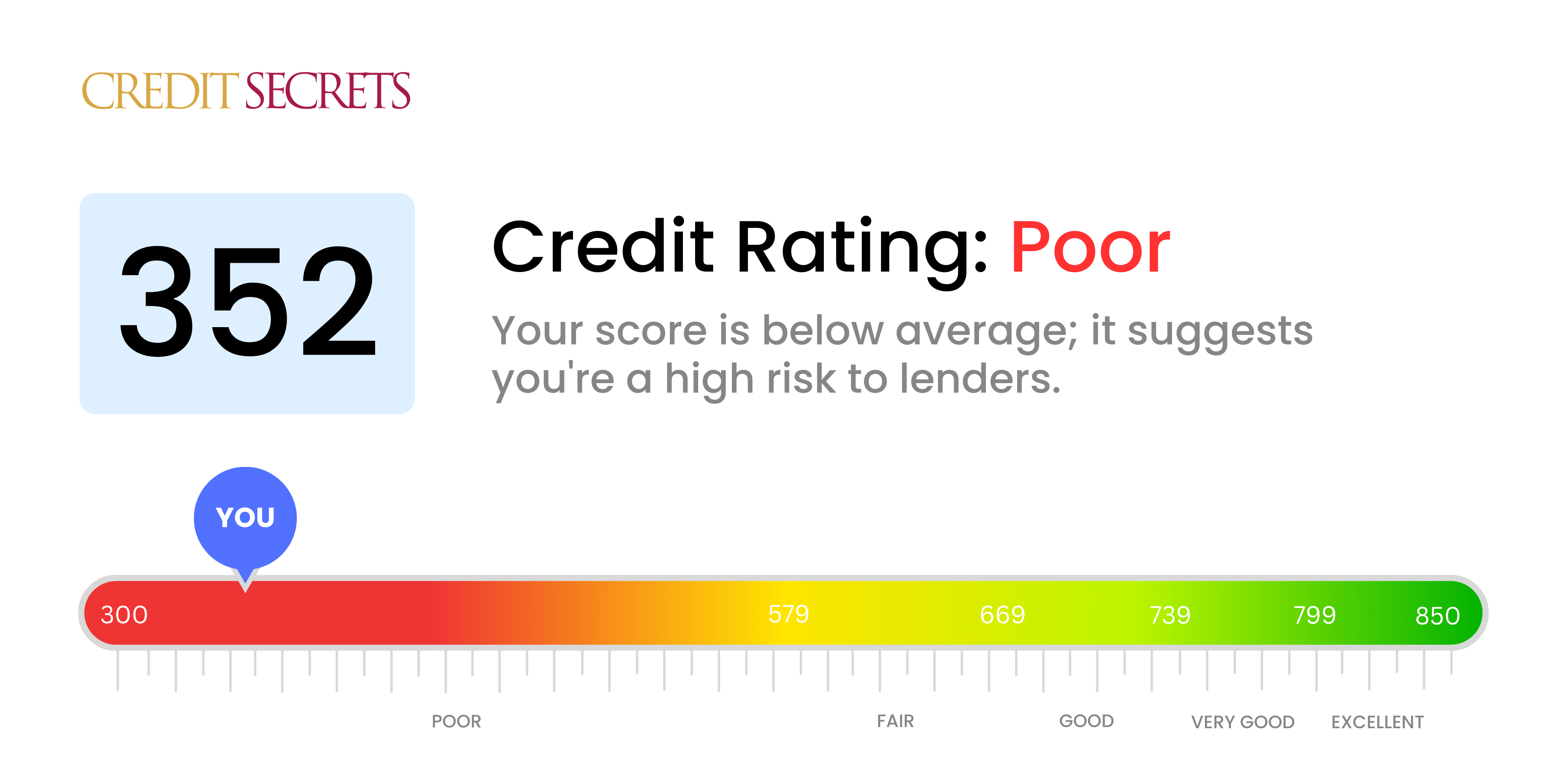

Is 352 a good credit score?

A credit score of 352 is considered to be in the poor range. This could mean facing obstacles in securing loans and credit, as lenders might see you as a high-risk borrower.

However, don't lose hope: many people have significantly improved their credit score through consistent, positive financial habits like timely bill payments and reducing their debts. It's a journey that may take some time, but progress is possible. Remember, transforming your current financial situation is about taking small steps in the right direction.

Can I Get a Mortgage with a 352 Credit Score?

With a credit score of 352, your chances of being approved for a mortgage are quite slim. This score is considerably lower than the minimum typically required by lenders, indicating that you may have had some serious financial hardships such as defaults or missed payments.

While this may seem discouraging, it's important to remember that the situation is not permanent. You have the power to rebuild your credit score. Start by addressing the circumstances that contributed to your low score. This could involve settling outstanding debts or catching up on missed payments. This score will also mean that, even if you manage to secure a mortgage, your interest rates may be considerably higher due to the perceived risk.

