10 Lessons About Business and Investments we Learned After Watching Shark Tank.

In the past, when our parents wanted to teach us about entrepreneurship, they used the example of a lemonade stand. To most of us, this example served us well.

Today, when parents want to teach their children about starting and building a company, they use Shark Tank.

To starters, Shark Tank is a program where entrepreneurs present their businesses to a team of experienced and successful entrepreneurs. If they make a strong case, the investors invest their own money.

For this article, we spent months watching all episodes of the program. Here are the biggest lessons.

When One Door Closes, Another One Opens

Most entrepreneurs who appear on shark tank do not receive funding. To some, failure to obtain funds is often the end of their businesses.

To others, failure to receive funding is usually the start of something great. For example, a few years ago, the founders of a meal kit company called Plated appeared on Shark Tank seeking $400,000 in exchange for a 4%. They left the show without a deal. Less than two years later, Albertsons acquired the company for more than $300 million.

Another example is a company called Ring. In 2013, the founder made his pitch on Shark Tank. He wanted to raise $700,000 in exchange for a 10% stake, which valued the company at $7 million. All the sharks refused to invest. Today, the company is valued at more than $1 billion.

Therefore, if you want to start a business, you will likely meet criticism or resistance. When you are fundraising, investors will probably turn you off. The secret is to use the rejection as fuel to power your business to higher heights.

Simple Businesses always Win

In the nine seasons, we have seen all types of businesses, and the conclusion is that investors always consider simple businesses.

A good example is a company called Scrub Daddy that manufacturers quality and exciting cleaning products. Aaron Krause who sought $200K in exchange for a 15% stake founded it.

Because of its simplicity, Lori Greiner agreed to invest $200,000. Today, the company makes more than $100 million every year.

On the other hand, entrepreneurs behind Rolodoc aimed to create a social media platform for pharmacists and doctors. This is a complicated business because; they had to convince doctors and pharmacists to use their platform. Later, Mark Cuban named their pitch as the worst pitch ever.

Know the Numbers

When you are making a pitch to investors, always know the numbers.

The most important numbers you need to know are your current and future revenues, valuation, customer acquisition cost, and the cost of manufacturing your products.

Often, we watched investors with excellent companies fail to make a deal simply because of not knowing the numbers.

In other occasions, some entrepreneurs have turned down offers from the sharks especially when they believe they are getting a raw deal. For example, in season 4, Derek Pacque, pitched his company called Coatchex. Mark Cuban loved the company and offered $200,000 for a third of the company.

After consulting his professor, Derek rejected the offer because it undervalued his company. A few months later, Derek managed to raise more than $1.5 million from other investors.

Always Negotiate

Sharks and other venture capitalists love to invest in investors who know how to negotiate and even defend themselves.

When watching the past episodes, we were surprised at entrepreneurs who didn’t stand up to the investors who showed apparent interest in their business.

As an entrepreneur, you should always negotiate so that you can get a good deal for your company. As mentioned, always feel free to walk away if you think you are getting a raw deal.

Tell a Good Story

Some of the Shark Tank deals we watched were all about stories. Sharks love a good story.

A good example is what happened two years ago. An entrepreneur called Johnny Georges pitched his company Tree-T-Pee, which provides water containment solutions to local farmers.

Johnny manufactured his products for $2.25 and sold them for $4.25, and sharks were unimpressed for his tiny margins. In defense, he told them that his products targeted local farmers and that the $1 margin was enough for him.

His story captured the attention of John Paul DeJoria, who invested $100,000 in his business.

A Market for Weird Things

A few years ago, a young man came to Shark Tank to pitch his company; I want to Draw a Cat for You. He was seeking a $10,000 investment in exchange for a 10% stake.

His company’s business plan was to draw cat sketches for people. To most sharks, this idea was not only absurd but also a waste of their time.

In the end, Mark Cuban decided to invest in his company.

This idea is a validation that in our country, there is a market for everything.

Forget about the Market Size

A pitch I regularly hear from entrepreneurs is about the market size of their products. Often, they will talk about how big their market size is and how they are comfortable taking a small portion of that market.

Ideally, when investors put their money in a company, they want to have the entire market. They want to invest a little amount of money and later dominate the whole market.

When making a pitch to investors, always show them the road map you will use to gain the entire market. Think big.

Age is Just a Number

In entrepreneurship, age is just but a number. In several episodes, we watched young people make deals with investors.

For example, a few years ago, 11-year old Mikaila Ulmer introduced her company, BeeSweet Lemonade to investors. Her company manufactured different flavors of lemonades. In the episode, Daymond John invested $60,000 in exchange for a 25% stake in her company.

In 2016, the company became a national brand that is carried by major brands like Whole Foods and Walmart.

We have also seen episodes where senior citizens make deals with the sharks.

