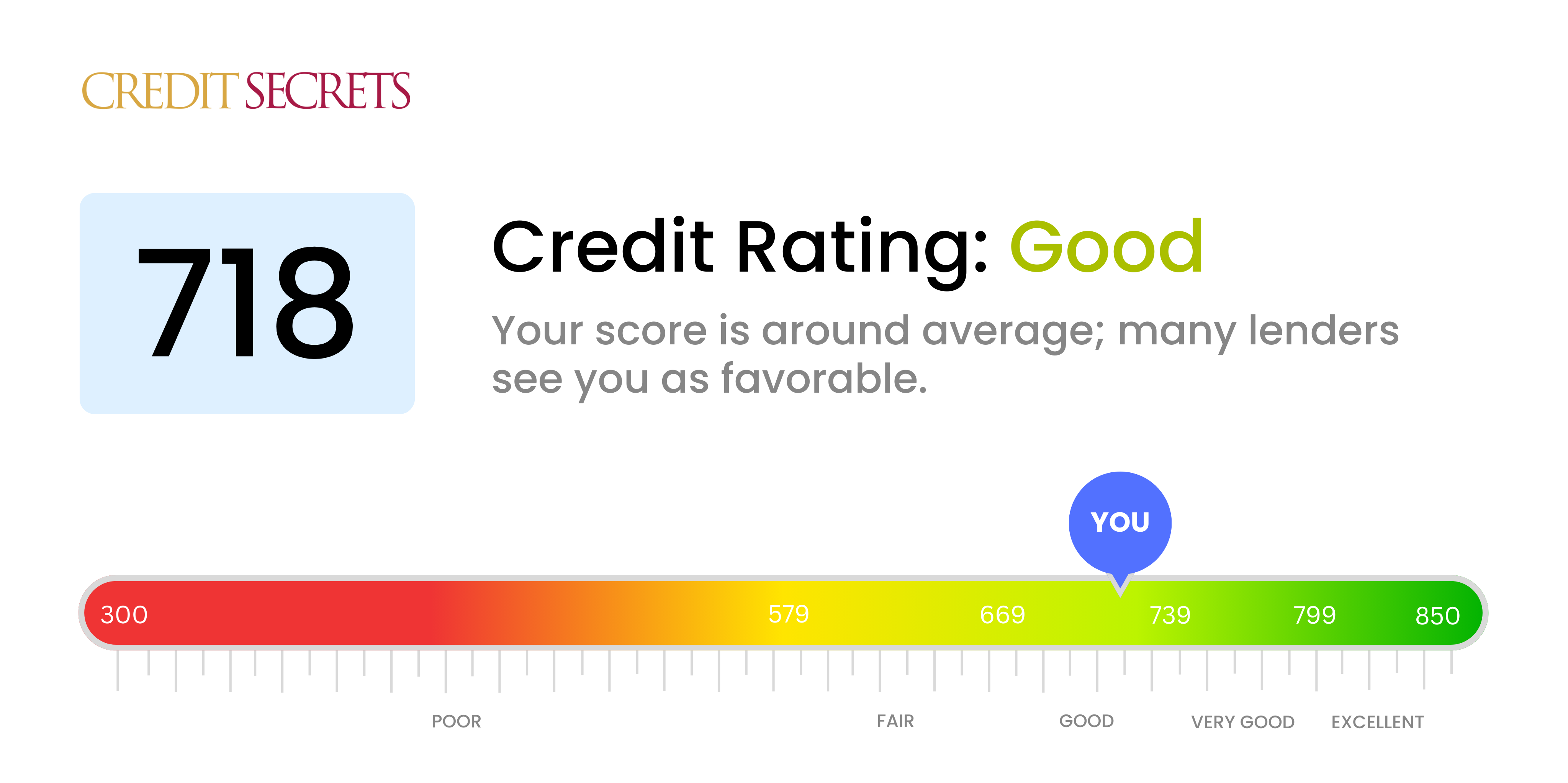

Is 718 a good credit score?

With a score of 718, you are boasting a decent credit score that falls within the 'good' credit range. This typically indicates responsible financial conduct and makes you more likely to receive favourable terms when seeking credit, however, you may not reap all the benefits reserved for those with 'very good' or 'excellent' credit scores.

This score will open a number of doors for you: It can make it easier to secure approval when applying for loans, credit cards, or other forms of credit, and it may result in relatively lower interest rates. Nevertheless, reaching into the 'very good' or 'excellent' ranges can provide even better rates and terms, thus, it may be beneficial to work towards improving your score even further.

Can I Get a Mortgage with a 718 Credit Score?

A credit score of 718 is generally considered good and satisfactory. It communicates to lenders that you're reliable and have a history of responsibly managing your credit, which increases your chances of approval for a mortgage. However, while this score improves your likelihood of mortgage approval, it doesn't necessarily guarantee the most favorable interest rates or loan terms.

