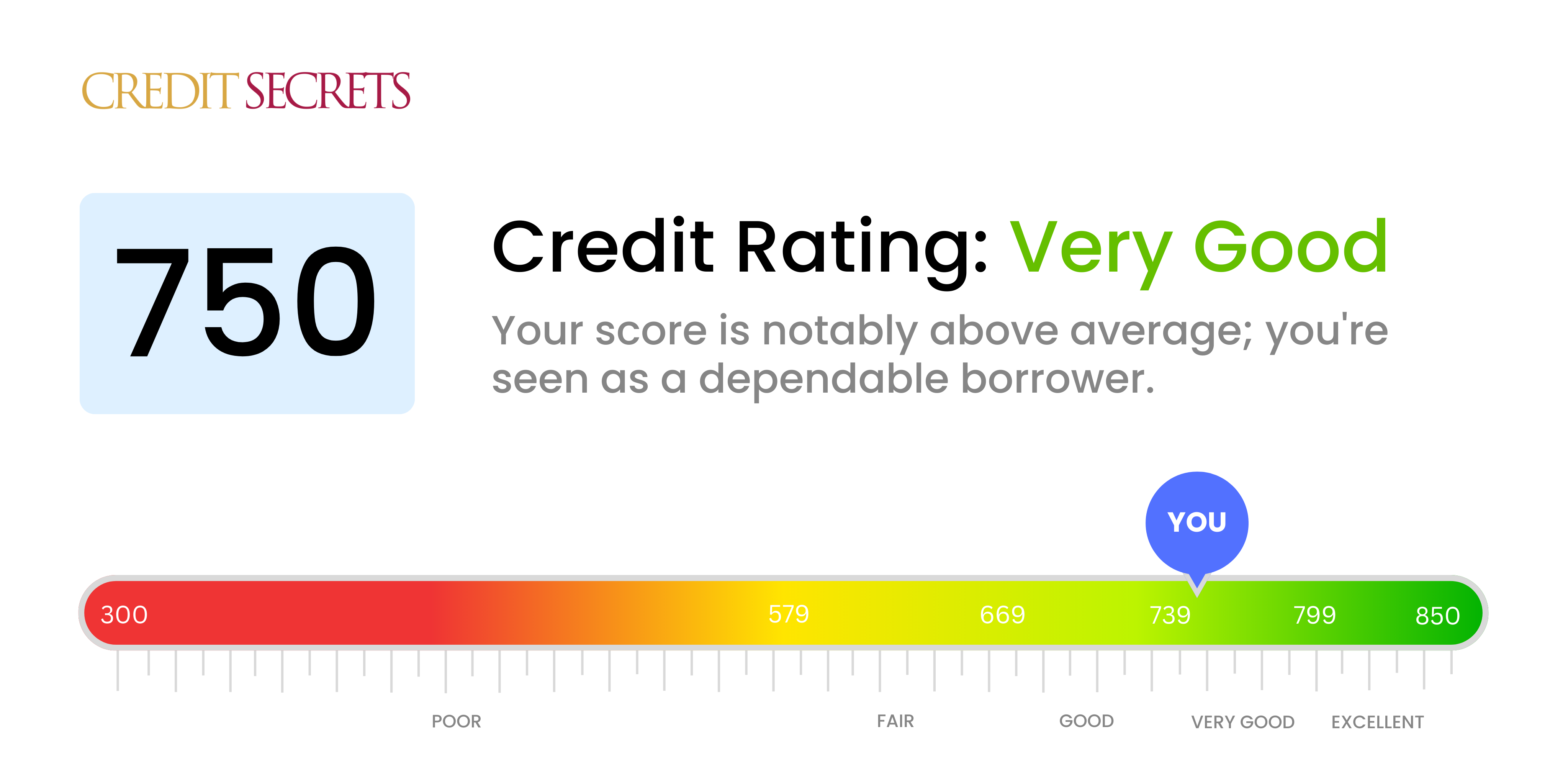

Is 750 a good credit score?

If your credit score is at 750, this places you within the 'very good' range. This implies that you've done a commendable job when it comes to managing your credit. With this score, you're likely to have a firm footing with lenders and may have no problem getting approved for loans or credit cards. You'll typically enjoy lower interest rates and favourable terms due to this strong credit score. Still, there's room for improvement to reach the 'excellent' range.

It's essential to continue practicing responsible credit behaviour, like timely payments, keeping your credit usage low, and not applying for new credit frequently. You're closer to achieving a score in the 'excellent' range, which can unlock even more financial opportunities for you. Start by continuing to maintain the habits you've developed and remember, each step is getting you closer to your financial goals.

Can I Get a Mortgage with a 750 Credit Score?

If you have a credit score of 750, you are in a solid position to apply for a mortgage. This score is considered good by most lenders, indicating you have been reliable and consistent in meeting your financial obligations. It demonstrates a distinct level of trustworthiness, which lenders significantly appreciate when considering loan approvals.

