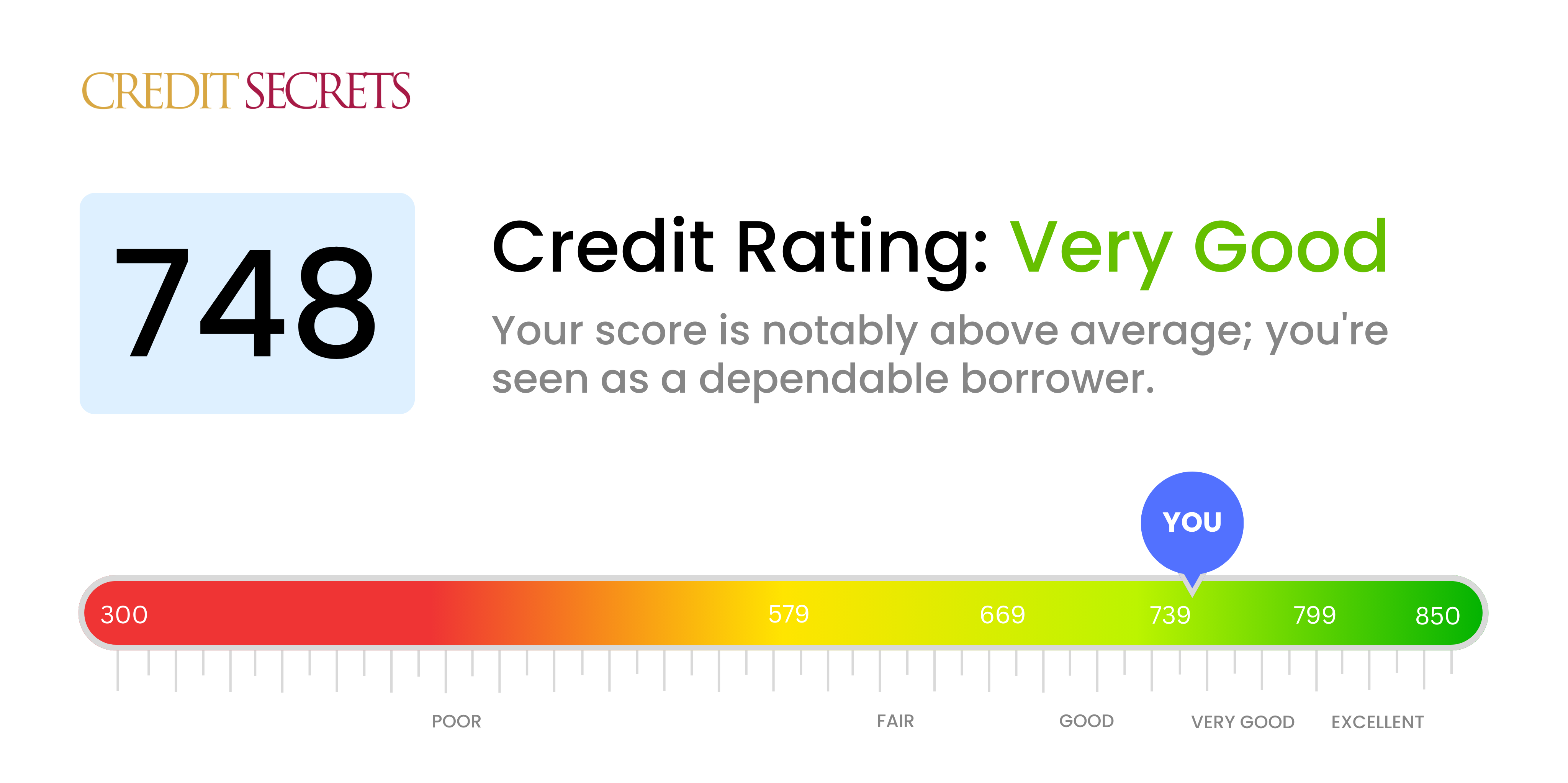

Is 748 a good credit score?

With a score of 748, you're doing quite well credit-wise. This lands you in the 'Very Good' category, which indicates you've done an impressive job managing your credit. Having such a score can offer you enviable opportunities like lower interest rates on loans and credit cards, greater likelihood of loan application approval and chances for better negotiation power with lenders.

However, remember there's always room for financial growth. Keeping a keen eye on your credit activity and ensuring you continuously meet your financial responsibilities will not only help maintain your good credit score but may even boost it into the 'Excellent' range. With perseverance and discipline, you can enhance your financial future and open up even more opportunities.

Can I Get a Mortgage with a 748 Credit Score?

Having a credit score of 748, you're in a solid position to be approved for a mortgage. This score is well above the threshold that most lenders look for when assessing potential borrowers. This suggests a track record of responsible credit use and timely payments, qualities lenders appreciate.

