a good standing with your secured credit card, consider exploring diverse types of credit such as a credit builder loan or a retail credit card. This can showcase your capability of handling multiple accounts responsibly, aiding your credit score incrementally.