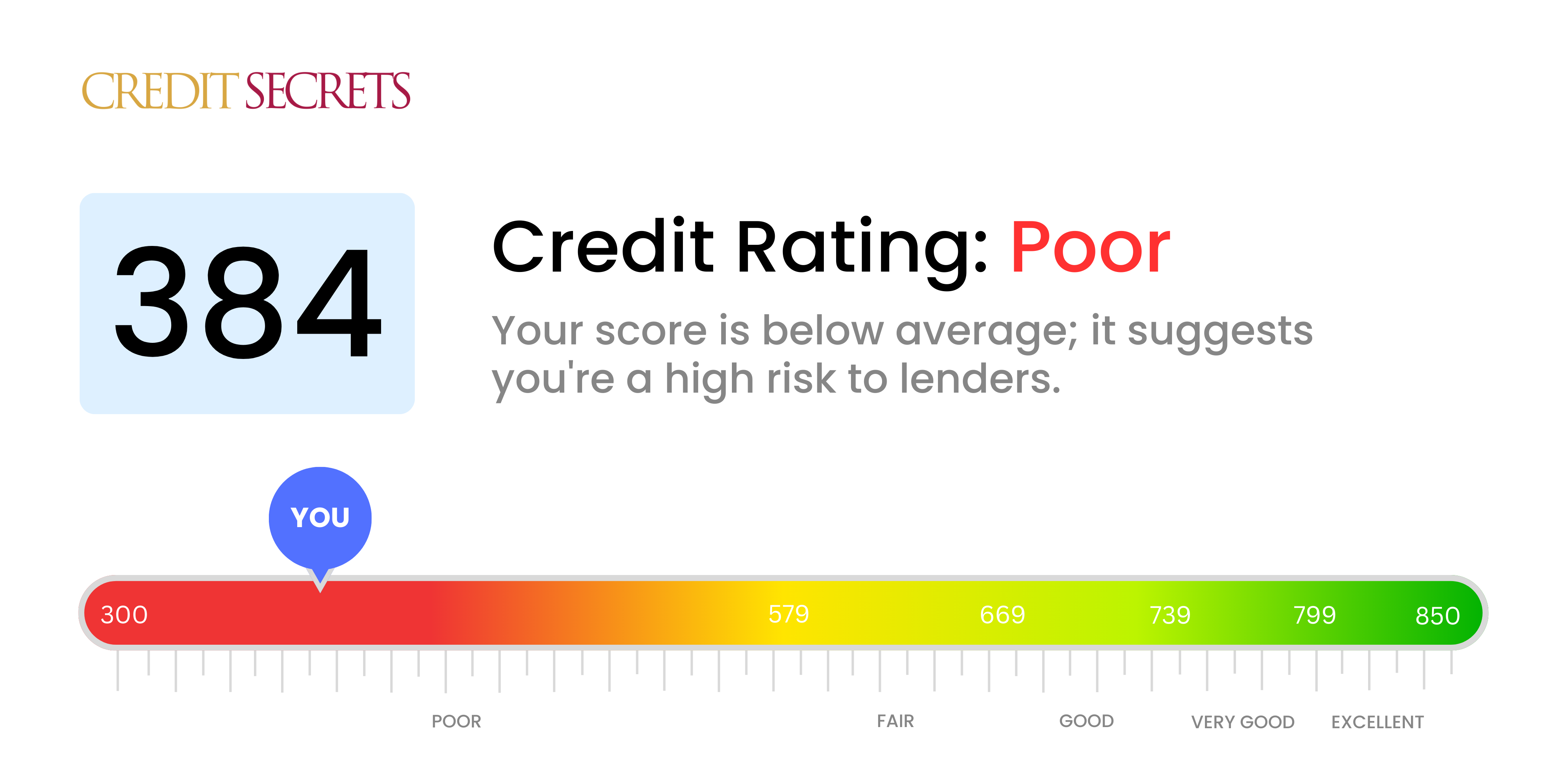

Is 384 a good credit score?

A credit score of 384 falls into the 'Poor' range. This typically means lenders may see you as a risky borrower, making it more challenging to qualify for loans or credit, and interest rates may be higher if credit is extended. However, with the right steps, it can be improved and we're here to guide you in that process.

With a score of 384, there's plenty of room for enhancement. This journey toward a better credit score can open up opportunities like being approved for lower interest rates and access to better borrowing options. Remember, it's not a reflection of your worth, and while improvement might require some time and patience, it's entirely possible.

Can I Get a Mortgage with a 384 Credit Score?

It's important to be straightforward: with a credit score of 384, obtaining a mortgage approval will be very challenging. This score is significantly under the lowest score most lenders will consider. A credit score in this vicinity often points to a history of serious financial obstacles, such as late payments or defaults on loans.

These situations can be tough to be in, but unfortunately traditional lenders operate with particular criteria. A lower credit score can often lead to significantly higher interest rates, which in the long run can make your mortgage potentially unmanageable. If homeownership is a key goal for you, looking into alternative options could be fruitful. In some circumstances, government-backed loans and programs could offer routes to homeownership that are not strictly dependent on credit score. However, they often come with their own specific stipulations which are worth researching thoroughly before deciding.

