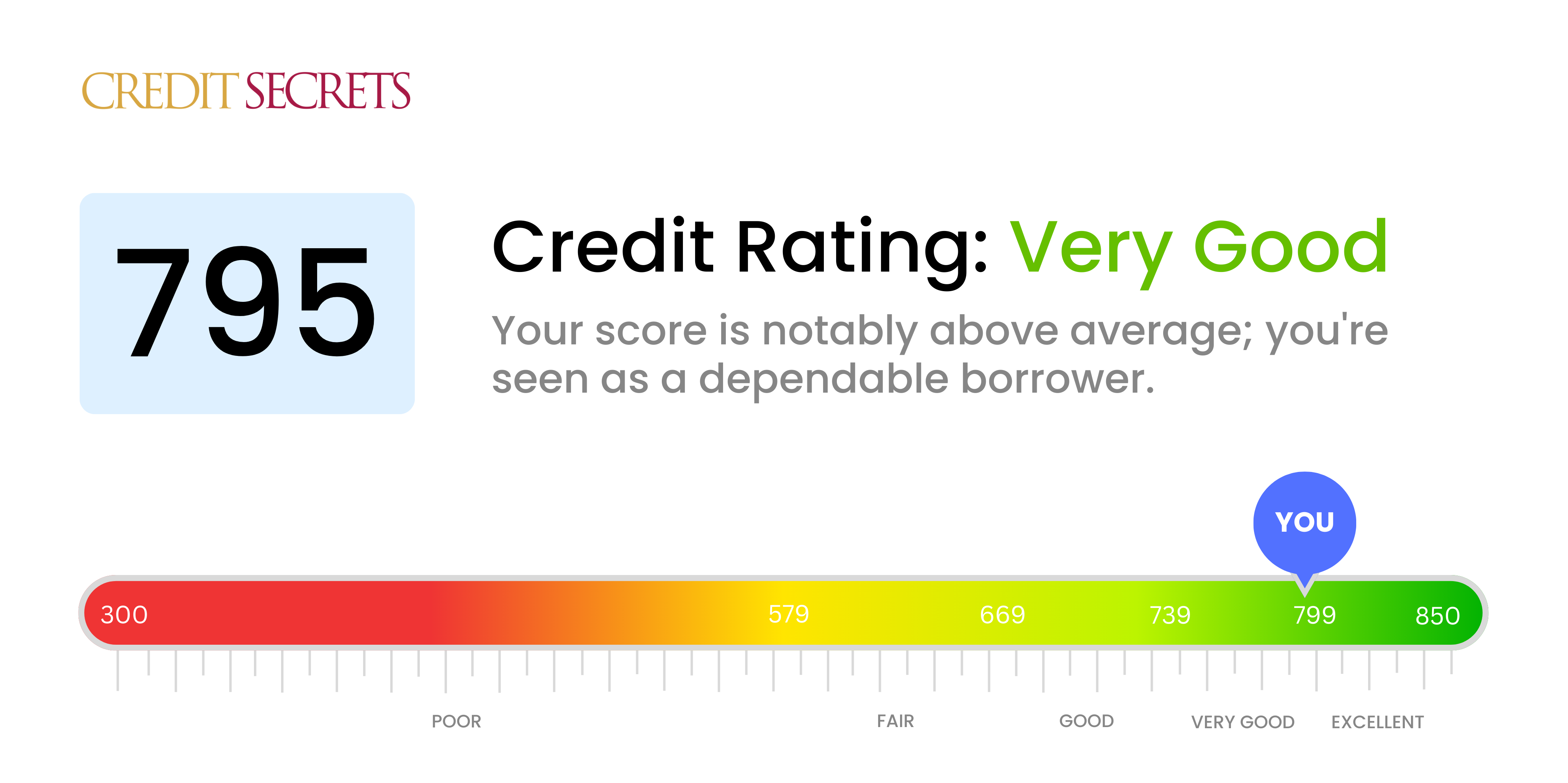

Is 795 a good credit score?

Your credit score of 795 is considered very good. This typically means it is easier for you to get approved for loans or credit cards with lower interest rates, which could save you money over the long term. This score also signifies your reliability to lenders, making it likely for you to receive better terms for loans and insurance policies.

Do remember, though, maintaining a good credit score requires consistent effort. Try to pay any bills on time and aim to lower your credit utilization. Maintaining your score and potentially pushing it into the 'excellent' range will further expand your financial possibilities and provide you with more options in the future.

Can I Get a Mortgage with a 795 Credit Score?

If you have a credit score of 795, there's good news for you. You are very likely to be approved for a mortgage, as your score is significantly higher than the minimum threshold typically required by lenders. A credit score like yours demonstrates a consistent history of responsible credit use and timely payment, criteria highly appreciated by financial institutions.

