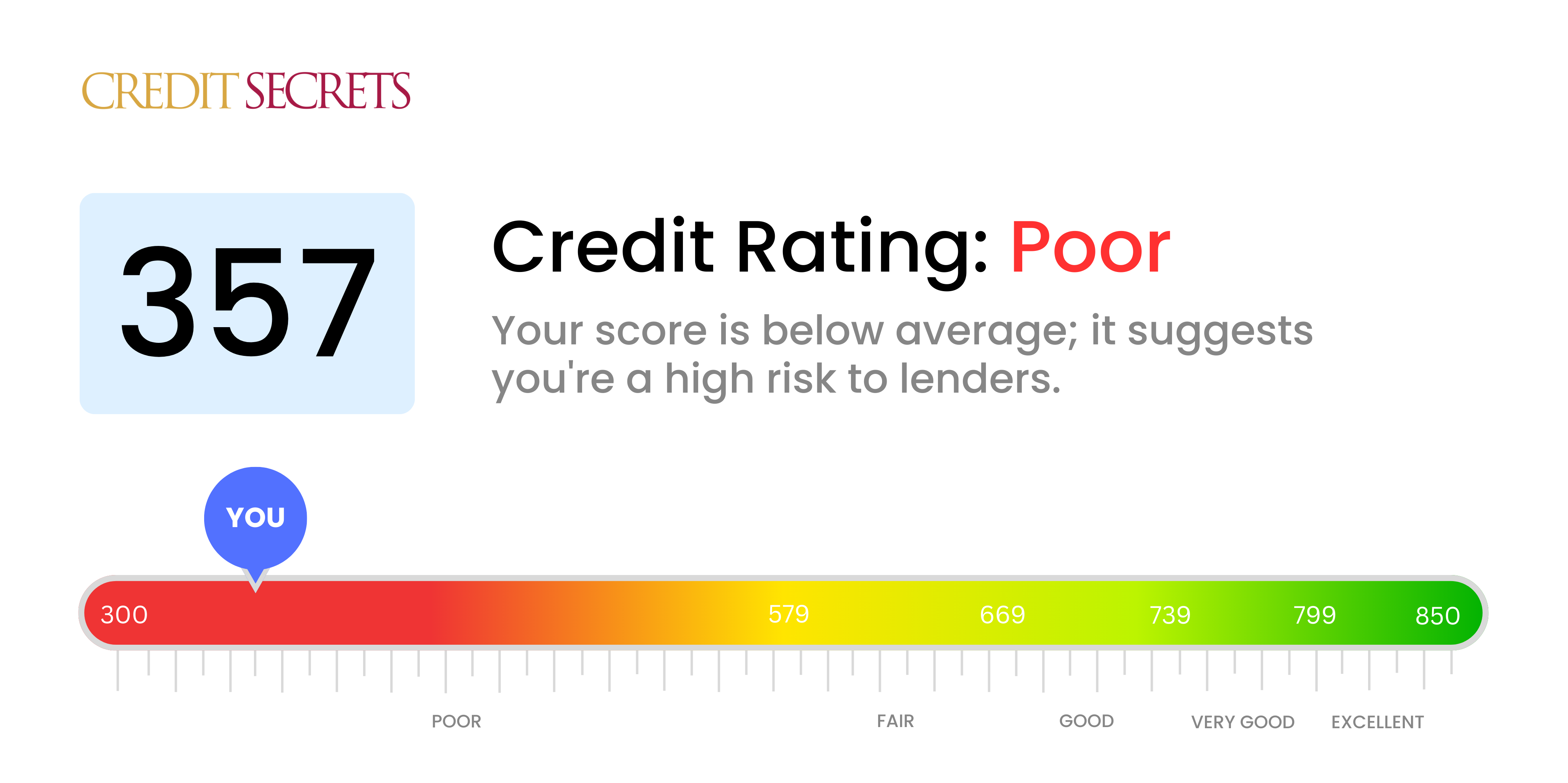

Is 357 a good credit score?

A credit score of 357 is considered poor. With this score, you might face a more stringent process when applying for credit and may not obtain competitive interest rates or credit terms. However, it's not the end of the line, there are several ways to improve your score and put you in a better financial position.

While it may seem challenging, opportunities for credit score improvement still exist. You may need to work on paying your bills promptly, reducing the amount of debt you owe, and ensuring older credit problems are resolved. Through a dedicated and proactive approach, elevating your credit score is absolutely achievable.

Can I Get a Mortgage with a 357 Credit Score?

With a credit score of 357, securing a mortgage is virtually impossible. This score is significantly below the threshold set by most lenders and signifies considerable financial challenges, such as defaulted payments or consistent late repayments. This may not be the news you hoped for, but it's the hard reality and signifies a clear area for improvement.

Concerning alternatives, you might consider approaching subprime mortgage lenders who specialize in working with individuals with lower credit scores. But, caution is advised as these mortgages often come with high-interest rates and require significant down payments. Homeownership is still within reach, but a plan to improve your credit standing is vital. Regular, on-time bill payments, reducing your debt level and limiting new credit applications are several strategies that can help enhance your credit score. Remember, change doesn't happen overnight, but with dedication, it’s possible to graduate from your current financial status.

