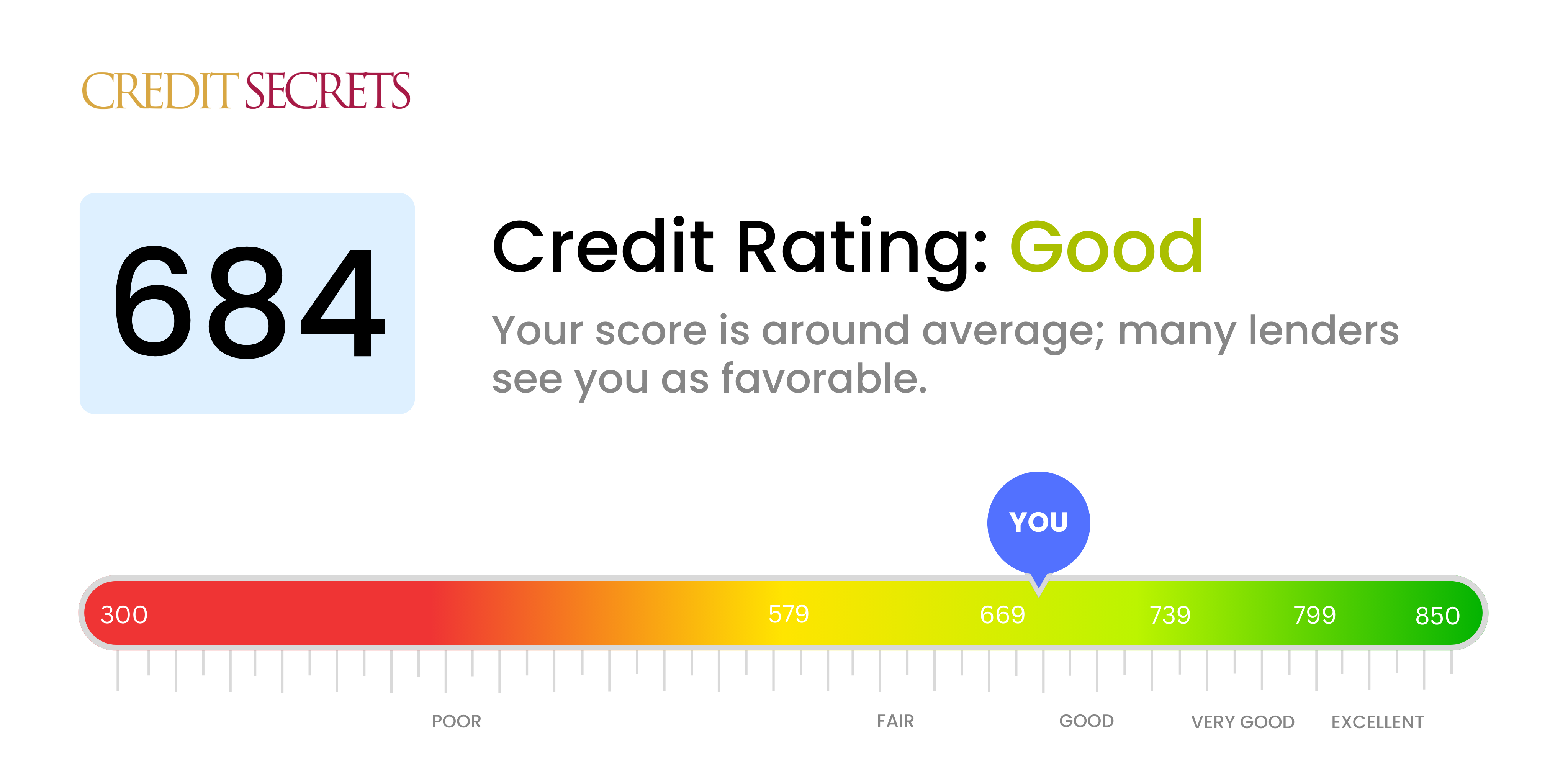

Is 684 a good credit score?

Your credit score of 684 falls within the 'Good' range according to accepted credit score standards. This means you are generally seen as a lower credit risk, which can make it easier for you to secure loans and receive competitive interest rates.

While a 'good' credit score is beneficial, it might still limit you from receiving the absolute best interest rates or loan terms. Regular on-time payments, reducing your debt, and cautiously managing your credit usage can help you boost your score. Remember, consistent and responsible credit habits can make a significant difference over time.

Can I Get a Mortgage with a 684 Credit Score?

With a credit score of 684, you may have a fair chance of getting approved for a mortgage. However, it's important to note that while a score in this range is close to what many lenders typically expect, it does not guarantee approval, particularly for the most competitive mortgage products. Every lending institution has different credit requirements, and there can be other factors at play, including your income stability, employment history, and overall debt level.

If your application is successful, it's critical to understand what the mortgage approval process entails. It'll require some patience as lenders delve thoroughly into your finances to verify your ability to make the monthly payments. Also, note that your credit score will significantly impact the interest rates you're offered. Even though a score of 684 is not bad, it is not excellent either, so you may not qualify for the lowest available rates.

