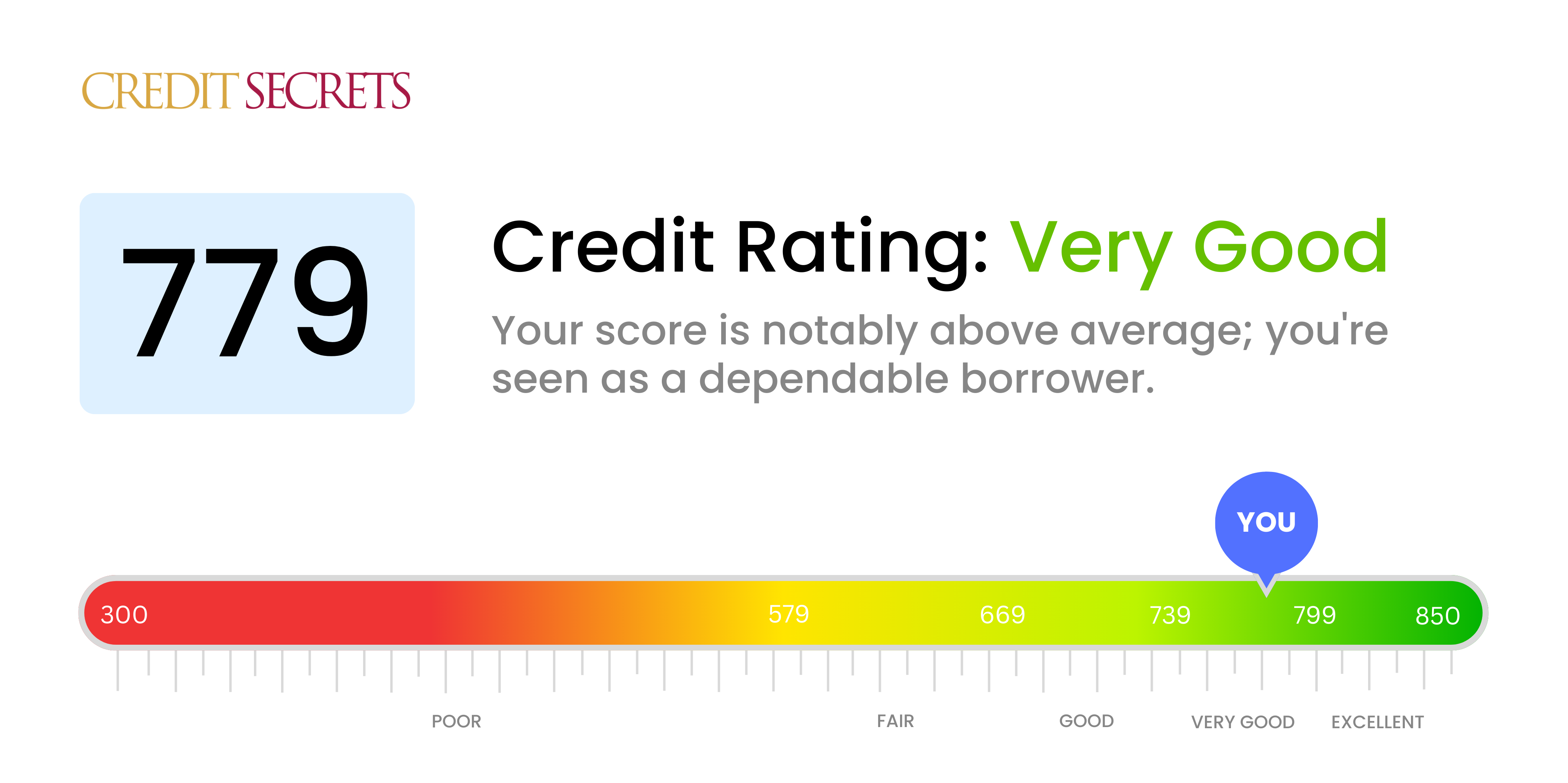

Is 779 a good credit score?

A credit score of 779 is considered very good, signaling that you've made responsible credit decisions in the past. Falling on the higher end of this category, you can expect to have a generally easy time qualifying for most types of credit with relatively low interest rates, however, there may still be room for some improvements to reach the 'excellent' credit score category.

While it's important to maintain the good habits that got you this score, like paying bills on time and keeping your credit utilization low, you can still aim for further enhancements. Moving your credit score up into the 'excellent' tier could unlock even better credit offers and interest rates. But remember, it's all about steady, responsible credit behaviors—play the long game.

Can I Get a Mortgage with a 779 Credit Score?

If you have a credit score of 779, you're in a solid position for mortgage approval. This score shows lenders that you're reliable and adept at managing your finances. Therefore, they're more likely to consider you a low-risk borrower. It's a testament to your responsible financial habits and disciplined credit use for you to have earned such a noteworthy score.

Given your exceptional credit score, you can expect the mortgage approval process to be relatively smooth. You'll typically be able to obtain a lower interest rate, reducing the overall cost of your mortgage. However, remember that credit score is just one factor that lenders consider. Other elements such as your income, employment history and debt-to-income ratio are also crucial in the decision-making process. Practicing financial prudence and maintaining your credit score will continue to open doors for you in your financial journey.

