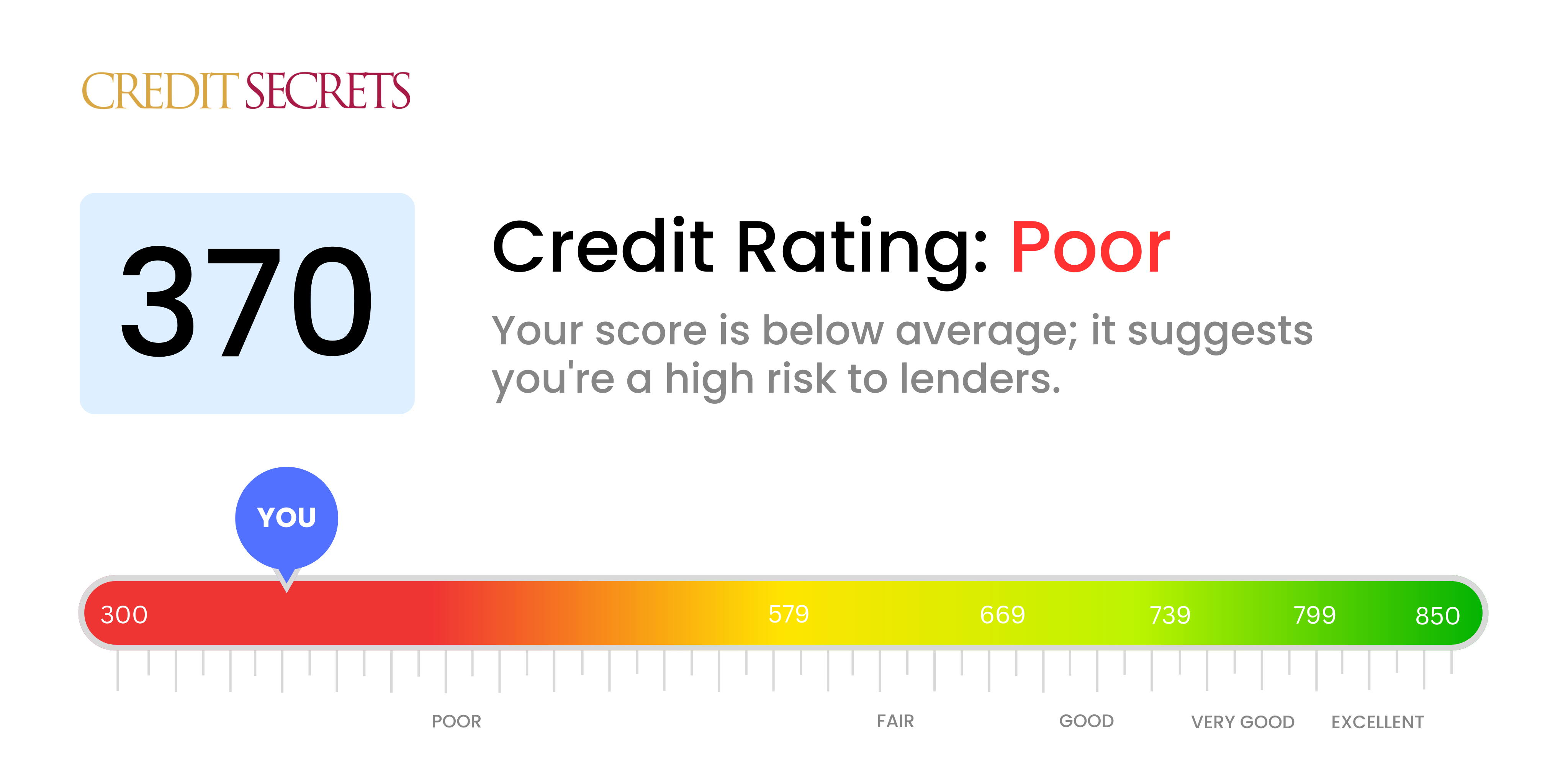

Is 370 a good credit score?

With a credit score of 370, it is apparent that you're dealing with a poor credit standing. Even though this is a challenging situation, the good news is there's room to improve and better your financial outlook.

Existing in the poor credit range means you may face difficulties when trying to secure loans, credit cards, or other forms of credit. It's common to encounter higher interests rates and less favorable terms due to lenders seeing you as a higher risk customer. However, don't lose heart! With consistent payment of debts, reducing amounts owed and adopting better financial behaviors, you can gradually lift your score to a healthier range.

Can I Get a Mortgage with a 370 Credit Score?

A score of 370, unfortunately, falls significantly short of the credit score most lenders look for when approving a mortgage. This score tends to indicate some serious financial hardships, whether they be past due bills, missed payments, or even defaults, all of which can be discouraging. It's a tough situation to be in, but not an impossible one to work out of.

The obstacle isn't insurmountable. While getting approved for a mortgage might be out of reach now owing to interest rates and other factors, you do have options. One immediate step you can take is to bring any outstanding debts or delinquencies up to date. Consistently making payments on time and demonstrating responsible use of your available credit will eventually help improve your credit score. This journey will require patience, but each small step brings you closer to a healthier financial future. Remember, your current credit score is not a life sentence, it's merely a snapshot of your financial health at this moment.