While a 718 credit score puts you in a promising place, remember the mortgage approval process is multifaceted. Lenders not only observe your credit score but also review employment history, income stability, and overall debt to calculate your mortgage eligibility. Also, higher credit scores may lead to lower interest rates, so it's ultimately beneficial to aim for an even higher score for the best mortgage terms. Always remember, while this process can feel overwhelming, a credit score of 718 generally indicates good financial health and a higher potential for mortgage approval.

Can I Get a Credit Card with a 718 Credit Score?

With a credit score of 718, chances are favorable for credit card approval. This score indicates responsible financial habits like timely payment and minimal debt. While the credit journey remains continuous, a score of 718 is a positive indicator of good credit health. This should be seen as an accomplishment reflecting your consistent efforts to maintain solid financial standing.

With such a score, a number of credit card options could be a good fit. Standard credit cards are most likely within reach, which provide an array of valuable perks, from cash back rewards to travel bonuses. You should also consider cards with lower interest rates, as your score may qualify you for cards with better terms. However, it's always crucial to compare card terms and seek ones that align with your financial habits and goals, such as those with no annual fee, low late payment penalties, or high cash back rewards. Remember, every card approval can enhance your credit further, providing even more financial opportunities in the future.

With a credit score of 718, it's quite likely that you're considered a good candidate for a personal loan. Many lenders view a credit score in the 700s as evidence of solid financial responsibility and lower risk, increasing your chances of approval. It's still important to recognize that each lender has unique standards and requirements.

In the loan application process, a credit score of 718 can help in securing more favorable terms and lower interest rates. Lenders often provide more attractive loan terms and lower rates to individuals showing evidence of responsible credit usage reflected in their credit scores. Of course, credit score is just one factor lenders consider, so maintaining other elements of your financial health, like consistent income and low debt levels, is also important.

Can I Get a Car Loan with a 718 Credit Score?

With a credit score of 718, you're in a favorable position to be approved for a car loan. This score is considered good and indicates to lenders that you're financially responsible and have a history of repaying borrowed money on time. While the decision depends on various other factors, a credit score of 718 typically meets and even exceeds the minimum requirements set by most lenders.

Navigating the car purchasing process with this credit score should be a smoother ride for you. It'll not only improve your chances of getting approved for a loan, but may also bag you more favorable terms, like a lower interest rate. This means you could end up paying less over the life of your loan. However, it's always wise to review the terms meticulously before signing any agreements. Having a good credit score like 718 is a great start as it shows lenders that you're a reliable borrower, enhancing your opportunities for affordable car financing.

What Factors Most Impact a 718 Credit Score?

Grasping an understanding of your 718 credit score is one step closer to better financial health. Knowing and tackling the factors contributing to this score will lead you towards progress.

Payment History

Your payment history greatly contributes to your credit score. Paying your bills on time can help to improve your score.

What to Do: Inspect your credit report for evidence of late or missed payments. Past due payments may be impacting your score.

Credit Utilization

Keeping your credit utilization low is key. If your credit cards are frequently maxed out, this could be bringing down your score.

What to Do: Review your credit card statements. Try keeping your balances at a minimum, relative to your credit limits.

Credit History Length

If you have a fairly young credit history, this might be a factor in your score. Older accounts contribute positively to your credit health.

What to Do: Examine your credit report. Ask yourself if you've recently started using credit, as newer accounts may lower your score.

Credit Mix

Maintaining a diverse assortment of credit accounts could be an area of potential improvement for your score.

What to Do: Assess your credit portfolio. Do you have a good mix of credit types like student loans, car loans, mortgages, and credit cards?

Hard Inquiries

Applying for several new credit accounts within a short period of time can adversely affect your score.

What to Do: Review your credit report for recent applications. Multiple hard inquiries might be a reason for your current score.

How Do I Improve my 718 Credit Score?

With a credit score of 718, you’re in a good place, but there’s always room for improvement. Here are high-impact strategies to help you take your credit profile to the next level:

1. Regularly Check Your Credit Report

Ensure your credit report is accurate. Inaccurate information can lower your score. If you find any errors, dispute them with the credit bureaus promptly. This review should be your first step.

2. Keep Your Credit Utilization Low

Your credit utilization ratio can impact your credit score significantly. Aim to keep your balance below 30% of your credit limit on each card. Pay off your balances in full every month, if possible.

3. Stay On Top of Payments

Your payment history heavily influences your credit score. Ensure all your bills are paid on time, even the ones not directly related to credit like utilities and rent. Late payments can harm your score.

4. Don’t Close Old Credit Card Accounts

Long-standing accounts with good history can boost your score. Unless there’s a compelling reason, such as high fees or interest rates, consider keeping such accounts open.

5. Limit Credit Inquiries

Every time you apply for new credit it results in a hard inquiry on your report, which can temporarily lower your score. Only apply for new credit when absolutely necessary.