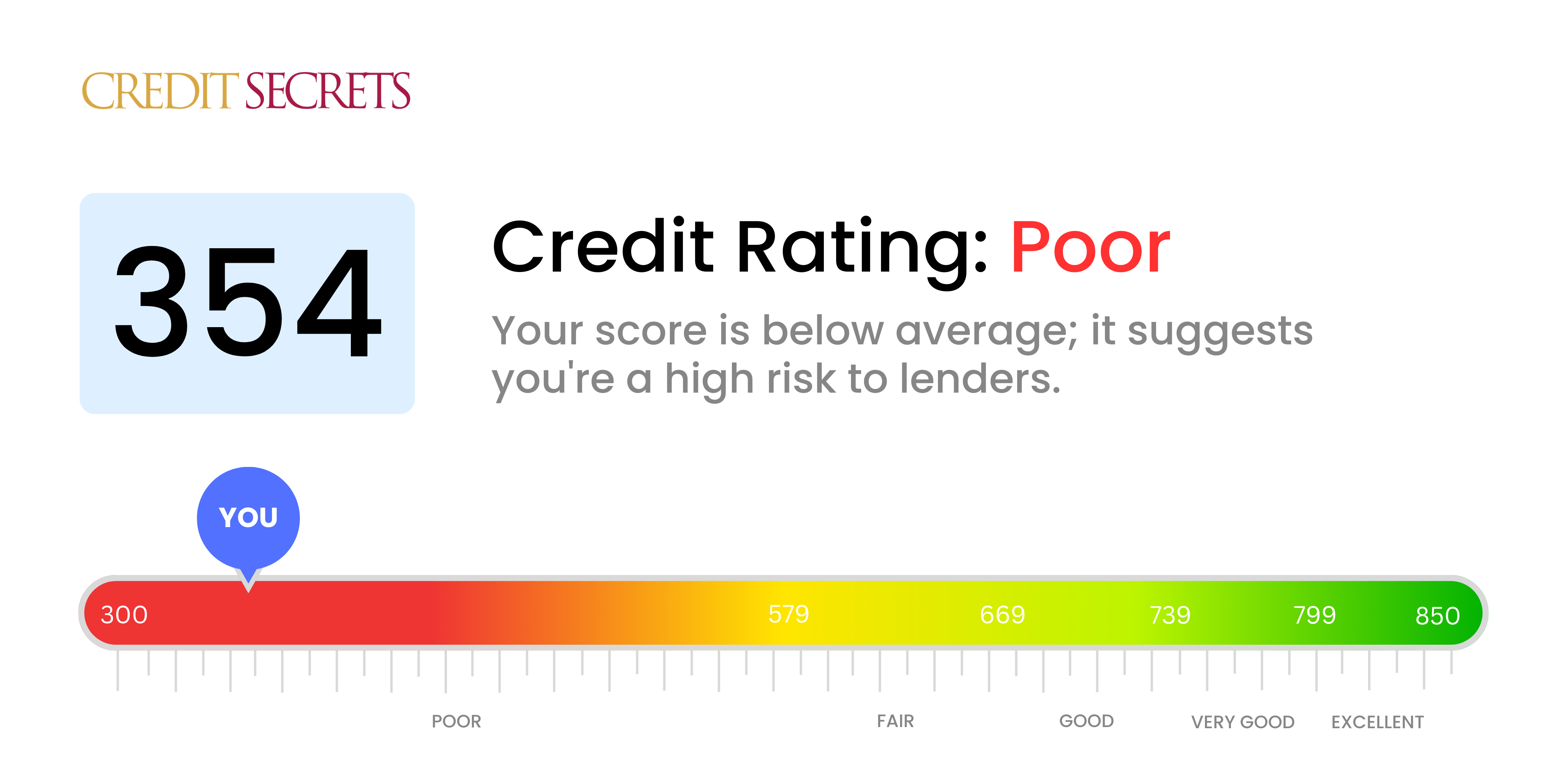

Is 354 a good credit score?

With a credit score of 354, you've entered a zone that is considered 'poor', according to the standard credit score scale. While it does suggest financial difficulty, remember it's only a snapshot of your current situation, not a life sentence.

Being in the 'poor' credit category might make it challenging to qualify for loans and credit cards. However, it doesn't mean there are no options available or ways to improve. By making informed decisions, becoming disciplined in managing finances, and developing a clear plan of action, you can steadily raise your credit score over time.

Can I Get a Mortgage with a 354 Credit Score?

Considering a credit score of 354, it's extremely unlikely that mortgage approval will be achieved. This score falls significantly below most lender's minimum prerequisites. It often implies severe financial problems such as defaulted payments or extensive debts. Such a score is indicative of financial hardships and past struggles to maintain the standard credit responsibilities.

Recognizing the tough reality of this situation, it's critically important to initiate the process of enhancing your credit score. Your priority should be to rectify any outstanding financial obligations and delinquencies adversely affecting your score. The journey to a healthier credit score involves creating a consistent pattern of timely payments as well as responsible credit usage. Improving your credit score might be a slow process, but remember with persistent and dedicated effort, a brighter financial future is within your reach. As you make progress, you can begin to explore alternative homeownership options like rent-to-own agreements, or seeking out lenders who specialize in bad credit mortgages.

