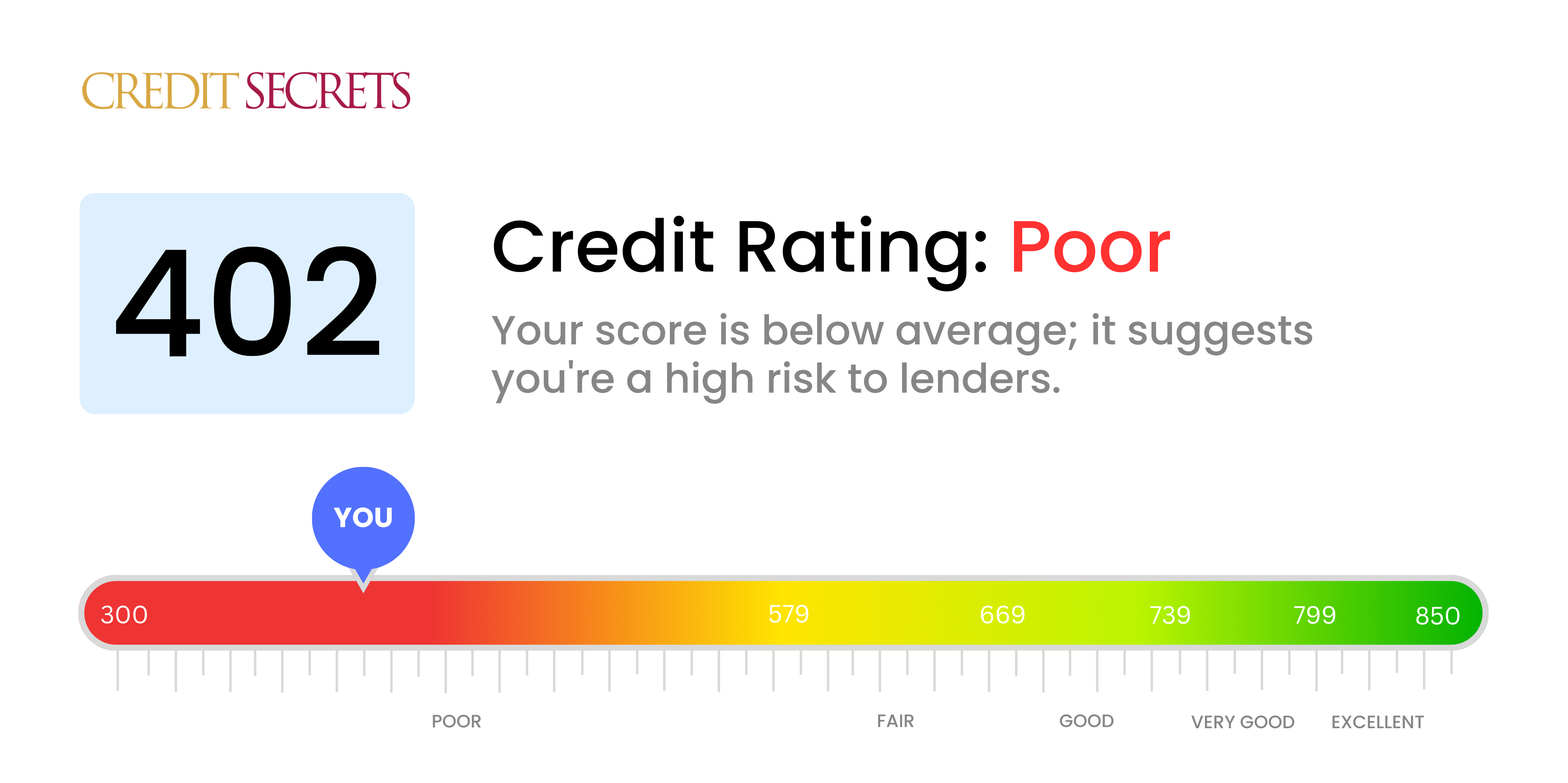

Is 402 a good credit score?

Having a credit score of 402 puts you in the 'poor' credit range, which isn't typically ideal from a lender's perspective. While this can pose some challenges when seeking credit or loan approvals, there's always room for improvement and plenty of strategies to raise your score.

Don't be disheartened, as a poor credit score doesn't define you permanently. Your financial journey can look different with deliberate and consistent effort. You may face higher interest rates or stricter lending requirements for now, but remember, credit rebuilding is a journey and you've taken the crucial first step of understanding where you stand.

Can I Get a Mortgage with a 402 Credit Score?

A credit score of 402 suggests that it is considerably difficult for you to be approved for a mortgage. This score is significantly lower than what most lenders require, indicating a history of monetary challenges such as missed payments or loan defaults. It's crucial to acknowledge that this difficult situation can be improved over time.

Dealing with outstanding debts that influence your credit score negatively is an effective initial approach. Building a pattern of payments made on time, as well as responsible credit usage, is also instrumental in enhancing your score. Remember, it's a slow process to repair and boost your credit score, but it can be done with patience and commitment. You are in control of your financial future, although now might not be the right time to apply for a mortgage. Those with higher scores often benefit from lower interest rates, making it worthwhile to focus on improving your credit before seeking approval for a mortgage.

Can I Get a Credit Card with a 402 Credit Score?

