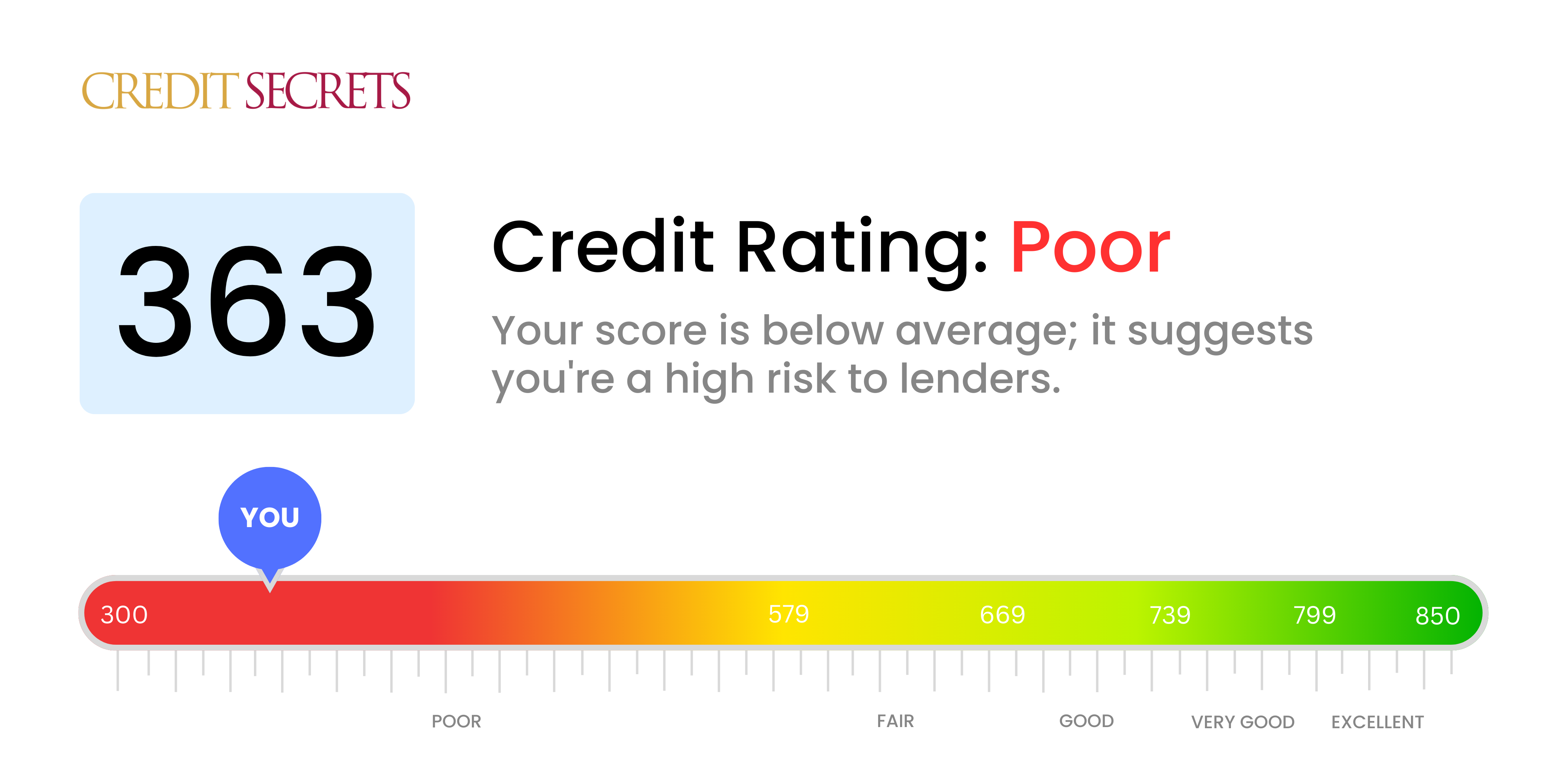

Is 363 a good credit score?

A credit score of 363 classifies as poor, according to the standard credit score scale. This suggests that you may encounter significant challenges in obtaining new credit or loans, which could include higher interest rates or more stringent requirements for approval, due to the risks lenders associate with lower credit scores. However, remember that this situation is not permanent and with consistent effort, you can boost your score and improve your financial health.

Can I Get a Mortgage with a 363 Credit Score?

With a credit score of 363, it's unlikely you'll be approved for a mortgage. Credit scores in this range are viewed by lenders as a significant risk because they reflect a track record of financial issues, such as missed payments or defaults. It's a tough spot to be in, but there's reason for optimism.

Alternatives to a traditional mortgage might be your best bet for now. Look into government-backed loans or consider a co-signer with a better credit score who can help increase your likelihood of approval. It could also be worth investigating lease-to-own arrangements. In regards to interest rates, bear in mind that lower credit scores typically correlate to higher interest rates. This is because lenders want to offset the potential risk they take on by lending to those with a history of credit issues.