Can I Get a Credit Card with a 779 Credit Score?

Holding a 779 credit score is a positive achievement, reflecting your responsible financial habits and dedication to maintaining a healthy credit history. This score places you at the upper end of the credit scale, a fact that is likely to be noticed and appreciated by prospective lenders. It’s an indication that you’ve been diligent in honoring your past credit agreements and meeting your financial obligations.

The likelihood of being approved for a credit card with this score is very high. With such a robust score, options may range beyond the basic credit cards. Premium travel cards, known for their extensive rewards and perks, may be a great option, should your lifestyle needs match. Low-interest rate credit cards could also be suitable, combining the benefits of flexible credit with reduced interest charges. Overall, a high score like yours allows for a good degree of flexibility and choice when selecting a credit card. However, it's essential to keep maintaining those responsible financial habits that got you this far.

The stark reality is that a credit score of 453 is quite low in comparison to the benchmark scores many traditional lenders look upon favorably. To them, such a low score symbolizes a considerable risk, bringing into question the likelihood of securing a conventional personal loan. We know it's not easy to hear, but understanding how your credit score impacts your borrowing options is crucial.

Although conventional personal loans may not be an option, you might explore alternatives such as secured loans, where collateral is involved, or co-signed loans, with someone having a better credit score acting as guarantor. Also, Peer-to-peer lending platforms could be considered; they sometimes show leniency towards credit score requirements. Be mindful, however, that these alternatives could carry higher interest rates and less attractive terms, which is a reflection of the increased perceived risk for the lender.

Can I Get a Car Loan with a 779 Credit Score?

With a credit score of 779, the probability of securing a car loan is high. Lenders usually regard scores above 660 as favorable, and a score of 779 is well beyond this threshold. Having such an excellent credit score puts you in a very advantageous position, as it signals to lenders that you are a reliable borrower. Your history indicates that you are likely to repay borrowed money on time, reducing their risk.

When obtaining a car loan with a high credit score like yours, you can expect lower interest rates and more favorable loan terms. Because your score shows that you're a low-risk borrower, lenders are often willing to offer more competitive rates. Remember, however, to still compare offers from different lenders. The car purchasing process should be smoother with your high score, but always ensure to understand the terms of any loan agreement before signing. Securing a car loan isn't just likely for you, it's highly probable with beneficial terms.

What Factors Most Impact a 779 Credit Score?

With a score of 779, you're already in an excellent credit range, and understanding the factors impacting your score can help you maintain or even improve it.

Credit Utilization

Though you may be responsible with your spending, your credit utilization ratio could be influencing your score. This calculates the ratio of your outstanding balances to your overall credit limit.

How to Check: Keep an eye on your credit card balances. Are they less than 30% of your credit limit? This is considered beneficial for your credit score.

Payment History

Your score suggests you've been consistent with your payments. However, even a single late payment or default can impact your credit rating.

How to Check: Regularly check your credit report for any late payments and ensure all future payments are on time.

Credit History Length

Credit longevity can positively affect your score. If you've been managing credit for a long time, it's likely you're proficient at handling your debts.

How to Check: Evaluate the length of your credit history by considering the age of your oldest and youngest accounts, as well as the average age of all your accounts.

Credit Mix

Having a variety of credit types can demonstrate to creditors your ability to manage multiple types of debt successfully.

How to Check: Assess your mix of credit types such as credit cards, retail accounts, installment loans, etc. It's essential to balance your credit and handle it responsibly.

Hard Inquiries

Though fewer in significance, too many credit inquiries in a short period could slightly influence your score negatively.

How to Check: Review your credit report to see the number of credit inquiries. Try to limit applying for credit within short intervals to avoid numerous hard inquiries on your report.

How Do I Improve my 779 Credit Score?

With a credit score of 779, you’re nearly at top-tier creditworthiness. But, there’s always room for improvement. The following strategies are particularly suitable for your current credit status:

1. Regularly Monitor Your Credit Report

At this stage, it’s crucial to stay vigilant about your credit details. Regularly reviewing your credit report helps ensure correct data and can alert you to any suspicious activities that could harm your score. Remember, it’s not uncommon for credit reports to contain errors. Spotting and disputing these quickly is key.

2. Maintain Low Utilization Rates

With a solid score, you likely already have good credit habits. Continue being mindful of your utilization rates. Endeavor to keep them below 30% and preferably around 10% of your credit limits. Even with excellent credit, high utilization can bring your score down.

3. Consistently Pay on Time

Your payment history is a significant factor in your credit score. Ensure all bills, loans, and credit card balances are paid on time. Building a longer history of dependable, timely payments will continue to benefit your score.

4. Consider Credit Diversity

If you don’t have a variety of credit types – like credit cards, auto loans or mortgages – adding another well-managed account to your credit mix can boost your score. However, remember to only borrow what you’re comfortable with repaying.

5. Avoid Unnecessary New Credit

Avoid unnecessarily applying for new credit. Each application triggers a hard inquiry on your report, which can slightly lower your score. Only apply for new credit if it’s absolutely needed and you’re sure to manage it responsibly.