Eventually, with consistency and a determined effort to manage your finances responsibly, your credit score can improve. Even though it might feel daunting now, remember that every step taken towards financial responsibility will steer you closer to a stronger financial future.

Can I Get a Credit Card with a 352 Credit Score?

Having a credit score of 352 signifies that approval for a traditional credit card is likely to be quite difficult. Lenders may perceive this score as a sign of significant financial struggles, making it more risky to lend. Facing this reality may seem disheartening, but it's crucial to see it as a stepping stone towards building financial stability. Acknowledging where your credit stands is the starting point of your financial improvement journey.

Given the circumstances with a lower score, other options could be worth exploring. Secured credit cards, which require a deposit that serves as your credit limit, can often be easier to get and can help rebuild credit gradually. Another avenue might be to find a reliable co-signer or to consider using a pre-loaded debit card. These aren't quick fixes, but can be instrumental in paving the way towards financial security. Do keep in mind that any credit options available for such scores can carry significantly higher interest rates due to the higher risk perceived by lenders.

Can I Get a Personal Loan with a 352 Credit Score?

With a credit score of 453, the likelihood of securing a traditional personal loan is low. To lenders, low scores signal high risk, making them hesitant to extend credit. While this can be a tough pill to swallow, it's necessary to understand the limitations that come with such a score. However, rest assured that this isn't the end of the line and there are still options available.

Consider investigating alternatives like secured loans, where you'll offer up collateral, or co-signed loans, where a person with a higher credit score can vouch for your ability to repay. Peer-to-peer lenders may also be more flexible with credit score requirements. However, be aware that these alternatives may carry higher interest rates and less favorable terms due to the increased risk for the lender. Navigating these challenges might feel daunting, but with careful consideration of your options, it's possible to find a path forward.

Can I Get a Car Loan with a 352 Credit Score?

With a credit score of 352, it's crucial to be upfront about the challenges you may face while trying to secure a car loan. Car loan providers typically want to see credit scores over 660. Scores below 600 often fall into what they categorise as 'subprime'. Your score of 352 fits into this subprime division, potentially making it harder to secure a desirable loan.

This score could result in higher interest rates or even being denied a loan. Loan providers see lower credit scores as a sign of increased risk, based on the likelihood of difficulty in repaying the loan. That's just how the industry works.

Keep in mind, there may still be a path forward for you. Some loan providers specifically focus on people with lower credit scores. Just remember, these opportunities may come with much higher interest rates due to the level of perceived risk. Be sure to review the terms carefully as you navigate this process so you can make the best decision for your financial future.

What Factors Most Impact a 352 Credit Score?

A credit score of 352 is severe, but there's always hope for improvement. By pinpointing and rectifying the factors influencing your score, you can build a path to a more prosperous future.

Credit Payment History

Typically, a deep dip in the credit score such as this may be caused by significant issues with your payment history. Late or defaulted payments could be dragging your scores down.

How to Check: Thoroughly review your credit report for any late or missing payments. Any past financial missteps could have seriously impacted your score, and addressing these is vital.

Outstanding Debt

Sizeable amounts of debt, especially if it's mostly unsecured debt like credit cards, would likely play a significant role in lowering your score.

How to Check: Go through your credit cards statements and other loan documents. Are you heavily indebted compared to your income? It's critical to work towards reducing debt where possible.

Public Records

Public records like bankruptcies, collection accounts, or tax liens have a severe impact on your score.

How to Check: Inspect your credit report for any such public records. If any items need addressing or resolving, prioritize these.

Length and Variety of Credit

A short or non-diverse credit history could be detrimental to your score. Lack of a mix of credit accounts (credit cards, retail accounts, car loans etc) could also be a factor.

How to Check: Evaluate your credit report for both the length and breadth of your credit history. If your history is short or lacks variety, consider opening different types of credit accounts and manage them well.

How Do I Improve my 352 Credit Score?

Operating with a credit score of 352 might feel constraining, yet with earnest efforts and targeted strategies, you can certainly reform your credit status. Here are some of the most constructive steps tailored for your current situation:

1. Analyze Your Credit Reports

Begin by acquiring your credit reports from the three major credit bureaus. Review them meticulously for any errors or discrepancies that may be unfairly dragging down your score. Dispute any inaccuracies you find to enhance your credit standing.

2. Prioritize Delinquent Accounts

Delinquent or defaulted accounts inflict the most damage on your credit score. If you have any such accounts, plan to address them first. Discuss with your lenders about hardship programs or loan modifications that could assist you.

3. Limit New Credit Applications

Reserve taking on new credit for when your score has seen significant improvement. Multiple credit inquiries in a short span can further dip your already low score.

4. Use a Secured Loan or Credit Card

Secured loans or credit cards can be a smart way to prove your creditworthiness. With a cash deposit acting as collateral, you can gradually build a positive credit history by consistently meeting your billing deadlines.

5. Incorporate Variety Into Your Credit

Once you are in a better credit position due to diligent payment of your secured line of credit, consider adding different forms of credit, such as installment loans or retail store cards. Make sure to manage these responsibly.