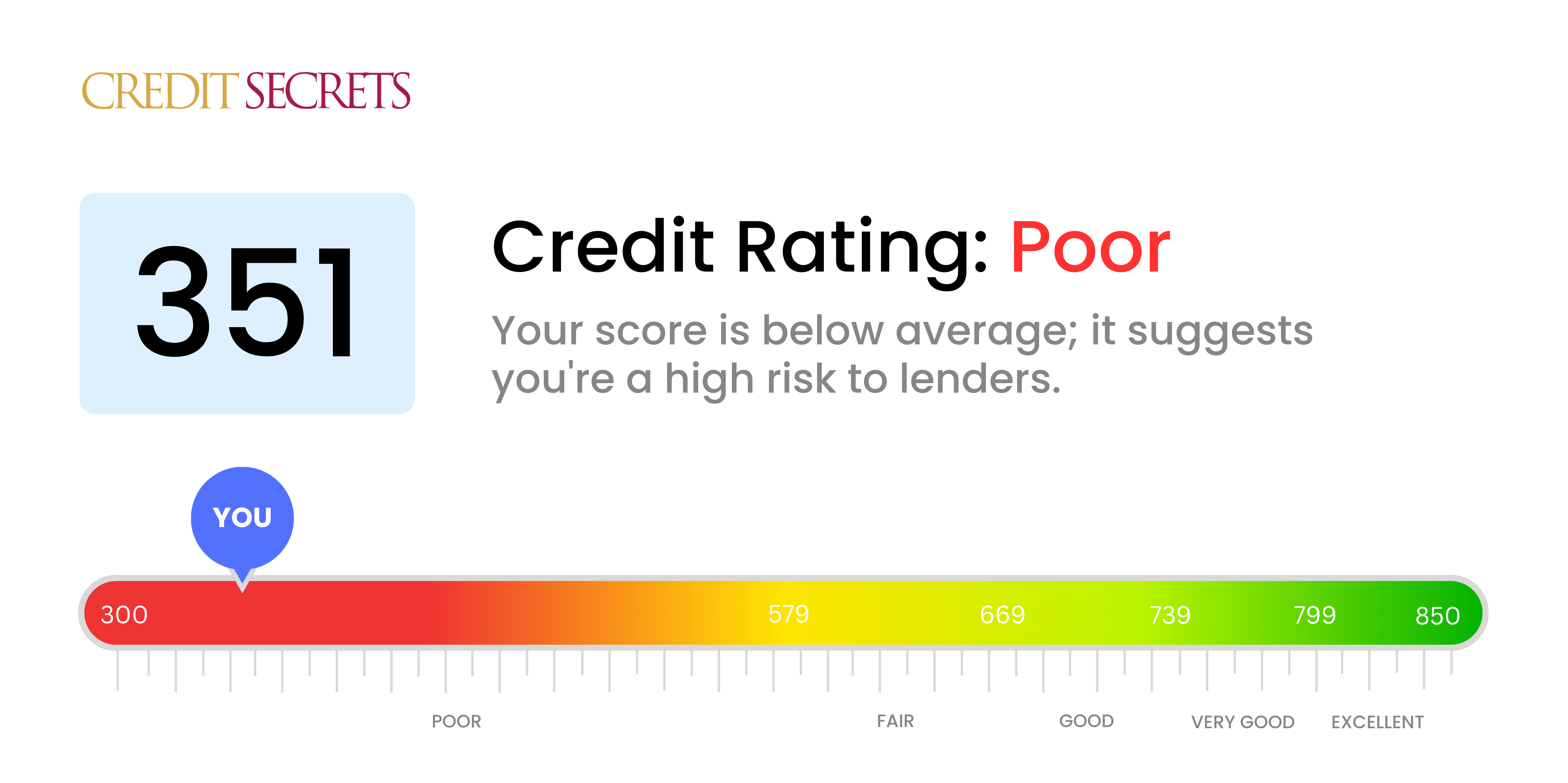

Is 351 a good credit score?

A credit score of 351 falls into the 'poor' category. Having such a score, you might encounter challenges when seeking credit and may face higher interest rates on loan applications, due to the perceived high financial risk.

Despite these hurdles, it's important to know this isn't the end of the line. It's possible to enhance your credit score with smart, consistent financial strategies. By making timely payments, reducing debt, and carefully monitoring your credit, you can improve your credit score eventually.

Can I Get a Mortgage with a 351 Credit Score?

A credit score of 351, unfortunately, makes getting approval for a mortgage extremely unlikely. This score is considerably lower than the minimum requirement of most lenders and suggests serious financial setbacks in the past, such as missed or defaulted payments.

While this is undoubtedly discouraging, there are other avenues to explore. One possible solution could be to consider alternative financing options like securing a private lender. Alternatively, you might want to explore programs designed to aid those with poor credit in securing a home loan. Keep in mind, however, these solutions often come with higher interest rates. It's crucial to weigh all options carefully before proceeding.

