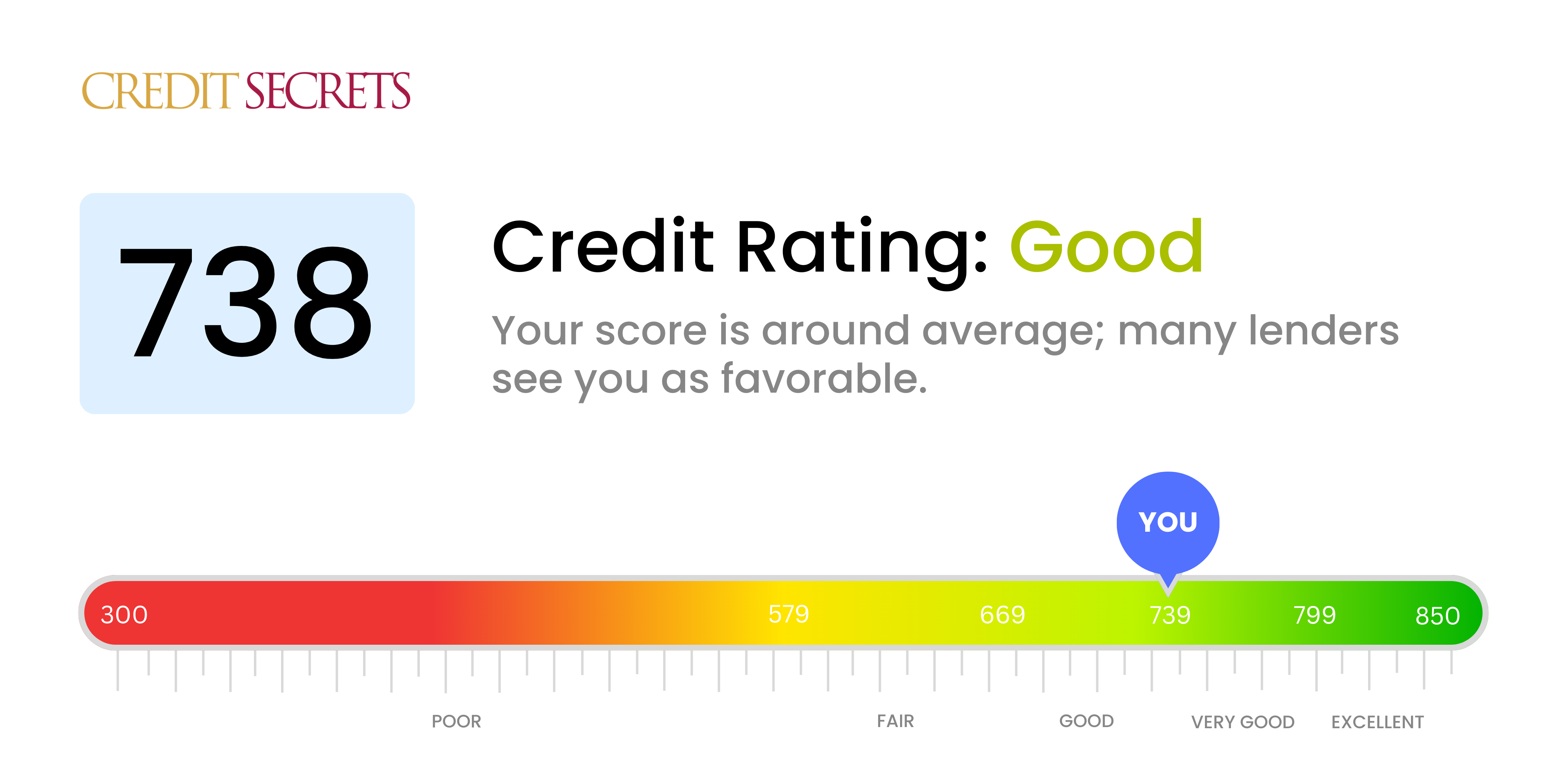

Is 738 a good credit score?

Based on the credit score ranges, a score of 738 is judged as 'good'. This is not perfect, but it still opens doors to competitive credit options you may not previously have been eligible for.

Having a good score like 738 typically opens up more lending options, competitive interest rates and credit cards with better rewards. While it's not in the 'very good' or 'excellent' range, there's no need to stress— you are doing well and are on the right track to improving your credit profile even further.

Can I Get a Mortgage with a 738 Credit Score?

With a credit score of 738, you stand a good chance of being approved for a mortgage. This score is well above the average and suggests that you have a history of responsibly managing your debts and making regular payments. Lenders will likely view you as a low-risk borrower.

