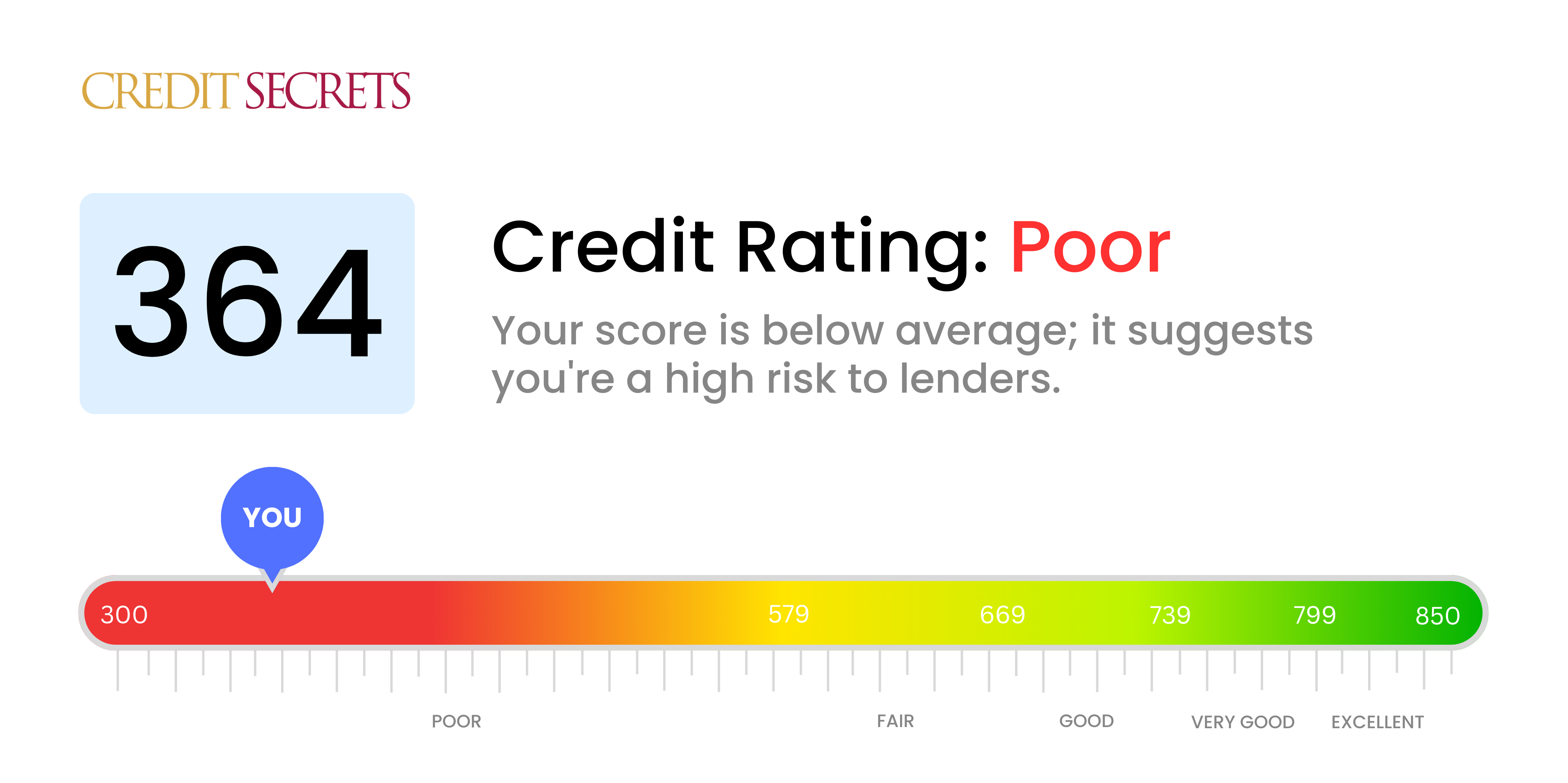

Is 364 a good credit score?

A credit score of 364 falls into the 'poor' category, but don't be discouraged. Unfortunately, with this score, obtaining loans or credit can be difficult and interest rates will likely be higher than average.

Every cloud has a silver lining though. With focused action and the right steps, improving your credit score is very achievable. Careful management of your finances and adhering to positive credit habits such as paying bills on time and limiting credit card usage, will gradually bolster your score. Remember, even small changes can make a big difference on the path toward a healthier financial future.

Can I Get a Mortgage with a 364 Credit Score?

With a credit score of 364, unfortunately, the path to mortgage approval can be quite difficult. This score is significantly lower than what most lenders generally look for, indicating past financial setbacks may have occurred like late payments or defaults. However, this isn't a permanent situation and there are alternative solutions that can be considered.