Being armed with such a strong credit score, you can expect a more streamlined mortgage approval process. However, remember that your credit score is only part of the picture and additional factors like your income, employment history and debt-to-income ratio will also play a role. Given your high score, you may also potentially benefit from more favorable interest rates, which could lower your monthly mortgage payments and save you a significant amount of money over the life of your loan. Nevertheless, it's always smart to shop around with different lenders to see who can offer you the best deal possible.

Can I Get a Credit Card with a 795 Credit Score?

With a credit score of 795, you are in an excellent position to be approved for a credit card. This score reflects a strong history of financial responsibility and trustworthiness in the eyes of lenders. While the process of managing credit can be complex and demanding, having a high score like yours is of great benefit.

With such a high credit score, you have the flexibility to choose from a variety of credit cards to best suit your lifestyle and financial goals. Premium travel cards might be a great choice if you're looking for rewards related to travel, like airline miles and hotel stays. Cash back cards that reward everyday purchases could also be a good option if you prefer tangible, immediate benefits. Also worth considering are cards offering low interest rates, which could be particularly advantageous if you occasionally carry a balance from month to month on your card. Regardless of what card you choose, remember to manage your credit wisely to maintain your high score and positively influence your financial future.

With a credit score of 795, you're in a strong position when it comes to obtaining a personal loan. This score is well above the average range, showcasing a solid track record of responsible credit management. As such, lenders are likely to view you as a low-risk borrower, increasing your chances of loan approval.

In the loan application process, your high credit score can play a significant role in offering you some advantages. Lenders may offer you their best interest rates and terms, acknowledging your reliable credit history. Additionally, the approval process could be quicker compared to those with lower scores. Just remember, every lender will still take into account other considerations such as income and existing debt. However, with your score of 795, you're likely to be greeted with a more positive response during your personal loan application journey.

Can I Get a Car Loan with a 795 Credit Score?

A credit score of 795 is impressive and reflects great financial responsibility. Such a high number casts you in a favorable light with most lenders, and you're highly likely to receive approval for a car loan. It indicates a strong history of timely repayment and prudent credit use, reducing risk from the lender's perspective.

When it comes to the car purchasing process, expect smooth sailing. With a credit score of 795, you'll likely qualify for the most advantageous loan terms, including low interest rates. This favorability can translate to significant financial savings over the life of your loan. But stay vigilant. Even with such a sterling credit score, ensure you fully understand all terms and conditions before finalizing any loan. Looking into various lenders for the most competitive deal is still a wise move. Your high credit score puts you in control of the car purchasing process.

What Factors Most Impact a 795 Credit Score?

With a credit score of 795, you're doing well but there may still be areas for improvement, as well as actions you can take to maintain your good score. Understanding and addressing these factors can help keep your score in good standing.

Credit Utilization Rates

While your score is high, you should still keep an eye on your credit utilization rate. This is your total credit card balance compared to your total credit limit. Lower utilization rates reflect positively on your score.

How to Check: Review your credit card statements. A healthy credit utilization rate is generally considered to be around 30% or less.

Type and Length of Credit

The amount of time you've had credit, along with the types of credit you've utilized (mortgages, auto loans, credit cards etc.), plays a significant role in establishing your credit history.

How to Check: Examine your credit report to determine the length and variety of your credit history. Avoid opening too many new accounts in a short period.

Payment History

Even with a high score, it's always important to remember that timely payment of your bills is key. Late payments can negatively impact your score.

How to Check: Always review your bills and statements to ensure your payments have been made on time.

Debt-to-Income Ratio

Your debt-to-income ratio, which is all your monthly debt payments divided by your gross monthly income, also impacts your credit score. It's a good indicator of your ability to repay borrowed money.

How to Check: Calculate your debt-to-income ratio and aim to keep it as low as possible.

How Do I Improve my 795 Credit Score?

With a commendable credit score of 795, your financial health appears to be in excellent shape. Nevertheless, there’s still room for improvement. Deliberate, calculated steps at this stage will help boost your credit even further.

1. Maintain Low Balances

It’s best to keep your credit card balance low relative to your credit limit. Although you’ve mastered handling credit well, continuing to keep balances – ideally under 10% of your limit – will manifest in an impressive credit utilization ratio, an essential aspect of your credit score.

2. Ensure Timely Bill Payments

Consistency is key in maintaining a high credit score. Ensure that all your bills such as utilities, rent,, phone or internet services are paid on time. This careful punctuality contributes positively to your credit reputation over time.

3. Consider a Long Credit History

Maintaining long-standing credit accounts helps demonstrate your financial stability to credit bureaus. Consider keeping older credit cards open, even if you no longer use them frequently. Ensure they have zero balance and are cost-effective to retain.

4. Regularly Review Your Credit Report

Monitoring your credit report is crucial even with a great score. Erroneous information can occasionally find its way onto your report. Checking for inaccuracies and disputing them promptly can protect your high score from unnecessary dips.

5. Diversify Carefully

Your credit mix contributes to your score. Having a variety of responsibly-managed credit types–like mortgages, car loans, credit cards–can demonstrate your ability to handle different credit forms. However, don’t take on new credit simply for the sake of diversification.