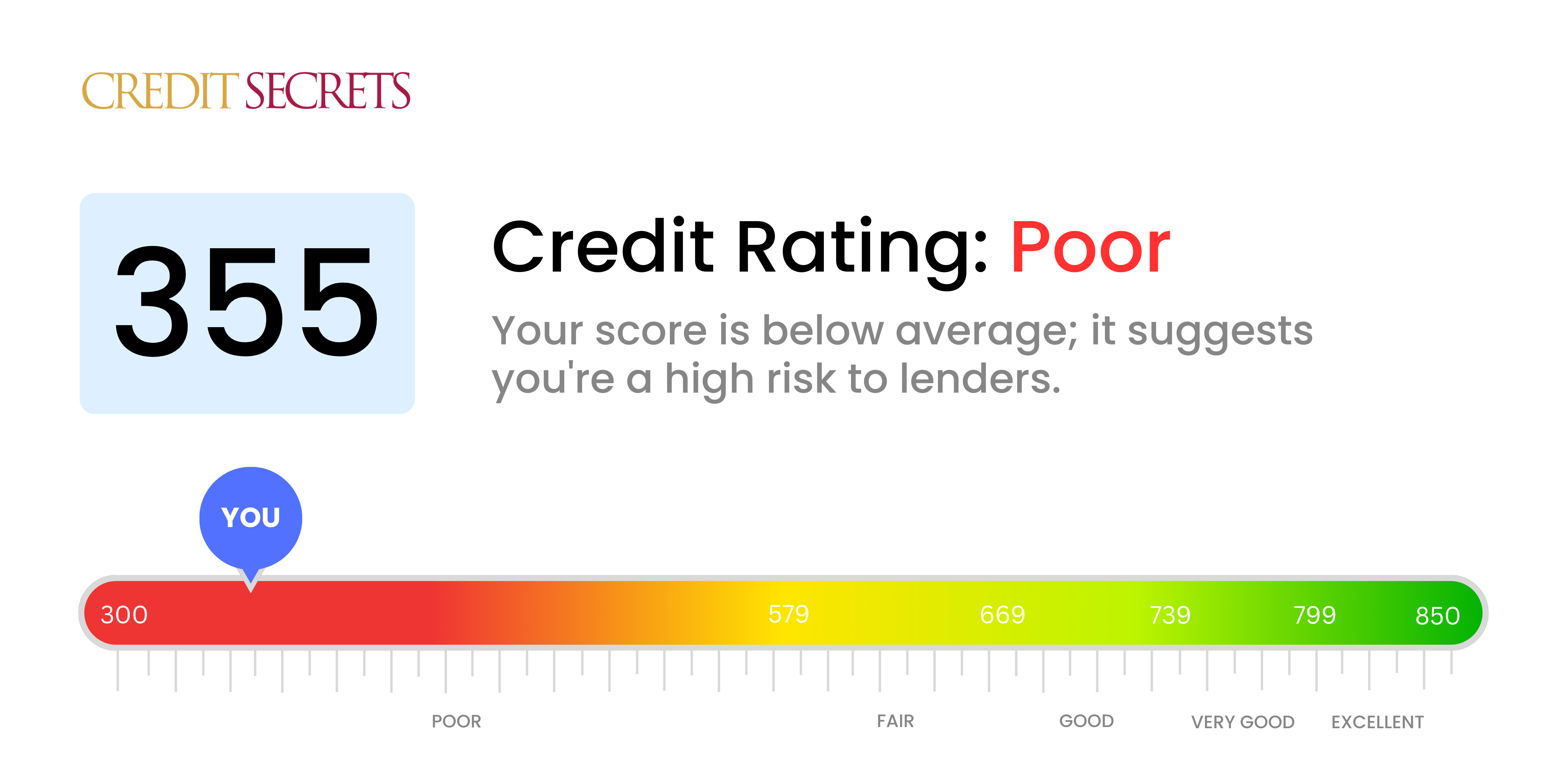

Is 355 a good credit score?

A credit score of 355 is considered a poor credit score. If you find yourself in this credit range, you may encounter difficulties when applying for loans or credit cards, as lenders may see you as a higher risk. However, remember that improving your score is achievable with consistent, responsible credit behavior.

With a poor score, options may be limited, and you might face higher interest rates or stringent loan terms if lenders do choose to extend credit. Don't lose hope though - your financial situation can get better over time with the right steps. It might be challenging, but taking control of your credit now can open a world of opportunity in the future.

Can I Get a Mortgage with a 355 Credit Score?

Unfortunately, with a credit score of 355, obtaining approval for a mortgage is highly unlikely. This is significantly below the minimum threshold that lenders typically consider. A score in this low range is often indicative of previous financial trouble, such as late payments or defaults on loans.

However, remember that this isn't a permanent situation. You have options and alternatives to consider. For instance, focusing on paying off any existing debt or balances making sure to meet payment deadlines consistently can gradually raise your credit score. Alongside this, using credit responsibly and keeping your credit utilization low can also contribute to a better credit score. This journey might seem tough initially, but every step you take towards improving your financial health puts you one step closer to home ownership. Achieving a sustainable credit score and securing a mortgage isn't easy, yet with sincerity and determination, it's absolutely within your grasp.

