Is 380 a good credit score?

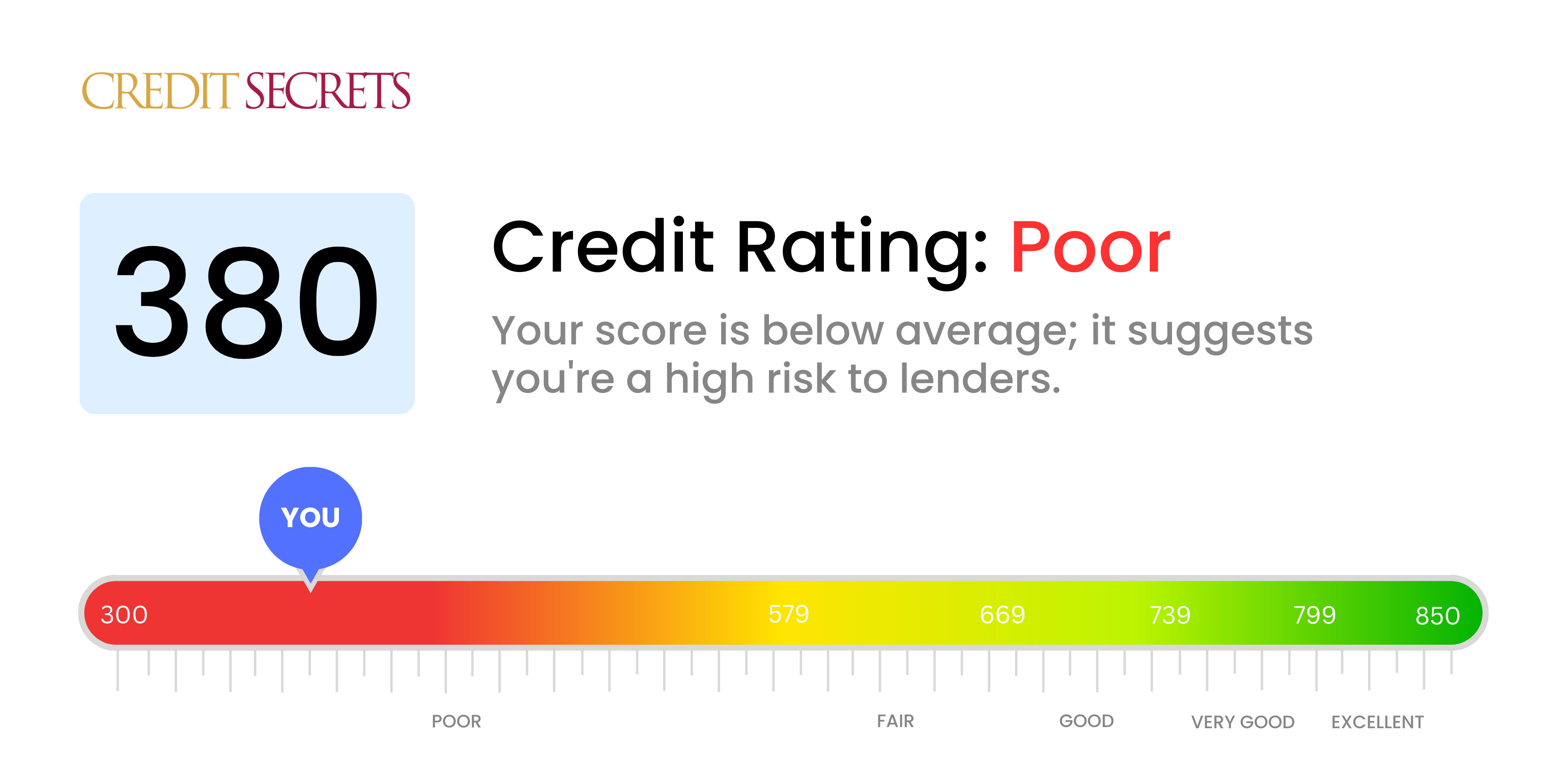

With a credit score of 380, your score is categorized as poor. This isn't what anyone would hope for, but remember, it's not an end-all be-all. It simply signifies that you've had a fair share of financial difficulties in your past, which are still reflecting in your credit history.

Credit options might be more limited for you and any credit that if you are approved for, will generally have higher interest rates. This might seem like a tough situation to handle, but don't worry, it's far from permanent. With some well-implemented financial measures and patience, you can gradually improve this score and work your way back to better financial health.

Can I Get a Mortgage with a 380 Credit Score?

A credit score of 380 signals significant financial challenges and is likely to hinder your ability to secure a mortgage. Lenders usually require a higher score to approve mortgage applications as this reflects a borrower's creditworthiness and their ability to repay loans on time. A score of 380 often implies a history of missed or late payments, overutilization of credit, or other financial setbacks.

Though it's a tough spot to be in, remember that it's not an end-all situation. A variety of options, like government-backed loans or subprime loans, might still be available to you despite your present score. Be aware, however, these alternatives often come with high-interest rates and extra fees. As a result, they might cost you more in the long run, but they can provide an opportunity to start rebuilding your credit history. Always ensure to thoroughly study all the terms and conditions before agreeing to such agreements. With time and responsible management of your finances, your credit score can improve.

