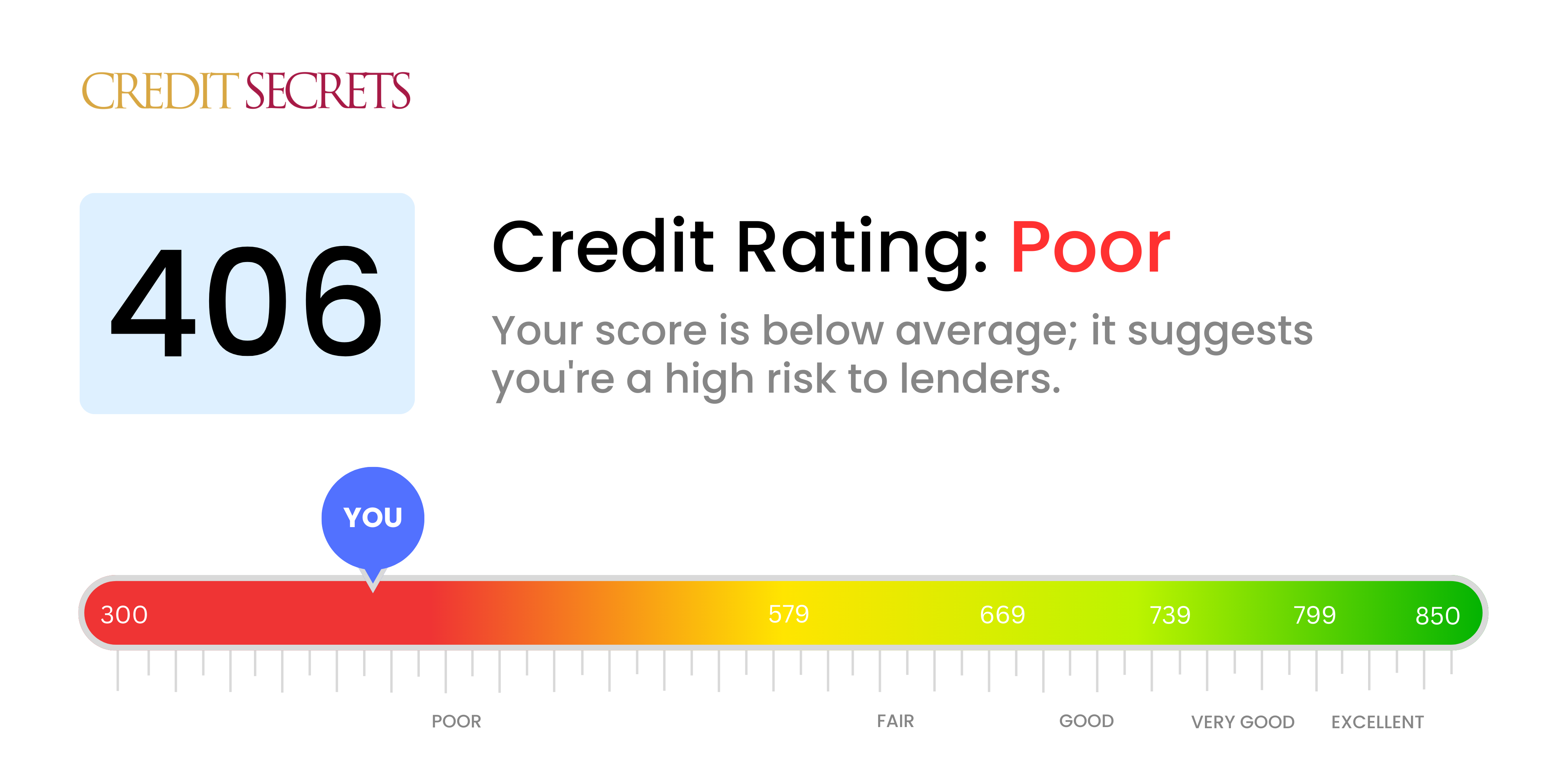

Is 406 a good credit score?

A credit score of 406 is considered to be in the 'poor' range. This score can limit your access to certain financial opportunities like secure loans, competitive interest rates or favorable terms with financial institutions. However, despite these challenges, know that improvement is always possible and taking steps towards raising your score can open up these opportunities in time.

With this score, lenders might see you as a riskier investment, and as a result, you may find it difficult to qualify for additional lines of credit or loans. However, this doesn't mean you're stuck forever. By understanding your credit and taking active steps towards improvement, such as payment consistency and debt management, your score can start to rise.

Can I Get a Mortgage with a 406 Credit Score?

If your credit score is 406, it may be difficult for you to be approved for a mortgage. Scores of 500 to 579 are generally considered poor and with a score lower than 500, most conventional lenders may consider you a high-risk borrower. A number in this range typically signifies a history of not meeting financial obligations or having issues managing credit.

Having a low credit score doesn't mean you have no options. Some government-backed loans, such as FHA loans, do offer more lenient credit requirements. However, be aware that these alternatives often come with higher interest rates, meaning you'll pay more over the life of the loan. It's not an ideal situation, but it might offer a path forward while you work on improving your credit. Never give up, remember that rebuilding credit takes time, but every step you make counts towards better financial health.