Can I Get a Credit Card with a 370 Credit Score?

With a credit score of 370, securing approval for a traditional credit card is, unfortunately, quite unlikely. This score, typically seen as high-risk by lenders, generally indicates a past of financial hardships or unfortunate financial missteps. This reality might be difficult to stomach, but it's crucial to face it head-on and know the truth about your financial health. Acknowledging your financial standing is the first step towards a better credit future, even though it may seem hard at first.

Given the difficulties tied to such a low score, alternatives such as secured credit cards might be worth exploring. Secured credit cards require a deposit, which acts as your credit limit, making them generally easier to get approved for. In addition, it might be advantageous to consider seeking a co-signer or perhaps look into pre-paid debit cards. These options might not immediately improve the situation, but they can be vital tools towards a path of financial stability. Be aware, interest rates on any available credit sources to individuals with such a low score are generally significantly higher due to the increased risk perceived by lenders.

Can I Get a Personal Loan with a 370 Credit Score?

With a credit score of 370, your chances of being approved for a personal loan from conventional lenders are severely limited. This score is significantly below the usual range that lenders consider safe for lending. This reflects a high risk for lenders, and they may hesitate to approve your loan application. It's undoubtedly a tough situation, but understanding the implications of this credit score for your personal loan prospects is essential.

Since standard personal loans may not be readily available, alternative lending options could be considered. Secured loans, where you provide collateral, or co-signed loans, with someone guaranteeing for you, may be potential solutions. Another possibility is peer-to-peer lending, offering sometimes more adaptable credit requirements. It's essential to note, however, these alternatives may carry higher interest rates and terms that are not as favorable, reflecting the higher risk to the lender. Yet, these could offer a path to securing a loan, providing a sense of optimism in a tough situation.

Can I Get a Car Loan with a 370 Credit Score?

With a credit score of 370, securing a car loan may present a considerable challenge. The majority of lenders generally look for individuals with credit scores above 660 and regard scores below 600 as subprime. Unfortunately, your credit score of 370 falls far below this range. This lower score implies a higher risk to lenders, and signifies a likelihood of potential difficulties when it comes to repaying borrowed monies.

However, this score doesn't spell the absolute end to your car ownership ambitions. Certain lenders do cater to those with less-than-stellar credit scores. Yet, be aware that these loans often come packaged with considerably elevated interest rates. These increased rates act as a safeguard for the lenders against the heightened risks they assume. Understanding the terms and keeping patience, however, can still pave the way to securing that much-needed car loan. Remember, every setback is a setup for a comeback. Keep pressing on!

What Factors Most Impact a 370 Credit Score?

Grasping the factors behind a score of 370 is a critical step toward financial recovery and credit score improvement. By acknowledging these factors, you can begin to tackle them for a better financial tomorrow. Each financial journey is unique with its share of lessons and progress.

Damaged Credit History

Payment missteps, including late payments or defaults, can heavily weigh on your credit score. This is a probable reason behind a 370 score.

How to Check: Evaluate your credit report for any missed payments or defaults. Think back on any instances of late payments, as these can decrease your score.

High Credit Utilization

Credit utilization is another key component of your score. If your credit lines are maxed out, this can drastically lower your credit score.

How to Check: Assess your credit card statements. If your balances are nearly at their limits, aim to reduce them.

Short Credit History

A brief credit history can lower your credit score. A new credit account or a lack of long-standing ones can contribute to a score of 370.

How to Check: Look over your credit report to ascertain the lifespan of your accounts. Did you recently open a new one?

Limited Credit Mix

Possessing various types of credit and managing them properly can elevate your credit score. A lack in credit diversity could be a contributing factor to your score.

How to Check: Reflect on your credit types such as credit cards, car loans, and mortgage loans. Have you been sporadic with applying for new credit?

Public Records

Public records like bankruptcies or tax liens can significantly lower your score.

How to Check: Scrutinize your credit report for any public records. Deal promptly with any items needing your attention.

How Do I Improve my 370 Credit Score?

Confronted with a credit score of 370, it may seem like a daunting task to improve it. However, a strategic plan can help you overhaul your financial future. Let’s focus on the accessible and most influential measures for this score range.

1. Evaluate Your Credit Report

Initial step is to get a complete understanding of your credit report. Error in reports is not uncommon and it has a drastic effect on your score. File for a dispute if you find any mishaps.

2. Strive to Clear Defaults and Collections

Tackle any defaults and collection accounts at once. These are severe negative items bringing your score down. Reach out to the collector and discuss setting up a payment plan or negotiate a settlement.

3. High-Interest Debt – Your Main Enemy

High interest debt such as payday loans have a spiral effect on your financial health. Make it a mission to clear it off and avoid in future.

4. Consider a Credit-Builder Loan

With your existing score, qualifying for conventional credit might be difficult. A Credit-Builder loan can be a great alternative. This loan is specifically designed to help consumers build or rebuild their credit.

5. Do Not Overlook Late Payments

Get current on all your credit accounts by paying off overdue payments as this is considerably impacting your score. Aim to pay on time moving forward.

Improving a severely damaged credit score requires steady commitment and patience. Implementing these steps will gradually help you build a new credit future.