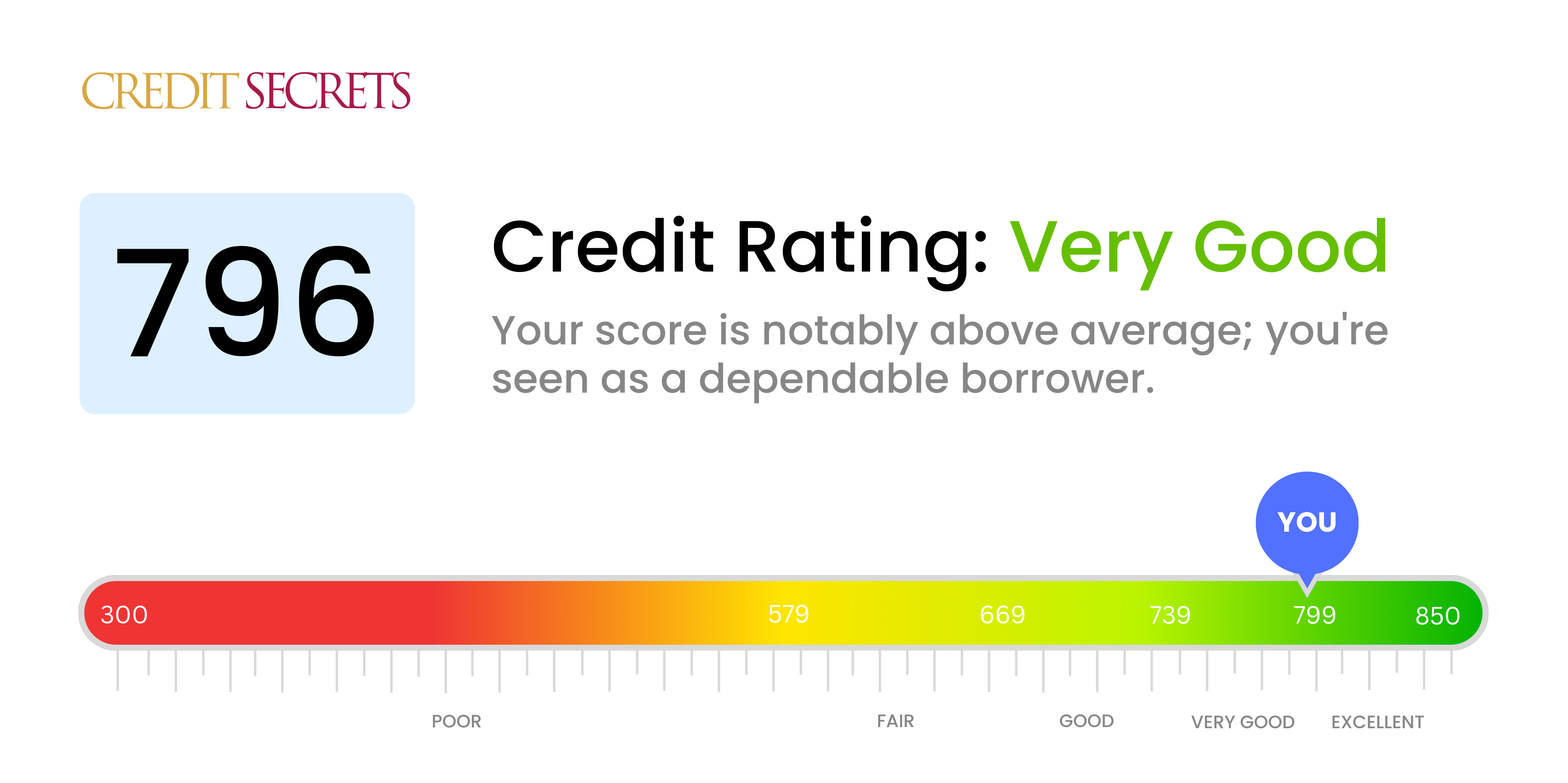

Is 796 a good credit score?

With a credit score of 796, you're positioned well within the 'Very Good' credit range. This score conveys that you've managed your credit responsibly, which not only opens the door to lower interest rates on loans and credit cards, but also offers a sense of reassurance to prospective lenders and landlords about your creditworthiness.

Being in this credit tier typically results in a smoother financial journey, including easier approval for rental houses and apartments, more favorable loan terms, and even more negotiating power. Continue maintaining this healthy credit habit, as you're just a few points away from getting into the 'Excellent' credit category which would potentially unlock even more benefits.

Can I Get a Mortgage with a 796 Credit Score?

A credit score of 796 is typically considered an excellent score, which greatly increases your chances of being approved for a mortgage. This score signals to lenders that you handle your credit responsibly, making you a lower financial risk. This achievement clearly reflects a history of timely payments and sound overall credit management.

Now that a mortgage approval is highly probable, the process can appear complex, but it's essentially straightforward. With a credit score as high as yours, lenders are likely to offer you more favorable terms, including lower interest rates. However, it's important to remember that approval isn’t solely based on your credit score. Other factors like your income, employment status, and debt-to-income ratio will also be considered.