Can I Get a Credit Card with a 354 Credit Score?

With a credit score of 354, your path to getting approved for a traditional credit card appears steep and challenging. This score is often regarded as risky by lenders, as it suggests financial struggle or previous fiscal mishandling. There's no sugarcoating it - this is a tough situation to be in, but it's crucial to confront it head on with understanding and positivity. Knowing where you stand is the cornerstone of repairing any financial damage.

Secured credit cards may be a fitting choice to journey out of this credit predicament. These type of cards necessitate a deposit which doubles as your credit limit and can be simpler to acquire. They can also serve as stepping stones to mend your credit over time. Co-signing a credit card or opting for prepaid debit cards could be potential strategies too. Remember, these options might not provide an immediate solution, but they can certainly aid the road towards financial recovery. Also keep in mind, any form of credit offered tend to have higher interest rates due to the high-risk nature of the score.

Can I Get a Personal Loan with a 354 Credit Score?

With a credit score of 453, it's difficult to secure approval for a personal loan from conventional lenders. This is because your score falls significantly below the acceptable range, which can be quite discouraging. To lenders, a score this low usually implies a high degree of risk. It's essential to understand what this credit score means and the impacts it might have on your financing options.

Although standard personal loans might appear unattainable, you aren't without options. Certain alternatives like secured loans, which require collateral, or co-signed loans might be feasible for you. Even peer-to-peer lending platforms can be considered, as they sometimes have more relaxed credit requirements. However, it's important to remember that these alternative solutions may have higher interest rates and less appealing terms. This is due to the increased risk perceived by the lenders. Remain hopeful and explore your options carefully.

Can I Get a Car Loan with a 354 Credit Score?

With a credit score of 354, getting a car loan might be a tough journey. Lenders usually look for credit scores above 660 for comfortable terms. Unfortunately, a score lower than 600 falls into what's known as the subprime category, and your 354 score sits squarely in this group. This could result in increased interest rates or even an outright denial of your loan application. This is due to the fact that a lower credit score signals a higher risk to lenders, reflecting potential challenges in repaying the borrowed funds.

However, don't lose hope. A low credit score doesn't close all doors to obtaining a car loan. Some lenders are experienced in dealing with lower credit scores. However, tread carefully, as these loans often come with much higher interest rates. The reason for these increased rates is the lenders' need to offset the risk involved in lending to those with a lower credit score. Despite the rough path that might lie ahead, securing a car loan is still feasible. Approach it with caution, understand the terms thoroughly, and you can still realize your goal of owning a car. Remember, improving your credit score is a journey and not a destination.

What Factors Most Impact a 354 Credit Score?

An understanding of your credit score of 354 is your first step towards a better financial future. No matter what issues you may be facing, know that improvement is always possible. This is your journey, and it's in your hands to turn things around.

Payment Records

Quick resolutions of debt can often lead to better credit scores. Late or defaulted payments might be dragging your current score down.

How to Check: Look over your credit report thoroughly. Identify any instances of missed or late payments. Setting a proper payment plan can be a step towards improvement.

Level of Debt

Carrying high levels of debt can lead to lower credit scores. If your credit cards are always maxed out, this might be lowering your score.

How to Check: Evaluate your credit card statements. Keeping balances less than 30% of your credit limit can positively impact your score.

Short Credit History

Having a short credit history may negatively impact your score.

How to Check: Look at your credit report and focus on the length of your credit history. Aim for longevity with your accounts

Credit Diversity

Without a diverse range of credit, such as auto loans, mortgages, and credit cards, your score may be lower.

How to Check: Review your credit accounts. Feel free to diversify, but do so mindfully. Opening many accounts in a short time span can be damaging.

Public Records

Public records like bankruptcy or collection issues could be negatively affecting your score.

How to Check: Through careful review of your credit report, identify and address all public records. Start working towards resolution in a systematic manner.

How Do I Improve my 354 Credit Score?

With a credit score of 354, you’re facing some hurdles. However, steps can be taken to increase your score. Let’s focus on the most feasible and potent actions for your current situation.

1. Review and Rectify Credit Reports

Incorrect or outdated information might be reducing your score. Order your free annual credit reports, review them for errors, and if you find any, promptly initiate a dispute process. Such corrections can significantly improve your score.

2. Establish a Reliable Payment Pattern

Timely payments are vital for credit repair. Prioritize making steady, on-time payments on all your current obligations, even if they’re just the minimum payment. This can start to establish a reliable payment history, which will boost your score over time. Automating your payments can help ensure you never miss a due date.

3. Prioritize High-Interest Debts

Snowball or avalanche methods can be effective ways to tackle high-interest debts. By paying off high-interest loans first, you can reduce your overall debt quicker, positively affecting your credit score.

4. Consider a Secured Loan or Secured Credit Card

Secured loans or secured cards can be more accessible to obtain with a lower credit score. These can help you build credit when used responsibly. Make small purchases and repay them promptly to build a consistent history of responsible credit use.

5. Limit New Credit Applications

Each new credit application can lower your score. It’s best to limit new inquiries and focus on establishing a good payment history for now. Save applying for new credit for when your score has improved.