Moving forward, consider taking steps to raise your credit score for the future. Though this is a gradual process, patience and determination can help you create a healthier financial profile, increasing your possibilities for loan approvals down the line.

Can I Get a Credit Card with a 351 Credit Score?

Having a credit score of 351 would indeed make it very hard for you to be approved for a standard credit card. This is a fairly low score, suggesting that there might've been some financial challenges in the past. However, don't let this discourage you. It's crucial to face reality and acknowledge your financial situation before you can begin mending it.

With a 351 credit score, you might want to explore other alternatives. One option could be a secured credit card that makes use of a deposit as your credit limit. This could equip you with a credit-building tool that you can handle responsibly. Additionally, you might want to look into prepaid debit cards or getting a reliable co-signer. These might not offer an immediate fix, but they provide a stepping stone towards improving your financial health. It's important to remember that any credit option you have at this point would likely come with higher interest rates due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 351 Credit Score?

With a credit score of 351, securing a personal loan through traditional lenders can be troubling. Your score falls well below the threshold most lenders consider safe, indicating a considerable risk to them. This too often, unfortunately, results in declined loan applications. It's a difficult place to be, but it's necessary to understand the impact of your credit score on your borrowing prospects.

While mainstream loans may not currently be an option, there are still other routes you could explore. Secured loans, where you provide collateral, could be one option. Co-signed loans, where another individual with a more attractive credit standing assists, are another possibility. Platforms that offer peer-to-peer lending sometimes have more flexible credit criteria. Be mindful though, as these alternatives can carry higher interest rates and less favorable terms, as they account for the increased risk to the lender.

Can I Get a Car Loan with a 351 Credit Score?

Having a credit score of 351 might make getting approved for a car loan quite difficult. Wired into the lending system is the notion that individuals with scores above 660 are typically deemed as 'low-risk' borrowers. But if your score is under 600, it's often categorized as subprime, indicating the potential risk lenders might face in receiving their repayment. Your score of 351 falls into this high-risk category, and thus, may lead to increased interest rates or even outright rejection of loan applications.

That being said, don't lose hope. There are lenders out there willing to work with individuals who have lower credit scores. It's important, however, to exercise caution with these loan offers as they typically come with considerably high interest rates. These lenders often understand the risk they are taking and attempt to balance this with elevated rates. With patience, vigilance, and a thorough understanding of loan terms, the possibility of securing a car loan still exists, even if the journey seems a bit uphill at the moment.

What Factors Most Impact a 351 Credit Score?

Understanding your 351 credit score is the initial step towards improving your financial health. Here are a few factors that may explain your current score and how you can verify and address them.

Negative Items on Credit Report

Negative items such as collections, charge-offs, or judgements significantly lower your credit score.

How to Check: Examine your credit reports for any negative items that might impact your score. Try considering how you can address these issues.

Damaged Payment History

A damaged payment history resulting from missed or late payments can substantially depress your score.

How to Check: Review your credit report for delayed or missed payments. Resolve to improve the timeliness of your payments.

High Debt-to-Income Ratio

Having a high debt-to-income ratio can harm your credit score.

How to Check: Evaluate your earnings against your debt. If the ratio seems high, focus on reducing your debts.

Short Credit History

A short credit history might negatively influence your score as it makes it difficult for lenders to determine your creditworthiness.

How to Check: Appraise the age of your oldest and newest accounts. Try to keep old accounts open while responsibly managing new credit.

Limited Credit Variety

Having a limited variety of credit might restrict your score. A healthy mix of credit card loans, retail accounts, and mortgages contributes to a better score.

How to Check: Assess your credit report to identify the variety of credit. Strive for a balanced mix to enhance your credit profile.

How Do I Improve my 351 Credit Score?

With a credit score of 351, you’re facing a significant challenge. But there’s no need to panic; with a diligent and focused approach, you can elevate your score. Here’s your tailored plan:

1. Examine Your Credit Report

Before you take any steps, familiarize yourself with your credit report. Identify any errors or discrepancies – these may be adversely affecting your score. If you discover any, promptly dispute them with the credit bureaus.

2. Prioritize Delinquent Accounts

Delinquent accounts, such as those in default, collection or have been charged-off, have a substantial impact on your score. Connect with your creditors to negotiate feasible payment plans and work toward clearing these debts.

3. Apply for a Secured Credit Card

At this stage, getting a conventional credit card may be tough. Opt for a secured credit card instead, where a security deposit serves as your credit limit. Make manageable purchases and diligently pay off the balance each month to demonstrate sound financial habits.

4. Explore Becoming an Authorized User

Ask a close friend or trusted family member with good credit to add you as an authorized user on their account. This can serve to boost your credit score by adding their favorable credit habits to your report. Ensure the credit card company reports such activity to the credit bureaus.

5. Diversify Your Credit

Once your credit starts to improve, and you’ve established a good payment record with your secured card, begin to diversify your credit. Consider credit builder loans or store credit cards, managed responsibly, to fortify your credit score.