It's vitally important to begin improving your credit score. Prioritize addressing outstanding debts and developing a consistent history of on-time payments. Although it can be a slow and steady journey, each step forward puts you in a better position for a brighter financial future.

Can I Get a Credit Card with a 363 Credit Score?

With a credit score of 363, your chances of being approved for a conventional credit card are quite low. It's tough to hear, but it's vital to address your financial situation head-on with honesty and determination. Such a score suggests to lenders a history of financial obstacles that might make them hesitant to extend credit to you.

But don't lose heart—there are alternatives to standard credit cards that can still help you on your journey towards financial stability. It might be worthwhile to explore secured credit cards. These require an upfront deposit that becomes your credit limit, making them relatively easier to qualify for. It's also worth bearing in mind that interest rates tend to be higher for lower scores due to the increased risk seen by lenders. Another option might be a prepaid debit card, which though not a credit card, can still provide the convenience of card-based transactions. Remember, this situation isn't permanent, and adopting the right financial strategies can help improve your credit over time.

Can I Get a Personal Loan with a 363 Credit Score?

Given a credit score of 363, it's unfortunately very unlikely that you'd be approved for a personal loan using typical lending channels. This score is a lot lower than what most banks and lending institutions consider safe to lend to. The lower your credit score, the higher the risk you present as a borrower. We understand this might not be what you want to hear, but it's essential to be realistic about your situation.

But don't lose heart, you do have alternatives. Secured loans, where you provide an asset as a guarantee, might be a possibility. Co-signed loans, where another individual with strong credit backs your loan, can also be considered. Then there's peer-to-peer lending, where personal investors might be willing to lend even if your credit score is low. Remember though, lenders often compensate for lending to higher risk borrowers with less flexible terms and increased interest rates. Being aware of this can help in making informed decisions about your financial future.

Can I Get a Car Loan with a 363 Credit Score?

With a credit score of 363, it's unlikely to get approved for a car loan. Most lenders view scores above 660 as desirable, and anything under 600 as subprime. At 363, your credit score is well below the subprime threshold. This low score could mean higher interest rates or even a flat-out rejection. Because from the viewpoint of lenders, a low score indicates a high-risk - a risk that you might have trouble repaying a loan.

Having said this, a low credit score doesn't mean you can't ever buy a car. There are lenders who work with individuals dealing with lower credit scores. However, be prepared as these loans usually carry higher interest rates as a means of offsetting the risk. It may not be easy, but with cautious thought and careful examination of the terms, there is a chance of securing a car loan. Remember, hope is not lost, it's only a bit more challenging.

What Factors Most Impact a 363 Credit Score?

Grasping a credit score of 363 is the first step on your path to financial advancement. Let's delve deep into the aspects that lead to this score and how to amend them for a more secure financial outlook. Remember, betterment is always in your hands.

Late or Missed Payments

Your credit score can greatly be influenced by a history of late or missed payments. This is probably a main factor for your current credit score.

How to Check: Look thoroughly into your credit report for any missed or late payments which might have impacted your score negatively.

High Credit Utilization Ratio

Using a high proportion of your available credit can lead to a drop in your score. If your credit card balances are high relative to your total limit, this might be a crucial factor to your score.

How to Check: Regularly overview your credit card statement to identify if the balance is close to the limit. Strive to keep the balances low.

Short Credit History and New Credit

Having a short credit history or opening new lines of credit can pose potential risk to your credit score.

How to Check: Refer to your credit report. Check the age of your oldest and newest account and average age of all accounts. Consider how frequently you have been opening new credit lines recently.

Public Records and Collections

Public records like bankruptcies, tax liens, or collections can greatly affect your credit score.

How to Check: Scan your credit report for any public records. Confront any negative items listed for faster resolution.

How Do I Improve my 363 Credit Score?

With a score of 363, your credit is severely compromised. However, rejuvenation is possible with time, determination and the right steps. The following firsthand action plan is specifically tailored to situational needs:

1. Revisit Payment History

Rendering payments on time massively influences your credit score. If you have missed or delayed payments, it is urgent to address them. Catch up on overdue payments and strive to maintain a clean record henceforth. Develop a feasible budget and adhere to it.

2. Minimize Debt-to-Credit Ratio

The relationship between your total debt and available credit significantly impacts your credit score. Aim to maintain your outstanding balances under approximately 30% of your overall credit limit. Start with the revolving credit lines that are closest to their limits.

3. Opt for a Secured Credit Card

In your current scenario, securing a standard credit card may prove difficult. Look into obtaining a secured credit card, contractual to a refundable security deposit. Use the card for minor expenses and ensure to clear the full amount each billing cycle for good credit history.

4. Authorize Credit Card Usage

Enquire with a reliable friend or relative who possesses a solid credit standing about becoming an authorized user on their credit card. This will help grow your credit reputation, provided the card provider reports authorized user activity to the reporting agencies.

5. Credit Diversity

Introduce variety to your credit portfolio once you gain stability with your secured card. Trying out different types of credit responsibly, like a credit builder loan or a department store card, can improve your credit score.