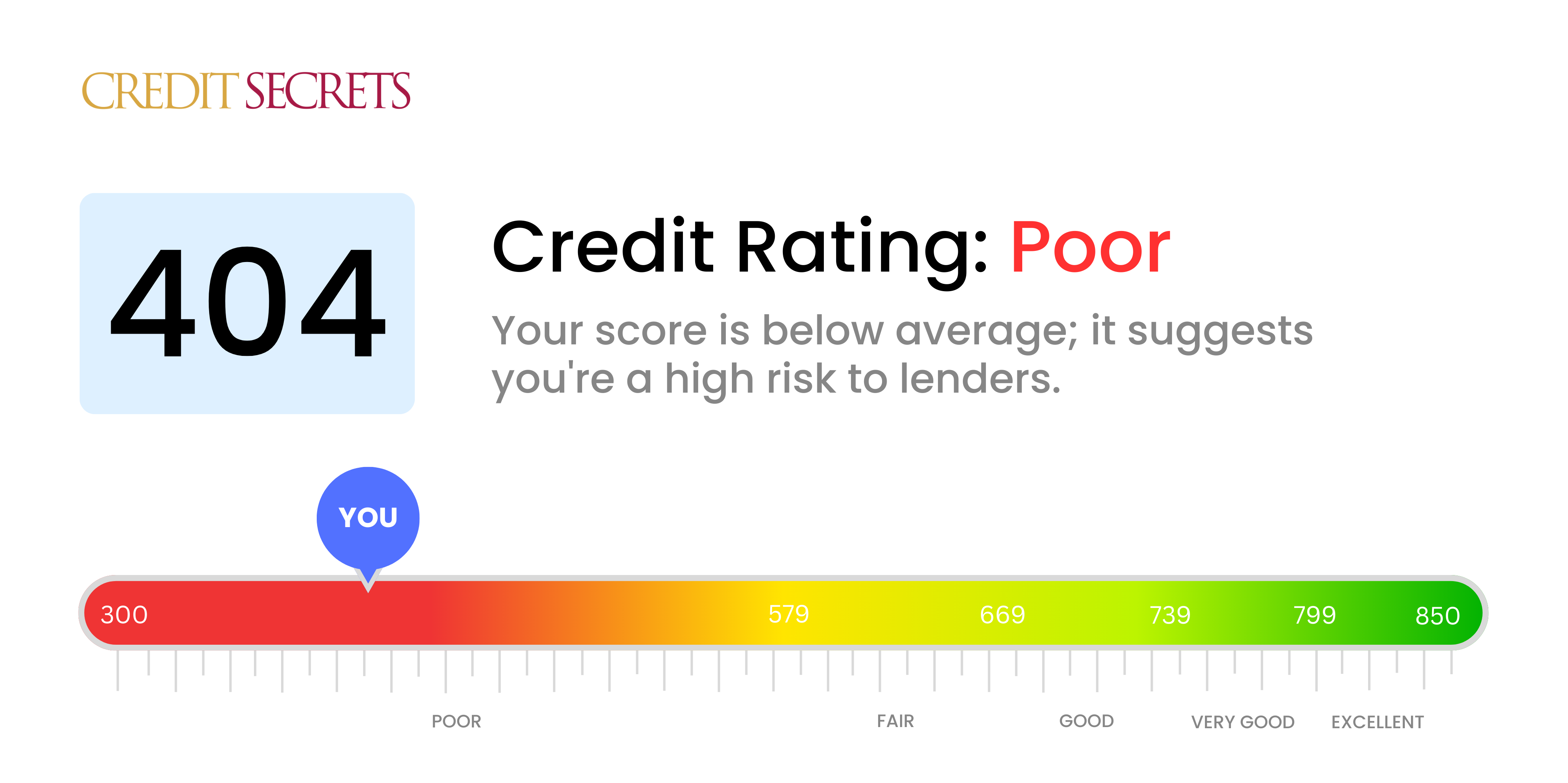

Is 404 a good credit score?

A credit score of 404 falls into the 'Poor' range. Unfortunately, this suggests that you may have a significant amount of debt or have previous missed repayments, both of which can make it difficult to qualify for new credit. However, there's always room for improvement and following smart credit practices can start to raise your score over time.

Typically, lenders see a Poor credit score as a strong indicator of higher risk. This means you might face challenges in getting loans or credit cards approved, and if you are approved, you're likely to encounter higher interest rates. It's important to stay hopeful, and know that your current financial situation can be improved — bad credit isn't a life sentence, it's just a hurdle to be jumped.

Can I Get a Mortgage with a 404 Credit Score?

Unfortunately, with a credit score of 404, it’s quite unlikely that you could be approved for a mortgage at this point. This credit score suggests significant financial challenges in your past, such as missed payments or defaults. Most lenders generally require a credit score that's much higher before they would consider approval.

A credit score of 404 would typically be seen as a warning sign to lenders that you may struggle to make on-time payments, making you a high risk for them. At this stage, a traditional mortgage may be out of reach. However, don't lose hope as there are other alternatives that may be worth exploring. One such option might include seeking out a rent-to-own agreement on a property. Alternatively, a co-signer who has a strong credit score might help make your loan application more appealing. Understand that improving your credit score is crucial for your long-term financial health. This journey will take time, patience and strategic planning but it is not impossible.