One of those alternatives could involve saving for a larger down payment to offset the credit risk to lenders. In rare cases, some mortgage lenders might consider a lower credit score if you are able to make a significant down payment. Additionally, consider looking at government-backed loans specifically designed to assist people with lower credit scores. Remember, it's essential to be patient and persistent in this process. It takes time to build your credit score up, but every day you are closer to achieving your financial goals.

Can I Get a Credit Card with a 364 Credit Score?

Having a credit score of 364 certainly presents challenges when it comes to approval for conventional credit cards. This lower rating reveals to lenders a potentially rocky financial history or past difficulties. Although this may be disappointing, acknowledging your current credit status is a brave and necessary step towards improving your financial outlook. Remember, hurdles are not permanent obstacles but opportunities for growth and betterment.

There are still potential routes to consider with a score like this one. One such alternative might be a secured credit card. These cards necessitate a deposit which then defines your credit limit. While this doesn't provide immediate relief, it paves the way for credit improvement over an extended period. Consider involving a co-signer or exploring prepaid debit cards as another option. Keep in mind, any credit possibility that becomes accessible with your score will likely come with high interest rates due to the risk perceived by the lenders, but this too is a stepping stone on the path to financial recovery.

Can I Get a Personal Loan with a 364 Credit Score?

With a credit score of 364, it is unlikely that a traditional personal loan would be approved by most lenders. This score is seen as a significant risk, typically associated with a history of missed or late payments, defaults, or possibly bankruptcy. We understand that this isn't an easy news to swallow but it's crucial to accept the reality of where your credit score stands.

However, this does not mean you're out of options. There are alternatives such as secured loans, where an asset is offered as collateral, or co-signed loans, where someone with a better credit score can act as a guarantor on the loan. You can also explore peer-to-peer lending platforms, as they can be slightly more flexible on credit score requirements. Beware though, these alternatives usually come with higher interest rates due to the increased risk perceived by the lender. Despite the setbacks posed by a lower credit score, there are still paths forward in your financial journey.

Can I Get a Car Loan with a 364 Credit Score?

When it comes to a credit score of 364, securing approval for a car loan can be a difficult road. The majority of lenders usually prefer credit scores above 660 to grant favorable loan conditions. A score of 364 is notably low and considerably far into the subprime category, which could result in less than ideal terms in the rare instances where loans are approved. This score could unveil a higher risk for lenders, as it hints at potential challenges related to repayment of the borrowed money.

While this may seem discouraging, don't let it completely deflate your ambitions of owning a car. There are a few lenders who specialize in providing loans to individuals with reduced credit scores. But keep in mind, these loans generally come with significantly higher interest rates due to the lender's perception of the increased risk involved. A careful review of the loan terms and prudent decision-making can still make your dream of having a car a reality, albeit a potentially costlier one.

What Factors Most Impact a 364 Credit Score?

Having a credit score of 364 suggests that you may be facing a few challenges in your credit history. Fear not, understanding these challenges will serve as the first steps to improvement.

Late Payments

Late or missed payments could be significantly affecting your credit score. Late payments get reported to the credit bureaus and can bring down your score.

How to Check: Look closely at your credit report and identify any instances of late or missed payments.

Overused Credit

Understand that high credit utilization rate - using a large portion of your available credit - can lead to a low score like 364.

How to Check: Examine your current credit limits and the balances you’re carrying on your credit cards. If the balances are quite high, your score could be lower.

Short Credit History

A short credit history might also play a role in your lower credit score. A longer credit history offers more data and demonstrates more responsible use of credit over time.

How to Check: Scan your credit report for the length and variety of credit accounts.

Public Records and Collections

Having public records like bankruptcies, foreclosures or collections on your credit report could tremendously impact your score.

How to Check: Review your credit report for any damaging public records or collections.

Start addressing these financial aspects today and slowly but surely, you'll journey your way to a healthier financial life.

How Do I Improve my 364 Credit Score?

A credit score of 364 is markedly low, but not impossible to improve. Let’s address some strategic and approachable methods to enhance your current situation:

1. Rectify Your Late Payments

Starting with the accounts with the most delayed payments will have a profound effect. Reach out to your creditors, negotiate a payment plan, and update any incomplete or incorrect information. By doing so, you will start building a healthier credit record.

2. Limit Your Credit Card Usage

Within your limitations, try to reduce your credit card usage. If possible, ensure to keep your credit utilization ratio below 30% of your limit in the long run. Pay more attention to cards with the highest interest rates.

3. Consider a Secured Credit Card

Your current score might make it hard to qualify for a regular credit card. In this case, a secured credit card could be beneficial. Aided by a cash collateral deposit, this card can help you establish a consistent payment pattern.

4. Authorized User Status

An individual with strong credit history can help by adding you as an authorized user on their credit card. This shared positive credit record can be a significant boost to your overall credit history. Keep in mind that the creditor should report this authorized user activity to credit bureaus.

5. Explore Credit Diversification

Once a good payment rhythm is established with a secured card, look to explore other credit options like credit-builder loans. Handling various credit types successfully can positively affect your credit score.