In the mortgage approval process, having a score of 750 can mean more favorable terms and potentially lower interest rates as a reward for your solid credit history. However, keep in mind that a credit score is not the only factor lenders consider; they also assess your income, employment status, and debt-to-income ratio, among others. Yet, overall, with a credit score of 750, you can generally anticipate a smoother approval process for a mortgage loan.

Can I Get a Credit Card with a 750 Credit Score?

If your credit score is 750, it's highly likely you'll be approved for a credit card. This is viewed as a very good score, and lenders see you as someone who manages their finances carefully. Understandably, this is a proud moment, but remember to maintain a responsible approach to your financial habits to keep this advantageous position.

With such a favorable score, you'll find you qualify for an array of credit cards suited to your financial needs and lifestyle. Top-tier rewards cards, like those offering generous travel points or cashback, will be within your reach. You might also consider cards with low interest rates or exceptional perks. Keep in mind, however, that interest rates vary between credit card issuers, so make sure to compare these as well as the rewards on offer before making a decision. Ultimately, with a 750 credit score, you have the luxury of choice, enabling you to select a card that works best for you.

If you have a credit score of 750, you're in a good place for securing a personal loan. This score is well above the average and the likelihood of you getting approved is quite high. Lenders view this score as a sign of financial responsibility and trustworthiness. It's a testament to your history of paying back debt on time and managing your credit efficiently.

During your personal loan application process, your 750 credit score will prove beneficial. You can expect smoother approval processes and more favorable terms, such as lower interest rates. This is because lenders are confident in your ability to meet your repayment obligations, hence the risk to them is lower. Do remember, it's still crucial to carefully review all terms and conditions before accepting a loan offer. Financial decisions should always be made wisely, especially when they involve taking on debt.

Can I Get a Car Loan with a 750 Credit Score?

A credit score of 750 indicates a strong credit history and responsible financial management. This means you are in a great position when it comes to applying for a car loan. Lenders regard a credit score of above 700 as excellent, hence a score of 750 generally increases the likelihood of you getting approved for a car loan. Your high score represents lower risk to lenders, which may translate to more favorable loan terms and lower interest rates.

As you go into the car purchasing process with this credit score, anticipation can be quite high. Expect potential lenders to view you as a prime borrower. This means you'll not only have greater access to a wider range of lenders, but you may also qualify for the most competitive interest rates on the market. Even though the process may seem straightforward, always remember to read the terms and conditions thoroughly, and ensure you're getting the most suitable deal for your financial situation.

What Factors Most Impact a 750 Credit Score?

Parsing a score of 750 is key to progressing on your financial journey. Don't forget, this journey is unique for everyone, full of chances to develop and learn new financial strategies.

Payment Consistency

At a score of 750, consistent payments are probably a strength of yours. A single slip-up, however, could impact your score.

Check this way: Examine your credit report for any late or missed payments. These could have lowered your score.

Credit Utilization

It's likely you've mastered not using up all your available credit, but there's always room for improvement. Keeping utilization under 30% is a common guidance.

Check this way: Review your credit card balances. Are they well below the limits? If not, aim to lower them where possible.

Length of Credit History

With your current score, it’s possible you have a long credit history with well-maintained accounts, but a few relatively new accounts might have slightly lowered it.

Check this way: Look at your credit report to determine the age of your oldest and most recent accounts and the overall average age.

Credit Variety and Recent Applications

Having a diverse array of credit accounts and handling new credit responsibly can boost your score.

Check this way: Evaluate your mix of credit accounts. Also, consider whether you have been applying for new credit frequently.

Public Records

Your score suggests that you may not have serious public records like bankruptcies, but even smaller collections could impact your score.

Check this way: Check your credit report for any public records. Address any items listed that may require resolution.

How Do I Improve my 750 Credit Score?

Congratulations on maintaining a credit score of 750! This is considered a very good score, laying an excellent foundation for financial legitimacy. However, there’s always room for improvement and advancement towards an exceptional score. Here are the steps tailored for your current situation:

1. Maintain Your Credit Utilization Ratio

Given your score, it’s likely you’re managing your credit cards well, but continue to be diligent. Maintain your credit utilization ratio under 30%. This means, if your credit limit is $10,000, aim to keep your balances under $3,000. It shows you’re a responsible and disciplined borrower.

2. Keep Track of Accounts in Good Standing

Ensure to stay current with all your credit accounts. Being late on even a single payment can impact your score negatively. Automated payments can help in avoiding any slip-ups.

3. Limit New Credit Inquiries

Applying for too much new credit at once can make lenders see you as a higher risk. Limit your credit inquiries and only apply for credit when its absolutely necessary.

4. Diversification of Credit

You have a good score, which means you likely have varied credit – credit cards, auto loans, perhaps a mortgage. Maintaining diverse types of credit over time can give your score a further boost. Achieve this without over-borrowing by, for instance, using a mix of revolving credit (like credit cards), and installment loans (like auto or personal loans).

5. Monitor Your Credit Regularly

Keep an eye on your credit reports. Look out for any erroneous items that could be dragging your score down inadvertently. With your score at 750, you’re already doing fantastic, but small irregularities can make big differences.