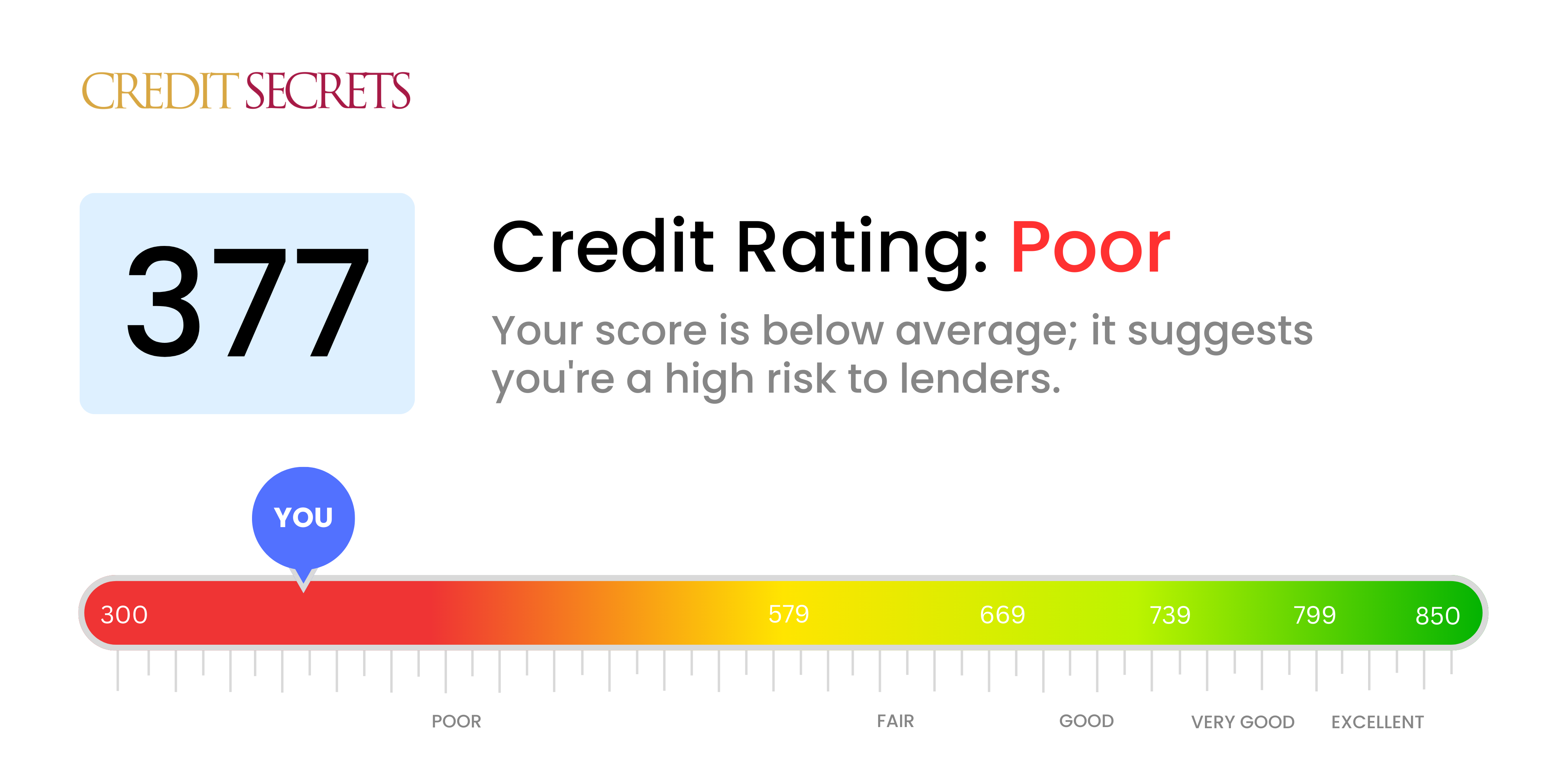

Is 377 a good credit score?

Having a credit score of 377 falls into the 'Poor' category. It's evident that there are some serious financial hardships involved, but please remember that it's absolutely possible to improve your score. Though opportunities for receiving approval on loans or credit may be quite limited at the moment, don't let those limitations define your future. Endeavor to understand your finances and use this understanding to rebuild your credit health.

Taking immediate action to manage outstanding debts, and maintaining consistent, timely payments can help to improve your score over time. It's a journey that may seem difficult, but with determination and patience, progress is possible. Despite a low score today, envision a future with better credit and more financial freedom, because it's wholly attainable with the right steps.

Can I Get a Mortgage with a 377 Credit Score?

With a credit score of 377, securing a mortgage approval might be a challenging task. This score falls significantly beneath the typically required threshold set by lenders. Unfortunately, a score like this is an indicator of past financial troubles, possibly as a result of default payments and other mishaps.

This isn't the end of the road, however. Tough circumstances call for determined efforts. Begin by addressing any unpaid debts or financial missteps that could be damaging your score. Next, strive to develop a pattern of timely payments and wise credit utilization. It may take some time, but deliberate and consistent efforts can lead to improvement in your credit health. Keep in mind that this is a step-by-step journey towards financial stability. It is possible to rebuild and restore your credit worthiness, paving your way to prospective home ownership in the future.

