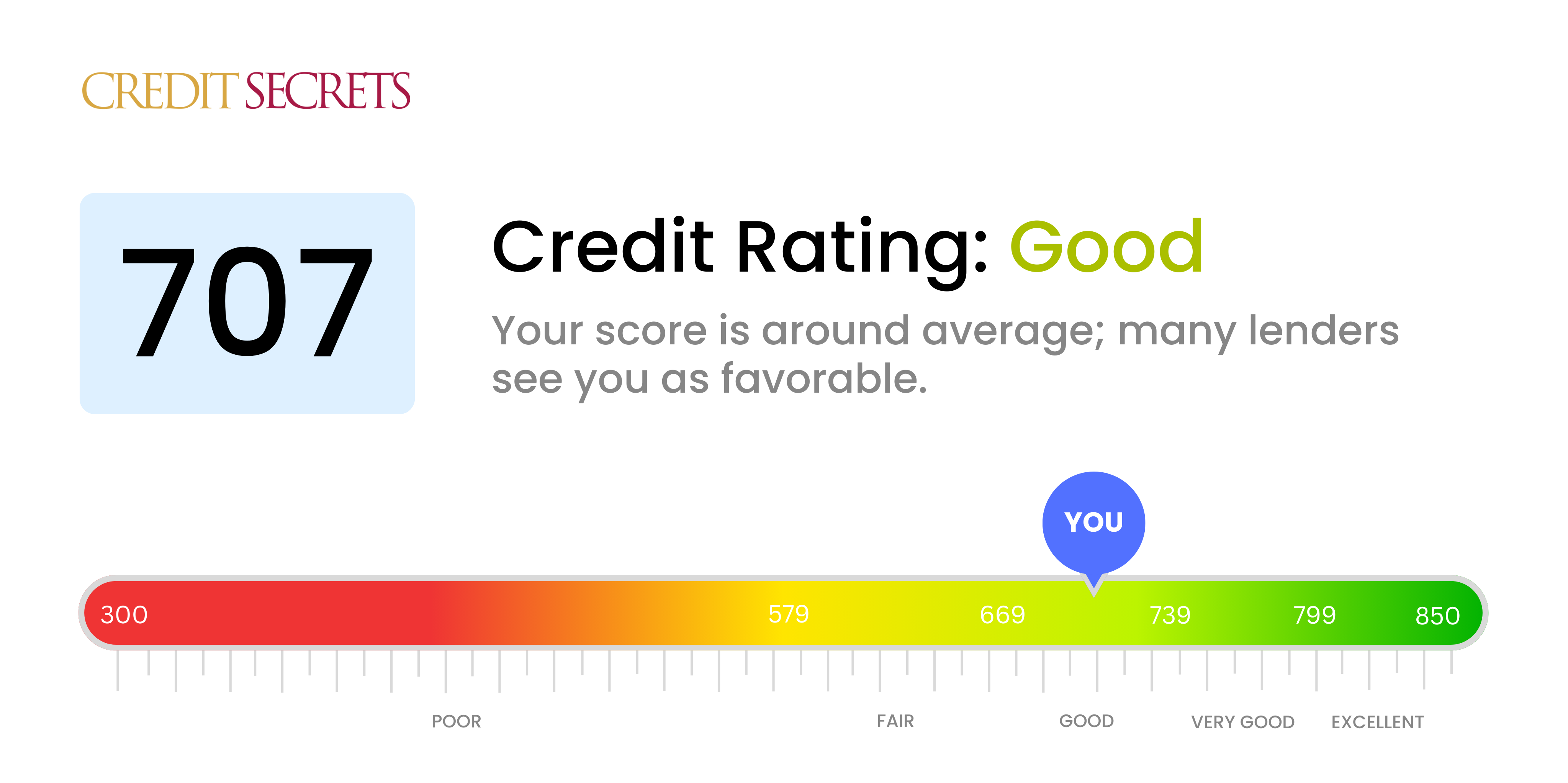

Is 707 a good credit score?

Your 707 credit score is categorized as 'Good.' This means you've shown responsible credit behavior which places you in a beneficial position when applying for credit or loans. Not being in the 'Very Good' or 'Excellent' categories indicates there's still room for improvement, but your score signifies you're on the right path.

With a score of 707, you can generally expect to be approved for many types of credit, including credit cards, auto loans, and mortgages, typically with competitive interest rates. It's important, however, to continue managing your credit responsibly in order to maintain and improve this score. Always pay your bills on time, maintain low balances, and avoid accruing too much debt at a time. Keep up the good work, and your score is likely to rise over time.

Can I Get a Mortgage with a 707 Credit Score?

With a credit score of 707, you are more likely to receive approval for a mortgage. This score is within the range that many lenders consider 'good,' reflecting a history of responsible credit use and on-time payments. This shows potential lenders that you're a reasonably low-risk borrower, giving you a higher chance of being approved for a mortgage.