Can I Get a Credit Card with a 406 Credit Score?

Unfortunately, a credit score of 406 makes it quite difficult to be approved for a standard credit card. This score is regarded as a high-risk by lenders, often indicative of past financial challenges or missteps. This information can be difficult to hear, but understanding your credit situation is an essential first step on the path to financial recovery.

Looking at alternatives to regular credit cards may be beneficial. Secured credit cards can be a good option. These cards necessitate a deposit that becomes your credit limit. They’re often easier to get and can help rebuild credit over time. Exploring options like drawing on a co-signer or trying out pre-paid debit cards can also work. Remember, such alternatives aren’t quick solves, but they can assist in the journey towards more stable finances. It should be noted that typically, interest rates for any credit accessible to those with lower scores are substantially higher, reflecting the elevated risk for lenders.

Can I Get a Personal Loan with a 406 Credit Score?

If you have a credit score of 406, the likelihood of getting approval for a personal loan tends to be very slim. This score is significantly lower than what most lenders usually see as minimally acceptable. At such a score, lenders may perceive providing a loan as a risky undertaking, often resulting in application rejection. Clearly, this news is not exactly what you hoped for, but it is crucial to understand the current loan landscape your score presents.

Traditional loans may not be an available pathway for you right now but consider alternate routes like secured or co-signed loans. In the former, you provide an asset as collateral while in the latter someone with a stronger credit score co-signs the loan. You also could explore peer-to-peer lending platforms. However, bear in mind that these alternate options often have higher interest rates and less ideal terms, due to the increased perceived risk for lenders.

Can I Get a Car Loan with a 406 Credit Score?

Having a credit score of 406 can certainly make securing approval for a car loan more difficult. Generally, lenders are looking for scores over 660 to offer preferable conditions, and below 600 is frequently viewed as less than ideal. Your score of 406 falls into this category, potentially resulting in higher interest rates or even an outright rejection. This is because a low credit score suggests a higher level of risk to the lender, indicating that you might have had trouble repaying money in the past.

Even so, a low credit score doesn't entirely close off the possibility of purchasing a car. There are certain lenders who specialize in assisting those with lower credit scores. However, it's important to remember that these loans often come with much higher interest rates, as lenders use this as a method to protect their investment from the increased risk. While it might be a tougher journey, with careful attention to the terms and conditions, getting a car loan is still a feasible goal.

What Factors Most Impact a 406 Credit Score?

With a credit score of 406, it's essential to understand the substantial factors that could have contributed to this score for an effective financial recovery plan. Your path toward a healthier financial standing is lined with opportunities for growth and learning.

Poor Payment History

Payment history considerably affects your credit score. Missed or late payments are likely contributing to your current score.

What to Do: Examine your credit report for any late payments or missed installments. Reflect on your payment practices and make necessary changes.

High Credit Utilization

Overextended credit cards can be detrimental to your score. If your card balances are routinely near their limits, it's likely lowering your score.

What to Do: Read through your credit card statements closely. Pay attention to your balances compared to their limits. Keeping balances far below the limits is key.

Minimal Credit History

A brief credit history can negatively affect your score, particularly if you've recently opened new accounts.

What to Do: Look over your credit report to assess the age of your credit accounts. Contemplate on whether you've opened new credit lines recently and how it may have impacted your score.

Insufficient Credit Diversity

An optimal credit score requires a mix of credit types, managed responsibly.

What to Do: Evaluate your range of credit accounts. Aim for a balanced mix of credit cards, retail accounts, installment loans, etc., and manage them wisely.

Adverse Public Records

Public records such as bankruptcies or tax liens can significantly pull down your score.

What to Do: Ensure to resolve any such adverse records listed on your credit report.

How Do I Improve my 406 Credit Score?

Your current credit score of 406 is considered low, but don’t worry, there are actionable strategies that you can take to start building towards a better score:

1. Tackle Overdue Accounts

First and foremost, identify any accounts that have fallen into delinquency and devise a plan to clear these debts. Paying down your most overdue accounts first minimizes their negative impact on your credit score. Approach your lenders to discuss possible payment arrangements if required.

2. Monitor Credit Utilization

Your credit utilization rate – the ratio of your credit card balances to their respective credit limits – should ideally be kept below 30%. Prioritize reducing balances on the cards with highest utilization to improve your score.

3. Consider a Secured Credit Card

Given your current score, a secured credit card, where a cash deposit is required up front, could be a practical option. Small, regular purchases paid off every month helps you establish a positive track record of responsible credit usage.

4. Seek to Be an Authorized User

If possible, ask a relative or friend with a good credit history to add you as an authorized user on their credit card. This could potentially boost your score by reflecting their good credit habits in your report. Make sure that the card issuer reports authorized user activities to the credit bureaus.

5. Explore Different Types of Credit

Once you’ve managed to establish a pattern of responsible credit usage with a secured card, look into diversifying your credit portfolio by responsibly managing different types of credit, like a small personal loan or a retail credit card, to further enhance your score.