Nonetheless, this is a positive step towards achieving your financial goals, and it is possible to build on this momentum to create a strong financial future.

Can I Get a Credit Card with a 684 Credit Score?

If your credit score is 684, you might be curious about whether you'll be approved for a credit card. Generally, a score in this range is seen as fair in the eyes of potential lenders. It might not automatically get you approved for every card out there, but it certainly does not count you out.

You're in a decent position to be considered for several types of credit cards. Starter credit cards, for instance, can be a good fit for people with fair credit scores. They are generally more accessible and can help further improve your credit over time. Secured cards could also be an option to consider. Although they require a deposit up front, they're often easier to obtain and can pave the way towards better credit. Lastly, interest rates for individuals with a score like yours might be a bit higher than rates for those with excellent credit. It's important to keep that in mind and strive to always pay your balance in full each month if possible.

With a credit score of 453, it's a harsh reality that securing approval for a personal loan from traditional lenders may seem like an uphill battle. Lenders often regard a score in this range as a substantial risk, which could greatly diminish your chances of obtaining such a loan. While these circumstances are tough, it's important to grasp what this score means for your borrowing options.

You might still find other paths open to you. For instance, secured loans where you offer collateral, or co-signed loans where someone with a better credit score guarantees for you might be possibilities. Additionally, peer-to-peer lending platforms could be an alternative as they might have more flexible credit requirements. However, bear in mind these alternatives might come with higher interest rates and less favorable terms, as they present a higher risk to the lender. Though the going may get tough, remember your present credit situation doesn't determine your financial future. There's always room for improvement.

Can I Get a Car Loan with a 684 Credit Score?

With a credit score of 684, your chances of getting approved for a car loan are fairly good. This score is slightly over the typical minimum requirement of most lenders, which means that your application may be viewed favorably. Also, being on this side of the score spectrum means you're less likely to be perceived as high risk to lenders. Nonetheless, it's important to remember that every lender has a different threshold and your approval could still be influenced by other factors.

As you navigate through the car purchasing process, you may find that your credit score impacts the terms of your loan. Given that your score is slightly over the average minimum, lenders may offer you a higher interest rate compared to someone with an excellent score. This is common practice, as lenders use interest rates to offset possible risk. However, don't be discouraged, there's room for negotiation. Patience, research, and open discussions with potential lenders will guide you toward an agreeable deal fit for your situation.

What Factors Most Impact a 684 Credit Score?

Understanding a credit score of 684 is an important step towards setting your financial goals. Evaluating key factors that are likely affecting your ranking gives a better grip on your financial situation. Remember, everyone's financial narrative is unique, providing precious lessons and opportunities for growth.

Credit Usage

Your percentage of total available credit used can hugely impact your credit score. If you're frequently nearing your credit limit, this could be a contributing factor.

How to Check: Take a closer look at your credit card statements. Are you often hitting or nearing your credit limit? Striving to reduce your balances could help improve your score.

Credit History

The longevity of your credit can affect your credit score. Having a shorter credit history may be limiting your score.

How to Check: Consult your credit report and determine the age of your oldest and latest accounts, as well as the average age of all your accounts. Were any accounts opened recently?

Variability of Credit

Handling different types of credits responsibly can positively influence your score. Have you only been using one type of credit? This might be limiting it.

How to Check: Evaluate your blend of credit accounts – do you hold credit cards, retail accounts, installment loans, or mortgage loans? Running different types of credit helps build a higher score.

Collection Accounts

Reports of turned over debts to collection agencies can seriously affect your score.

How to Check: Examine your credit report for any mention of collection activities. Attend to such instances promptly for a better score.

How Do I Improve my 684 Credit Score?

A credit score of 684 falls in the category of fair or average credit. Though not drastically low, this score can be heightened further. Here are some of the most effective steps made particularly for your credit condition:

1. Regularly Monitor Your Credit Report

Consistently keep track of your credit reports for any errors or inaccuracies. If found, contact the credit bureau promptly to amend them. Errors in your credit report can pull down your credit score without your knowledge.

2. Limit Hard Inquiries

Several hard inquiries can harm your credit score. Consequently, apply for new credit only when needed. Lenders usually run a hard inquiry to check if you’re creditworthy, which can drop your score temporarily.

3. Maintain Older Credit Accounts

Duration of your credit history impacts your credit score. Keep your older accounts open even if they’re not in regular use, as long the do not incur annual fees. These accounts contribute towards lengthening your credit history, thereby, enhancing your credit score.

4. Pay Bills On Time

Paying your bills promptly is of extreme importance. Late payments affect your credit score negatively. Make sure all your bills, not limited to credit card bills alone, are paid on time.

5. Manage Your Debts

Regardless of the type of debt you have, managing them effectively can help boost your credit score. Regularly review your financial commitments and strategize a plan that allows you to pay them off without any hassle.