Despite your solid credit score, it's important to be prepared for the mortgage approval process to be thorough and potentially time-consuming. Lenders will consider all aspects of your financial profile including income, employment, and existing debts. Also, although your credit score is good, it may not guarantee the lowest interest rates available. These rates can vary based on a range of factors including the lender’s criteria, economic conditions, and competition in the mortgage market. But remember, a 738 credit score opens many doors, positioning you favorably in the pursuit of home ownership.

Can I Get a Credit Card with a 738 Credit Score?

With a credit score of 738, you stand a good chance of being approved for a credit card. This score is generally seen as relatively positive by lenders. It demonstrates a history of responsibly managing debt and usually means you've made timely payments, kept balances low, and avoided major financial mistakes. It's helpful to approach this score with realistic optimism as it showcases good financial discipline.

Given this positive standing, most types of credit cards may be within reach. You might consider starter cards if you're new to credit, or a rewards card if you want to maximize your spending. There are also premium travel cards that can earn airline mileage or other travel benefits—particularly useful if you travel frequently for work or leisure. Do bear in mind that the finer details and interest rates can vary between card companies, so it's worth investing time to research and compare options before choosing the one that best suits your lifestyle and financial goals.

With a credit score of 738, your financial portrait paints a rather appealing picture to potential lenders. This number is comfortably positioned in the 'good' credit score range, showing that you have managed your previous credits responsibly. As a result, you are more likely to be approved for a personal loan than someone with a lower score.

During the personal loan application process, lenders will typically verify your credit score. With a score of 738, you can expect a smooth process as your profile indicates that you are a lower risk borrower. Furthermore, this could also mean lower interest rates for you. Bear in mind, however, that a multitude of factors such as your income and employment stability will also be considered. Stay patient through the process, keep your finances in check, and remember maintaining your credit score is an ongoing process.

Can I Get a Car Loan with a 738 Credit Score?

Possessing a credit score of 738 puts you in a relatively strong position when seeking approval for a car loan. Generally, lenders look positively upon a score that exceeds the 700 mark. With your score of 738, lenders will see you as a low-risk borrower, which means you're more likely to secure approval for your car loan at attractive interest rates.

As you proceed with your car purchase, having a credit score of 738 can translate into more manageable monthly payments and potentially a wider range of options. Remember to shop around and compare loan offers, as some lenders may still offer better terms than others. With your strong credit score, the road to owning your car looks quite smooth, and you should be able to navigate the process with confidence.

What Factors Most Impact a 738 Credit Score?

Understanding a credit score of 738 is integral to further enhancing your financial health. By looking at the likely factors behind this score, you can identify ways to boost it further. It's essential to remember that each financial journey is unique, presenting its own set of lessons and growth opportunities.

Credit Utilization Ratio

Your credit utilization, or the amount of your available credit you’re using, can majorly impact your credit score. With a score of 738, it's possible that your utilization is slightly high.

How to Check: Review your credit card statements. High balances can be indicative of a higher credit utilization ratio, which may lower your score.

Payment Consistency

Consistency in timely payments contributes significantly to a higher credit score. There might be a few late payments or missed ones that are impacting your score.

How to Check: Check your credit report for any late or missed payments. Take note of any instances where your payments were not on time as these can hamper your score.

Credit History Length

The duration of your credit history also matters, with longer histories proving beneficial for your score.

How to Check: Scan your credit report to evaluate the length of your oldest and newest accounts and the mean duration of all your accounts.

Credit Mix

Having a diverse mix of credit—such as credit cards, retail accounts, installment loans, and mortgage loans—can help increase your credit score.

How to Check: Assess your variety of credit accounts to check for credit mix.

How Do I Improve my 738 Credit Score?

With a credit score of 738, you’re on your way to excellent credit health. However, some precise strategies will help propel you into the optimal range. Here are the most beneficial steps to take for your current score situation:

1. Review Your Credit Report

Ensure your credit report is accurate by reviewing it for any potential errors. Identify any wrong information, fraudulent activity, or discrepancies and dispute them with the credit bureaus. This helps in maintaining your score.

2. Maintain Low Credit Utilization

Maintain your credit card balance below 30% of your credit limit. Aim for an even lower percentage for ideal results. This reflects your good spending habits and boosts your credit score.

3. On-time Payments

Payment history is paramount when it comes to your credit score. Endeavor to make every payment on time. Automatic payments are a reliable method to prevent late or missed payments.

4. Keep Old Accounts Open

A longer credit history helps your credit score. Even if you’ve paid off a credit account, consider keeping it open, unless it comes with high fees.

5. Steer Clear of Hard Inquiries

Restrict unnecessary borrowing. Each hard query has the potential to lower your credit score. Only apply for credit when necessary to steer clear of the negative impact of multiple hard inquiries.