Can I Get a Credit Card with a 404 Credit Score?

Regrettably, with a credit score of 404, it is quite unlikely to be approved for a traditional credit card. This score is generally viewed by lenders as high-risk, suggesting potential past financial hardships or less-than-ideal management. Although disheartening, it's critical to face this situation with realism and a determination to improve.

The challenging scenario presented by a low score like this could prompt a look into other options such as secured credit cards. These cards require a deposit that sets your credit limit and can be a more attainable way to start rebuilding your credit over time. Other potential pathways include having a co-signer or using pre-paid debit cards. While these choices don't offer an instant remedy, they're valuable tools in the quest for financial recovery. It's important to remember that any available credit options for those with such credit scores usually carry considerably higher interest rates, reflecting the increased risk for lenders.

Can I Get a Personal Loan with a 404 Credit Score?

Unfortunately, a credit score of 404 is considerably low for traditional lenders to approve for a personal loan. This score signifies to lenders that you're a high-risk borrower, making it extremely unlikely that you'll get approved for a traditional loan. While this news may be disheartening, it's crucial to be aware of what a credit score of this magnitude means for your borrowing options.

Although conventional personal loans might be out of reach for now, there are still other alternatives available to you. Secured loans, where some form of collateral is provided, or co-signed loans, where another person with a higher credit score guarantees your loan, might be viable options. You might also consider peer-to-peer lending platforms which may not be as stringent with credit requirements. Be mindful, though, these substitutes can often carry higher interest rates and less favorable loan terms due to the elevated risk associated with your credit score.

Can I Get a Car Loan with a 404 Credit Score?

Having a credit score of 404 certainly presents some challenges when applying for a car loan. Generally, lenders favor applicants with a score of 660 or more, while those with a score below 600 often face difficulties. Unfortunately, with a score of 404, you are likely to encounter similar troubles. The reason for this is that lenders see a low credit score as a sign of high risk, indicating potential issues with repaying the loan.

However, this does not entirely rule out your chances of getting a car loan. There are lenders who focus on helping individuals with lower credit scores, though caution is advised as these loans tend to come with significantly steeper interest rates. These high rates are a way for lenders to protect their investment, given the perceived risk. Despite the potential hurdles, with careful planning and comprehensive analysis of the loan terms, procuring a car loan remains possible.

What Factors Most Impact a 404 Credit Score?

To positively reshape a credit score of 404, gaining a clear understanding of the influencing factors is the key. Your individual financial journey is diverse and is a continuous learning course filled with potential growth opportunities.

Payment Consistency

Your regular payment obligations play a significant role in your credit score. Missed or delayed payments might be a primary reason your score is where it is.

Checking Mechanism: Ensure review of your credit report to identify any overdue payments or defaults. Reflect on your payment attitude as it greatly influences your score.

Credit Utilization Ratio

Utilizing your credit cards to their maximum limit can pull down your score. If your cards are always nearly maxed out, this might be a determinant in your current score.

Checking Mechanism: Browse through your credit cards statements. If the balances are constantly close to the maximum, it would be advantageous to maintain a lower ratio.

Credit Infrastructure

Lack of credit diversity could be affecting your score negatively.

Checking Mechanism: Review your credit accountability; the variety of credit resources you handle, like credit cards, installment loans, mortgages. Contemplate if you have been recently overwhelming your credit possibilities.

Public Records

Any public files such as tax liens or bankruptcies can drastically impact your score negatively.

Checking Mechanism: Assess your credit report for any public files and ensure clearing up any mentioned items that demand resolution.

How Do I Improve my 404 Credit Score?

Having a credit score of 404 places you in a challenging situation, but don’t despair! There are actionable steps you can take to boost your score.

1. Get Current on Outstanding Debts

Your credit score can be severely impacted by overdue debts. Prioritize bringing these debts current to enhance your credit standing. Reach out to your creditors and explore options such as payment arrangements that could assist you in fulfilling this obligation.

2. Curb Credit Utilization

If high credit card balances are a concern, aim to lower them to less than 30% of your credit limit. By doing so, you effectively lessen the impact on your credit score. The cards with the highest utilization should be your utmost priority.

3. Seek a Secured Credit Card

With a credit score of 404, securing a traditional credit card may be a struggle. Opt for a secured credit card and deposit a refundable amount as collateral. Use this card responsibly to help rebuild your score gradually.

4. Authorized User Status

Look for an opportunity to become an authorized user on a credit card belonging to a trusted individual with a good credit history. This tactic can augment your credit score as it incorporates the primary cardholder’s good credit habits into your own credit history.

5. Expand Your Credit Portfolio

Once you’ve demonstrated responsible use of a secured card, consider diversifying your credit portfolio. An assortment of credit types can further strengthen your credit score. This could involve taking out a credit builder loan or applying for store credit. Just remember, every credit decision should be handled prudently.