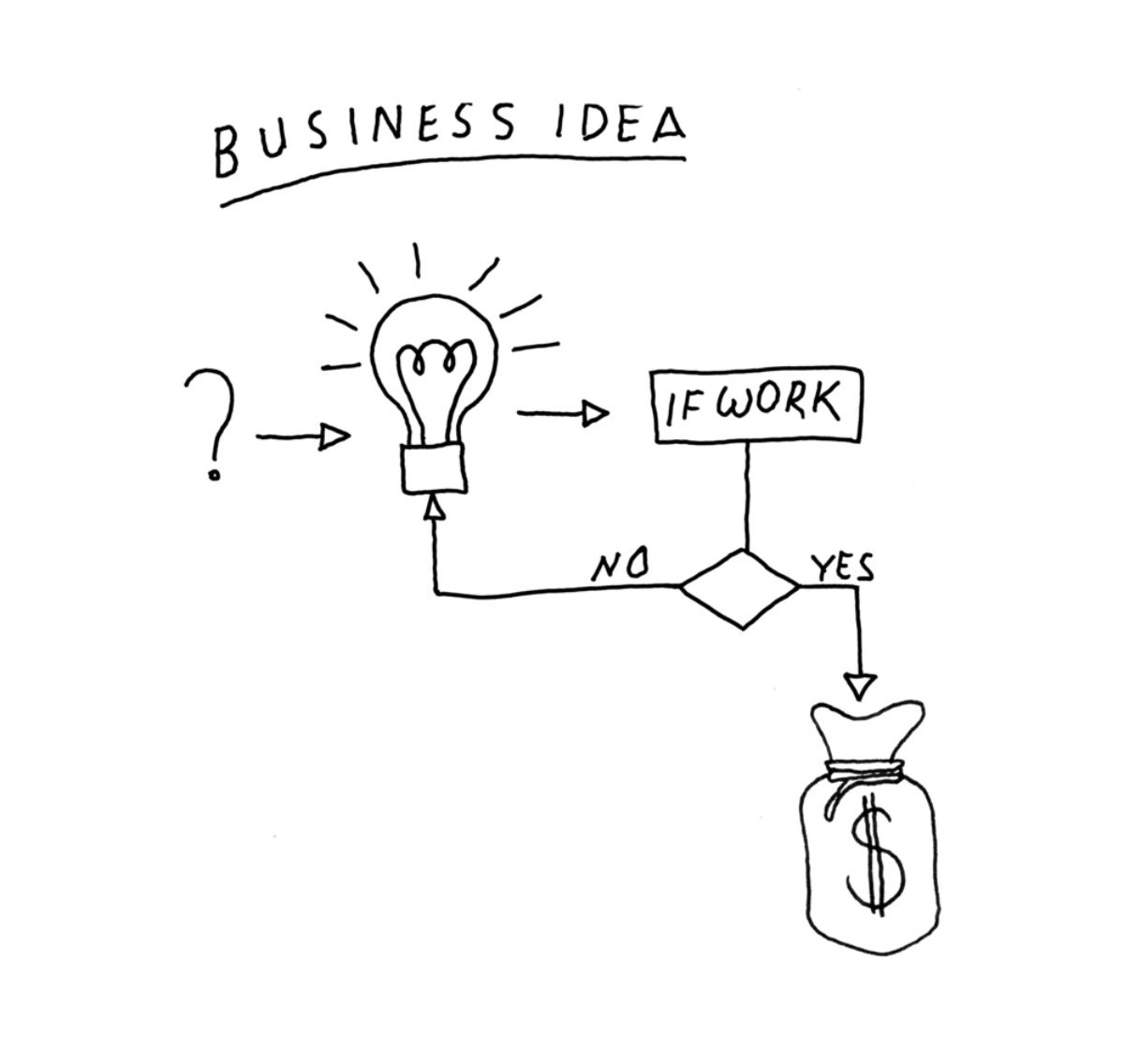

Solve a Problem

The secret to making a deal on Shark Tank is if you are solving a problem.

For example, while fashion is a huge industry, finding high-quality clothes for women is a big challenge. Diana and Josh Harbor went through this problem and created a company called Red Dress Boutique that created a personalized way of online shopping.

The company was so successful that Mark Cuban invested more than a million dollars.

On the other hand, we watched hundreds of products that did not solve any problems.

For example, in the second episode, Darren Johnson introduced the Ionic Ear, a Bluetooth device that is implanted in the user’s ear canal. This company did not solve any problem. Years later, most sharks call it their worst pitches.

Patent Your Product

A common issue raised by the Shark Tank panel is about Intellectual Capital (IP). Most investors will likely invest in a product that is protected by a patent. This is because other entrepreneurs who are watching will probably come up with a similar product at a lower price, which will end your business.

Conclusion

We spent hours watching all episodes of Shark Tank. We also read interviews made by the sharks and people who have been on the program.

The biggest lesson was, if you have a product that solves a big problem, know the numbers, have a patent, and have excellent presentation skills, you will likely get a deal.