Despite the intricacies, don't allow the process to intimidate you. There might be a lot of scrutiny, but for someone with a credit score as commendable as yours, most of this is just a formality. Approaching this process with patience and diligence will undoubtedly open the door to your new home.

Can I Get a Credit Card with a 796 Credit Score?

With a credit score of 796, it's highly probable that credit card applications will be approved. Respectable lenders often see this solid credit score as low risk, meaning it reflects a positive history of managing financial responsibilities. This is definitely a strong position to be in, but it's beneficial to approach it with due diligence to maintain this level of financial health.

In light of a strong credit score like 796, options like premium credit cards become more accessible. These cards often offer extensive perks such as large reward points, travel benefits, or cash back on purchases. Another viable option is a low-interest credit card, as a high credit score allows for negotiation of lower interest rates. Remember, with a great credit score, the power is in your hands to explore and select the best credit card options driven by your specific needs and lifestyle. Still, it's crucial to continue responsible financial behaviors and timely repayments to maintain your high credit score.

With a credit score of 796, you're in an excellent position to secure a personal loan. A number this high suggests to lenders that you're a trustworthy and responsible borrower, capable of managing your credit effectively. It signals your ability to manage your debts timely and accurately, which significantly boosts your chances of loan approval.

When you apply for a loan, you can anticipate a smooth application process. Your high credit score may entitle you to relatively low-interest rates on your loan, reflecting your low risk as a borrower. Still, remember to shop around for the best deals - consider various loan types and lenders to take full advantage of your well-earned credit score. While your approval chances are high, each institution has its own criteria and conditions, so the approval is not a guaranteed outcome. But with 796 as your credit score, you certainly have more options open to you.

Can I Get a Car Loan with a 796 Credit Score?

Having a credit score of 796 is highly favorable when it comes to seeking a car loan. Lenders ordinarily prefer scores above 660, and a score of 796 is well within the 'excellent' credit rating. This demonstrates to lenders that you are responsible with borrowed money, making them more likely to approve a car loan at favorable terms.

When it comes to the car loan processes for a credit score of 796, you can expect to receive some of the best terms that lenders have to offer. Lower interest rates are commonly given to those with stellar credit scores. This is because lenders view you as a lesser risk and, thus, are comfortable offering a loan at a lower interest rate. However, it is important to understand the terms fully before signing any loan agreement. It is always a good idea to shop around for the best rates and terms. Remember, you have good credit and lenders should be competing for your business.

What Factors Most Impact a 796 Credit Score?

Understanding a credit score of 796 is key for a sound financial future. While a score in this range is generally considered very good, knowing the factors that have contributed to it adds clarity to your financial picture.

Credit History's Length

Part of your high score can likely be attributed to the length of your credit history. Having established credit over a long period of time contributes positively to your score.

What to do: Examine your credit report to get a sense of how long you've been using credit. The longer your history, the better this looks to lenders.

Payment Consistency

Consistent, on-time payments significantly affect a credit score. Your high score suggests you've probably been very diligent about making payments in a timely manner.

What to do: Maintain this good habit by continuing to make prompt payments, avoiding late fees and potential dips in your credit score.

Credit Utilization Ratio

Another crucial element influencing your credit score is the utilization ratio, or how much of your available credit you're using. For a high score like 796, it's likely you're using a smaller percentage of your available credit.b

What to do: Ensure you're not overusing your credit limit, ideally keeping utilization below 30%.

Credit Diversity

Having a mix of different types of credit (credit cards, student loans, car loans, etc.) can also contribute positively to a high credit score.

What to do: Continue to manage a diverse mix of credit responsibly.

Please remember, these are just likely contributors. Every individual's credit history is unique.How Do I Improve my 796 Credit Score?

Boasting a credit score of 796 marks you as an individual with an excellent credit history. This high score has likely been achieved by consistently managing your financial obligations responsibly. However, there’s always room for improvement and the following steps can help you hit the elusive perfect score:

1. Maintain Low Credit Utilization

Strive to utilize only a small percentage of your available credit. Although it may seem challenging, aim to use less than 10% of your total credit limit. This signifies that you don’t heavily rely on debt and further boosts your creditworthiness.

2. Be Consistent with Payments

Continue paying your credit card bills and any outstanding debt on time. This positive payment history contributes significantly to enhancing your credit score. Avoid any late payments as they could reduce your score.

3. Diversification of Credit

Having a variety of types of credit, such as credit cards, retail accounts, and installment loans, can show lenders you can handle different types of credit responsibly. If your credit portfolio lacks diversity, consider opening a new kind of credit account – but only if you can confidently manage it.

4. Limit Hard Enquiries

Avoid making unnecessary credit applications, as each one triggers a hard inquiry on your credit report. Too many can negatively impact your credit score, and they stay on your credit report for two years.

5. Review Credit Report Regularly

Even with a high credit score, it’s crucial to monitor your credit report to prevent any errors or fraudulent activity from tarnishing your creditworthiness. Promptly report any inconsistencies to credit bureaus.