Remember, a low credit score does not only affect your ability to get a mortgage but also the interest rates that you will be offered. Generally, the lower your score, the higher the interest rates. This means you'll end up paying more over the life of the loan. Hence, improving your credit score will not just improve your chances of approval, but could help you to save thousands of dollars in the long run.

Can I Get a Credit Card with a 377 Credit Score?

Obtaining a traditional credit card with a credit score of 377 might feel like an uphill battle, as this is seen as a lower score by lenders. This can be a reflection of past financial struggles, and it can seem disheartening. But remember, having this knowledge is important, as this understanding is crucial for making informed decisions towards your financial health.

With this lower score, your path might be different, but not impossible. Looking into options like secured credit cards could prove beneficial. These cards require a deposit which becomes your credit limit, offering a potentially easier way for those with low scores to obtain credit. Alternatively, considering a co-signer or opting for prepaid debit cards could be sensible solutions. Although these steps don't instantly improve your score, they can provide a platform to begin the journey towards better credit health. Interest rates may be higher due to the greater perceived risk, but with careful budgeting and consistent repayments, it's possible to march towards a brighter financial future.

Can I Get a Personal Loan with a 377 Credit Score?

With a credit score of 377, securing approval for a personal loan from traditional lenders may be challenging. This score is considered considerably lower than the range typically accepted by most lenders, indicating a higher risk. It's crucial to understand that this credit score might limit your borrowing options. Yet, it's not the end of the road—there are still possibilities out there for you.

Consider turning to alternatives like secured loans which require collateral or co-signed loans where someone with higher credit co-signs your loan. Peer-to-peer lending might be another viable option as these platforms occasionally have more lenient credit requirements. However, these alternatives usually come with higher interest rates and terms that are less favorable, reflecting the higher risk perceived by the lenders. Regardless, they might provide the financial support you need at this point in time.

Can I Get a Car Loan with a 377 Credit Score?

Having a credit score of 377 may bring on some hurdles when looking to get approved for a car loan. Lenders typically see scores above 660 as favorable. When a person's score rests below 600, this can be seen as subprime, and a score of 377 falls into this range. This offers a picture to lenders of elevated risk with a history that might imply potential challenges in repaying loans.

Though the journey might have some rough patches, don't lose hope. Receiving approval for a car loan isn't completely out of reach, even with a low credit score. Some lenders focus on working with individuals who have low credit scores. However, be aware that these loans often carry high interest rates, driven by the perceived risks that lenders are assuming. So, while getting a car loan with a 377 credit score is more challenging, it's not impossible. Just ensure to carefully scrutinize the terms to make a prudent and informed decision.

What Factors Most Impact a 377 Credit Score?

Grasping the implications of a 377 credit score is a key step towards financial empowerment. Recognizing and confronting the elements shaping this score is the first stride towards a stronger financial standing. Keep in mind, your financial journey, though challenging, is a series of valuable life lessons.

Neglected Payments

Your payment record vastly influences your credit score. Missed or delayed payments might be a major factor in your current score.

To Take A Look: Scrutinize your credit report for any missed or late payments. Contemplate on instances when you couldn't make payments on time, as this could be detrimental to your score.

Credit Usage

Excessive credit utilization can cause your score to dip. If your credit cards are nearly maxed out, this might be a significant factor in your current scoring.

To Evaluate: Go through your credit card statements meticulously. Are your balances nearing the limits? Try to maintain a low balance compared to your total limit.

Short Credit History

A brief credit history can lead to a lower credit score.

To Evaluate: Examine your credit report for the age of your oldest accounts, new ones and the average age of all accounts. Consider if you have opened new credit accounts recently.

Type of Credit and Recent Credits

A mix of diverse credit types and managing new credit judiciously are indicators of good credit health.

To Assess: Review the variety of your credit accounts, which may include credit cards, retail accounts, installment loans. Consider if you have recently opened new accounts.

Public Records

Public records such as bankruptcies or tax liens can negatively affect your score.

To Inspect: Review your credit report thoroughly for any public records. Handle any issues listed that need immediate attention.

How Do I Improve my 377 Credit Score?

With a credit score of 377, you’re faced with a challenging situation, but the opportunity for substantial improvement is within your reach. Implementing the following strategic approaches can help you quickly escalate your score from this situation:

1. Attend to Defaulted Accounts

With a credit score of your level, defaulted accounts could be part of the reason. Identifying these accounts should be your utmost priority. Make a plan to start repayments and don’t hesitate to negotiate with your creditors about a possible repayment plan that fits your financial situation.

2. Consider a Credit-Builder Loan

A reasonable step for your circumstance is to consider acquiring a credit-builder loan. This loan can help you create a commendable payment history, reflected on your credit report, thereby boosting your score.

3. Utilize a Secured Credit Card

Under your current score, an effective approach would be to apply for a secured credit card. These cards require a security deposit which you can keep within manageable levels. Regular usage and timely repayments on this account will start reflecting positively on your credit score.

4. Become an Authorized User on Someone Else’s Card

If possible, become an authorized user on a trusted person’s credit card. This can help you tap into their good credit history, thus improving your score. Make sure the credit card company reports authorized user activities to the credit bureaus.

5. Manage Your Debt-to-Income Ratio

Examine your debt-to-income ratio. If it’s high (above 40%), it can negatively impact your credit score. Address this by either lowering your debt or increasing your income. The lower this ratio, the better your credit score.