Can I Get a Credit Card with a 357 Credit Score?

Unfortunately, with a credit score of 357, securing approval for a traditional credit card may be quite a challenge. This score often reflects past financial issues or imbalances. It's always disheartening to face these tough realities, but understanding your credit profile is crucial and can eventually help you regain control over your financial health. Knowledge is power, so don't be discouraged.

If a traditional credit card is currently unattainable, consider alternatives such as secured credit cards. These cards require a deposit which also serves as your credit limit. They can be easier to get approved for, and can also help you to gradually improve your credit score. Another option could be a prepaid debit card, or finding someone to co-sign on a card with you. While these aren't immediate solutions, they are stepping stones towards cultivating a more positive credit history. Just be aware that interest rates for these alternatives may be higher, due to the elevated risk lenders associate with low credit scores.

Can I Get a Personal Loan with a 357 Credit Score?

With a credit score of 357, your chances of being approved for a personal loan from conventional lenders are unfortunately quite slim. A score in this range is seen as high risk to lenders, indicating a history of late payments, defaulted loans, or other negative markers. While this news may not be what you're hoping for, it's critical to face it head on and consider what it means for your financial future.

While your credit score might make it difficult to secure a traditional loan, there are some alternatives available. Secured loans are an option, where you back the loan with an asset like your car or home. Another alternative might include loans co-signed by someone with a higher credit score. Peer-to-peer lending is another avenue to explore. These can, however, come with higher interest rates and less favorable terms due to the increased risk for the lender. Approaching these options with a clear understanding of the costs and terms is crucial for making an informed decision.

Can I Get a Car Loan with a 357 Credit Score?

A credit score of 357 is unfortunately too low for most conventional car loans. The credit score scale generally falls between 300 and 850, with anything under 600 often considered subprime. A score below 600 implies a high risk to lenders, and indicates potential struggles with meeting repayment obligations, based on credit history.

This doesn't mean you should give up on your goal of buying a car, though. Lenders exist who are willing to work with individuals with less-than-perfect credit scores, but it's crucial to note that this usually means much higher interest rates. The higher rates act as a protective measure for lenders against the increased risk they're taking. Remember, the path to getting a car may be rough but it's not impassable. Stay diligent and consider all the terms thoroughly, as it's still possible to secure a car loan.

What Factors Most Impact a 357 Credit Score?

Understanding the reasons behind a credit score of 357 is key in creating a feasible plan for improving your finances. Being aware of and addressing the factors that have resulted in such a score will help you carve out a path towards a healthier financial future.

Past Due Payments

Failing to make timely payments may have a severe effect on your credit score. Late payments or defaulting on loans could account for this current score.

How to Check: Analyze your credit report for any late payments, defaults, or missed payments. Reflect on past dues and their influence on your score.

High Credit Usage

Maxing out credit cards negatively affects credit scores. High credit utilization might be contributing to your low score.

How to Check: Scrutinize your credit card statements. Are they reaching their limits? Regularly keeping low balances in comparison to your total credit limit can help.

Short Credit History

Lack of a long-term credit history is unfavorable to your score.

How to Check: Examine your credit report to assess age of your oldest and newest accounts, and average age of all your accounts. Think about any new accounts you have recently opened.

Diverse Credit Types and New Credit

Having various types of credit and handling new credit responsibly impacts your score positively.

How to Check: Evaluate the variety of credit accounts you have such as credit cards, retail accounts, installment loans and mortgage loans. Regularly adding to your credit mix is a good practice.

Public Records

Public records like tax liens or bankruptcies tremendously affect your score.

How to Check: Visit your credit report for any public records. Resolve any listed items that require attention.

How Do I Improve my 357 Credit Score?

A credit score of 357 is admittedly low, but don’t be discouraged. With certain steps, improvement is not only achievable, but closer than you think. Let’s dive into the actions you can start taking today – all tailored for your specific score situation:

1. Prioritize Delinquent Accounts

It’s crucial to begin by making all delinquent payments. If certain bills have slipped through the cracks, they become priority number one. Reach out to those creditors and arrange a feasible payment plan. Overdue accounts have the heaviest weight on your credit score, so by settling these debts, you’re effectively reducing the drag on your score.

2. Steps to Lower Outstanding Credit

Carrying a high balance on credit cards can be a major factor causing your low score. Aim to pay your balances down to under 30% of your total credit limit. Make this long-term goal easier by initially focusing on the card with the highest balance.

3. Consider a Credit-Builder Loan

Securing a credit-builder loan can be a strategic way to generate positive credit history. Essentially, you loan money to yourself and repay it in installments. Once the loan is fully paid, the money is released to you, and the lender reports your good behavior to the credit bureaus.

4. Opt for a Secured Credit Card

While a regular credit card may be out of reach at the moment, a secured credit card is a viable alternative. It operates like any card, but it requires a refundable deposit as collateral. Regular and responsible use of a secured card can positively affect your score.

5. Gradually Add to your Credit Portfolio

After gaining more control over your credit score, gradually add different types of credit. This could mean a retail card or installment loan. A wider mix of responsibly managed credit can further enhance your score. Remember, patience and consistency are key to better credit.