Can I Get a Credit Card with a 355 Credit Score?

Having a credit score of 355 certainly brings its own set of challenges when it comes to being approved for a regular credit card. Most lenders see such a score as extremely high risk, often a sign of past financial struggles or mishandling of funds. Despite how daunting this may seem, don't lose heart. Acknowledging your current credit situation is a crucial first move toward financial recuperation, even if it means embracing some hard truths.

Because of the complications linked to such a low score, you might want to look into options like secured credit cards. These cards demand a deposit that becomes your credit limit, making them generally easier to get. They can also be instrumental in helping you repair your credit gradually. Other possible avenues to look into are acquiring a co-signer or experimenting with pre-paid debit cards. While these options might not immediately rectify your situation, they can be early building blocks in your quest for financial soundness. Keep in mind, credit available to people with such scores usually comes with considerably steeper interest rates, mirroring the higher risk perceived by lenders.

Can I Get a Personal Loan with a 355 Credit Score?

If you're holding a credit score of 355, it's unfortunately far below the standard level that many traditional lenders typically look for when granting a personal loan. This lower score can indicate a heightened credit risk to lenders, making it improbable for you to be approved for a conventional loan. It’s a tough situation, and it’s necessary to understand what this score means for your potential borrowing options.

While traditional loans might not be feasible, other alternatives could be worth exploring. Options like secured loans, which require collateral, or co-signed loans, where someone with a better credit score backs you up, could be possible routes. Peer-to-peer lending platforms might also be an option due to their sometimes more lenient credit score requirements. Remember, these alternatives may come with higher interest rates and less favorable terms due to the increased risk perceived by lenders. It's important to make well-informed decisions based on your situation.

Can I Get a Car Loan with a 355 Credit Score?

Having a credit score of 355 places you in a challenging spot when it comes to securing a car loan. Most lenders prefer credit scores above 660, viewing scores below 600 as subprime, or high-risk. Sadly, your score of 355 falls well below this mark, which may result in high-interest rates or even denial of your loan application. Your low score indicates a high risk to lenders, suggesting that repayment of the loan might be difficult for you.

In spite of these hurdles, don't lose heart. It may still be possible to arrange a car loan. Some lenders are known to work with people who have lower credit scores. However, these loans often carry significantly higher interest rates to compensate for the higher perceived risk. A careful study of the terms and conditions, and a thorough understanding of the financial implications, would be crucial in such scenarios. Even though the journey might be a bit steep, obtaining a car loan isn't completely out of the question.

What Factors Most Impact a 355 Credit Score?

Gaining insights on a credit score of 355 paves the path to a healthier financial life. Understanding the factors that contribute to this is pivotal. Remember, every financial journey is unique and comes with valuable lessons to support your growth.

Payment History

Payment history is a critical factor in your score composition. Late payments or defaults might be a primary reason for your current score.

How to Check: Peruse your credit report for any signs of late payments or defaults. Think back to any instances where you might have delayed or defaulted on payments, as they are likely to influence your score.

Credit Utilization

High credit utilization could be a contributing factor. If your credit card balances are high compared to their limits, this could be affecting your score negatively.

How to Check: Check your credit card statements. Are your balances nearly maxed out? Endeavor to maintain low balances compared to your credit limits to help improve your score.

Length of Credit History

Having a brief credit history may be causing your score to suffer.

How to Check: Scour your credit report to ascertain the age of your accounts and consider whether you've recently opened new ones.

Credit Mix and New Credit

Diverse credit types and responsibly handling new credit is vital for a healthy score.

How to Check: Assess your portfolio of credit accounts such as credit cards, retail accounts, and loans. Also, review how frequently you’ve been applying for new credit.

Public Records

Public records like bankruptcies or tax liens can heavily impact your score.

How to Check: Review your credit report for any public records. Strive to address and resolve any listed items.

How Do I Improve my 355 Credit Score?

With a credit score of 355, it’s very much in the “bad” range. Don’t worry, though: improvement, while challenging, is possible. Here’s a targeted plan to help raise your credit score from where it is presently:

1. Tackle Overdue Debts

Seek out any overdue debts and make a plan to pay them. These debts have the largest negative impact on your credit score. Contact your lenders and discuss your options, including setting up a repayment plan.

2. Monitor Credit Card Spending

Your credit card utilization plays a major part in your credit score. Reducing your credit card expenses can be a big help. Try to keep your spending below 30% of your credit limit, and prioritize cards with the highest balances.

3. Consider Secured Credit Cards

Given your current credit score, obtaining an unsecured credit card might not be feasible. A secured credit card, which involves a security deposit, might be a more viable choice. Make small purchases and pay off your balance in full each month to boost your payment history.

4. Authorized User Opportunity

If possible, ask a close friend or family member with better credit to add you as an authorized user to one of their credit cards. This can help improve your credit standing by incorporating their good credit behavior into your credit record. Make sure their credit card company reports authorized user actions to the credit bureaus, though.

5. Enhance Your Credit Variety

Having a variety of credit types, including both revolving and installment loans, can aid in improving your credit score. Once you’ve created a good repayment track record with a secured credit card, consider expanding your credit variety carefully and responsibly.

Remember, the key to improving your credit score is consistency and patience. Stick to this roadmap, and you’ll begin to see improvements.