Entering the mortgage approval process, you can generally expect to receive competitive interest rates, as lenders consider you a low risk candidate. Nonetheless, different lenders have varying policies and rates, so it's advisable to shop around a bit to ensure you secure the best possible mortgage terms. Remember, your credit score is one part of the picture, but lenders also consider other factors such as debt-to-income ratio and employment history. Be prepared to provide detailed financial information to potential lenders to improve your chances of approval and achieve the most advantageous terms.

Can I Get a Credit Card with a 748 Credit Score?

With a credit score of 748, you're likely to be approved for a credit card. A credit score in this range indicates to lenders that you're a very responsible borrower, who rarely, if ever, misses payments. Dealing with credit isn't always easy, and maintaining a good score takes effort, so you should be proud of your achievement. However, it's still important to make effective credit decisions to maintain or even potentially improve your credit status.

With a credit score of 748, a good range of credit cards would be at your disposal. It might be a good time to consider a rewards credit card, which can offer cashback, points, or miles. For example, cards that offer reward points for supermarkets or dining might cater to your regular spending habits. On the other hand, if you frequently travel, a card offering travel rewards could be beneficial. Keep in mind though, that even though you're eligible for these cards, always assess the annual fees and interest rates before applying. Being vigilant about the cost of using credit remains important, even when your credit score is strong.

A credit score of 748 is generally deemed attractive by many lenders. Having this score significantly increases your chances of approval for a personal loan. It positions you as a low-risk borrower, demonstrating a history of financial responsibility and timely payments. That being said, each lender is distinct, and this isn't a definitive approval. Nonetheless, it's an encouraging situation to be in.

During the application process for a personal loan, lenders will probably offer you favorable terms due to your appealing credit score. This typically includes lower interest rates, which help keep your borrowing costs down. However, be aware that although your credit score is a significant factor, lenders may also consider other elements such as income and employment stability while determining the final loan approval. Keep a positive outlook but ensure you're aware of all the factors at play. Remember, good preparation is key to obtaining the best possible loan terms.

Can I Get a Car Loan with a 748 Credit Score?

An individual owning a credit score of 748 is indeed in a robust position to get approval for a car loan. This score is viewed as 'Good' in the eyes of lenders and signifies that you've been consistent and reliable with your credit in the past. When a lender sees a score of 748, it instills confidence in them about your creditworthiness.

In the car purchasing process, a credit score of 748 might bring you interest rates that are more favorable as lenders see you as a lower risk. Lenders might offer you competitive loan terms, which can ease the financial aspects of your car purchase. Keep in mind, the final offered terms can vary based on other factors like income and debt-to-income ratio. Still, with a score of 748, you're much closer to owning the car of your dreams.

What Factors Most Impact a 748 Credit Score?

Deciphering a credit score of 748 expedites your financial growth. It's important to highlight the determining factors behind your current score. Although every financial journey is independent, each harbor is filled with numerous possibilities.

Credit Utilization

Your credit score can be influenced by your credit utilization ratio. If your balances sit near their limits, this could be affecting your score.

How to Check: Glance through your credit card statements. Any balances nearing their limit? Keep them as low compared to the limit for optimum results.

Length of Credit History

You may face a hard time achieving a higher score with a relatively short credit history.

How to Check: Inspect your credit report and evaluate the age of your accounts. Also, see if you've recently added new accounts which can decrease your overall credit age.

Mix of Credit

Efficiently managing a diverse mix of credit sources aids in maintaining a good score.

How to Check: Consider the variety of your credit accounts. If you've efficiently managed credit cards, retail accounts, installment loans, and mortgage loans, you're on the right track.

Public Records

Your score can take a hit with public records such as bankruptcies or tax liens.

How to Check: Scrutinize your credit report for any public records. It's vital to address any listed items that could affect your score.

How Do I Improve my 748 Credit Score?

A credit score of 748 is deemed good but with a few enhancements, you can hit the excellent mark. Here are the most manageable and influential strategies for your specific score level:

1. Monitor Your Credit Report

Stay vigilant and regularly review your credit reports from all three bureaus; Experian, TransUnion, and Equifax, to spot any errors. Clearing up any inaccuracies can significantly boost your score.

2. Maintain Low Balances on Credit Cards

Even with a good credit score, high balances on your card can be concerning. Keep your credit utilization ratio below 30% of the total limit. The lower the percentage, the better it is for your score.

3. Punctuality in Payments

Your credit score reflects your creditworthiness. Make sure all your future payments, be it bills or credit card payments, are made on time. Delays can potentially harm your good credit score.

4. Long-Term Credit History

Let your older credit card accounts stay open as long as they aren’t costing you unnecessary in annual fees. They help in lengthening your credit history resulting in a positive impact on the credit score.

5. Avoid Unnecessary Credit

Unnecessary application for new credit cards can lead to a hard inquiry on your credit report, causing a temporary dip in the score. Avoid this until you truly need new credit.