Holding a credit score of 402 could cause difficulty in getting approved for a standard credit card. Financial institutions usually see this as an indicator of high risk, denoting past monetary issues or perhaps some mishandling of finances. It can be a bitter pill to swallow, but facing this reality with strength and awareness is the key to financial recovery. Always remember, acknowledging your credit standing is the initial step to improving your financial situation, even when it unveils uncomfortable realities.

There are other ways to deal with a score like 402 rather than despair. One might consider alternatives such as secured credit cards, which work by using a deposit as the credit limit. These types of cards are generally easier to obtain and can be a stepping stone to rebuilding credit incrementally. Co-signers or prepaid debit cards can also stand as flexible alternatives. While these paths won't immediately resolve the current predicament, they can at least create a roadmap towards attaining financial stability. However, do bear in mind that with such scores, any form of credit accessible often bears steep interest rates, mirroring the heightened risk perceived by lenders.

Can I Get a Personal Loan with a 402 Credit Score?

Having a credit score of 402 is below the typical threshold that many traditional lenders look at when approving a personal loan. That score demonstrates a significant level of risk from the lender's perspective, meaning you may find it challenging to secure a loan under standard conditions. It's a tough situation, but understanding your credit score's impact on your loan options is crucial.

On a positive note, you still have other possibilities. Secured loans, where you offer collateral, may be a viable option. Other alternatives include co-signed loans, where a person with a higher credit score guarantees for you. Peer-to-peer lending platforms can also be considered, as they sometimes have more flexible credit requirements. However, it's critical to recognize that these alternatives might come with higher interest rates and more challenging conditions, as these reflect the increased risk on the lender's part. Stay optimistic and keep exploring your options, your financial journey doesn’t end here.

Can I Get a Car Loan with a 402 Credit Score?

At a credit score of 402, the chance of getting approval for a car loan may be quite slim. Typically, lending institutions prefer to lend to individuals with scores above 660 as they are deemed less risky. When a credit score dips below 600, it's often categorized as subprime. This means that it carries a higher level of risk from the lender's perspective, as it suggests a greater likelihood of difficulty repaying the loan. Your score of 402 is well within this subprime bracket, which could result in higher interest rates or a loan application being denied altogether.

Nevertheless, don't lose hope. Even with a credit score of 402, it's not impossible to secure a car loan. There are some lenders who work specifically with individuals whose credit scores are lower than average. But, bear in mind these provide loans at quite high interest rates. The elevated rates are a way for these lenders to offset their risk, and are something that need to be considered carefully. While the path to getting a car loan might be steep, it's not unreachable. It's critical to investigate all the terms and rates thoroughly to ensure you make a decision that is best for your financial situation.

What Factors Most Impact a 402 Credit Score?

Having a credit score of 402 might seem daunting, but by understanding the likely contributing factors and addressing them, you can maneuver toward a better financial future.

Missed or Late Payments

Your payment behavior plays a huge part in your credit score. A history filled with late or missed payments could be the primary reason for your score.

How to Check: Have a look at your credit report for late or missed payments. Think about any incidences where you paid after the due date, impacting your score negatively.

High Credit Utilization

Consistently using a high percentage of your available credit also affects your score. A pattern of maxing out your credit cards might be another reason for your 402 score.

How to Check: Go through your credit card statements. Are most of your cards reaching their limits? Endeavour to maintain a low ratio of credit use to your total available credit.

Short Credit History

The length of your credit history also matters. A short or non-existent credit history could be impacting your score.

How to Check: Scan your credit report for the duration of your oldest and newest credit accounts and the average lifespan of all your accounts.

Limited Credit Mix

The variety of credit types matters too. A lack of diverse credit, like credit cards, auto loans, and mortgages, might be reducing your score.

How to Check: Review the types of credit accounts you hold. Make an effort to gradually diversify your credit portfolio.

Damaging Public Records

Public records such as bankruptcies, foreclosures, or tax liens can dramatically lower your score.

How to Check: Look at your credit report for public records. Take necessary steps for resolving these issues if they exist.

How Do I Improve my 402 Credit Score?

With a credit score of 402, you’re squarely in the range of poor credit. But don’t despair — it’s absolutely achievable to improve it from here. Here’s the most effective strategy for your specific situation:

1. Settle Outstanding Liabilities

Addressing accounts that have already gone into collections or that have been charged off should be your preliminary step. Contact the collection agencies and work on a repayment plan. This effort doesn’t erase the past default, but future lenders will see you’ve taken responsibility.

2. Maintain Low Credit Card Balances

High balances on your credit cards compared to their limits can drastically pull your score down. Strive to maintain your credit card balances below 30% of the total limit. Prioritize repaying the cards with the highest usage.

3. Apply for a Secured Credit Card

Given your current credit score, getting approved for an unsecured credit card might prove difficult. Look into getting a secured credit card that needs a cash collateral as a credit limit. Use this card carefully, making small purchases and paying off the amount entirely each month.

4. Request to be an Authorized User

If you know someone who has a great credit score and a reputation for responsible credit usage, ask if they wouldn’t mind adding you as an authorized user on their account. Your credit score could benefit from their good credit habits.

5. Script Your Way to Diverse Credit

Once you have a consistent, positive history with the secured card, you should explore additional credit options such as store credit cards or credit builder loans, which could help to enhance your credit mix and pump up your score.