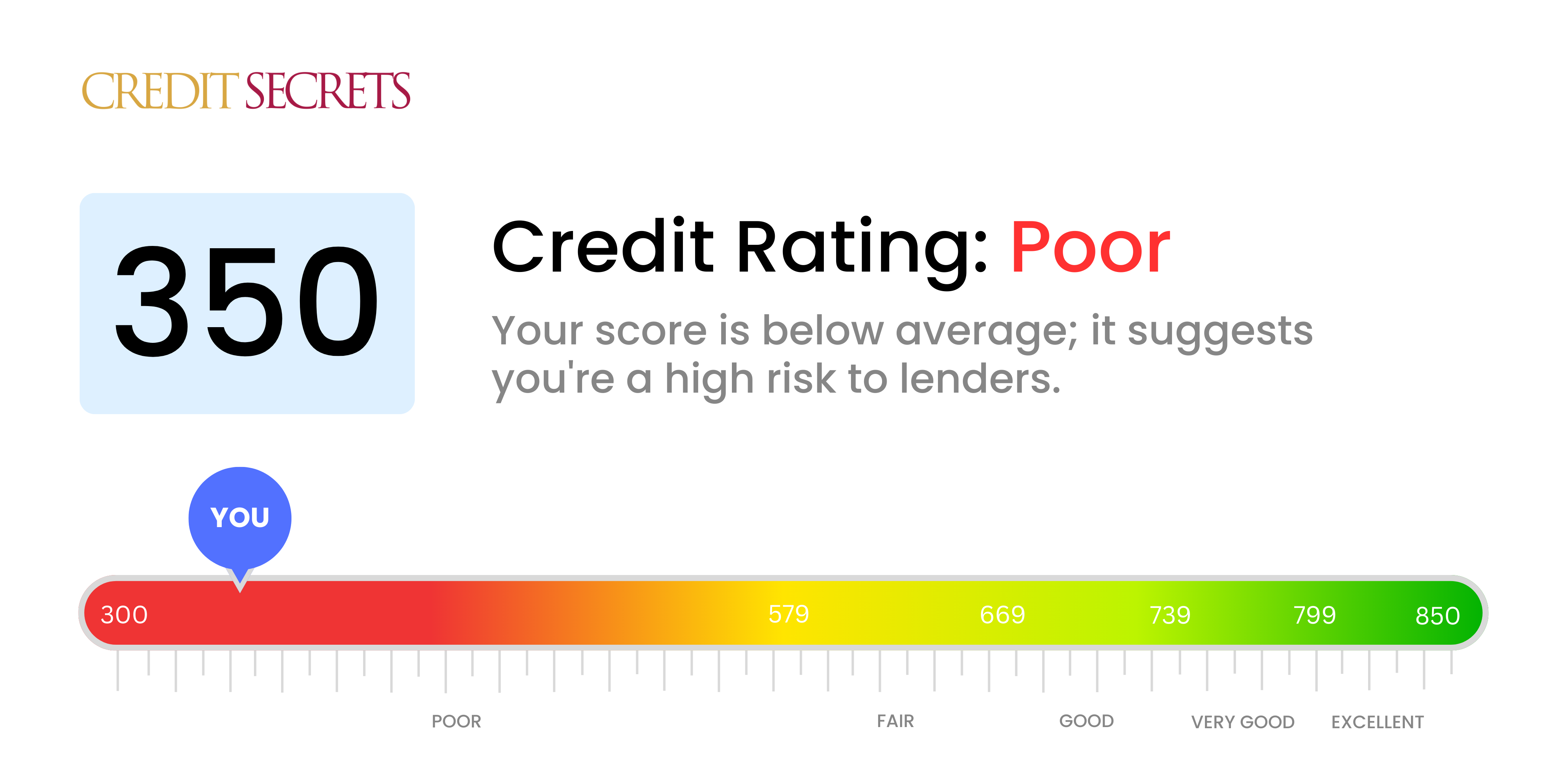

Is 350 a good credit score?

With a credit score of 350, it's clear you're encountering some challenges as this score falls within the 'Poor' category. Lets face it, a 350 credit score might make financial transactions like borrowing money or getting a credit card really difficult.

But not to lose heart. Credit Secrets is here to help turn things around. Remember, while this credit situation is tough, it's not something that can't be improved. By understanding how credit scores work and taking active steps to improve yours, you'll be on the path to financial progress in no time.

Can I Get a Mortgage with a 350 Credit Score?

Having a credit score of 350 indicates that obtaining a mortgage will be quite challenging. This score is significantly lower than what is generally required by lenders. A credit score this low tends to reflect a history of financial hardship, such as late payments or defaults.

However, your present situation doesn't have to dictate your future. Your credit score can be improved over time. Start by addressing any existing debts or discrepancies negatively affecting your score. Embarking on a path of making timely payments and responsible credit use can slowly help build your score. Remember, each step you take towards better financial health increases your chances for a financially secure future.

Mortgage alternatives when your credit score is low could include saving up to pay for a property outright. For this option, establishing a strict and consistent savings plan would be necessary. Alternately, you could consider a rent-to-own arrangement. There are also home loan programs designed for individuals with poor credit, though the interest rates will often be higher. Every financial choice carries its advantages and disadvantages, so conduct thorough research before making a decision.