During the mortgage approval process, you can expect lenders to evaluate your income, employment, and other financial factors in addition to your credit score. While a score of 707 generally increases your chances, it doesn't guarantee approval since lenders consider a variety of criteria. Being aware of these factors can prepare you for any potential hurdles. Keep in mind that the better your credit score, the better the interest rates and terms you may qualify for. Remember, despite the complexity, the mortgage approval process is a crucial step towards achieving your financial goals of homeownership.

Can I Get a Credit Card with a 707 Credit Score?

If you have a credit score of 707, you are likely to be approved for most credit cards. This score indicates that you have a fairly good history of managing your debt responsibly. However, it's still important to treat your credit score as an ongoing journey, treating every financial decision with care and thoughtfulness.

A wide range of credit card options is available to you. Begin by considering cards that best suit your lifestyle and spending habits. If you frequently travel, a premium travel card could help you benefit from your expenses. If you're a diligent budgeter, consider a cash back card that rewards your frugal habits. Remember, while a 707 score positions you well, interest rates can still vary depending on the issuer's policies. Always do your research and read the fine print to secure the most favorable terms for your financial future.

With a credit score of 707, you lie in the fair to good credit category. In the world of personal loans, a score like yours is often seen as satisfactory and shows a reasonable level of financial responsibility. Therefore, you stand a higher chance of approval for a personal loan. However, every lending institution has different requirements and levels of leniency. It's important to bear in mind that your credit score is a key factor, but not the sole factor.

Upon application, you can anticipate a relatively smooth process. Your aforementioned score may grant you access to a variety of loan options since lenders may see you as a less risky candidate. However, remember that while your chances are high, approval is not guaranteed. Additionally, interest rates are determined by your creditworthiness. The higher your score, the better the rates you're offered typically. Be sure to shop around for the best terms, and remember, every loan application leaves a mark on your credit history, so only apply for a loan when you've diligently researched and prepared.

Can I Get a Car Loan with a 707 Credit Score?

With a credit score of 707, you're in a favorable position to get approved for a car loan. This score is considered to be in the 'good' range and shows lenders that you're a reliable borrower. The likelihood of being granted a loan becomes higher with scores that fall in this category. Lenders are more assured of your ability to repay borrowed money, therefore, making qualification for a car loan significantly easier.

As you navigate the car purchasing process, expect the journey to be smoother. Lenders are likely to approve your loan application faster and may offer you better loan terms, such as lower interest rates. This is because a good credit score, like yours, is viewed as a lower risk to the lender. However, remember to thoroughly review all loan terms before committing, to ensure you're getting the best deal for your situation. Keep in mind that there are still various factors that can influence the final interest rate and terms of your loan, but overall, a credit score of 707 should serve in your favor.

What Factors Most Impact a 707 Credit Score?

Examining a credit score of 707 is crucial in your financial journey. Recognizing and working on the factors that led to this score will foster financial growth and improvement. Realize that each financial journey is unique, filled with opportunities for growth and acquisition of knowledge.

Credit Usage

Credit usage can significantly affect your credit score. If you're using a considerable amount of your available credit, it could be a key factor for your current score.

How to Check: Look into your credit card statements. Check whether your balances are close to or exceeding your limits. Aim to keep your balances low, relatively to the limit, to improve your credit score.

Debt Repayment

Timely repayment of your debts has a positive impact on your credit score. If you have any outstanding debts or late payments, these could have influenced your score.

How to Check: Go over your credit report to check if you have any delayed payments, defaults, or unresolved debts. These factors can significantly affect your credit score.

Credit History Duration

The age of your credit history can significantly affect your score. If your credit history is short, it may have negatively affected your score.

How to Check: Review your credit report to understand the average age of your accounts and the age of your oldest and newest account.

Type of Credit

Having a diverse mix of credit accounts and managing new credit responsibly play a crucial role in fostering a good credit score.

How to Check: Review your credit report to understand your mix of credit accounts - like credit cards, retail accounts, and installment loans. This diversity can significantly enhance your credit score.

How Do I Improve my 707 Credit Score?

With a credit score of 707, you’re already within the “good” range, but there’s always room for improvement. Below are some considerate, achievable measures tailored for your current score.

1. Regular Credit Card Use and Payment

At this score level, you’re likely eligible for regular credit card offers. Use your card for routine purchases and pay off the balance in full and on time every month. This will reflect positively in your payment history, which significantly impacts your credit score.

2. Keep Credit Utilization Low

Avoid maxing out your credit cards. Experts advise maintaining your credit utilization ratio under 30%. This means if your credit limit is $10,000, your balance should ideally stay under $3,000. Lower ratios reflect better and can uplift your score.

3. Monitor Your Credit Report

Regularly check your credit report for any errors that could hurt your score. If you spot any, dispute them immediately. This practice can also help you understand the factors affecting your score.

4. Maintain Old Credit Accounts

The length of your credit history matters. Even though you may not use them often, don’t close your oldest credit accounts. These help lengthen your credit history, boosting your score over time.

5. Limit New Credit Applications

Applying for various new credit accounts in a short period can lower your credit score. Unless necessary, avoid taking on new debt and focus on managing the credit you already have properly.

By persistently following these practical steps, you can improve your credit score and aim for financial stability and freedom.