Can I Get a Credit Card with a 380 Credit Score?

With a credit score of 380, it's true that getting approved for a standard credit card can be difficult. In the eyes of lenders, a score like this often indicates a high risk, implying past financial adversity or mishandling of money. It's crucial to face this fact with a spirit of awareness and honesty. Acknowledging your current credit situation is a significant first step toward financial betterment, even if it reveals some uncomfortable realities.

When faced with a low credit score like 380, you may want to examine alternatives. Secured credit cards may be worth considering, as they ask for a deposit that becomes your credit limit, making it easier to get approved. Furthermore, searching into options like pre-paid debit cards or securing a co-signer can offer other pathways. While these choices don't provide an immediate remedy, they can serve as practical tools on the path to financial security. It's crucial to remember that interest rates with any available credit option will likely be higher, as lenders see low scores as a greater risk. Yet, with persistent efforts, progress towards improved credit is entirely possible.

Can I Get a Personal Loan with a 380 Credit Score?

In the world of lending, a credit score of 380 unfortunately falls quite short of what most traditional lenders would see as acceptable for approving a personal loan. This score poses a substantial risk to lenders, making it highly unlikely that you would be approved for a loan under normal conditions. It's a tough situation, but understanding the implications of a credit score this low is a pivotal step in navigating your financial options.

Even though conventional loans might seem off-limits, there are other choices out there. These include secured loans, where an asset you own serves as collateral, or co-signed loans, where a person with good credit co-signs your loan. Online peer-to-peer lending platforms can also be a viable choice since they frequently have more flexible credit requirements. But remember, these options may carry higher interest rates and less appealing terms due to the increased risk for the lender.

Can I Get a Car Loan with a 380 Credit Score?

Holding a credit score of 380 does throw up some roadblocks when it comes to securing a car loan. It's important to understand that most lenders favor scores above 660. Unfortunately, your score of 380 is considerably lower and falls into the subprime range. This alludes to a higher likelihood of having run into financial difficulties in the past, making lenders a bit wary about your prospects of repayment.

Still, this doesn't mean your journey ends here. Certain lenders cater specifically to those with lower credit scores. Please be advised that these loans may carry significantly higher interest rates. This is a strategy lenders use to protect themselves against the elevated risks they perceive. Navigate cautiously, scrutinize the terms diligently, and remember: the path may be rocky, but obtaining a car loan is not an impossibility.

What Factors Most Impact a 380 Credit Score?

Having a 380 credit score can sometimes feel overwhelming. But don't fear, understanding the factors shaping your score is the first step toward a healthier financial future. Each person's financial journey is unique, and with the correct knowledge, you can turn your situation around.

Payment History

Your payment history might be affecting your score adversely. Consistent late payments or defaults are most likely impacting your 380 credit score negatively.

How to Check: Examine your credit report for any late payments or defaults. Think about any times you might've delayed your payments, as they could have contributed to your score.

Credit Use

Maxing out your credit cards - known as high credit utilization - can undermine your credit score. This is possibly a substantial factor affecting your 380 score.

How to Check: Look at your credit card statements. If your balances are hitting their limits, aim to lower them. Keeping a balance that’s far from the limit is ideal.

Length of Credit History

A short credit history can negatively influence your credit score.

How to Check: Observe the age of your oldest and most recent credit accounts on your credit report. If you've opened many new accounts recently, this may be one reason for your score.

Credit Variety and Fresh Credit

Maintaining a mix of credit types and managing new credit responsibly is a critical part of maintaining a good credit score.

How to Check: Survey your mix of credit accounts such as credit cards, retail accounts, loan installments, and home loans. Ponder whether you have been sparingly applying for new credit.

Public Records

Public records like bankruptcies or tax liens can heavily drag down your credit score.

How to Check: Search your credit report for these records. Address them if you find any, as they can lead to significant improvement in your score.

How Do I Improve my 380 Credit Score?

With a credit score of 380, you’re currently faced with substantial credit challenges. However, don’t despair as there are practical steps you can take to begin rebuilding your credit:

1. Clear Outstanding Debts

Your first step should be to start resolving your unpaid debts, as these have the most profound impact on your credit score. If possible, speak with your creditors to work out a manageable payment plan. Remember, clearing these debts is crucial for your score’s growth.

2. Minimize Credit Utilization

Once you’ve addressed your outstanding debts, it would be ideal to keep your credit utilization as low as possible. Strive to maintain it beneath 30% of your credit limit. Also, work towards lowering the debt on the credit cards with the highest usage rates.

3. Apply for a Secured Credit Card

A secured credit card could be an excellent option for you at this stage. Although it needs a cash deposit, the card can help establish your credit score’s positive growth trend if managed wisely.

4. Seek to Become an Authorized User

Being an authorized user on a friend or family member’s credit card can positively influence your credit history. This strategy would show your credit reliability and boost your credit score considerably. Ensure the credit card provider reports the shared credit activities to credit bureaus.

5. Maintain a Diverse Credit Portfolio

Once you’ve developed a solid credit history, considering a credit builder loan or retail credit card might help. However, ensure you handle these responsibly to strengthen your credit score.