Can I Get a Credit Card with a 350 Credit Score?

Having a credit score of 350 indicates significant financial challenges. This severe rating typically means that approval for a traditional credit card is highly unlikely. It's a tough situation, but understanding your own credit circumstances is a key element of course-correction. It's indeed a tough pill to swallow, but staying informed about your credit status is crucial on the road to better financial health.

Considering your 350 score, you may need to opt for credit card alternatives. A secured credit card could be a solid choice. With these cards, you make a deposit that then serves as your credit limit. Although not ideal, they're often easier to get approved for, and their usage can help restore credit over time. Alternatively, you may want to think about obtaining a prepaid debit card or getting a co-signer, which are also decent options. Alas, interest rates associated with any credit available to a person with a 350 score will likely be high. This mirrors the increased risk the lender is taking on. While these strategies don't offer an immediate fix, they can be constructive in your journey to financial recovery. Remember, each small step counts and there's always light at the end of the tunnel.

Can I Get a Personal Loan with a 350 Credit Score?

A credit score of 350 is markedly below the level that lenders generally consider when approving a personal loan. A score this low indicates a high level of risk in lender's view, suggesting it's improbable they would approve any money lending under standard conditions. This is a tough spot to be in, but it's crucial to acknowledge what this credit score implies for your borrowing prospects.

When traditional loan routes aren't a possibility, other options might be worth exploring. Secured loans, which involve providing collateral, or co-signed loans, where someone with a higher credit score backs your application, could be alternatives. Platforms that conduct peer-to-peer lending can occasionally be more amicable towards lower credit scores. It's crucial to remember, however, that such alternatives typically come accompanied by higher interest rates and less favorable terms, as they take on the higher risk associated with your credit score.

Can I Get a Car Loan with a 350 Credit Score?

If you're looking to get a car loan with a credit score of 350, you may face some hurdles. Car lenders often prefer scores that are at least 660. However, this doesn't mean you're out of options. Some lenders work with individuals who have lower credit scores, but tread carefully. Loans made under these circumstances typically carry significantly higher interest rates, due to the greater risk that lenders perceive. High interest rates protect lenders, but for you, it means a more expensive loan and a potentially heavier financial burden.

Despite the challenges, it's crucial not to be disheartened. It's possible to find a car loan, even with a 350 credit score. Just remember, higher interest rates may feel like a setback, but they are not a roadblock. With careful planning and by gaining a thorough understanding of the loan terms, you can still achieve your goal of owning a car. Stay determined and look at this as an opportunity for growth and learning in your financial journey.

What Factors Most Impact a 350 Credit Score?

Analyzing a credit score of 350 is essential to identify the most impactful contributors to such a low score, and to start your journey towards credit improvement.

Payment Defaults

Persistent payment defaults could be one of the biggest reasons behind your current score.

How to Check: Review your credit report for any signs of unresolved defaults. Reflect on your history of bill payments, as this may be a significant factor in lowering your score.

High Credit Utilization

Maxing out your credit limits signals credit risk to lenders and can be a factor in your low credit score.

How to Check: Look at your credit card statements. If you’re consistently reaching or exceeding your credit limit, then work towards reducing your balances.

Short Credit History

Having a limited or short credit history may be another factor contributing to a score of 350.

How to Check: Inspect your credit report and try figuring out the age of your accounts. Having recently opened new accounts may also count against you.

Lack of Credit Mix

Managing different types of credit such as mortgages, auto loans and credit cards, can boost your credit profile.

How to Check: Understand your mix of credits. Expanding and managing a mix of credits could help improve your score over time.

Impacting Public Records

Public records such as bankruptcies and foreclosures severely impact your credit score.

How to Check: Look through your credit report for any public records. Consider seeking legal advice to resolve these issues.

How Do I Improve my 350 Credit Score?

With a credit score of 350, your financial situation might seem challenging, but fear not, progress is truly possible. Here’s a comprehensive guide with feasible steps for improving your credit score from this point:

1. Resolve Outstanding Debts

Start by clearing any significant debts that you currently have. Prioritize tackling any accounts that have been sent to collections. Make arrangements with your creditors to agree on a feasible repayment plan, gradually reducing your outstanding debts.

2. Establish a Payment History

Next, focus on making your payments on time, every time. Future lenders will be interested in how consistently you have made your credit payments. Avoid late payments as it is one of the main factors that negatively affect your credit score.

3. Secure a Credit Card

Given your credit score, applying for a secured credit card would be a smart move. It offers a way to build credit when traditional methods are not available. These require a security deposit, but they build a history of good credit use if managed well.

4. Consider a Credit-Builder Loan

A Credit-Builder loan can be a valuable tool for building credit as payments are usually reported to the three major credit bureaus. As you repay the loan on time, a positive payment history is established, improving your credit score gradually.

5. Check Your Credit Reports for Errors

Ensure to regularly review your credit reports for accuracy. Errors can sometimes happen and have a negative impact on your credit score. Report any discrepancies to the respective credit bureau to have them rectified promptly.

By adopting these feasible steps, bettering your credit score from a 350 is achievable and will put you on a path to financial freedom.