Understanding Mortgage Pre-Approval

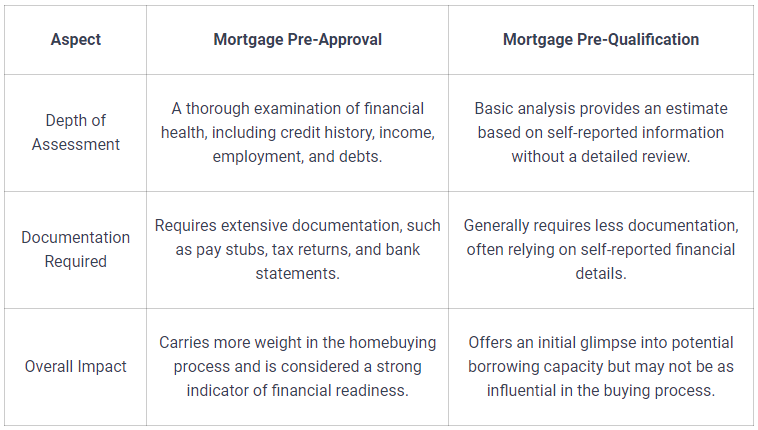

Mortgage pre-approval is a pivotal step in the home-buying process. It’s an initial evaluation done by a lender to determine the amount they’re willing to pay you for a home purchase. The lender analyzes your financial situation, such as credit history, employment status, debt, etc.

It brings you closer to your dream house.

Getting pre-approval for a mortgage has lots of benefits. The biggest advantage is that it makes you a competitive buyer in the real estate market. Do you know why is that?

Because sellers are generally more inclined to consider offers from pre-approved buyers. It indicates a high chance of successful completion of the purchase.

But how do you get pre-approved for a mortgage?

How long does a mortgage pre-approval last?

Keep reading because, in this article, we’ll tell you everything you need to know about mortgage pre-approval. Let’s get started.

What is Mortgage Pre-Approval?

Mortgage preapproval is a verification in written form from a mortgage lender. It tells that you qualify for the mortgage amount you applied for. The lender checks your documentation, credit score, and tax returns and then decides on the amount of mortgage you are pre-approved for.

Preapproval for mortgage = Green signal to purchase a home.

But what does PRE in front of approval stand for?

It’s a short-term preliminary, which indicates that the lender still needs to validate all the information. Once it’s done, the lender will issue a final approval.

Mortgage preapproval provides you with clarity about your financial situation. Thus, you can easily find the right home that fits your budget.

The Mortgage Pre-Approval Process: Steps and Preparation

Now that you know about home loan pre-approval, it’s time to discuss how to get pre-approved for a mortgage. Every step in the process is crucial for homebuyers. Let’s look at each of these so you can get a mortgage pre-approval!

Steps and Preparation for Mortgage Pre-Approval:

1. Credit Health Check and Improvement

You should consistently monitor your credit because it’s crucial for preapproval. Having good credit is critical because it influences interest rates as lenders make decisions. Focus on improving your credit score by paying bills on time and maintaining a low credit utilization ratio.

You can check credit reports for free from Annual Credit Reports. If you notice any inaccuracies, immediately report them. Reduce your debts by creating an effective strategy or making a debt repayment plan.

Looking for more guidance?

Get our Credit Secrets book now.

2. Gathering and Organizing Documentation

It’s time for the next step of the preapproval process for a mortgage. This is the collecting of essential documents, which include:

- Income verification (pay stubs, tax returns)

- Asset statements (bank statements, investment accounts)

But this process can be messy and reduce efficiency.

That’s why you should create a file for all the mortgage paperwork. This streamlines the pre-approval process.

3. Assessing Financial Readiness

To determine your mortgage readiness, it’s best to consider your income, debts, and living expenses. Calculate the debt-to-income ratio. Divide total monthly debt payments by gross monthly income.

But is that the only way to assess?

Not at all.

You can also use mortgage calculators to estimate loan amounts. Knowing this lets you align your home-buying goals with a realistic budget. It also demonstrates responsible financial habits.

4. Lender Assessment and Comparison

For preapproval, lenders carefully analyze all the information. They scrutinize your credit reports, income, and debt-to-income ratio.

But there’s one thing most people miss.

It’s comparing rates and terms. You should check offers from multiple lenders for best interest rates, loan terms, and overall cost. It will make your home-buying journey financially sound.

Benefits of Mortgage Pre-Approval

There are various advantages of mortgage preapproval. Here are some of the benefits you should keep in mind.

- Indicates serious and financially qualified buyers.

- Sellers are more likely to consider and favorably respond to offers.

- Specifies the maximum loan amount. Focuses home search on affordable properties.

Preapproval accelerates the home-buying process because that’s how to move to final mortgage approval. Because most of the documentation approval is completed during pre-approval. So, the transition to the next stage is much faster.

How Long Does A Mortgage Pre-Approval Last?

The mortgage pre-approval lasts for 60 to 90 days. However, the time duration may vary depending on the lender. The lender will freeze the approved loan amount and terms during this time frame. So homebuyers can find a property within their budget.

But what’ll happen if it expires?

Many individuals believe that expiration is equivalent to auto rejection. But that’s not necessarily true. Instead, you should reassess your financial situation, update your paperwork, and send another application. Strategically time your house-hunting process so everything goes systematically. Set a clear budget because this is pivotal for house hunting.

Impact of Mortgage Pre-Approval on Credit Score

During the preapproval process, the lender makes a hard inquiry on your credit report. It has a minor impact on your credit score. But what if there are lots of inquiries?

If there are too many inquiries for the same purpose, such as mortgage shopping, then all the inquiries will be considered as one single inquiry. It will minimize the impact of inquiries on your credit score.

But don’t neglect credit health during the home-buying process. Here are some effective tips for you.

Minimize additional credit activities and avoid opening new accounts. Pay on time and resolve any discrepancies on the credit report.

Choosing the Right Lender for Pre-Approval

Selecting a lender for mortgage preapproval is extremely crucial. Here are some factors you should consider.

- Compare interest rates offered by different lenders.

- Assess the terms of the loans, including the duration and type (fixed-rate, adjustable-rate).

- Examine the associated fees and closing costs.

- Check the lender’s reputation and customer reviews.

You can find a personalized solution for your home-buying needs by comparing different lenders.

Conclusion

Mortgage preapproval is a pivotal step in the home-buying process. Its benefits include credibility with sellers, a clear budget, and a streamlined approval process.

Ready to take the next step in your home-buying journey?

Contact our experts today, who are ready to assist you at every stage to prepare you for your mortgage preapproval. We understand how difficult it can be to understand what steps you need to take now for a home loan pre-approval later. It can be tiring and exhausting.

But with our assistance, you can make this tiresome process easy. So reach out to us today, and let’s transform your mortgage preapproval experience.