Can I Get a Credit Card with a 384 Credit Score?

Having a credit score of 384 can make it difficult to secure approval for a traditional credit card. This score is typically viewed by lenders as risky, often evidencing a past filled with financial challenges or missteps. It's vital to face these realities head-on with a clear-dressed understanding as it is the first stride towards eventual financial recovery.

Because acquiring regular credit might be a hurdle with such a score, looking at other alternatives might be beneficial. Secured credit cards are a good alternative. These cards require a deposit which serves as your credit limit and helps you build up your credit gradually. Considering having a co-signer or exploring pre-paid debit cards could be other practical choices. Though these don't offer an immediate fix, they are practical routes to becoming more creditworthy. Remember, due to the risk involved, credit options available at this score level generally come with higher interest rates than average. It's a journey towards financial stability and every small step counts.

Can I Get a Personal Loan with a 384 Credit Score?

With a credit score of 384, acquiring a traditional personal loan may prove challenging. This is because most lenders consider this score to be significantly below the acceptable range and associate it with high lending risk. It's a tough situation, and it's important to understand what this means for your borrowing abilities.

However, don't lose hope. You have other borrowing alternatives to consider to help you navigate your situation. Secured loans, which require collateral, and co-signed loans, backed by a person with a better credit history, are options. Another choice could be peer-to-peer lending platforms, which sometimes have softer credit requirements. Do understand though, these alternatives might carry higher interest rates and less favorable terms. These are a reflection of the additional risk lenders undertake when approving loans for those with low credit scores.

Can I Get a Car Loan with a 384 Credit Score?

With a credit score of 384, you may find acquiring a car loan a little tough. The reason is that most lending establishments normally prefer to work with credit scores around 660 or higher. As a matter of fact, scores falling below 600 are often seen as subprime and that category includes your current score. This could unfortunately mean facing higher interest rates or even dealing with outright loan rejections. Generally, a lower credit score signals a higher risk for lenders, as it suggests potential hardships in paying borrowed money back.

But don't despair, a lower credit score doesn't entirely close off your options for purchasing a car. There are specific lenders who make it their business to work with individuals holding lower credit scores. However, remember that the interest rates could be significantly higher due to the increased perceived risk taken by the lender. So, with careful understanding of the terms and a considerate review, getting a car loan still remains a genuine possibility. Keep believing and focusing on improved financial management, and you'll get there.

What Factors Most Impact a 384 Credit Score?

A credit score of 384 shows room for substantial improvement. But don't worry, you have the power to change your financial future. Here are some factors that might have led to this score and ways to examine each aspect.

Outstanding Debt

Excessive unpaid debts significantly affect your credit score. Check your credit report for any outstanding obligations.

How to Check: Scrutinize your credit report thoroughly. Ensure to track any unfinished payment obligations.

Payment Timeliness

Consistent late payments indicate a higher credit risk, which results in a lower score.

How to Check: Review your payment history on your credit report. Note any late or missed payments and strive to make future payments on time.

Credit Utilization

High credit utilization, where your balances approach or exceed your limits, could be another reason.

How to Check: Evaluate your credit limits and the amounts you owe. Endeavor to keep balances significantly below limits.

Recent Credit Activity

New applications for credit, especially multiple in a short timeframe, can lower your score.

How to Check: Your credit report will reveal any recent loan applications. Aim to space out any necessary credit applications over time.

Negative Information on Record

Public record entries like bankruptcy or repossessions have a detrimental effect on your score.

How to Check: Check your credit report thoroughly for any unfavorable public record entries and strive to resolve these issues.

How Do I Improve my 384 Credit Score?

With a credit score of 384, your credit is currently classified as very poor. However, strategic steps can be taken to rectify this.

1. Focus on Overdue Accounts

Address any accounts that may have fallen behind. Delinquent accounts carry a heavy weight on your credit score. Start by paying the most overdue balances, and reach out to your creditors to negotiate feasible payment arrangements, if needed.

2. Pay Down High Credit Balances

High balances can significantly harm your credit score. Strive to keep your balances below 30% of your total credit limit. Begin by tackling the cards with the highest balances and work your way down.

3. Consider Secured Credit Cards

Given your score, obtaining a traditional credit card could be difficult. Secured credit cards, which require a cash deposit, may be a viable option. Use this responsibly, and aim to pay off your balance in full each month. This can aid greatly in establishing a good track record of reliable payments.

4. Leverage Trusted Relationships

Have a trusted individual with strong credit add you as an authorized user to their credit card. This move could help bolster your score by associating it with their consistent payment history. Ensure the credit card company records the activities of authorized users.

5. Explore Different Types of Credit

In time, it’s worthwhile to diversify the types of credit you use. Once you’ve established a solid payment history with a secured card, consider other forms of credit such as auto loans or personal loans. Each form of credit managed wisely will further boost your credit score.